Get the free Confirmation on EU Securitization Disclosure Requirements

Get, Create, Make and Sign confirmation on eu securitization

Editing confirmation on eu securitization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out confirmation on eu securitization

How to fill out confirmation on eu securitization

Who needs confirmation on eu securitization?

Comprehensive Guide to Confirmation on EU Securitization Form

Overview of EU securitization forms

Securitization is the financial practice of pooling various types of contractual debt, such as mortgages, car loans, or credit card debt obligations, and selling them as consolidated securities to investors. This process not only provides liquidity to the originators of the debt but also allows investors to diversify their portfolios. Compliance with EU regulations surrounding securitization is crucial, as these rules are designed to protect investors and enhance market stability.

The EU securitization framework has evolved significantly to address the complexities in the financial markets, particularly after the 2008 financial crisis. The introduction of regulatory standards, including the Securitization Regulation of 2017, established a clear framework that aims to restore confidence in securitization practices.

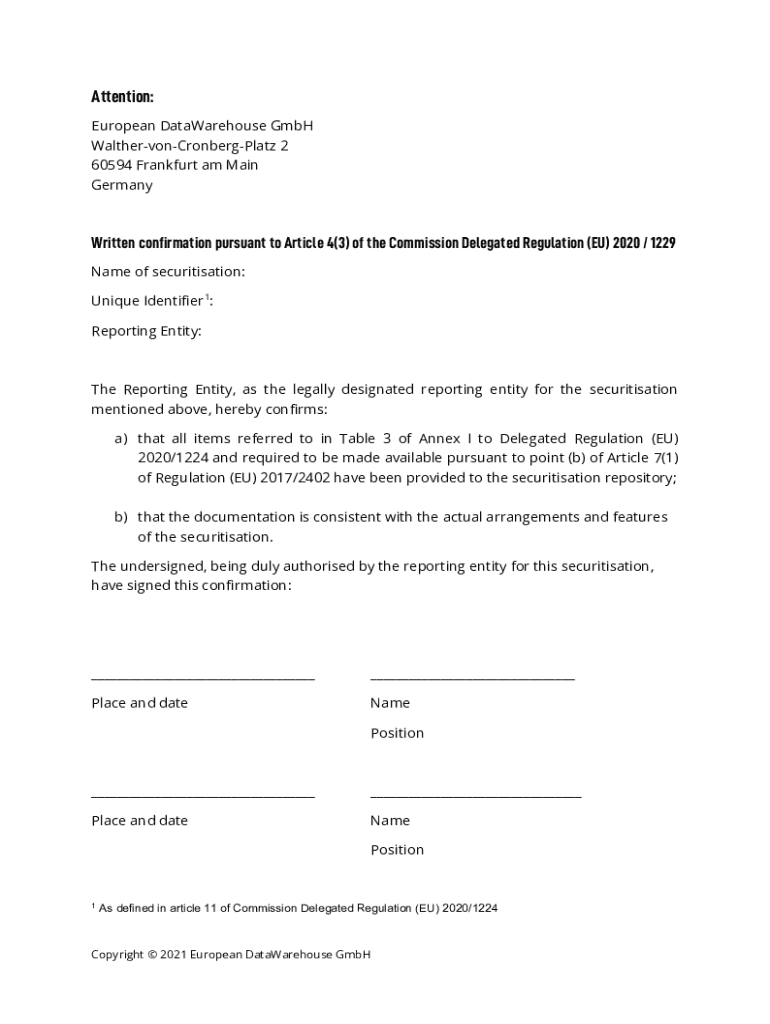

Understanding the confirmation process

The confirmation on EU securitization form refers to the validation phase where all details presented in the securitization-related documents are verified for accuracy and compliance. This confirmation is critical, as it serves as a safeguard for all parties involved in the transaction by ensuring that the structured product meets necessary legal standards and risk assessments.

Key participants in this process include the originators, who create the debt instruments; issuers, who package these debts into securities; and investors, who purchase these securities. Each party must collaborate closely, providing accurate information to avoid compliance issues or rejections during confirmation.

