Get the free Critical Illness Claim Form

Get, Create, Make and Sign critical illness claim form

Editing critical illness claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness claim form

How to fill out critical illness claim form

Who needs critical illness claim form?

Completing Your Critical Illness Claim Form: A Comprehensive Guide

Understanding critical illness insurance

Critical illness insurance provides financial support for individuals diagnosed with specified serious medical conditions. The purpose of this insurance is to alleviate the economic burden that often accompanies a critical health event, allowing policyholders to focus on recovery rather than financial stress.

Filing a claim is crucial when dealing with a critical illness, as it allows you to access the funds needed for treatment and recovery. Understanding the most common covered conditions can help you make informed decisions about your policy and the urgency of your claim.

Preparing to submit your claim

Before you submit a critical illness claim form, it’s vital to gather the necessary documentation. Preparing beforehand ensures a smoother process and minimizes delays in claim approval. First and foremost, you’ll need to collect your medical records that confirm your diagnosis.

Having a thorough understanding of your policy is equally essential. Familiarize yourself with key terms, conditions, and claim thresholds to ensure you’re meeting all requirements specified by your insurer.

Step-by-step guide to completing the critical illness claim form

To begin, you will need to access the claim form either through your insurance provider’s website or through pdfFiller. pdfFiller offers an excellent way to fill out and edit your forms seamlessly.

