Get the free Cash Expense Voucher for Natca Members

Get, Create, Make and Sign cash expense voucher for

How to edit cash expense voucher for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash expense voucher for

How to fill out cash expense voucher for

Who needs cash expense voucher for?

Cash Expense Voucher for Form - How-to Guide

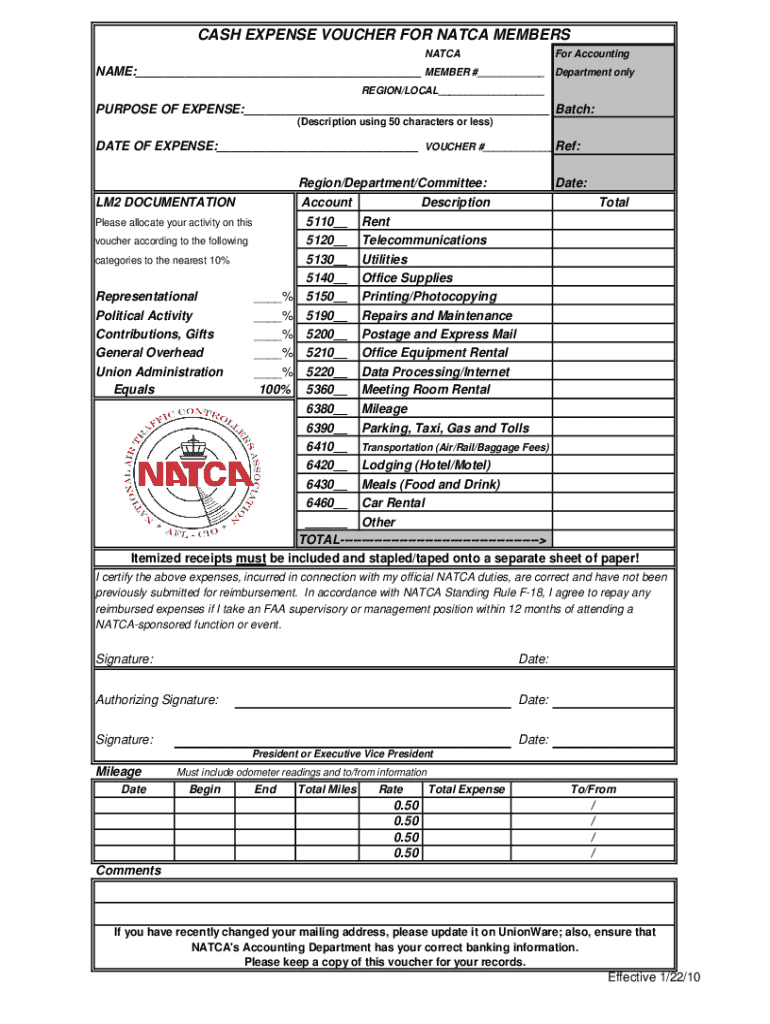

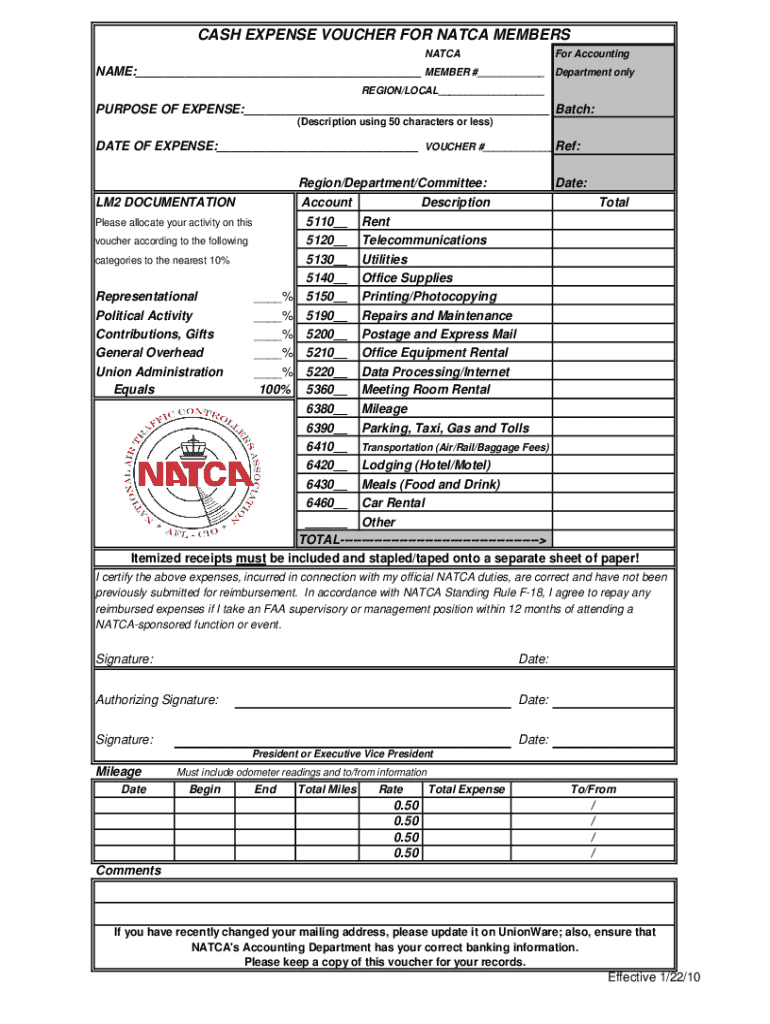

Understanding the cash expense voucher

A cash expense voucher is a critical tool used by businesses to document cash disbursements. By providing a formal record for each transaction, it ensures accountability and transparency in financial management. The primary purpose of a cash expense voucher is to detail expenditure incurred, primarily through petty cash, and allows organizations to track expenses efficiently.

The importance of using a cash expense voucher lies in its ability to facilitate audits and financial reviews, ensuring that every cash transaction is accounted for. Essential components of a cash expense voucher typically include the date of the transaction, the amount spent, a description of the expense, and the signature of the individual making the expense. These elements create a comprehensive record that supports financial integrity within an organization.

When to use a cash expense voucher

Cash expense vouchers should be utilized whenever cash disbursements are made for business expenses, especially for small amounts that might not justify formal purchase orders. It is particularly useful in situations like employee reimbursements for meals, travel expenses, or minor office supplies. Incorporating a cash expense voucher in these instances not only formalizes the expense but also aids in tracking expenses closely.

In comparison to other expense management systems, such as digital expense reporting software, cash expense vouchers can be simpler and quicker to generate, especially for smaller transactions. This simplicity allows managers to maintain a fluid cash flow while ensuring that all expenses are trackable and justified. The benefits of using cash expense vouchers include ease of use, immediate availability, and reduced risks of errors in manual expense reporting.

How to create a cash expense voucher

