Get the free Credit Card Authorisation Form

Get, Create, Make and Sign credit card authorisation form

Editing credit card authorisation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorisation form

How to fill out credit card authorisation form

Who needs credit card authorisation form?

Understanding the Credit Card Authorization Form: A Comprehensive Guide

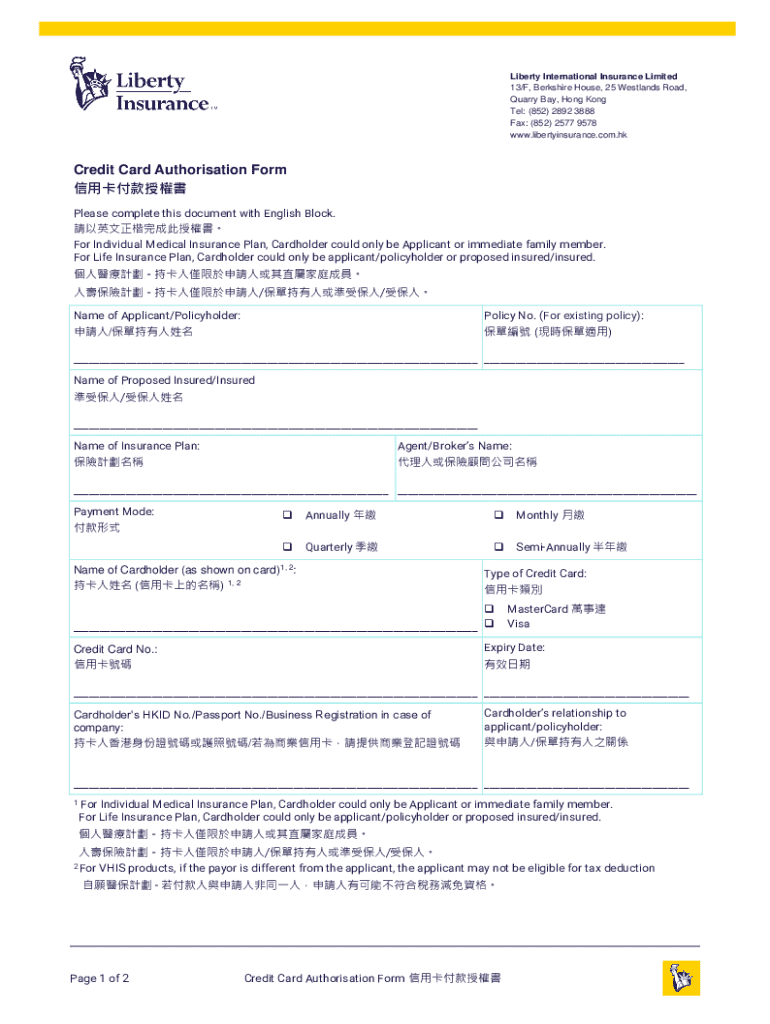

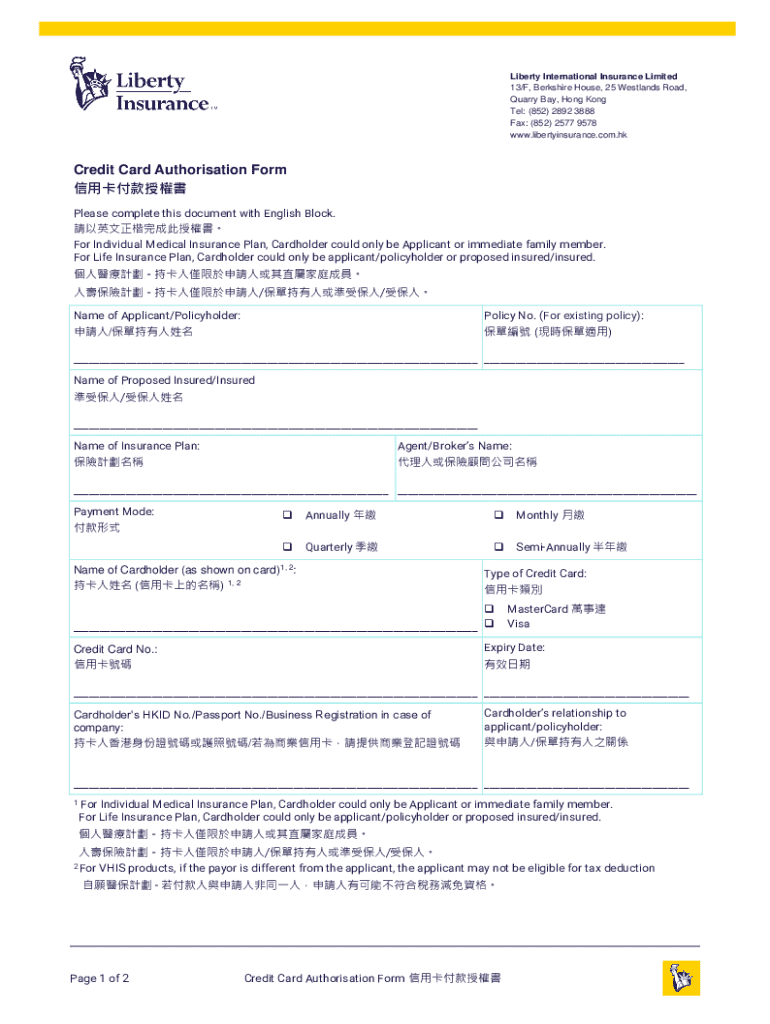

What is a credit card authorization form?

A credit card authorization form is a document that businesses use to gain permission to charge a customer's credit card for a specified amount. This form serves as a critical tool for security and transparency in transactions, outlining the details of the authorization and ensuring both parties understand their rights and responsibilities.

Key components of a credit card authorization form typically include the cardholder's details, such as their name, credit card number, expiration date, and billing address. Additionally, it may contain terms and conditions of the authorization, outlining the purpose of the charge and any recurring billing agreements. Ensuring transparency in this process is vital; it offers customers clarity and builds trust between them and the business.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form can significantly reduce the risk of chargeback abuse. By securing explicit consent from customers, businesses can protect themselves from disputes over unauthorized transactions. This not only safeguards their financial interests but also enhances customer trust, as clients see that the company takes information security seriously.

Moreover, these forms streamline billing processes, facilitating smoother transactions. This efficiency is vital for restaurant and service industries where quick payments are essential. In addition, a credit card authorization form enhances security around transactions by ensuring sensitive information is handled appropriately, further minimizing the chance of fraud.

Key elements in credit card authorization forms

A well-structured credit card authorization form includes several required pieces of information. Primarily, it needs the cardholder's name, credit card number, expiration date, and billing address to verify identity and ownership of the card. Gathering this information helps reduce potential fraud risk and ensures that the transaction is legitimate.

