Get the free Credit Card Processing Form

Get, Create, Make and Sign credit card processing form

Editing credit card processing form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card processing form

How to fill out credit card processing form

Who needs credit card processing form?

Credit Card Processing Form How-to Guide

Understanding credit card processing forms

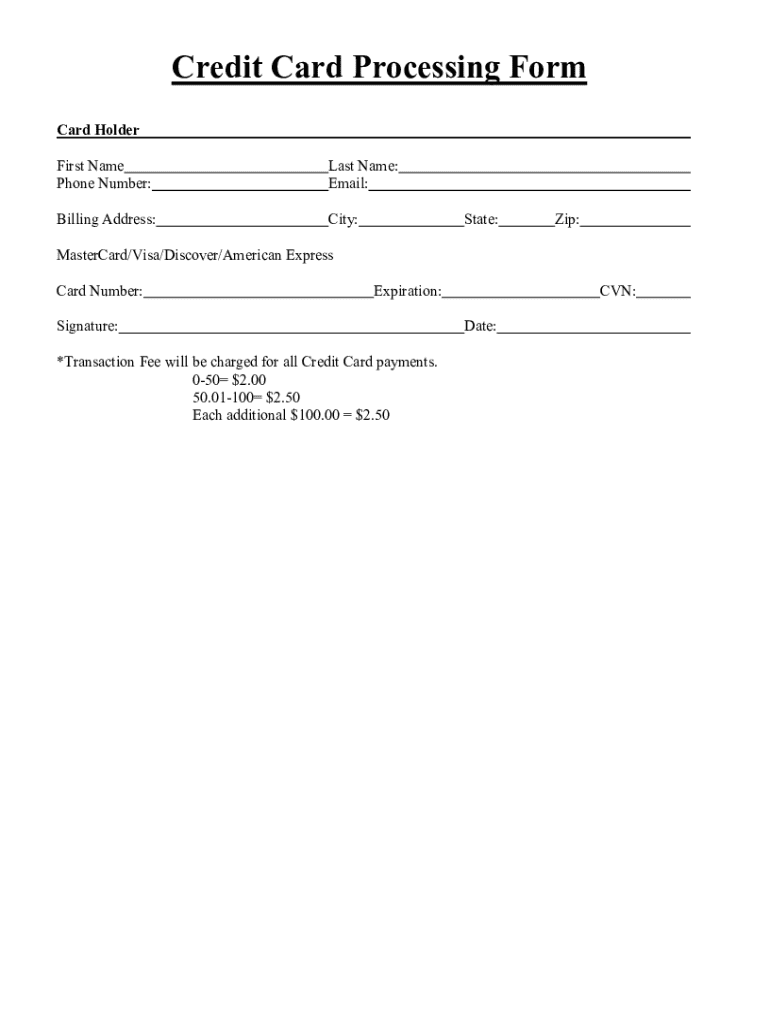

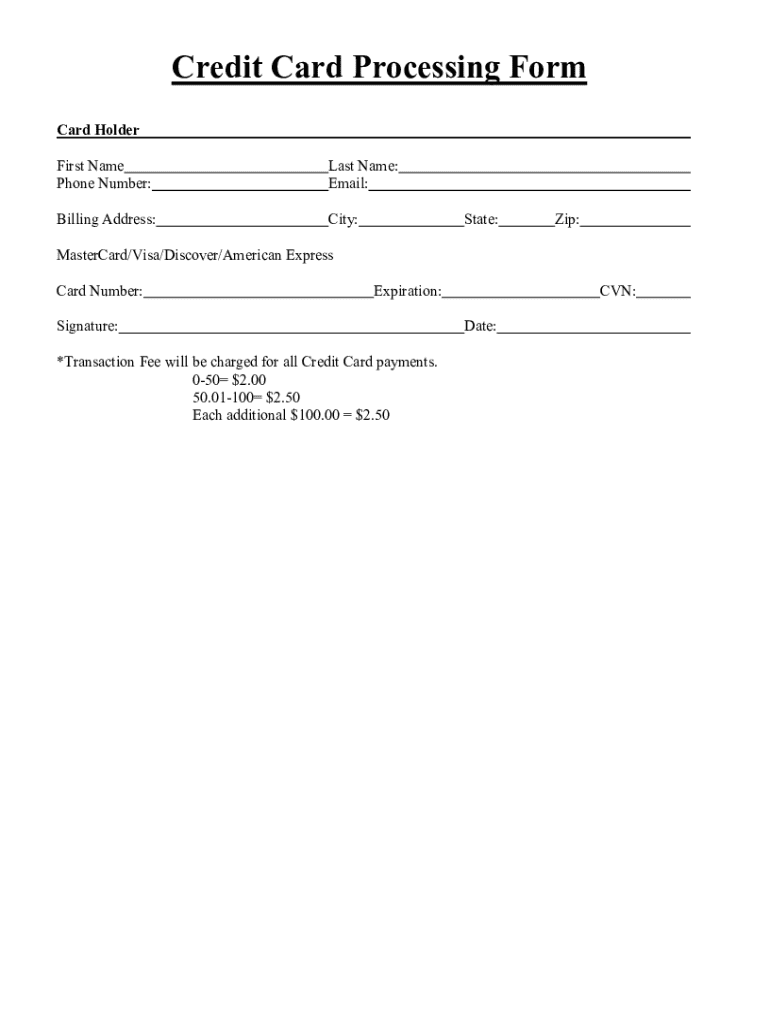

A credit card processing form is a secure document used to collect and authorize payment information from customers. Its main purpose is to facilitate financial transactions, allowing businesses to efficiently handle payments through credit card providers. These forms are crucial in various business contexts, ensuring seamless transactions while protecting sensitive customer information.

The key components of a credit card processing form typically include mandatory fields such as cardholder name, card number, and expiration date. Optional fields might encompass the CVV code and billing address. Understanding these elements is vital for both the merchant and the customer to complete the transaction smoothly.

Key components of a credit card processing form

In more detail, credit card processing forms can be categorized into three main types: online forms, which are used on websites for e-commerce transactions; offline forms, often utilized in restaurants or stores; and mobile processing forms, typically found in applications for on-the-go payments. Each type serves unique business needs.

The role of credit card authorization forms

A credit card authorization form is distinct from a processing form, primarily used to obtain explicit permission to charge a customer’s card for specific transactions. This form is vital in proving that the cardholder has agreed to the charge, offering additional protection against disputes.

Authorization forms are especially beneficial in scenarios such as subscription services or rentals where ongoing payments may occur. They also ensure compliance with payment regulations, protecting both the merchant and consumer.

When to use a credit card authorization form

Employing a credit card authorization form at the right time can make a significant difference in transaction integrity. It might be essential in instances where future charges are expected or in high-risk industries that experience a higher rate of chargebacks. Understanding the appropriate applications of this form can enhance your business operations and customer trust.

Completing your credit card processing form

Filling out a credit card processing form requires careful attention to detail to avoid mistakes that can lead to unsuccessful transactions. Here is a step-by-step guide to ensure accuracy:

Common mistakes include leaving fields incomplete or misreading card details. Ensuring the information is entered correctly can save time and frustration.

Tips for enhanced security

