Get the free Card Payment Authority Form

Get, Create, Make and Sign card payment authority form

Editing card payment authority form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out card payment authority form

How to fill out card payment authority form

Who needs card payment authority form?

Card Payment Authority Form: A Comprehensive Guide

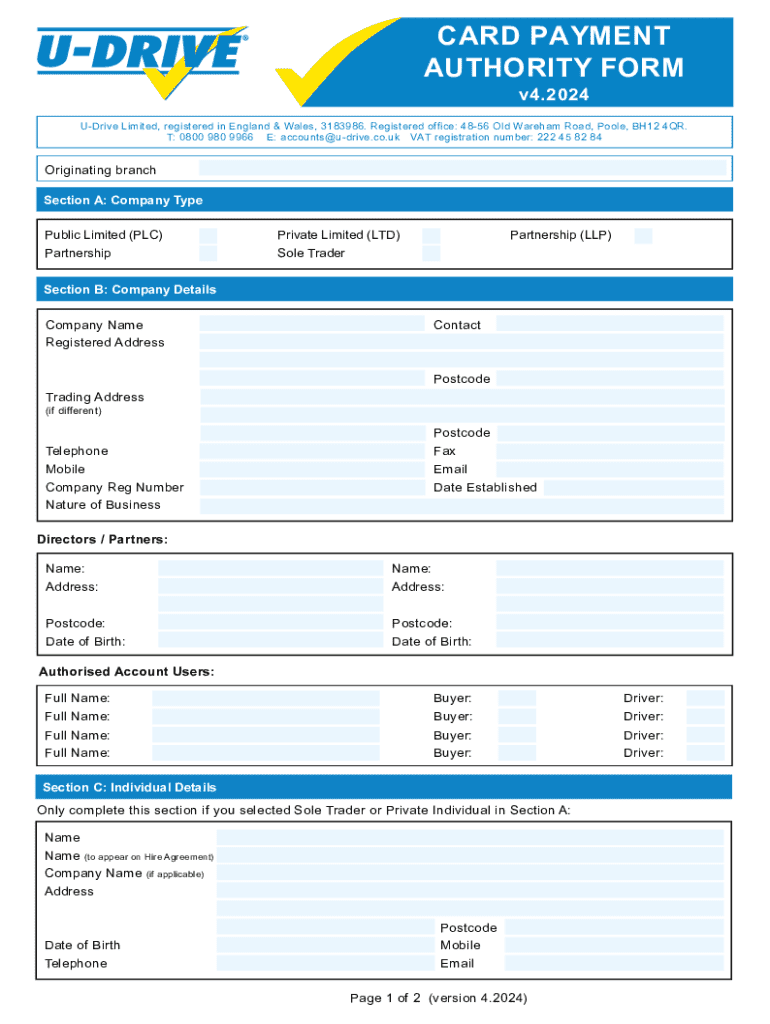

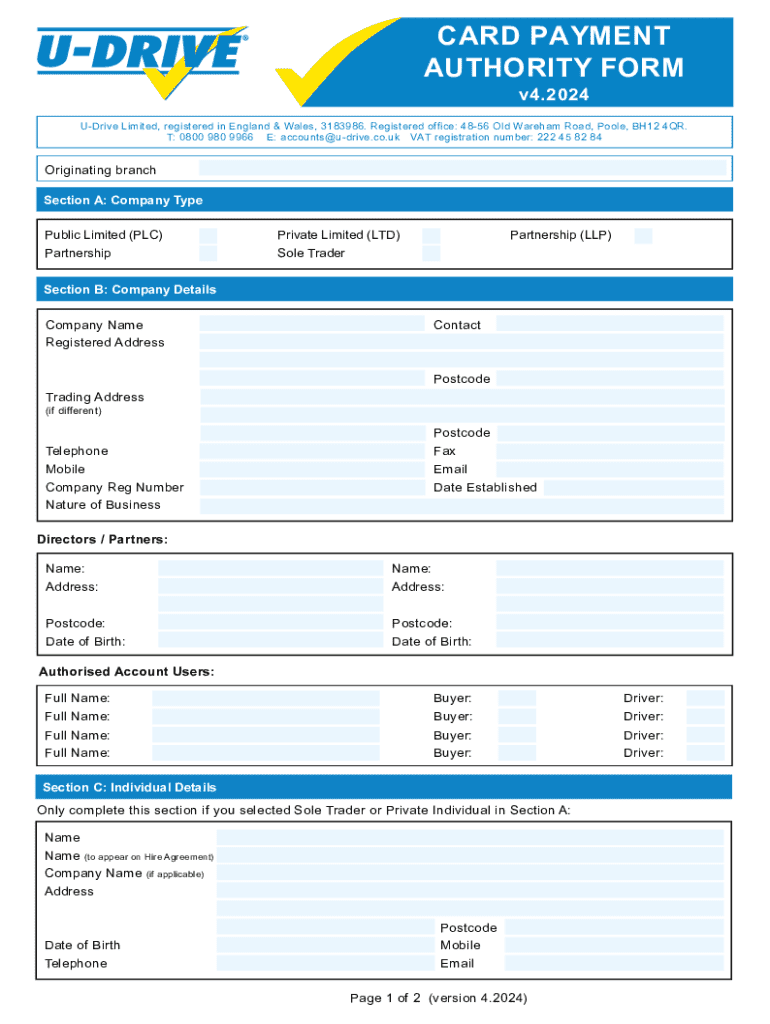

Understanding the card payment authority form

A card payment authority form is a crucial document that enables businesses to collect payments from customers’ credit or debit cards. It is an essential part of ensuring that these transactions are conducted securely and legally. This form provides explicit authorization from the cardholder, granting the business permission to charge their card for specific amounts at specified intervals.

The importance of utilizing a card payment authority form cannot be overstated. It serves as a protective measure for both the merchant and the customer, offering a clear record of the transaction's terms. Without this form, businesses may face increased risks associated with chargebacks and disputes, which can be costly and cumbersome to resolve.

Key elements of a card payment authority form typically include the following components:

Benefits of using a card payment authority form

Utilizing a card payment authority form offers myriad benefits for businesses and customers alike. One primary advantage is the mitigation of chargebacks and disputes. By maintaining a record of the cardholder's agreement, businesses are less vulnerable to claims of unauthorized transactions, ultimately protecting their bottom line.

Furthermore, this form helps streamline the payment collection process. It establishes a clear agreement on how and when payments will be taken, allowing for more efficient billing and reducing administrative burdens. Businesses often find this operational clarity aids in maintaining customer satisfaction.

The ability to enhance security and compliance also stands out among the benefits. With the authorization documented, companies can feel assured they are adhering to necessary financial regulations, thereby reducing their risk profile. Additionally, this form increases customer accountability since customers are informed and have agreed to the terms of payment, thereby fostering a more trustworthy business relationship.

