Get the free Crs Controlling Person Tax Residency Self-certification Form

Get, Create, Make and Sign crs controlling person tax

Editing crs controlling person tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs controlling person tax

How to fill out crs controlling person tax

Who needs crs controlling person tax?

Understanding the CRS Controlling Person Tax Form: A Comprehensive Guide

Understanding the CRS Controlling Person Tax Form

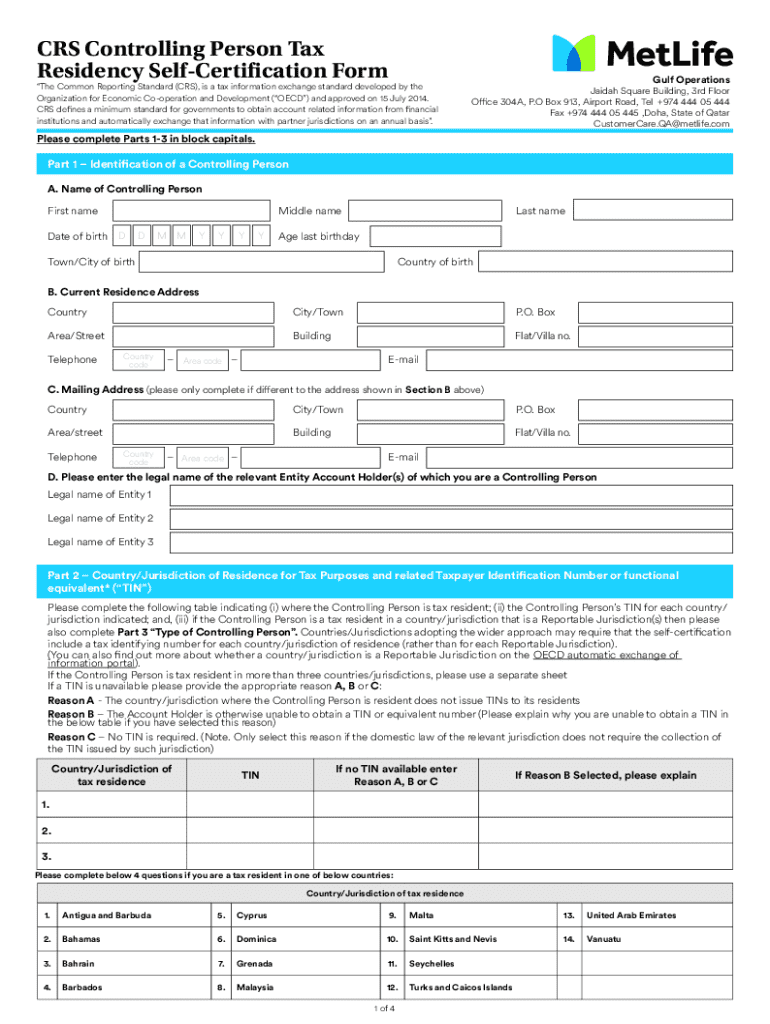

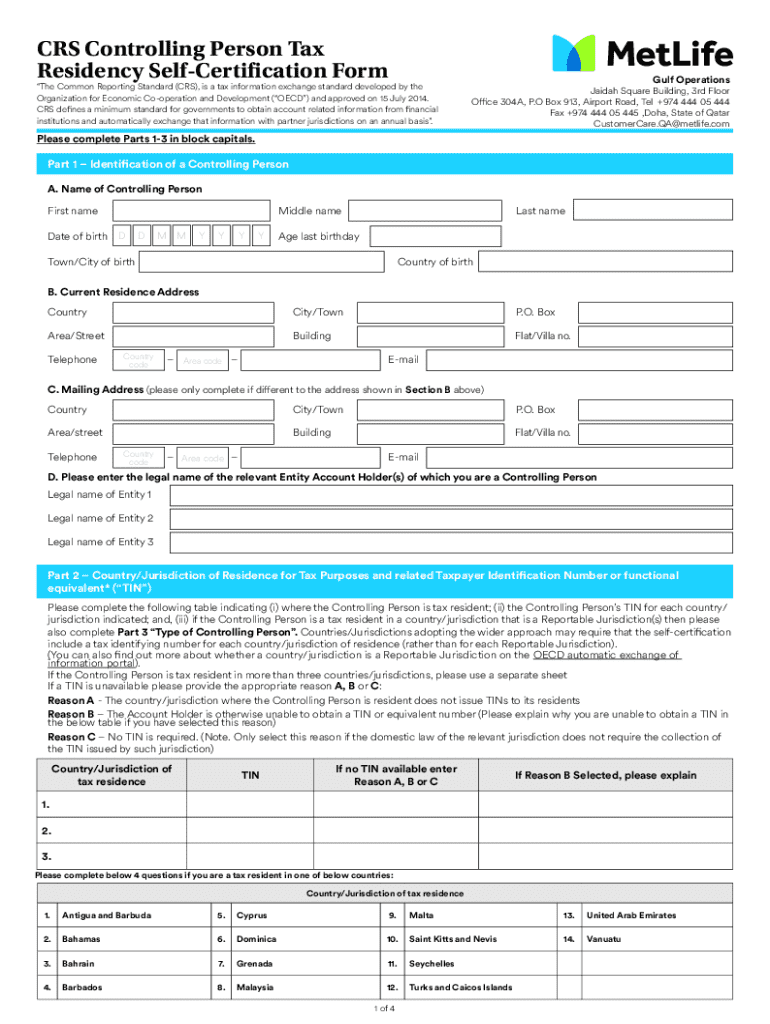

The Common Reporting Standard (CRS) Controlling Person Tax Form is a crucial document designed to promote transparency in the realm of international taxation. Developed by the OECD, the CRS allows tax authorities worldwide to exchange information on foreign financial accounts held by individuals and entities. The CRS Controlling Person Tax Form specifically targets individuals who exercise control over a legal entity or arrangement, such as trusts and corporations, ensuring that taxing authorities can effectively assess tax liabilities.

