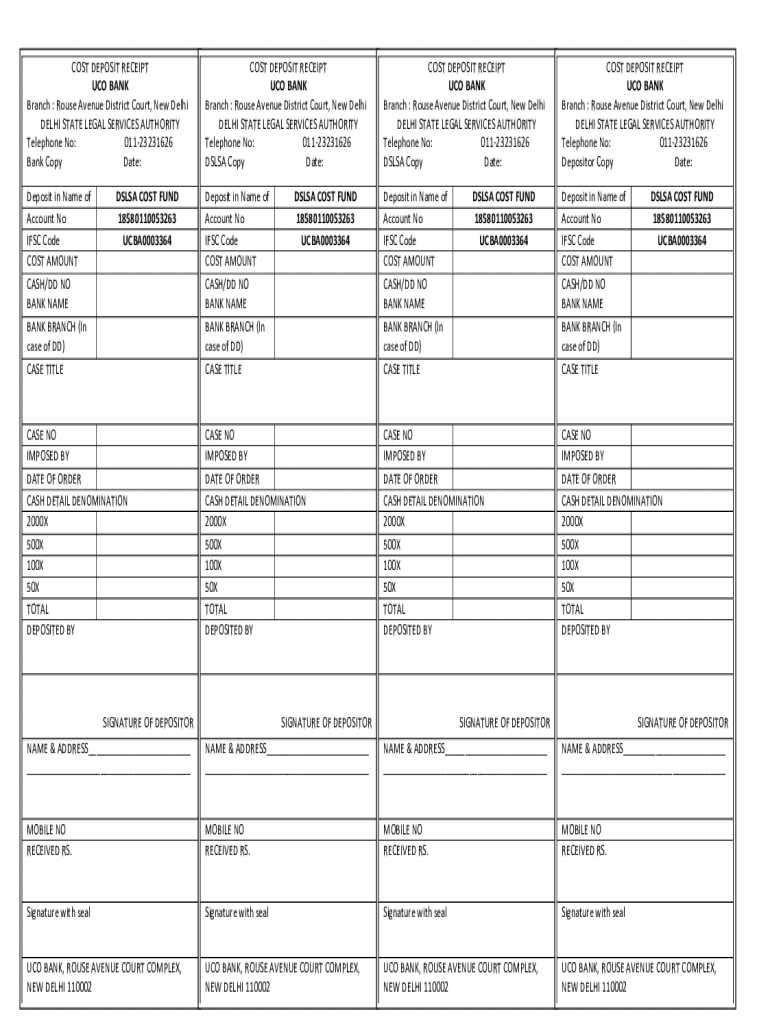

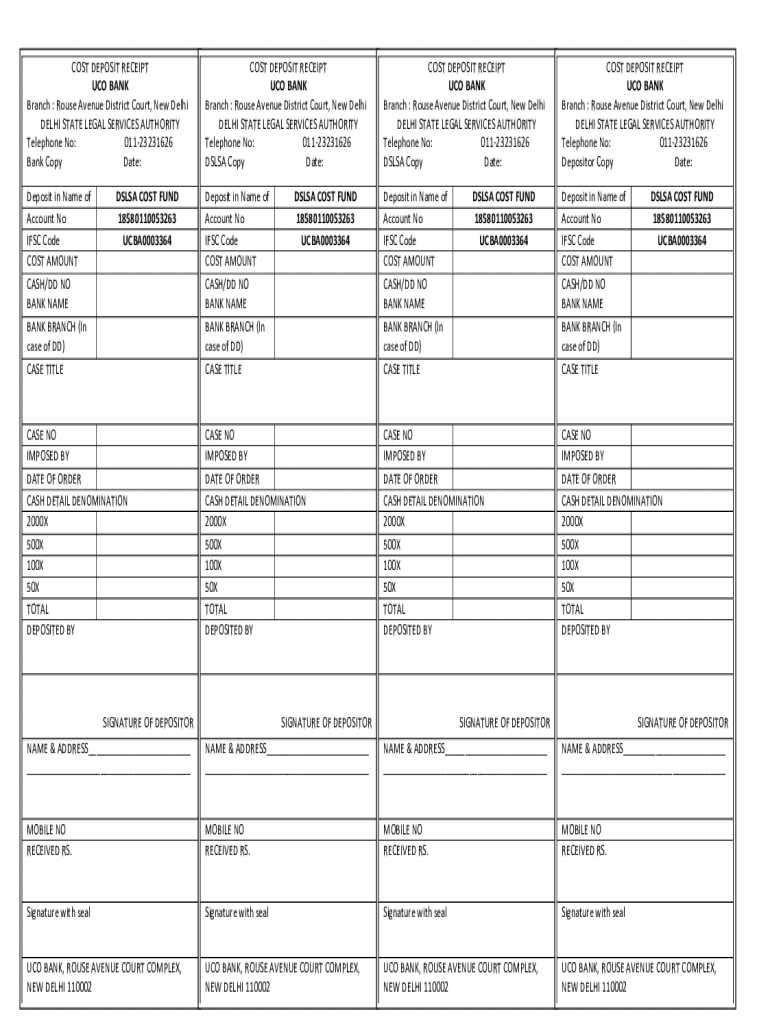

Get the free Cost Deposit Receipt

Get, Create, Make and Sign cost deposit receipt

Editing cost deposit receipt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost deposit receipt

How to fill out cost deposit receipt

Who needs cost deposit receipt?

Cost Deposit Receipt Form: A Comprehensive How-to Guide

Understanding the cost deposit receipt

A cost deposit receipt serves as a formal acknowledgment that a deposit has been made towards a service or product. It acts as proof of payment and details the amount, date, and recipient of the funds. Its primary purpose is to ensure clarity in financial transactions, protecting both the payer and the payee. When engaging in monetary dealings, especially in high-value purchases or services, having a cost deposit receipt is essential.

The importance of the cost deposit receipt in financial transactions cannot be overstated. It not only provides evidence of a transaction but also aids in bookkeeping, tax filing, and financial auditing. Notably, this document differs from other financial documents like invoices and bills, which request payment rather than acknowledge it. Understanding these distinctions is crucial for effective financial management.

Key components of a cost deposit receipt

A well-structured cost deposit receipt includes several essential components to ensure comprehensive coverage of the transaction details. Key elements to include are:

In addition to these essentials, one might consider including optional components such as an invoice number reference for streamlined tracking and payment terms and conditions to outline any stipulations related to the deposit.

Types of cost deposit receipts

Cost deposit receipts can come in various formats and types, catering to different industries and preferences. The three primary types include:

Understanding these different types helps you select the appropriate format for your needs.

Creating your cost deposit receipt

Crafting a cost deposit receipt has never been easier than with the pdfFiller platform. Follow this step-by-step guide:

Customizing your receipt templates is also crucial for branding purposes. Adding your logo or brand colors not only personalizes the receipt but also enhances its professionalism.

Common use cases for cost deposit receipts

Cost deposit receipts find application in numerous scenarios across various sectors. Here are some common use cases:

