Get the free Certificate of Exemption of Local Hotel/motel Excise Tax

Get, Create, Make and Sign certificate of exemption of

Editing certificate of exemption of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption of

How to fill out certificate of exemption of

Who needs certificate of exemption of?

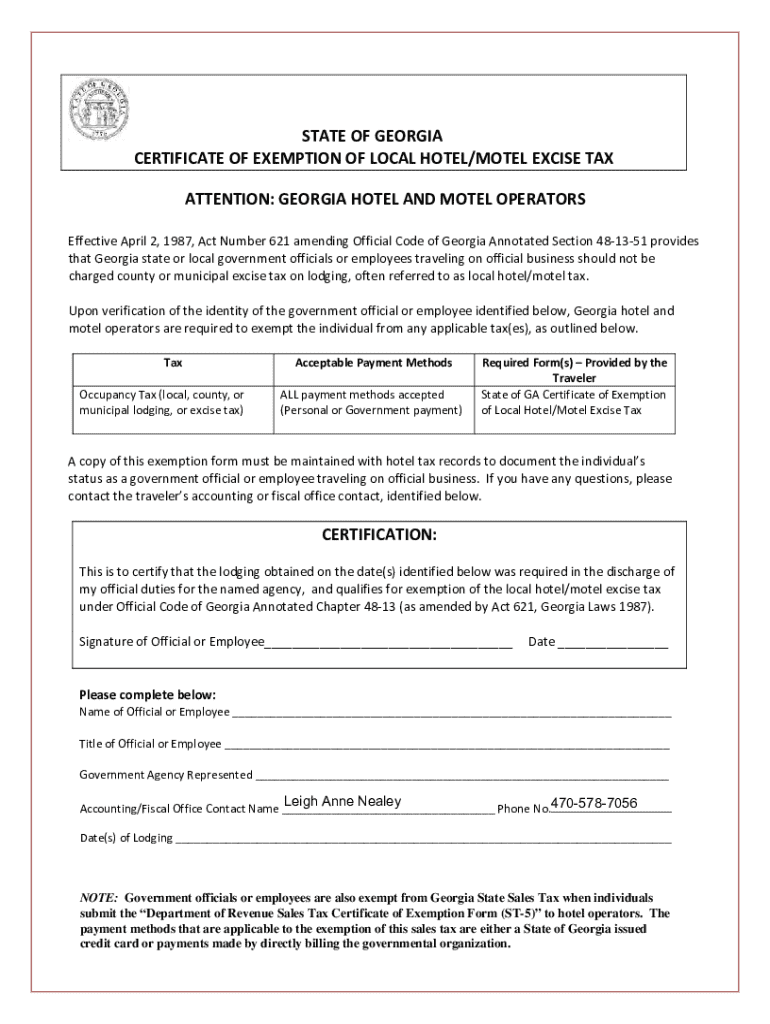

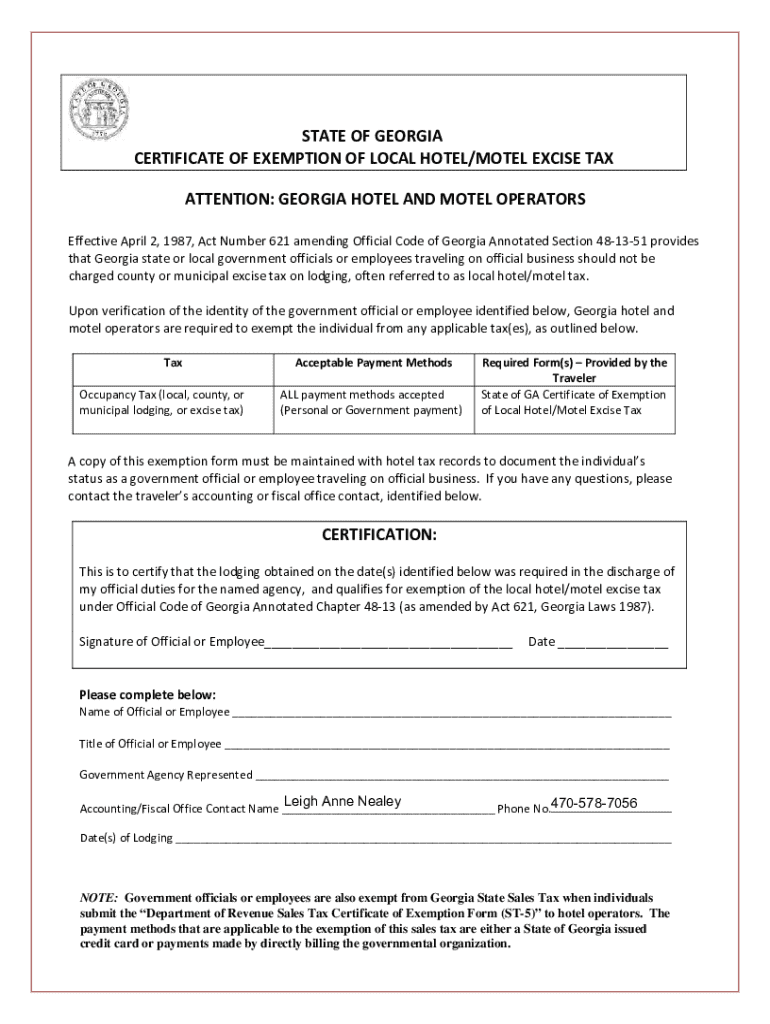

Understanding the Certificate of Exemption of Form

Understanding the certificate of exemption

A certificate of exemption is a vital document that allows individuals or entities to bypass certain tax obligations under specific conditions. Its primary purpose is to validate that the holder qualifies for an exemption from certain taxes, such as sales tax or income tax. By obtaining a certificate of exemption, you ensure compliance with regulations while protecting your business operations and finances.

