Understanding the Certificate of Insurance Request Form

Overview of the Certificate of Insurance Request Form

A Certificate of Insurance (COI) request form serves as a formal mechanism for individuals and entities to request proof of insurance coverage from their service providers and vendors. This document acts as a verification tool, showcasing the types of coverage a vendor holds and pertinent policy details.

COIs hold significant importance in insurance transactions, as they provide an assurance that a party is adequately insured against potential risks. Organizations often require them to safeguard against liabilities that could arise during contract execution, such as workplace accidents, property damage, or third-party claims. The need for a COI arises in various scenarios, including securing contracts with governmental entities, participating in community events, or even renting venues.

Vendor Contracting: When entering into agreements for service provisioning.

Event Planning: Required for hosting events where liability coverage is a concern.

Property Leases: Needed for proving insurance among tenants and landlords.

Key components of the Certificate of Insurance Request Form

Each certificate of insurance request form should encompass essential components to ensure clarity and completeness. The first portion includes the date of request, which helps in tracking the timeline of requests. Another vital field is the date the certificate is needed, anchoring the urgency of the request and reinforcing timely submission.

Furthermore, specifying both the start and end dates of the event or contract can prevent confusion. The requestor information section captures necessary details such as the name of the individual making the request, their contact information, and the relevant department to help facilitate communication.

Finally, the certificate holder information must state the exact name and address of the entity to be covered, ensuring that all parties are correctly identified. These details work together to create a complete and informative request.

Coverage details

Understanding the types of insurance coverage needed is vital when filling out the certificate of insurance request form. Typical options include general liability, which covers common risks associated with business operations, and workers compensation, mandatory for businesses to protect employees injured on the job.

Auto liability coverage is essential for companies using vehicles for operations, while professional liability insurance protects against claims of negligence or faulty services. Additionally, organizations should consider whether a renewal of the COI will be required when insurance policies refresh, which can affect planning and operational readiness.

Steps for requesting a Certificate of Insurance

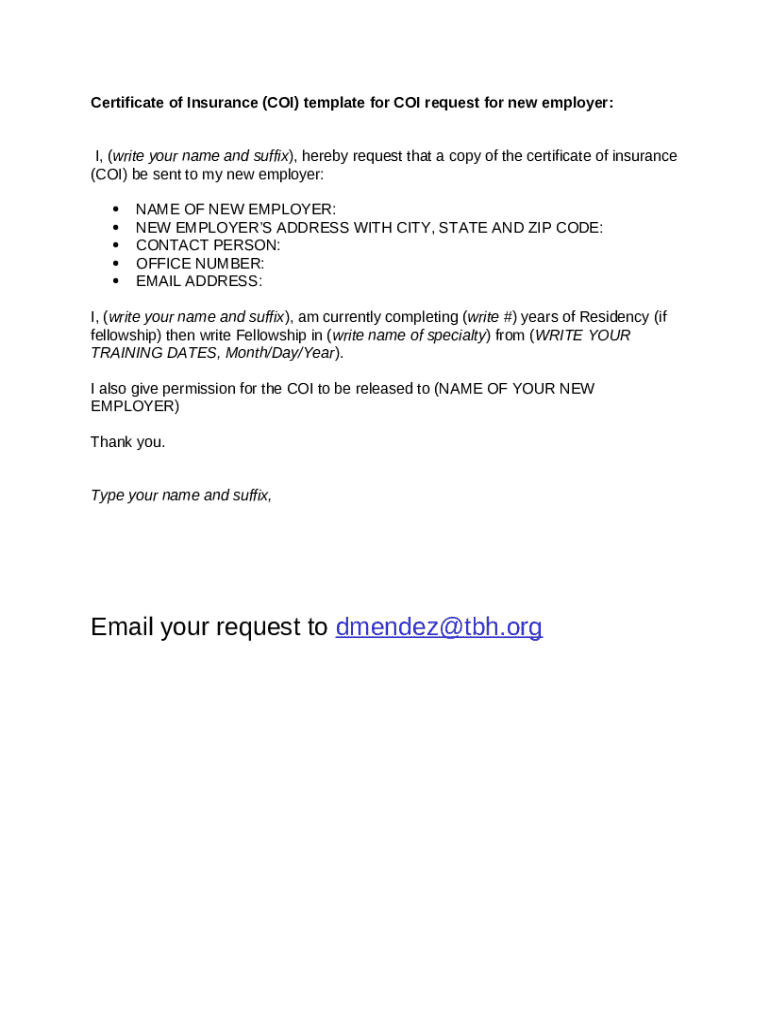

Requesting a Certificate of Insurance from a vendor can be straightforward if approached systematically. Begin by drafting a concise email or message that clearly states your requirement for a COI.