Creating a cash expense voucher can be straightforward when following a structured process. First, gather all necessary information to ensure that each field of the form can be accurately populated. Required fields typically include the date, amount, purpose of the expense, as well as the spender's information and signatures. Supporting documentation such as receipts or invoices should also be collected to substantiate the cash disbursements.

Next, choosing the right template is crucial. pdfFiller offers various cash expense voucher templates that can be downloaded and customized as needed. Users can easily adapt these templates to fit their specific requirements. Once the right template is selected, the step-by-step creation process involves accessing pdfFiller, utilizing its editing tools for personalization, and adding e-signature capabilities for electronic approvals — making it efficient and user-friendly.

Filling out the cash expense voucher

Completing the cash expense voucher effectively requires attention to detail. Each section of the voucher should be filled out clearly, starting with the date and amount. Providing a thorough description of the expense is important—this not only aids recognition but also helps in accurately categorizing the expense for reporting purposes. Utilizing clear language and avoiding jargon will enhance understanding for anyone reviewing the voucher later.

Common mistakes to drop include failing to match the receipts with the corresponding expense amounts, incorrect date entries, and omitting signatures. These oversights could lead to delays in reimbursement or compliance issues with internal controls. Therefore, participants in the expense reporting chain should familiarize themselves with their organization’s policies to ensure compliance and minimize errors.

Approving and managing cash expense vouchers

The approval process for cash expense vouchers typically requires sign-off from a supervisor or manager. This creates a check-and-balance system, ensuring that all expenses are reviewed and validated before disbursement. Once approved, maintaining a tracking system and archiving expenses is vital in order to create a comprehensive record for both financial analysis and compliance audits.

