Get the free Credit Review Request

Get, Create, Make and Sign credit review request

How to edit credit review request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit review request

How to fill out credit review request

Who needs credit review request?

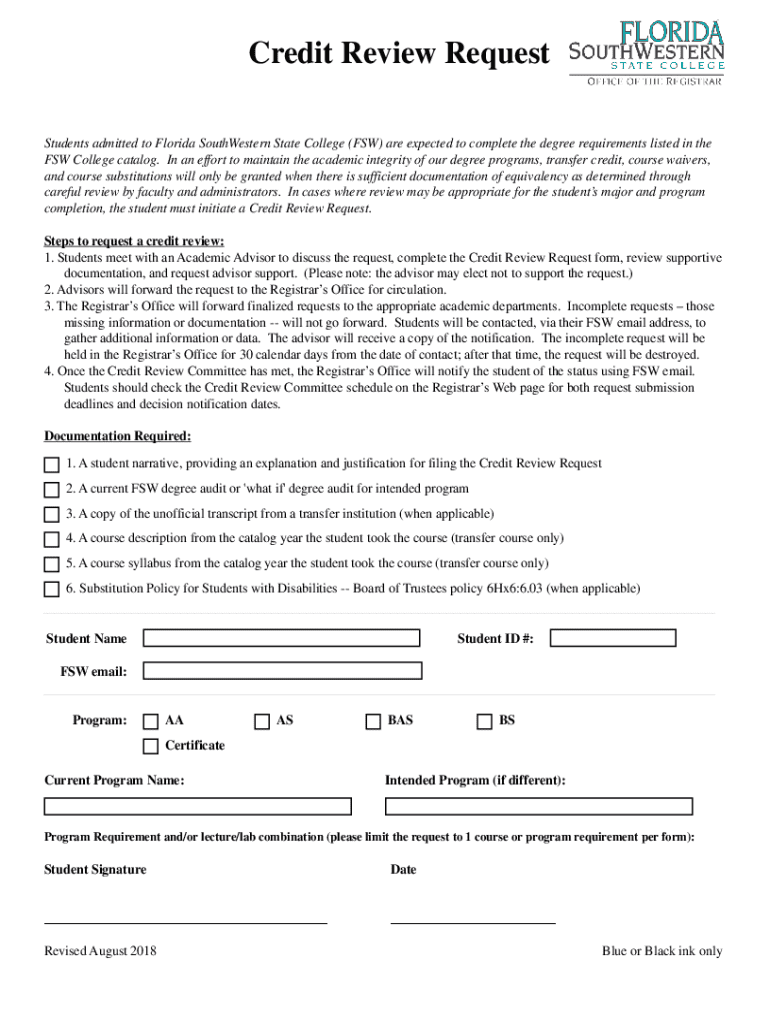

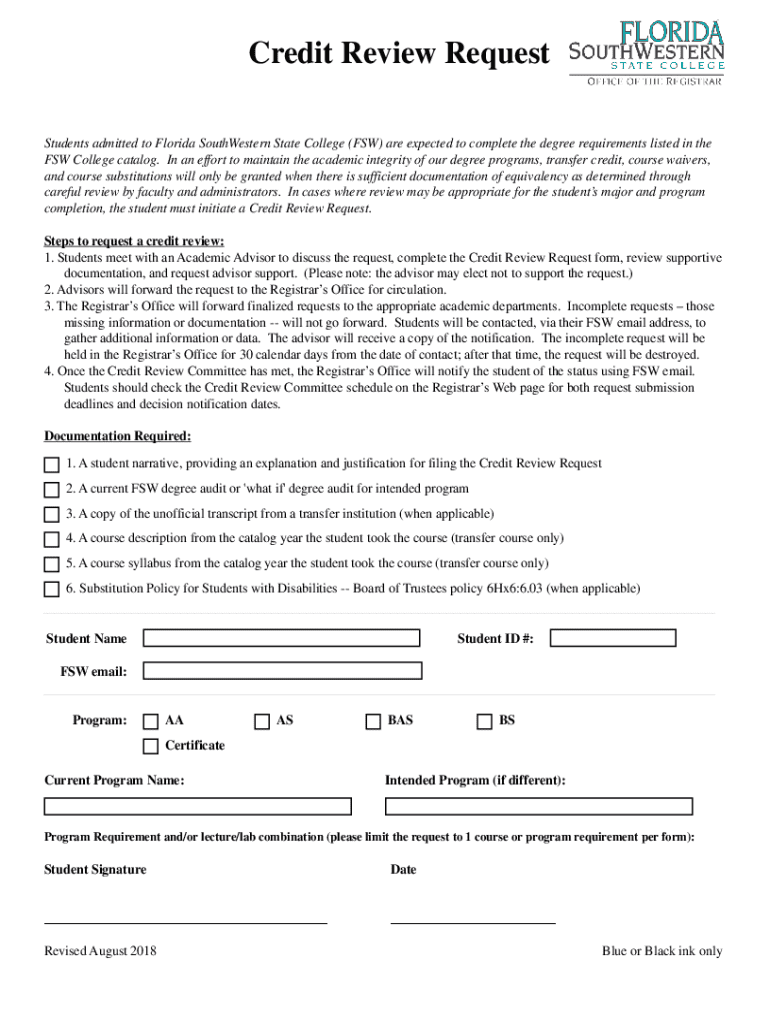

Comprehensive Guide to the Credit Review Request Form

Understanding the credit review request form

A credit review request form is a vital document for individuals and businesses who wish to assess or challenge their credit status. This form serves as a formal request to lenders or credit agencies to review a credit report or score. Understanding its purpose is crucial, as it can significantly impact one's financial opportunities, such as securing loans, credit cards, or mortgages.

The importance of the credit review request form lies in its ability to help users identify potential errors in their credit reports, seek better terms for loans, or improve their credit standing. Organizations often rely on accurate credit assessments when making lending decisions, making this form a key component in financial management processes.

Who needs to use this form?

Various individuals and groups may find the credit review request form useful. Here are some examples of who should consider using this important tool:

Key elements of the credit review request form

To effectively use the credit review request form, understanding its key elements is essential. These elements often include specific required and optional information that can impact the review process.

Required information typically includes personal identification details such as your full name, address, Social Security number, and date of birth. Furthermore, the form may request your financial background and credit history, including any current debt obligations or accounts. Lastly, it's crucial to submit any supporting documents needed for verification, which may include pay stubs, bank statements, or previous credit reports.

Optional information might include additional remarks or explanations regarding special circumstances that could affect your credit status. A specific request for follow-up or further evaluation can also be helpful, especially if you have unique needs or considerations.

How to fill out the credit review request form

Filling out the credit review request form accurately is crucial for a successful review process. Here’s a step-by-step guide on how to do it:

To enhance the effectiveness of your submission, be aware of common pitfalls, such as skipping the signature or omitting essential documents. Always strive for clarity and completeness in your information to facilitate a smoother review process.

Submitting the credit review request form

Once the credit review request form is filled out, submission is the next step. There are several methods you can utilize to submit your request, ensuring that it reaches the right department promptly.

Follow-up procedures are equally important after you submit your form. Utilize tools to track your request status, allowing you to stay informed about its progress. Expect a timeline for response, typically ranging from a few days to several weeks, based on the complexity of your request. Don't hesitate to reach out to designated contact points for any inquiries or updates.

Managing your credit review request