Filing this form is essential for compliance with international tax norms, particularly under the tax laws of various jurisdictions. It's important to understand the key definitions associated with this form, including what constitutes a 'controlling person.' Such understanding not only helps in accurate submissions but also informs individuals of their tax obligations on a global scale.

Determining if you need to complete the CRS Controlling Person Tax Form

Identifying whether you need to complete the CRS Controlling Person Tax Form begins with understanding who qualifies as a controlling person. Generally, this includes individuals who own more than a specific percentage of an entity, often set at 25%, or those who exercise significant control over the entity's financial and operational decisions.

Your financial institution will typically provide criteria for completion based on their interpretation of the CRS guidelines. For instance, if you're opening a foreign account or setting up an offshore investment, the institution may require you to submit this form as part of their due diligence process against tax evasion. Always verify with your financial institution to ensure you meet their specific requirements to complete the form.

Detailed breakdown of the CRS Controlling Person Tax Form

The CRS Controlling Person Tax Form comprises several key sections that need to be filled out accurately. The primary fields include personal information, such as your name, address, and date of birth, as well as your nationality. Each entry is vital to ensure proper identification and compliance.

You will also need to provide your Tax Identification Number (TIN). The TIN is crucial as it links your compliance information with your country's tax records. In the case of entities, additional information related to the entity's structure and controlling persons is also necessary.

Step-by-step guide to filling out the CRS Controlling Person Tax Form

Filling out the CRS Controlling Person Tax Form may initially seem daunting, but breaking it down into manageable steps simplifies the process:

Editing and managing your CRS Controlling Person Tax Form with pdfFiller

Once you've filled out the CRS Controlling Person Tax Form, pdfFiller offers a seamless way to manage your document. Uploading your completed form to pdfFiller allows you to easily edit any details if needed. Utilizing pdfFiller’s user-friendly interface, you can make adjustments, correct any mistakes, or enhance your document’s presentation through various editing features.

Additionally, pdfFiller provides a secure eSign function, allowing you to sign your form digitally and share it with relevant authorities or financial institutions without any hassle. This completely cloud-based access ensures that your essential documents are just a few clicks away, ready to be managed wherever you are.

Common mistakes and how to avoid them

Filing the CRS Controlling Person Tax Form may seem straightforward, yet there are several common pitfalls that can complicate the process. One significant area is inaccuracies in personal details such as misspelled names or incorrect dates of birth. To avoid these issues, it is essential to double-check your entries against official documents.

Another frequent mistake pertains to Tax Identification Numbers. Ensure you are using the correct TIN format as defined by your country's tax authority. An incorrect or missing TIN can lead to processing delays or significant penalties. Stay proactive—troubleshoot potential submission issues beforehand to avoid compliance penalties.

FAQs on CRS Controlling Person Tax Form

Many individuals face uncertainty regarding their status as a controlling person. If you find yourself unsure whether you fit this classification, reach out to your financial institution or a tax professional for clarity. Understanding the nuances of controlling interests is vital for timely compliance.

When dealing with multiple accounts and controlling persons, it’s essential to report each account accurately. Each controlling person linked to a given account must be noted distinctly. Moreover, changes to your controlling status can affect your reporting obligations, making it necessary to maintain an open line of communication with your financial institutions.

Importance of compliance and implications of non-compliance

Compliance with the CRS Controlling Person Tax Form is not merely bureaucratic; it has real implications if neglected. Tax authorities worldwide take compliance seriously, and failure to submit the form by the deadline or inaccuracies can lead to penalties, scrutiny, or worse—legal repercussions.

Tax authorities typically view incomplete or incorrect submissions unfavorably, leading to further inquiries or prolonged investigations into your financial activities. It is crucial to keep your information current, especially when changes occur in your financial status to avoid tax complications down the line.

Additional tools and resources from pdfFiller

pdfFiller offers various interactive tools that enhance your document management experience. From templates specifically for the CRS Controlling Person Tax Form to examples of completed forms, users can access valuable resources to aid in their filing efforts. Utilizing these tools can streamline the submission process, ensuring completeness and compliance.

Furthermore, customer support is readily available to assist with any document-related queries, providing personalized guidance to help you navigate the various facets of tax documentation.

Benefits of using pdfFiller for tax form management

Using pdfFiller for managing your CRS Controlling Person Tax Form not only simplifies the filing process but also enhances overall efficiency. By utilizing a cloud-based platform, individuals and teams can create, edit, and manage documents from anywhere, whether at home or on the go.

The platform's capabilities ensure secure handling of your sensitive documents while maintaining compliance with applicable regulations. pdfFiller empowers users by seamlessly facilitating the editing, e-signing, and collaboration process—making tax form management manageable and stress-free.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send crs controlling person tax for eSignature?

How do I execute crs controlling person tax online?

How do I edit crs controlling person tax in Chrome?

What is crs controlling person tax?

Who is required to file crs controlling person tax?

How to fill out crs controlling person tax?

What is the purpose of crs controlling person tax?

What information must be reported on crs controlling person tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.