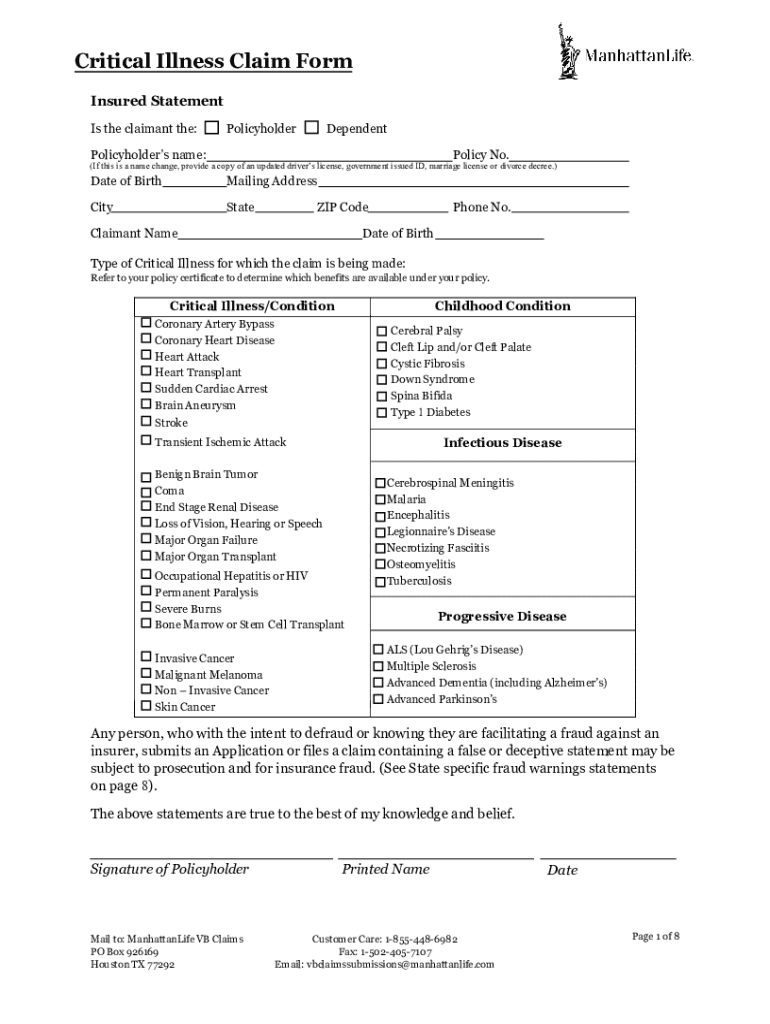

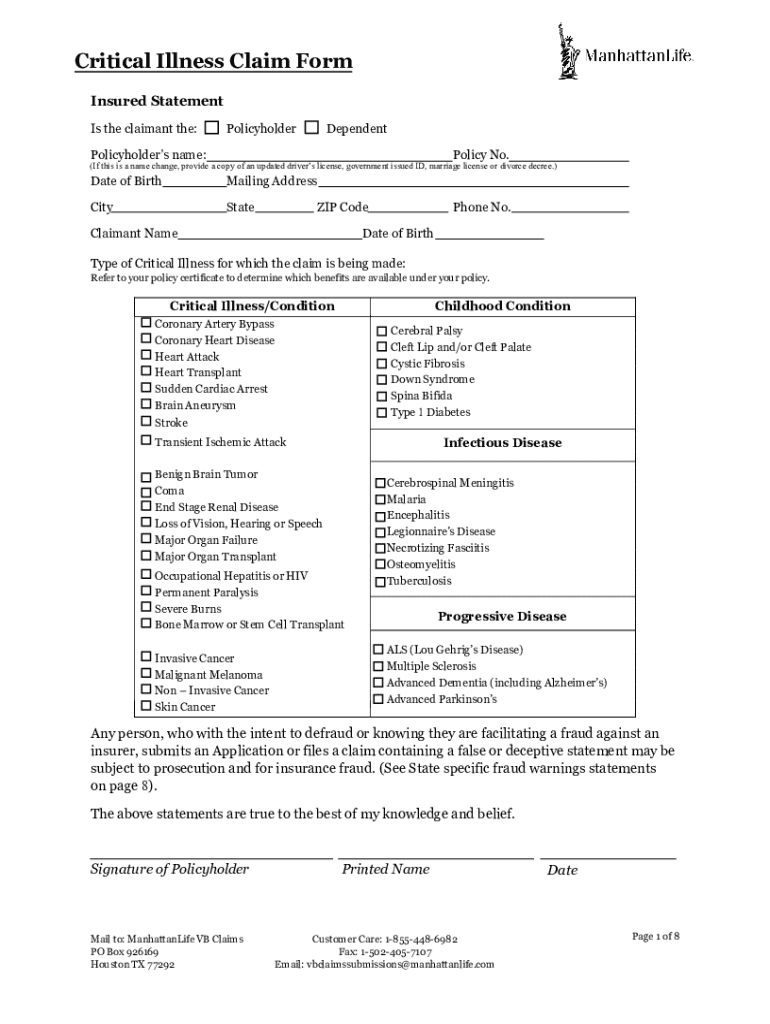

When completing the form, ensure to fill in each section accurately. Start with your personal information, including your name, address, and contact details. Follow this with your insurance details, specifically your policy number and coverage information. Detailed medical information such as your diagnosis, treatment dates, and medical provider’s information must be filled out next.

Lastly, ensure your signature, date, and any required disclosures are included before submission.

Tips for effective form submission

Accuracy is pivotal when submitting your claim. Carefully double-check all entries on your form and avoid common mistakes such as incorrect names or policy numbers. Utilizing pdfFiller’s editing tools can assist you in making quick corrections to avoid errors before submission.

Additionally, pdfFiller offers eSignature features that allow for easy signing of your documents. This can expedite the process and ensure your form is ready for submission without any further delays.

Tracking your claim status

Once you’ve submitted your claim, it’s important to understand the claims process timeline. Response times can vary; many insurers aim to respond within a few weeks, but this can depend on the complexity of the claim. Adhering to a consistent follow-up schedule can help keep you informed on your claim's status.

Through pdfFiller, you can also utilize their platform to track the status of your claim and ensure you have a solid record of submissions.

What to do if your claim is denied

Claims can be denied for several reasons, including insufficient documentation or not meeting the policy’s specific criteria. Understanding these reasons helps you prepare better should your claim be denied. In this case, it’s important to remain calm and take actionable steps to appeal the denial.

Appeals often have strict deadlines, so be sure to act promptly and consider consulting with your provider for further clarification on the appeal process.

Additional support and resources

Navigating the claims process can be challenging, but you’re not alone. Customer support through your insurance provider is available to clarify any confusion and guide you through the claim and appeal process. Furthermore, pdfFiller's support team can assist you with using their tools efficiently and help in managing your documentation.

Online communities and forums can also provide valuable insights and collective experiences to aid you during this process.

Optimizing your claim process with pdfFiller

In today’s fast-paced world, efficient document management is more crucial than ever. pdfFiller offers cloud-based document management, making it easy to store all your critical illness claim-related documents in one secure location accessible from anywhere. This greatly simplifies organizing and retrieving necessary paperwork when you need it the most.

Embracing a digital approach with tools like pdfFiller can significantly streamline your claims process, allowing you to focus on what truly matters—your health and recovery.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send critical illness claim form to be eSigned by others?

How can I get critical illness claim form?

Can I edit critical illness claim form on an Android device?

What is critical illness claim form?

Who is required to file critical illness claim form?

How to fill out critical illness claim form?

What is the purpose of critical illness claim form?

What information must be reported on critical illness claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.