Situations where a card payment authority form is necessary

There are several scenarios in which utilizing a card payment authority form becomes essential. Service providers—like those in the hospitality or restaurant industry—often require it to guarantee payment for services rendered. For instance, a restaurant might utilize this form to secure future events or bookings that require advance payment.

Subscription-based models, particularly those that involve recurring charges, create a need for this form as well. By capturing customer consent for ongoing payments, businesses ensure they have the necessary authorization to charge customers at regular intervals, significantly reducing the risk of service interruption due to payment issues.

High-value transactions, such as large online purchases or rental agreements, also necessitate a card payment authority form. In these cases, the businesses involved benefit by confirming that they have the legal authorization to process potentially significant amounts of money with minimal risk.

How to fill out a card payment authority form

Filling out a card payment authority form accurately is critical to avoid complications in the payment process. Here’s a step-by-step guide on how to complete this form effectively:

To ensure accuracy and compliance, it’s also vital to double-check the entered information and have a secondary party verify it as needed. This can be particularly helpful to avoid common mistakes that may lead to disputes later.

Common mistakes to avoid

When filling out a card payment authority form, there are several common pitfalls that businesses should avoid to ensure smooth operations. One significant mistake is providing incomplete information, which can lead to payment failures and necessitate re-authorization.

Equally important is securing proper consent from the cardholder. In some cases, businesses might overlook the need for the cardholder's signature, leaving them vulnerable to disputes regarding authorization. Failure to update stored cardholder data is another essential aspect to consider; outdated details can hinder transactions and damage client trust.

Lastly, it’s crucial to have a proper understanding of the implications of the authorization. Businesses should ensure cardholders are aware of the payment terms, such as recurring charges, to mitigate risks related to chargebacks and customer dissatisfaction.

