Get the free Credit Application and Contract

Get, Create, Make and Sign credit application and contract

How to edit credit application and contract online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application and contract

How to fill out credit application and contract

Who needs credit application and contract?

Credit Application and Contract Form: A Comprehensive How-to Guide

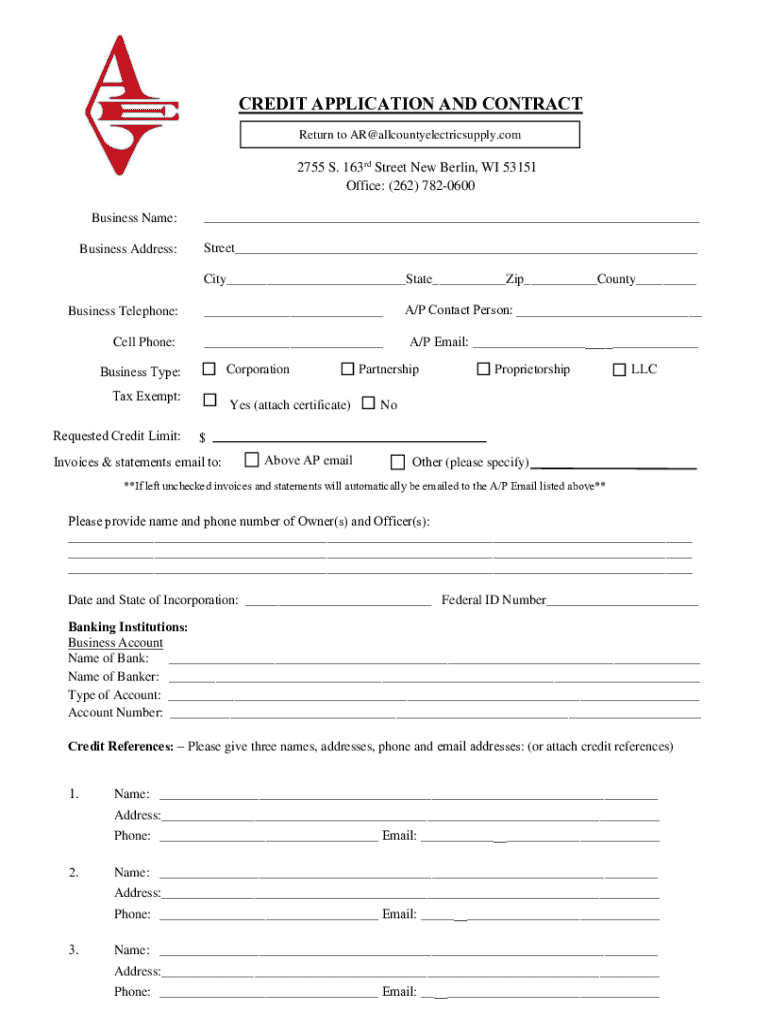

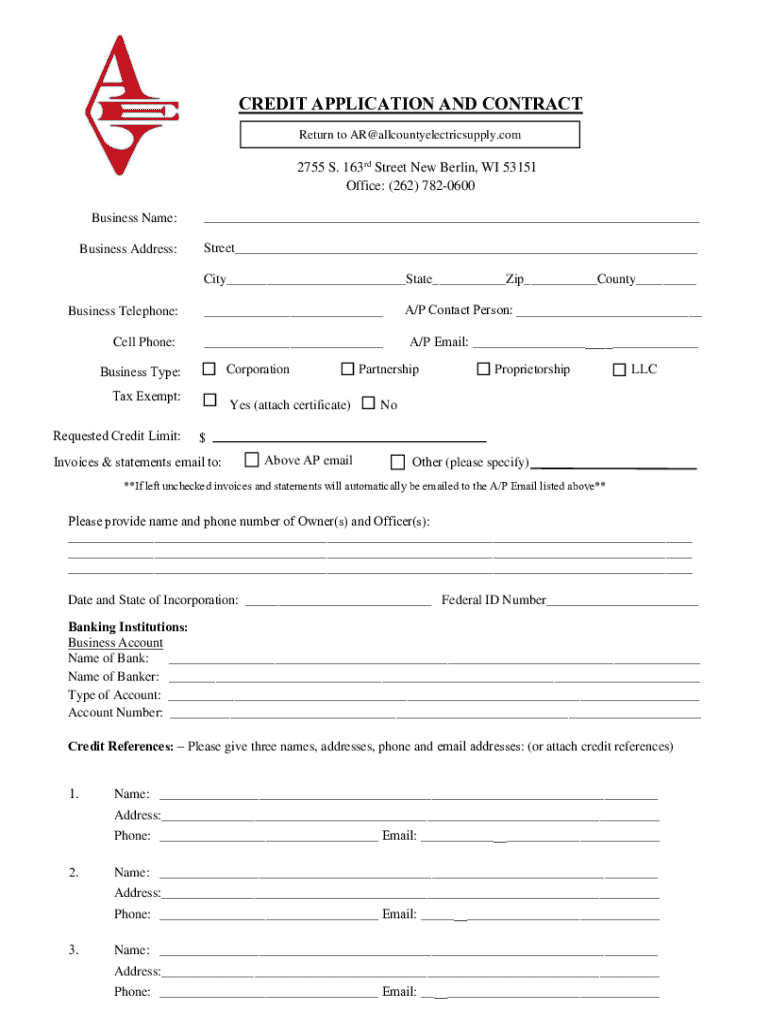

Understanding the credit application and contract form

A credit application and contract form is a crucial document used by individuals and businesses seeking financial support. It serves as a formal request for credit from lenders, allowing them to evaluate the applicant's creditworthiness based on provided personal and financial information.

The importance of this document cannot be overstated. It not only initiates the borrowing process but also establishes the terms and conditions under which credit will be extended. Accurately completed forms improve the chances of approval and help avoid delays.

Preparing to fill out the form

Before diving into the credit application and contract form, it's vital to gather the necessary documentation. Having all the required documents ready can streamline the process and prevent incomplete applications, which could lead to denials.

Essential identification documents include government-issued IDs like a passport or driver's license. Additionally, financial statements such as income proofs (like pay stubs or tax returns) and recent bank statements are critical. Employment verification documents may also be required to substantiate your current employment status.

Checking your credit score before applying is another critical step. A higher credit score typically enhances your chances of securing favorable loan terms. Many online platforms offer free tools to check your credit score, allowing you to assess your financial standing before submitting your application.

Step-by-step guide to completing the credit application

Completing the credit application and contract form requires careful attention to detail. Breaking the form down into sections can make this task more manageable and ensure accuracy.

Once completed, it's essential to review your form. Double-check for any discrepancies or missing information, as even minor errors can lead to application delays or denials. This extra step can enhance your chances of approval.

Editing and customizing the credit application form

In today's digital age, tools like pdfFiller can significantly facilitate the editing process of your credit application and contract form. With intuitive editing features, users can make modifications quickly and efficiently, ensuring accuracy before submission.

pdfFiller provides essential features such as adding or removing text, inserting images, and modifying the layout of your document. Customizing the appearance of your application not only makes it more visually appealing but also ensures brand consistency for business-related applications.

Signing the credit application and contract form

The signing process of the credit application and contract form has evolved significantly with the introduction of electronic signatures. eSignatures offer convenience and accuracy, removing the need for physical paperwork.

