Get the free Charitable Giving Form

Get, Create, Make and Sign charitable giving form

How to edit charitable giving form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable giving form

How to fill out charitable giving form

Who needs charitable giving form?

Charitable Giving Form – How-to Guide

Overview of charitable giving forms

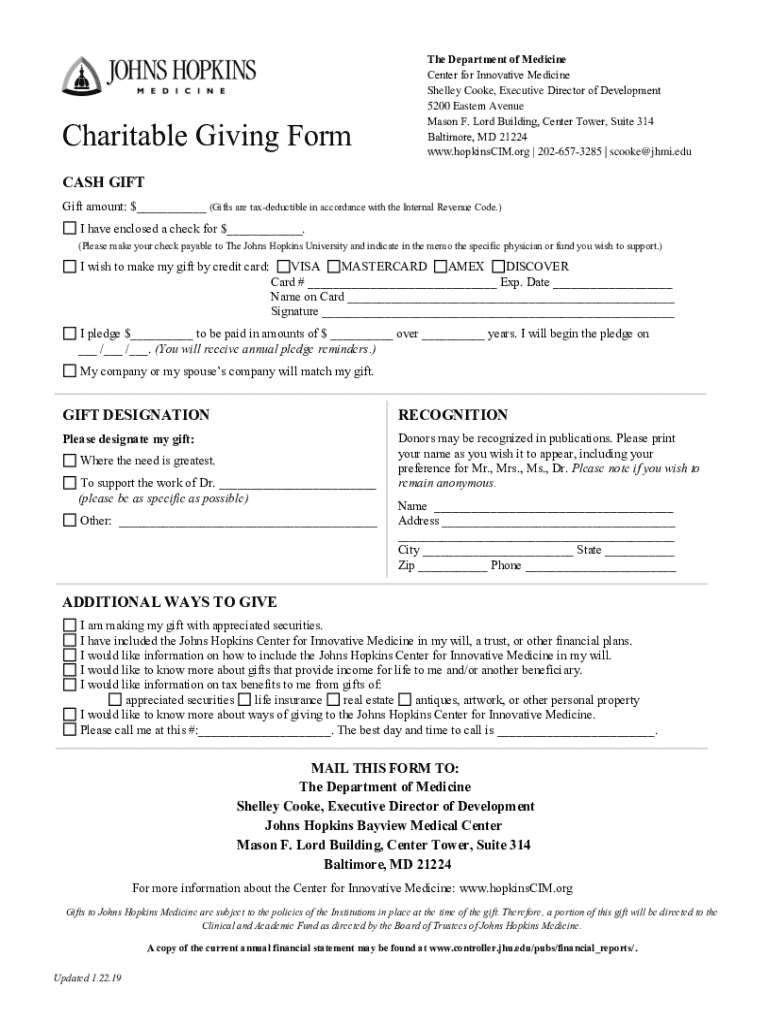

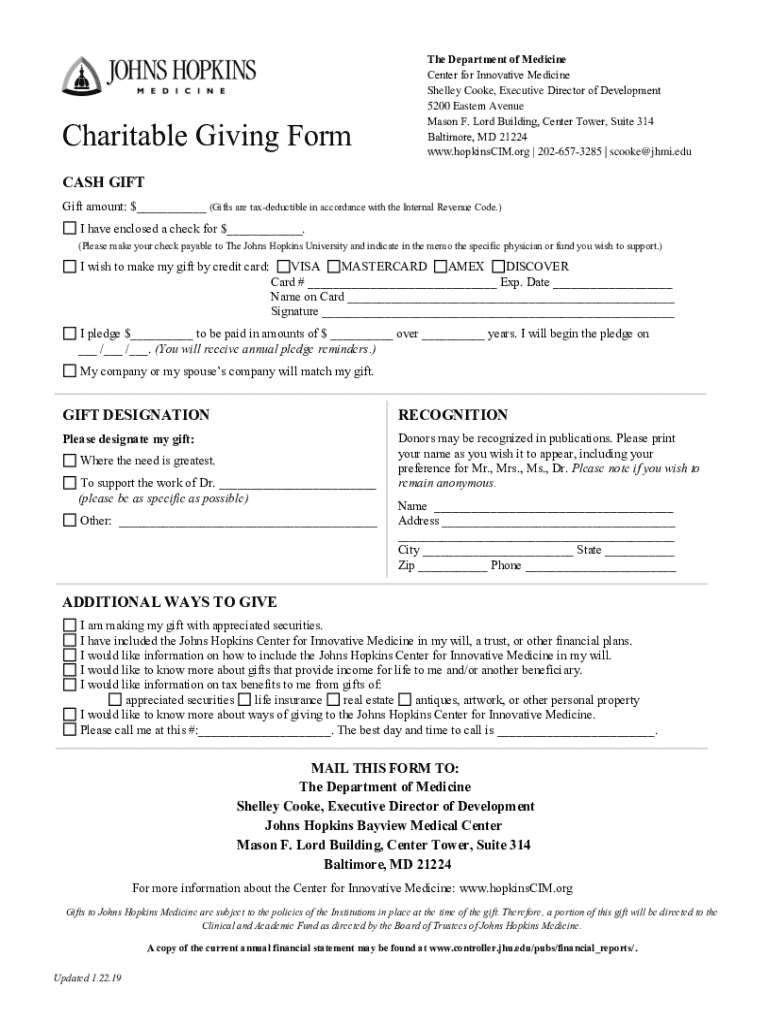

A charitable giving form serves as a structured document through which donors can contribute funds to nonprofits or charitable organizations. Its primary purpose is to streamline the donation process, ensuring ease and clarity for both the donor and the organization. For nonprofits, having an effective charitable giving form is crucial for maximizing donations and fostering donor trust, while donors benefit from a transparent and straightforward way to contribute to causes they care about.

Effective charitable giving forms usually encompass key features like multiple donation amounts, clear instructions, data protection assurances, and donor acknowledgment systems. These elements not only improve the user experience but also enhance the credibility of the nonprofit, encouraging more individuals to follow through with their generosity.

Getting started with charitable giving forms

Various types of charitable giving forms cater to different needs, and identifying the right one is essential. One-time donation forms are the simplest, allowing donors to make a singular contribution easily. For organizations looking to establish long-term support, recurring donation setups help create a steady stream of funding, encouraging habitual giving over time.

Fundraising campaign forms are another important type, designed specifically for events or initiatives aiming to raise a specific amount of money within a set timeframe. Choosing the right charitable giving form depends on your organizational goals, the expected donor engagement levels, and the intended use of the collected funds.

Crafting your charitable giving form

When developing a charitable giving form, you should include essential elements such as donation amount options, clear instructions for donors, and details about fund allocation. Donation amount options can range from specific dollar amounts to personalized input fields where donors can specify their contribution, allowing flexibility. Clear instructions guide the donor through the process, emphasizing the ease of contributing and the impact of their donation.

