Get the free Check Request/payment Authorization Form

Get, Create, Make and Sign check requestpayment authorization form

How to edit check requestpayment authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check requestpayment authorization form

How to fill out check requestpayment authorization form

Who needs check requestpayment authorization form?

Check Request Payment Authorization Form: A Complete Guide

Understanding payment authorization forms

A payment authorization form is a crucial document used to obtain consent from a payee before processing a payment. This form ensures that funds are disbursed appropriately and protects both the payer and payee from unauthorized transactions. Utilizing a payment authorization form is vital in any financial transaction, whether for personal finances or business expenditures.

The importance of using a payment authorization form cannot be overstated. It establishes a clear agreement on the terms of the payment, safeguarding against potential disputes or misunderstandings. Key elements typically included in a payment authorization form are the payee’s personal information, the payment amount, the date of the transaction, and the method of payment. Collectively, these components provide transparency and accountability for both parties.

Types of payment authorization forms

There are various types of payment authorization forms tailored to specific transactions. Understanding which form to use for which situation is essential for efficient payment processing.

Each type of form is applicable depending on the nature of the transaction. For instance, a credit card authorization is typically used for retail payments, while electronic payment authorizations are essential for subscription services or recurring billing.

How to use a check request payment authorization form

Properly completing a check request payment authorization form is key to ensuring the transaction proceeds without issues. Here are steps to guide you in filling it out effectively.

Common mistakes to avoid

Filling out a payment authorization form correctly is critical, but errors often occur. Being aware of common pitfalls can save you time and prevent complications.

Before submission, take a moment to double-check your form. Verifying each section will help ensure completeness and accuracy, mitigating the risk of unauthorized payments or rejections.

Best practices for managing authorization forms

Once you have completed the check request payment authorization form, managing it properly is also crucial. Ensuring that these documents are readily available and securely stored reduces the risk of lost or compromised information.

Implementing a structured approach to document management will not only ensure quick retrieval during audits but also instill confidence in financial transactions.

Integration of the check request payment authorization form with pdfFiller

pdfFiller enhances the usability of payment authorization forms with a range of features that simplify the document process. From editing capabilities to cloud accessibility, pdfFiller equips teams with essential tools.

Accessing and managing forms on a cloud-based platform streamlines the entire process, making it accessible from anywhere, which is particularly beneficial for remote teamwork.

Legal considerations in payment authorization

When dealing with payment authorization forms, it is essential to understand your rights and obligations. These documents can carry significant weight in legal and financial agreements.

Awareness of these legal aspects is crucial in fostering trust and ensuring compliance in financial transactions.

Frequently asked questions (FAQ)

Querying the usage and importance of payment authorization forms can foster better understanding for individuals and businesses alike.

Testimonials and case studies

Many businesses have realized significant benefits from adopting structured payment authorization process through platforms like pdfFiller.

The adoption of effective documentation processes has unequivocally demonstrated its value in efficiency and accuracy within various organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my check requestpayment authorization form directly from Gmail?

Can I create an electronic signature for signing my check requestpayment authorization form in Gmail?

How do I fill out check requestpayment authorization form using my mobile device?

