Get the free Certification of Final Taxable Value

Get, Create, Make and Sign certification of final taxable

Editing certification of final taxable online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certification of final taxable

How to fill out certification of final taxable

Who needs certification of final taxable?

Certification of Final Taxable Form: A Comprehensive Guide

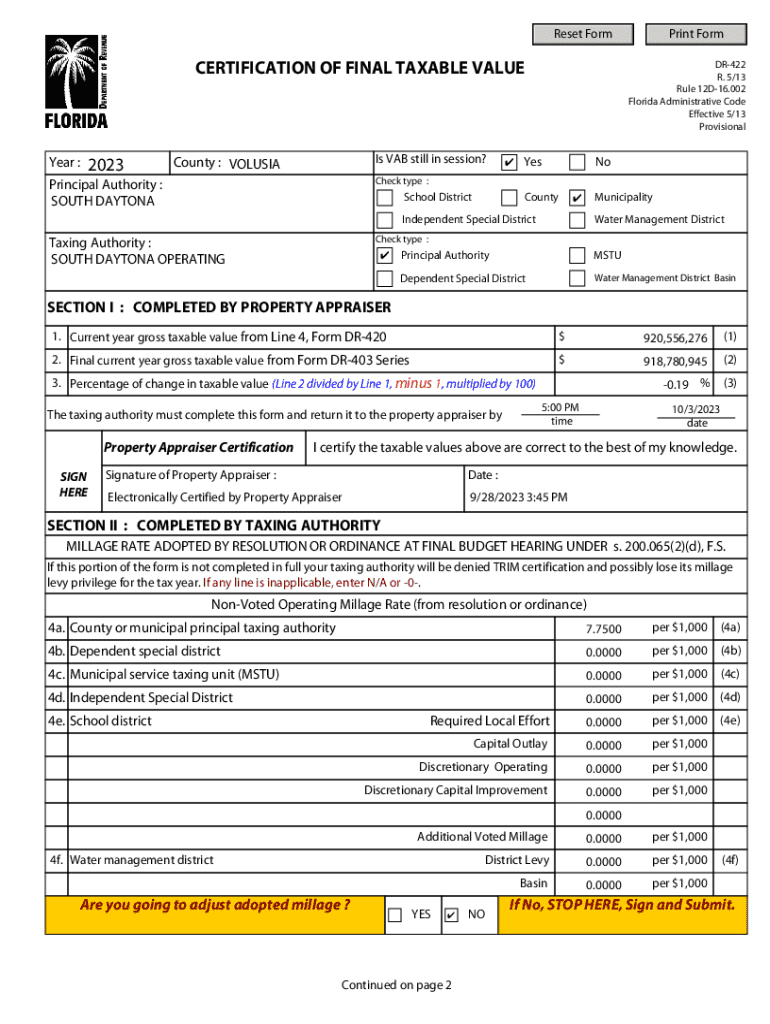

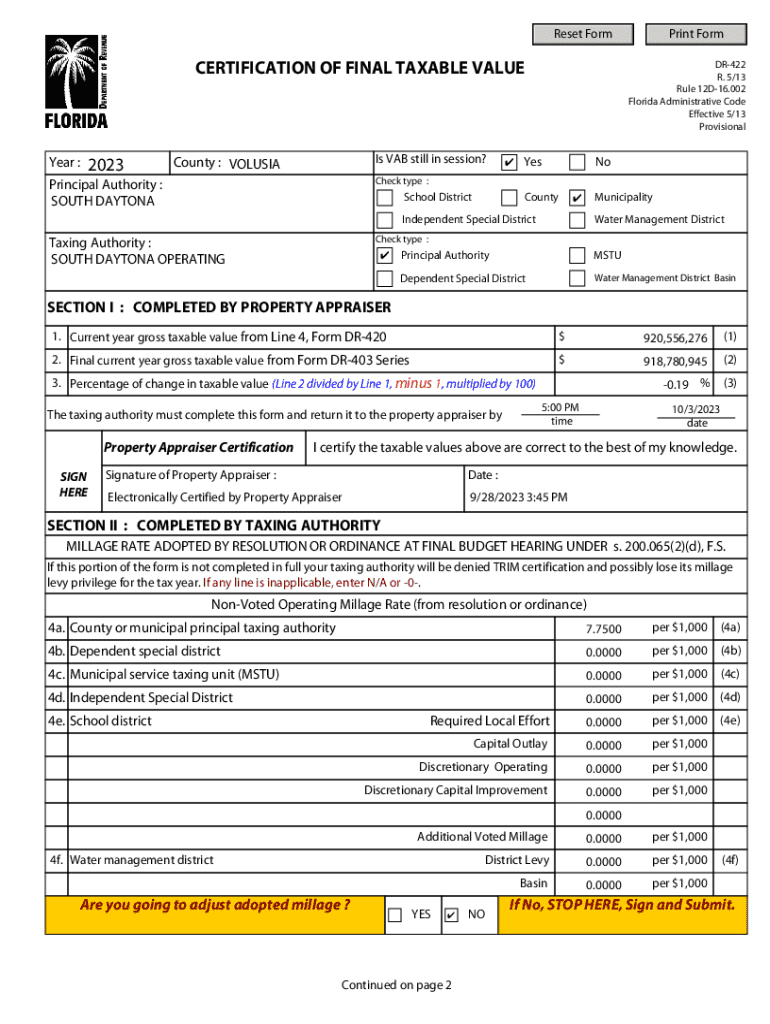

Understanding the certification of final taxable form

The certification of final taxable form serves as a crucial document in a taxpayer's journey, providing a declaration of all taxable income, deductions, and the overall tax liability for a specific period. This certification is essential for ensuring compliance with tax regulations, and it is required by various tax authorities during the assessment and verification of a taxpayer's financial records.