It's beneficial to inform donors about how their contributions will be used, ensuring transparency and encouraging larger donations. Personalizing your charitable giving form through branding and engaging language can significantly enhance its effectiveness. Incorporating your organization's logo and visuals can create a sense of familiarity, while storytelling and compelling language can resonate emotionally with potential donors, inspiring them to give.

User-friendly design and layout

A well-designed charitable giving form promotes a seamless user experience. Design best practices such as visual appeal and clarity should guide the layout. Using appropriate colors, spacing, and fonts can attract attention and aid readability. Additionally, ensuring mobile-responsiveness is crucial, as many users will access the form through mobile devices. A responsive design guarantees that all users can navigate the form efficiently, regardless of device.

Creating a seamless user journey involves minimizing required fields to the essentials and ensuring intuitive navigation throughout the form. This approach enables donors to complete their contributions with minimal confusion, reducing form abandonment rates. The easier it is for users to complete their donations, the more likely they are to follow through.

Payment processing and security

When incorporating payment processing into your charitable giving form, offering a variety of payment options is crucial to accommodate all potential donors. Options such as credit/debit cards, PayPal, and bank transfers can cater to different preferences, enhancing accessibility. Providing multiple payment methods not only encourages more contributions but also builds trust, as donors will feel more comfortable using payment methods they recognize and appreciate.

Equally important is the security of transactions. Nonprofits should implement SSL certificates and robust data encryption practices to safeguard sensitive donor information. Ensuring that the payment process is secure can significantly affect a donor's willingness to contribute, as security concerns often deter potential donors. Providing visible security assurances on the form can alleviate hesitations surrounding online transactions.

Testing your charitable giving form

Before launching your charitable giving form, usability testing is critical to ensure optimal functionality. This testing phase should include verifying the payment process and gathering user experience feedback. Conducting functional tests allows you to identify any technical glitches that could hinder the donation experience. Additionally, collecting feedback from potential users during this phase can provide valuable insights into their experiences and suggestions for improvements.