Understanding the legality of electronic signatures is crucial. They are recognized under laws such as the E-SIGN Act in the U.S., provided certain criteria are met. When using tools like pdfFiller, you can securely add your signature and collect signatures from co-applicants or guarantors, minimizing delays.

Managing your credit application after submission

Once your credit application and contract form are submitted, managing its status becomes the next priority. Keeping track of its progress helps maintain communication with the lender and overall organization in your financial matters.

Utilizing tools for tracking application status allows for timely follow-ups with the lender. Maintaining clear records of communication not only helps resolve potential issues swiftly but also prepares you for any inquiries related to the application.

Common FAQs about credit application and contract forms

Credit applications often come with a range of questions and concerns. Candidates frequently inquire about how long the application process typically takes, approval criteria, and what to do in case of errors or omissions on their application.

Addressing these common concerns can demystify the process and lead to a smoother experience. For example, understanding that many lenders will assess both income and debt-to-income ratios is critical. Providing accurate, complete information is essential for avoiding common application errors.

Benefits of using pdfFiller for credit application management

pdfFiller offers numerous advantages for managing credit applications seamlessly. From creating documents to secure signing, the platform enhances user experience through its cloud-based capabilities.

Key features include the ability to access documents from anywhere, collaborate with team members on joint applications, and integrate documents with cloud storage solutions. All these functionalities contribute to a smoother and more efficient application experience.

Success stories from individuals and teams highlight how pdfFiller has streamlined their application processes, ultimately resulting in positive outcomes and smoother financial interactions.

Interactive tools and resources available on pdfFiller

pdfFiller is not just a platform for editing documents; it also offers a suite of interactive tools designed to enhance the user experience when dealing with credit applications. These features simplify the application process, making it easy for users to navigate.

Form filling tools allow for efficient data entry, while workflow automation features streamline the approval process. Additionally, users have access to various templates for different financial applications, saving time and effort.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application and contract?

How do I complete credit application and contract online?

Can I create an electronic signature for the credit application and contract in Chrome?

What is credit application and contract?

Who is required to file credit application and contract?

How to fill out credit application and contract?

What is the purpose of credit application and contract?

What information must be reported on credit application and contract?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.