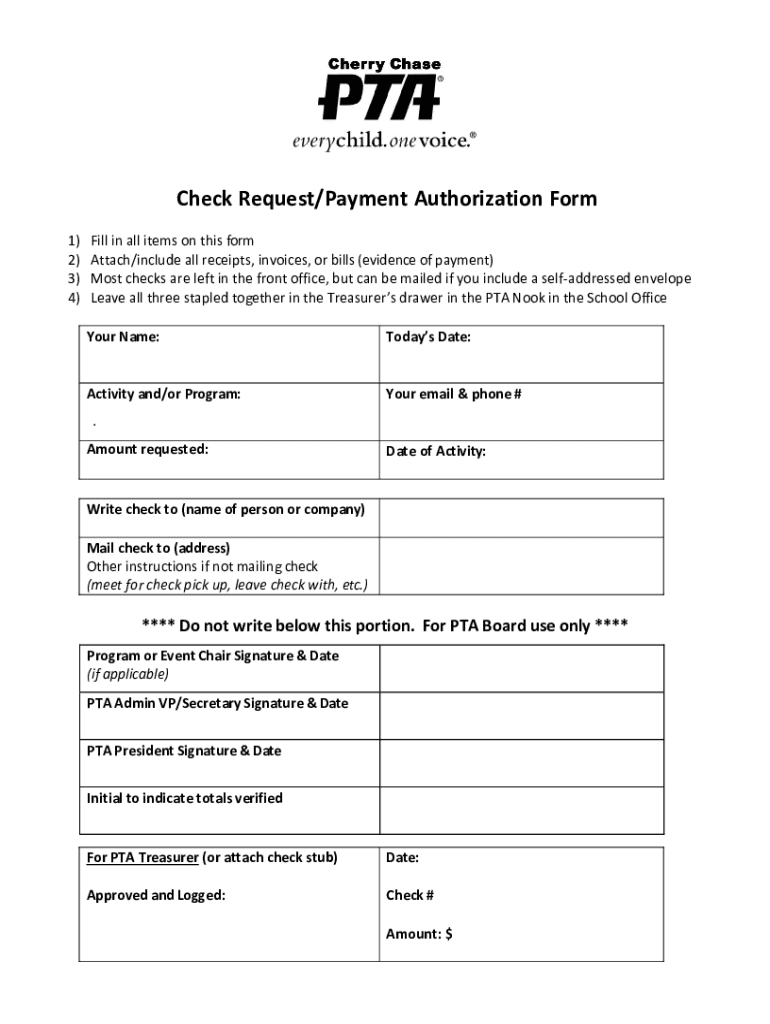

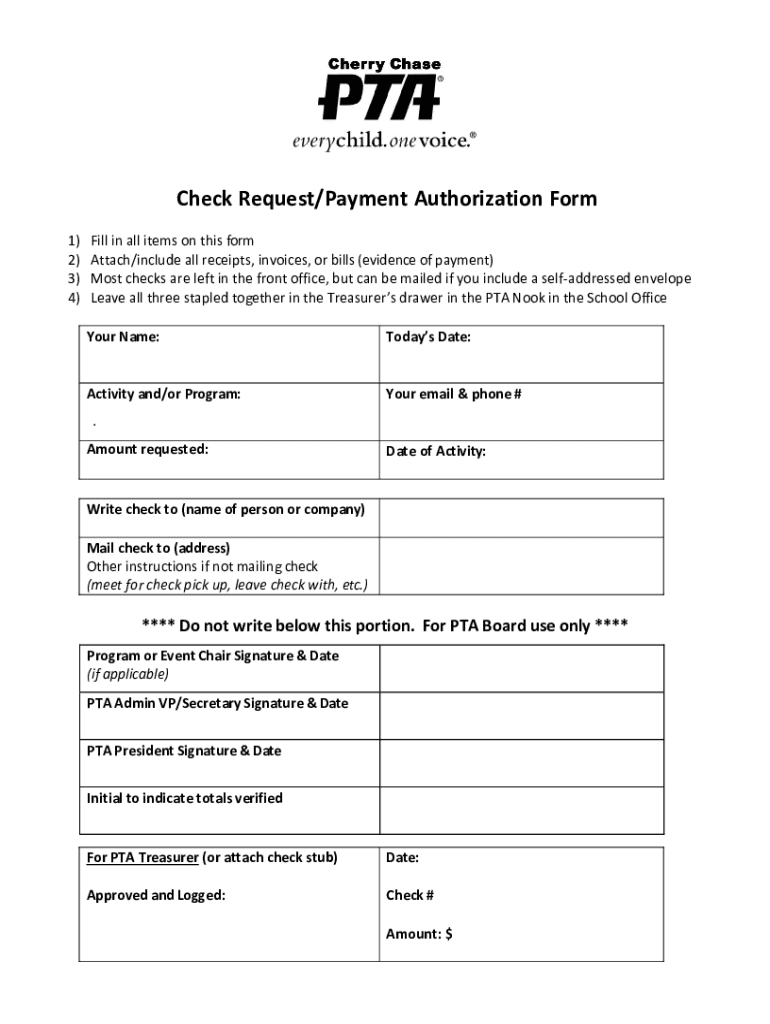

What is check request/payment authorization form?

Who is required to file check request/payment authorization form?

How to fill out check request/payment authorization form?

What is the purpose of check request/payment authorization form?

What information must be reported on check request/payment authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.