Best practices for managing card payment authority forms

Effective management of card payment authority forms is essential for safeguarding against fraudulent activities. Businesses should implement secure storage solutions for completed forms, ensuring that sensitive customer information is well-protected. Digital storage via cloud solutions can provide both security and ease of access.

Recommended retention periods for transaction records vary by region but generally suggest keeping them for at least five years. Regular audits and reviews of stored forms can help identify any outdated or unnecessary records, helping streamline document management while maintaining compliance.

Utilizing platforms like pdfFiller for storing and managing these documents provides a user-friendly, secure, and efficient solution. Their system allows for easy retrieval and modification, ensuring that businesses can maintain accurate and up-to-date card payment authority forms for all customers.

Frequently asked questions (FAQs)

Many individuals and businesses have questions regarding the specificities of card payment authority forms. One frequent inquiry is regarding the difference between a card payment authority form and a direct debit authorization. While both involve authorization for payments, a card payment authority typically applies to credit and debit cards, while direct debit is associated with bank accounts.

Another common question is about the process of canceling an authorization. If a cardholder wishes to revoke their authorization, they should communicate directly with the merchant to ensure the payment process is halted appropriately.

Businesses often wonder how to securely transmit completed forms to merchants. Using encrypted emails or secure online portals ensures that sensitive information is protected during transfer. Lastly, while businesses can technically accept card payments without this form, doing so greatly increases their exposure to risk, making it an impractical approach.

Related topics

To enhance your understanding of payment processes, it’s useful to examine the implications of card-not-present transactions. These transactions, which often occur online, have specific risks associated with fraud that make secure authorization forms even more essential.

Additionally, grasping the concept of PCI compliance is vital for any business dealing with card payments. This compliance ensures that businesses maintain security standards necessary to protect cardholder information, thereby protecting themselves from potential liabilities.

Strategizing effective chargeback management is another crucial aspect of payment processing. Understanding how to respond to chargebacks and minimize their occurrence can lead to healthier financial practices over time.

Interactive tools and resources on pdfFiller

pdfFiller offers a myriad of interactive tools to simplify the management of card payment authority forms. Users can download templates for these forms, allowing for easy customization to meet unique business needs. Furthermore, pdfFiller’s platform includes interactive tools for form editing and electronic signing, streamlining the overall process.

For those looking for a more visual guide, video tutorials are available, demonstrating how to efficiently fill and manage card payment authority forms using the platform. This resource is especially beneficial for individuals and teams seeking to enhance their document creation and management processes from an easily accessible cloud-based solution.

User testimonials

Real-life experiences from businesses using card payment authority forms reflect the ease and efficiency offered by pdfFiller. Many users report that the platform has simplified their document management processes significantly, allowing them to focus more on serving customers rather than getting bogged down in administrative tasks.

Customers have praised pdfFiller for its intuitive interface, highlighting how easy it is to implement their form management strategies with the tools provided. The feedback emphasizes that the ability to manage sensitive payment authorization forms securely from any location has played a vital role in enhancing their business operations.

How pdfFiller can enhance your payment authorization process

pdfFiller stands out by offering features that enhance the payment authorization process significantly. For instance, signature collection is made easy with integrated eSigning capabilities, ensuring that businesses can quickly obtain the necessary approvals without needing to meet face-to-face.

Additionally, pdfFiller facilitates collaboration among team members managing payment authorization. Their platform allows for multiple users to work on the same document, ensuring efficient communication and speedy resolution of issues.

The cloud storage advantages offered by pdfFiller also ensure that businesses maintain secure document access, with the ability to retrieve forms anytime, from anywhere. This flexibility proves invaluable for teams that require constant access to critical documents like card payment authority forms.

Explore more solutions

In addition to the card payment authority forms, pdfFiller offers a wealth of related forms and templates that cater to various business needs. Exploring these options can enhance organization and efficiency in document management.

Insights into pdfFiller's features reveal how they can accommodate the unique requirements of different businesses, providing tailored solutions for streamlined document management, payment processes, and compliance with financial regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my card payment authority form directly from Gmail?

How do I make changes in card payment authority form?

How can I edit card payment authority form on a smartphone?

What is card payment authority form?

Who is required to file card payment authority form?

How to fill out card payment authority form?

What is the purpose of card payment authority form?

What information must be reported on card payment authority form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.