The importance of using a certificate of exemption cannot be overstated. For businesses, it can mean significant savings if they are purchasing goods for resale or if they qualify under specific tax-exempt categories. Inappropriately paying taxes can lead not only to financial strain but also to issues with regulatory authorities.

Types of certificates of exemption

Certificates of exemption vary significantly depending on their application and the taxes they address. Understanding these types helps in determining which certificate is needed for your specific situation.

Key components of a certificate of exemption form

When filling out a certificate of exemption, there are several essential elements that must always be included. Identifying information like the name and address of the applicant and the seller is crucial for accountability and tracking purposes.

The reason for exemption must be clearly stated, as different categories of exemption may require different supporting documentation. Understanding state-specific requirements is also vital; it can influence not only the validity of your exemption certificate but also how the specific exemptions are administered.

Step-by-step guide to completing the certificate of exemption form

Completing a certificate of exemption form can seem daunting, but it can be broken down into manageable steps. First, in the preparation phase, gather all necessary documents such as ID, proof of tax-exempt status, and any additional paperwork relevant to your specific exemption type.

Next, identify the correct version of the form relevant to your jurisdiction, as guidelines and requirements can vary significantly. When filling out the form, pay close attention to detail, making sure each section is completed as per the instructions. Review your responses carefully to avoid mistakes, ensuring the required signatures and dates are present before submission.

Editing and modifying your certificate of exemption form

If you need to make edits to your certificate of exemption form, tools like pdfFiller streamline the process considerably. After uploading your document to the platform, you can easily add or remove information as needed. These modifications are especially helpful when collaborating with others, ensuring that all stakeholders can contribute without confusion.

Utilizing pdfFiller allows users to maintain control over the document while preventing any unauthorized changes. As editing tools are made available, take advantage of the platform to manage edits efficiently, ensuring the document remains compliant and up-to-date.

eSigning your certificate of exemption

Electronic signatures have transformed document management, making it simpler and quicker to approve and submit forms. With a platform like pdfFiller, eSigning your certificate of exemption can save time and resources. It ensures that all signatures are verified and securely stored.

To eSign using pdfFiller, navigate to your document, select the option to add a signature, and follow the straightforward prompts. The convenience of eSigning paves the way for enhanced efficiency in document workflows, especially when multiple signatures are required from different parties.

Submitting your certificate of exemption

After completing and signing your certificate of exemption, the next step is to submit it properly. Depending on your jurisdiction, there may be several submission options available, including online submission through local tax authority websites or traditional mailing.

Be sure to follow any specific guidelines for submission provided by your state or local authority. It is also advisable to track your submission status whenever possible to confirm receipt, ensuring you are not caught off guard by any issues that may arise post-submission.

Common questions about certificates of exemption

Navigating the process of obtaining a certificate of exemption raises several questions. One common concern is what to do if your application is denied. In such cases, it's important to review the reason for denial and take corrective action, which may include gathering additional supporting documentation or addressing compliance issues.

Another frequently asked question is how often you need to renew your certificate of exemption. The renewal frequency varies by state and type of exemption. Keeping a close eye on deadlines ensures that your status remains valid. If you misplace a certificate, confirming with the issuing authority about how to obtain a replacement can also be beneficial.

Related forms and templates

In addition to the certificate of exemption, various forms related to tax exemptions may also be necessary for different situations. Popular templates include those for sales tax exemption applications, income tax exemption requests, and nonprofit organization certification forms. Familiarity with these associated forms can streamline the process when applying for various exemptions.

By leveraging pdfFiller, users can quickly find similar forms or templates tailored to their specific needs, facilitating the tax exemption process efficiently.

Need help?

If you have questions or need assistance navigating the certificate of exemption process, help is available. Support options include online help desks, forums, and chat support through platforms like pdfFiller, which provide instant guidance and solutions for document management.

Moreover, the FAQs section on pdfFiller offers insights into common issues, tips for effective document handling, and troubleshooting advice, significantly enhancing your user experience.

Real-life examples and case studies

Successful navigation of the certificate of exemption process can change lives, particularly for businesses and non-profits. A local nonprofit organization was able to save a considerable amount in tax expenses by correctly filling out their exemption application, which in turn allowed them to reinvest those funds into community service.

Through real-life examples, users can observe how effective use of the certificate of exemption can lead to better financial health, demonstrating the observable impacts of correctly managing these forms in various sectors.

Conclusion of your journey with certificates of exemption

Navigating the world of certificates of exemption is vital for individuals and organizations alike. By understanding the nuances of these documents, including their types, filling requirements, and submission processes, you can significantly enhance your compliance capabilities and safeguard your financial interests.

The tools provided by pdfFiller empower users to facilitate every step, from editing and eSigning to seamless submission. Understanding how to properly manage your certificate of exemption ensures a smoother experience and unlocks immediate financial benefits for you and your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the certificate of exemption of electronically in Chrome?

Can I create an eSignature for the certificate of exemption of in Gmail?

How do I edit certificate of exemption of on an iOS device?

What is certificate of exemption of?

Who is required to file certificate of exemption of?

How to fill out certificate of exemption of?

What is the purpose of certificate of exemption of?

What information must be reported on certificate of exemption of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.