Key requirements for completing the EU securitization form

Completing the EU Securitization Form requires meticulous attention to specific mandatory information fields. These often include details such as the loan type, borrower information, credit ratings, and risk assessments. Each piece of information contributes to a complete picture for stakeholders and regulatory authorities.

Common mistakes in form completion include omitting key information, providing inconsistent data, or misunderstanding terminologies. For instance, failing to clarify the credit history of the debt can lead to significant issues in form approval.

Interactive tools for form management

Utilizing pdfFiller for managing EU Securitization Forms simplifies document interactions significantly. The platform offers cloud-based solutions that are easily accessed from any location. Here's a step-by-step guide to accessing and navigating pdfFiller:

Cloud-based document management solutions like pdfFiller provide enhanced collaboration opportunities, allowing teams to work concurrently on documents and maintain a single version for review and submission.

Detailed instructions for filling out the EU securitization form

When filling out the EU Securitization Form, it's essential to follow a step-by-step approach. Begin with personal and organizational details before moving on to specifics about the loans or securities involved. For each section, ensure that you are providing correct and current data.

Example scenario: If you are documenting a mortgage securitization, include the total amount of loans, borrower credit ratings, and any relevant historical default rates. This helps establish the reliability of the securities for potential investors.

Addressing common questions and concerns

Frequently, individuals may have questions regarding the confirmation of EU Securitization Forms. One significant concern is what to do in case of a confirmation rejection. Typically, you should request specific feedback from the reviewing authority to understand the discrepancies before making adjustments and resubmitting.

Terminology can also be a barrier; understanding terms like 'asset-backed securities' and 'tranching’ is vital for clear communication among parties involved. Here's a quick troubleshooting guide for common submission issues:

Updating information and re-submissions

It's essential to update the EU Securitization Form whenever there are significant changes in the data originally submitted. Changes may include alterations in borrower status, loan amounts, or market conditions. Be proactive in ensuring that the most up-to-date information is reflected in your submissions to avoid compliance issues.

Periodically, you may need to renew confirmations for long-term securitization agreements. Understanding the validity period of your documents can help keep your portfolio compliant and attractive to investors.

Impact of regulatory changes on EU securitization forms

Recent changes in EU regulations have had a considerable impact on securitization documentation. For instance, modifications in risk retention requirements and transparency standards have been established to elevate investor protection. Such changes necessitate updates to how forms are completed and submitted.

Future regulatory trends indicate that environmental and social governance criteria may become more prevalent in securitization processes. This could further alter documentation standards, requiring teams to adapt swiftly to maintain compliance.

Practical tips for teams and individuals

Managing multiple EU Securitization Forms can be challenging, especially for teams. Here are some best practices for managing these documents effectively:

Integrating document management into daily workflows can further streamline processes. Using features like automation in pdfFiller can minimize repetitive tasks, allowing team members to focus on higher-level analysis and decision-making.

Case studies: Successful navigations of the EU securitization process

Studying real-world examples of successful securitization can provide valuable insights. For instance, a financial institution that streamlined its form completion process by adopting technology saw a marked improvement in approval speed and accuracy. By utilizing pdfFiller's capabilities, they reduced turnaround times significantly and minimized errors.

Lessons learned from this experience include the importance of thorough training for staff involved in the process and maintaining clear communication with regulatory bodies throughout the confirmation phase.

Leveraging pdfFiller's features for enhanced document management

pdfFiller stands out due to its comprehensive tools that enhance collaboration, convenience, and compliance in managing EU Securitization Forms. Users can easily edit, sign, and store their documents all in one platform, significantly reducing the logistical challenges associated with traditional formats.

User testimonials highlight success stories where pdfFiller's functionalities have led to improved efficiencies. Individuals report smoother workflows and increased compliance capabilities, leading to higher confidence in submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the confirmation on eu securitization in Chrome?

How do I edit confirmation on eu securitization on an iOS device?

Can I edit confirmation on eu securitization on an Android device?

What is confirmation on eu securitization?

Who is required to file confirmation on eu securitization?

How to fill out confirmation on eu securitization?

What is the purpose of confirmation on eu securitization?

What information must be reported on confirmation on eu securitization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.