Understanding the review process is crucial for effectively managing your credit review request. Typically, credit agencies will provide a timeline for evaluations, which can vary significantly depending on their workload and the specifics of your case.

Factors influencing the review outcome often include the completeness of your submission, the clarity of the information provided, and the specific details of your credit history. After the review is completed, interpreting the results requires careful consideration. Changes in your credit report can indicate various developments – correctly understanding them will guide your next steps.

In case of favorable outcomes, you might consider applying for new credit or adjusting current credit terms. Conversely, if the outcome is not as expected, it may be necessary to investigate further or discuss options with a financial advisor.

Resources and tools for credit review

Using interactive tools can significantly enhance your understanding of your credit status. For instance, consider utilizing a credit score calculator or simulations that demonstrate the impacts of certain changes in your financial behavior on your credit.

Additionally, having supporting documentation readily accessible is essential. Leveraging resources that offer downloadable form templates can simplify the preparation process. Reviewing examples of completed forms can also help clarify expectations and improve your submission's accuracy.

pdfFiller capabilities for credit review request forms

pdfFiller stands out as a comprehensive solution for filling out, editing, and managing credit review request forms. Its features enhance document creation by allowing users to seamlessly edit PDFs through an intuitive interface, ensuring their forms are attractive and accurate.

Collaboration features on pdfFiller enable teams to work together on credit review requests efficiently. This capability allows for sharing forms securely and tracking changes in real-time, which is particularly beneficial in complex financial assessments.

Moreover, with cloud-based access, users can manage multiple submissions and versions of their forms from anywhere, ensuring they remain organized throughout the credit review process.

Common questions (FAQs) about credit review request forms

A frequent inquiry revolves around the difference between a credit review request and a credit dispute. While both processes aim to address inaccuracies, the review focuses on the assessment of credit status, whereas a dispute directly challenges specific entries in a credit report.

Exploring related forms and services

In addition to the credit review request form, several other financial review forms may be relevant, such as the Credit Re-Evaluation Request Form. Accessing related forms ensures that users are covered for various scenarios they may encounter in their financial journeys.

Furthermore, services from pdfFiller expand beyond just form filling. Users can benefit from eSigning services, pre-made form templates, and collaborative tools, all aimed at streamlining the document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit review request in Gmail?

How do I edit credit review request straight from my smartphone?

How do I edit credit review request on an iOS device?

What is credit review request?

Who is required to file credit review request?

How to fill out credit review request?

What is the purpose of credit review request?

What information must be reported on credit review request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.