Here’s a sample email template:

Subject: Request for Certificate of Insurance

Dear [Vendor’s Name],

I hope this message finds you well. We are in the process of reviewing our records and kindly request a current Certificate of Insurance showing the appropriate coverage as outlined in our agreement. Please include coverage for general liability, auto liability, and workers' compensation as applicable.

The certificate should be made out to [Your Company Name] and sent by [date needed]. If you have any questions or need further information, feel free to reach out to me directly.

Thank you for your assistance!

Best regards,

[Your Name]

[Your Contact Information]

[Your Department]

Ensure that you include your contact information, the exact details on coverage requested, and the urgency of the request to avoid delays.

Costs and considerations

In the United States, obtaining a Certificate of Insurance may entail nominal fees, though many providers offer COIs as part of their service packages. Factors influencing costs typically include the type of coverage required, the scale of coverage limits, and any specific risks associated with the service in question.

It is noteworthy that additional fees may arise if you request expedited processing or specialized coverage terms. Additionally, incomplete or incorrectly submitted requests can lead to costly delays, emphasizing the importance of attention to detail in form completion.

The role of technology in COI management

The evolution of technology has significantly impacted how Certificates of Insurance are managed within organizations. Cloud-based document management solutions, such as pdfFiller, offer several benefits that simplify the COI process. These platforms enable users to access COIs anytime, anywhere, streamlining retrieval and maintenance.

pdfFiller enhances COI management by providing interactive tools for form filling, which helps prevent errors, ensuring accuracy in the information submitted. Collaborative features allow teams to work together on document requests, making the process efficient and cutting down on miscommunication.

Automation in COI management further reduces human error and increases efficiency. Automated reminders for renewal dates and expirations help organizations stay ahead of necessary updates.

Best practices for managing COI requests efficiently

To manage COI requests efficiently, organizations should devise an organized system for incoming requests. Classifying these requests and maintaining a log for tracking purposes can minimize confusion and improve accountability.

Moreover, regularly monitoring and maintaining expiry dates ensures that coverage remains current. Organizations can develop a systematic COI management strategy that includes setting procedures for submitting requests, tracking responses, and managing renewals. Implementing essential tips, such as double-checking information before submission and pre-emptively requesting renewals well in advance, can prevent common mistakes that lead to lapses in coverage.

Industry-specific insights

Various industries hold unique considerations when dealing with Certificate of Insurance management. For instance, construction firms often face high liability risks, making comprehensive general liability and workers' compensation policies essential. In contrast, real estate businesses require COIs primarily for property risk coverage and landlord liability.

Event management companies might require multiple COIs simultaneously for different venues or events, making a strong organizational approach critical. Implementing effective COI management strategies in these industries can significantly mitigate risk and enhance credibility.

Consider case studies where effective COI management has resulted in minimized risks and improved customer satisfaction, showcasing the tangible benefits of proper documentation and insurance coverage.

Frequently asked questions (FAQs)

The meaning of a COI request may be clarified by understanding that it signifies a formal inquiry for proof of insurance coverage. Companies often require COIs to ensure all parties involved in a contract have adequate insurance to protect against any potential risks or liabilities.

Common challenges in COI management arise from incomplete submissions, inaccurate information, and delayed responses. Solutions involve creating a checklist for required elements and utilizing technology for tracking and reminders to streamline the process. Resources dedicated to quick assistance in COI matters can vastly improve experience and efficiency.

Advanced topics

The management of Certificates of Insurance has evolved significantly in a digital age, with integration into broader insurance technology solutions providing new efficiencies. Businesses are increasingly adopting AI-driven tools to ensure proper verification of insurance documents, narrowing the risk of error.

Future trends indicate that advancements such as automated COI verification checks will enhance reliability and compliance handling, creating a smoother workflow for risk management across various industries. Embracing these innovations ensures organizations not only keep pace with changing regulations but also fortify their risk management strategies.