To enhance overall security when completing credit card processing forms, use encrypted connections to protect data transmission. Additionally, consider how you store this sensitive information after processing, always opting for secure, compliant methods to guard against data breaches.

Editing and managing your credit card processing forms with pdfFiller

pdFiller provides powerful tools for editing credit card processing forms, making it easy to ensure accuracy and legality. Users can utilize interactive tools within pdfFiller to modify forms as needed, adding electronic signatures to streamline the approval process.

Collaborating with team members is made simple in pdfFiller, as real-time editing and commenting features enable seamless communication and updates. Managing completed forms is also straightforward, with cloud storage options allowing for easy retrieval and organization.

Managing completed forms

Best practices for document organization in pdfFiller ensure that your credit card processing forms are secure, easily accessible, and systematically arranged, thereby enhancing productivity and reducing the possibility of errors.

Frequently asked questions

Many individuals and teams have queries regarding credit card processing forms. Below are some frequently asked questions that can provide clarity on this topic:

Downloadable resources

pdfFiller offers access to a range of credit card processing form templates to streamline your operation. Users can customize these forms to suit their specific business needs, ensuring compliance and ease of use.

By leveraging these resources, you can enhance your financial documentation process, ensuring clarity and compliance.

Related articles and further reading

For those looking to expand their knowledge on related subjects, consider exploring these topics that delve deeper into payment processing and security practices:

Getting started with pdfFiller

Starting with pdfFiller is easy and efficient. Users can quickly create an account and gain access to the platform's vast library of forms and templates. The interface is designed to maximize productivity, allowing you to find the necessary tools quickly.

Interactive tools and support

pdfFiller provides a suite of interactive tools to enhance form functionality, allowing users to edit, sign, and collaborate seamlessly. Should you require assistance, customer support is readily available to guide you through any challenges you may face.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card processing form from Google Drive?

Can I create an eSignature for the credit card processing form in Gmail?

How do I fill out the credit card processing form form on my smartphone?

What is credit card processing form?

Who is required to file credit card processing form?

How to fill out credit card processing form?

What is the purpose of credit card processing form?

What information must be reported on credit card processing form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.