These examples highlight the versatility of cost deposit receipts across various financial transactions.

Managing and storing cost deposit receipts

Effective management and storage of cost deposit receipts are crucial for maintaining comprehensive financial records. Digital record-keeping has several benefits, such as:

Properly managing these documents aids in better financial oversight, which is especially important for small businesses or freelancers.

Legal considerations and requirements

Understanding the legal landscape surrounding cost deposit receipts is essential for compliance. Key considerations include:

Adhering to these legal aspects protects both the payer and the payee, ensuring accountability in all transactions.

Frequently asked questions about cost deposit receipts

Addressing common questions about cost deposit receipts can clear up confusion and ensure proper usage. Notable queries include:

These FAQs provide vital insights for users handling cost deposit receipts effectively.

Advantages of using digital cost deposit receipts

The shift to digital cost deposit receipts offers numerous advantages for users navigating document creation and management. Notable benefits include:

Digital solutions such as pdfFiller not only save time but also improve the overall efficiency of financial documentation.

Related document templates

As you explore cost deposit receipts, consider other types of receipt templates that may be relevant to your needs, including:

By understanding various receipt types, users can better navigate financial documentation requirements, and pdfFiller provides easy access to multiple templates for enhanced usability.

Getting started with your cost deposit receipt

For anyone looking to create a cost deposit receipt, here are some quick start tips for a no-fuss document creation process:

User testimonials reinforce the benefits of using pdfFiller for document management, highlighting its efficiency and user-friendly interface.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cost deposit receipt without leaving Google Drive?

How can I send cost deposit receipt for eSignature?

How do I fill out cost deposit receipt using my mobile device?

What is cost deposit receipt?

Who is required to file cost deposit receipt?

How to fill out cost deposit receipt?

What is the purpose of cost deposit receipt?

What information must be reported on cost deposit receipt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.