This document not only helps in determining the actual taxes owed but also aids in refund processing for overpayments. The significance of this form is reflected in its ability to give tax authorities a complete view of an individual's or entity's financial situation, thereby facilitating a fair tax assessment. Various regulations govern the certification process, such as the Internal Revenue Code in the U.S., which outlines specific requirements and guidelines.

Essential information you need

Before you embark on filling out the certification of final taxable form, it's crucial to gather all relevant documentation to support your declaration. This preparation ensures that you have a comprehensive view of your taxation situation, minimizing potential errors during submission.

Key documents include:

Familiarize yourself with key terms that will appear throughout the process, including taxable income, deductions, and credits, as understanding these concepts will empower you during form completion.

Step-by-step instructions for completing the form

Successfully completing the certification of final taxable form requires careful attention to detail. The following steps will guide you through this process.

### Step 1: Accessing the certification of final taxable form

You can find the certification form on the official tax authority's website or platforms like pdfFiller, which provides a user-friendly interface for accessing, editing, and managing forms. pdfFiller offers the form in various formats, including editable PDFs, ensuring accessibility for all users.

### Step 2: Filling out personal information

Begin by entering your personal information accurately. This includes your full name, address, social security number, and phone number. Ensure that all entries are correct and legible, as mistakes can lead to processing delays.

### Step 3: Declaring income and deductions

Next, clearly present your sources of income. Common categories include wages, self-employment income, rental income, and dividends. Be thorough and transparent. Don't forget to also account for deductions that may lower your taxable income, such as student loan interest or mortgage interest.

### Step 4: Signing and submitting the form

Once you've filled out the certification form, you can utilize pdfFiller’s eSigning options for a quick and secure signature. Subsequently, review your form for any last-minute errors before choosing your submission method—either online through the tax authority’s portal or via traditional mail.

Interactive tools for form management

pdfFiller’s interactive editor offers a robust set of tools for managing your certification of final taxable form and other documents. This platform facilitates easy editing and collaboration, making it simple to invite teammates for joint efforts if necessary.

Some notable features include:

These features not only streamline your workflow but also enhance collaboration, which is especially beneficial for teams handling tax matters.

Common mistakes to avoid

Filling out the certification of final taxable form may seem straightforward, yet several pitfalls can lead to complications and additional scrutiny from tax authorities. Some of the most common errors include omission of income sources, misreporting deductions, and incorrect personal information.

### Consequences of inaccuracies or omissions

Each of these mistakes can result in penalties or delays in processing your tax return. pdfFiller assists in minimizing these risks by highlighting mandatory fields and prompting you with checklists to ensure everything is complete. This feature helps ensure that your submission is as accurate and thorough as possible.

FAQs about the certification process

It’s common for taxpayers to have questions regarding the certification of final taxable form, especially concerning how long it takes for processing and what to do if there are issues. Here are answers to some frequently asked questions:

Real-life scenarios and case studies

The impact of the certification of final taxable form can differ based on individual financial circumstances. Consider a self-employed individual who manages their own tax filings. Precision is critical here; one oversight may lead to significant penalties or delayed refunds.

Alternatively, corporate entities that handle team-based tax filings showcase how collaboration through platforms like pdfFiller can increase efficiency and productivity. Sharing access and responsibilities ensures the accurate completion of the certification, ultimately leading to more favorable tax outcomes.

Learning from these scenarios, it's evident how vital the certification form process is across various tax situations, underscoring the importance of accuracy and thorough preparation.

Resources for further assistance

Navigating the complexities of tax forms can be daunting, but being equipped with the right resources can make all the difference. Several tax authorities and agencies provide comprehensive guidance on the certification of final taxable forms. For localized support, visit the website of your country’s tax authority or check for help articles associated with your jurisdiction.

If you encounter difficulties, pdfFiller offers customer support that can assist you through the process. Additionally, community forums have a wealth of shared experiences and solutions that can be immensely helpful.

Leveraging pdfFiller for seamless document management

pdfFiller stands out as a comprehensive platform that simplifies the management of tax documents such as the certification of final taxable form. Its cloud-based nature allows users to access their forms from anywhere, enabling flexibility and convenience for both individuals and teams.

With features designed to enhance efficiency, such as real-time collaboration and document automation, pdfFiller empowers users to complete this critical document with ease. Testimonials from satisfied users emphasize how the platform has alleviated their financial documentation burdens, ultimately enhancing their tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certification of final taxable in Gmail?

How do I edit certification of final taxable in Chrome?

Can I sign the certification of final taxable electronically in Chrome?

What is certification of final taxable?

Who is required to file certification of final taxable?

How to fill out certification of final taxable?

What is the purpose of certification of final taxable?

What information must be reported on certification of final taxable?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.