By addressing issues identified during testing, organizations can refine their forms to provide a smoother, more intuitive donor experience, ultimately leading to higher rates of conversion. Regularly revisiting and testing your forms can help keep them relevant and effective over time.

Promoting your charitable giving form

Effective promotion strategies are essential to driving donations through your charitable giving form. Leveraging social media platforms allows organizations to reach a broader audience, engage potential donors, and share compelling stories about the impact of their contributions. Creating shareable content and utilizing hashtags can further enhance visibility and encourage engagement.

Additionally, implementing targeted email marketing campaigns can directly reach your existing supporters, reminding them of the opportunity to contribute through your giving form. Utilizing analytics tools to monitor conversion rates enables organizations to assess the effectiveness of their strategies, allowing for data-driven adjustments to optimize performance. Understanding which channels generate the most engagement can guide future marketing efforts.

Example charitable giving forms

Examining existing high-performing charitable giving forms can provide valuable insights for building your own. An effective form often includes features like donation matching highlights, compelling visuals, and straightforward navigation processes that successfully capture donor information. For example, forms utilized during major campaigns may incorporate specific calls to action, making it easy for donors to understand their impact at a glance.

Case studies of successful campaigns can further illustrate the creative strategies deployed by organizations that have achieved significant fundraising goals. Exploring these examples can offer inspiration and practical ideas that can be tailored to your organization's unique mission and audience.

Bonus tips for enhancing donation effectiveness

Maximizing donor engagement through storytelling can significantly enhance the effectiveness of your charitable giving form. Sharing real-life stories and testimonials can foster emotional connections, motivating donors to act. Furthermore, providing regular updates on the impact of contributions ensures that donors remain informed and involved, emphasizing the continued relevance of their support.

Encouraging recurring donations can also be instrumental in improving long-term funding. Highlighting the benefits of such programs, like exclusive updates or personalized communication, can appeal to donors looking for deeper engagement. Implementing a well-structured monthly giving program can establish a reliable funding source and build a committed base of supporters.

Common challenges and solutions

While developing and deploying a charitable giving form, organizations may encounter common challenges. For example, donor concerns regarding transaction security, fund usage transparency, or user experience can deter contributions. Addressing these concerns proactively through well-placed FAQs or direct communication can mitigate hesitations and facilitate trust.

Additionally, technical issues like form loading errors or payment processing failures can undermine the donation process. To combat this, employing thorough testing protocols and having contingency plans in place ensures that organizations can resolve any issues and provide an uninterrupted and positive donation experience.

Legal considerations and compliance

Nonprofits must be alert to legal considerations and compliance when creating charitable giving forms. Understanding IRS regulations surrounding charitable donations is vital to ensure adherence to the law. Being transparent about fund usage is not only morally imperative but also legally necessary, as donors deserve to know how their contributions are utilized and the effects they are having.

Compliance with local and federal regulations builds trust within the donor community and can positively influence donation rates. Organizations should regularly review their practices and ensure all aspects of their charitable giving form align with the necessary legal requirements to protect both the organization and its supporters.

Tailored interactive elements

Incorporating tailored interactive elements into your charitable giving form can enhance user engagement and satisfaction. For instance, providing an interactive tool that allows users to customize their charitable giving form could empower them to select their preferred donation amounts and purposes. A live preview feature could enable donors to see real-time adjustments, ensuring they understand their contributions' impact before finalizing their donations.

These dynamic elements not only make the giving process more enjoyable but also signify the organization's investment in providing a user-centric experience. Ensuring that the form feels collaborative and personalized can encourage donors to contribute more generously.

Conclusion of the guide

Creating a compelling charitable giving form requires a combination of strategic thinking, design insight, and a genuine commitment to engaging donors effectively. By implementing the insights shared in this guide, organizations can optimize their forms to enhance user experience, increase engagement, and ultimately drive donations. The emphasis on security, functionality, and engagement will encourage a trusted channel for charitable contributions, positively impacting nonprofits and donors alike.

With the assistance of pdfFiller’s tools, organizations have the resources needed to create and manage effective charitable giving forms easily. We encourage you to take the time to refine your approach to charitable giving, ensuring your form is not only functional but also resonates with potential donors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify charitable giving form without leaving Google Drive?

How do I edit charitable giving form online?

How do I fill out charitable giving form using my mobile device?

What is charitable giving form?

Who is required to file charitable giving form?

How to fill out charitable giving form?

What is the purpose of charitable giving form?

What information must be reported on charitable giving form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.