Automation tools such as those offered by pdfFiller facilitate the management of cash expense vouchers. By integrating approved templates with automated workflows, businesses can streamline the entire approval process, reducing time spent manually handling paperwork. This approach not only saves on administrative costs but also increases accuracy and accountability across the organization.

Integrating cash expense vouchers with financial software

Integration between cash expense vouchers and accounting systems is crucial for maintaining accurate financial records. pdfFiller supports various integration options, enabling data synchronization between the cash expense voucher process and software like QuickBooks or Xero. This ensures that every expense recorded in the voucher reflects appropriately in financial reports, enhancing data reliability.

The benefits of using pdfFiller with accounting systems also extend to streamlined workflows and reduced chances of human error. For instance, case studies indicate that businesses leveraging these integrations experienced a significant decrease in processing time for expense reimbursements, thereby enhancing overall financial efficiency. Additionally, users can achieve better visibility into their cash flow.

How cash expense vouchers enhance accountability

Incorporating cash expense vouchers into financial practices greatly enhances record-keeping. These vouchers provide a clear paper trail for cash disbursements, allowing businesses to maintain accurate transaction records. Moreover, having a structured process for recording transactions fosters transparency, making it easier for internal and external auditors to review financial activities without discrepancies.

Benefits also extend to team morale; employees are usually satisfied knowing that their expenses are documented and that they will be reimbursed in a timely manner. Increased accountability and transparency can also deter potential fraudulent activities, as each expense requires proper documentation that links it directly to a specific accountable individual.

FAQs about cash expense vouchers

What types of expenses can be included in a cash expense voucher? Typically, any legitimate business-related expense can be recorded. This includes meals, travel reimbursements, and office supplies. How does the cash expense voucher support compliance? By providing a record for each cash transaction, it ensures that spending aligns with company policies. Are there limits to cash expenses? While policies vary by organization, many set daily or project-specific limits to manage cash flow effectively.

Best practices for effective expense management

Implementing best practices for expense management can significantly streamline processes within an organization. Establishing clear guidelines for what constitutes an acceptable expense ensures uniformity and transparency among team members. Furthermore, utilizing technology such as pdfFiller for creating, submitting, and tracking vouchers lends efficiency to the workload.

Regular reviews and audits of submitted expense vouchers are essential for maintaining accurate financial oversight. By proactively assessing these expenses, businesses can identify trends, address issues swiftly, and ensure that every disbursement aligns with budgetary constraints.

Related topics of interest

Exploring related topics can enhance your understanding of financial document management. For instance, a comparison between cash expense vouchers and travel expense vouchers reveals differences in usage and requirements. Additionally, examining the role of expense management software illuminates how technology transforms traditional processes into efficient systems. Lastly, investing time in fostering team collaboration on expense reporting can lead to improved communication and minimized confusion.

Getting started with pdfFiller

To create effective cash expense vouchers, pdfFiller provides an intuitive platform for users. With features that allow for seamless editing and collaboration, creating and managing cash expense vouchers is made simple. Signing up for a pdfFiller account unlocks access to various templates and tools needed to handle cash expense reporting effectively.

In addition, exceptional customer support and resources are available to assist users in navigating through the platform. Whether it’s guidance through the signing process or helping to troubleshoot any issues, assistance is accessible to ensure a smooth experience.

Conclusion: Maximizing efficiency with cash expense vouchers

Adopting cash expense vouchers can significantly enhance the financial processes within your organization. Utilizing platforms like pdfFiller empowers users to manage document workflows effectively, streamline approval processes, and maintain accurate records of cash disbursements. By integrating modern technology into expense management, organizations can achieve not only functional effectiveness but also financial transparency.

By harnessing the power of cash expense vouchers, teams are encouraged to ensure meticulous tracking of expenses, leading to maximized financial oversight. Implementing these best practices will ultimately result in a more productive and financially responsible organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cash expense voucher for without leaving Google Drive?

How can I send cash expense voucher for for eSignature?

Can I edit cash expense voucher for on an iOS device?

What is cash expense voucher for?

Who is required to file cash expense voucher for?

How to fill out cash expense voucher for?

What is the purpose of cash expense voucher for?

What information must be reported on cash expense voucher for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.