Optional elements may include the card verification value (CVV), although not every form requires this. Including a CVV in the authorization form can enhance security, but it’s crucial to manage how this information is stored. Some businesses might institute identification requirements to further validate the transaction. Legally, obtaining consent via signatures is essential to enforce the authorization, protecting both the customer and the business.

How to create a credit card authorization form

Creating a credit card authorization form can be streamlined with modern software tools. Start by selecting the appropriate platform, like pdfFiller, which simplifies document creation and management. This tool provides users with the ability to draft forms easily, ensuring legal compliance with built-in templates.

Once you've chosen a platform, utilize existing templates for convenience. Templates allow you to customize specific fields and the overall layout to match your business's branding. When drafting the content of the form, use clear and straightforward language to provide explicit instructions to customers, ensuring they understand each step of the authorization process.

Downloadable templates

pdfFiller offers a variety of customizable templates for credit card authorization forms, enabling businesses to tailor the document to their specific needs. Accessing these templates is straightforward; users can choose from an array of professional designs that fit their industry requirements.

Utilizing templates saves time and enhances efficiency in drafting credit card authorization forms. Moreover, as these documents are pre-structured with required elements, companies can focus on ensuring that the content aligns with their processes, thereby avoiding potential oversights.

Best practices for managing credit card authorizations

Proper management of credit card authorization forms is paramount for businesses handling sensitive payment information. Start by deciding between digital and physical storage options; digital storage methods, particularly with secured databases, can enhance accessibility while ensuring compliance with data regulations.

Regardless of the storage method, adherence to data protection protocols is vital. This includes restricting access to authorized personnel only and implementing encryption for sensitive data. Additionally, businesses should have clear guidelines for the retention period of records and conduct regular audits of authorization forms to ensure compliance with internal policies and regulatory requirements.

Common FAQs about credit card authorization forms

One frequently asked question is, 'Am I legally obligated to use credit card authorization forms?' While not mandated by law in most cases, using them can significantly protect businesses against chargebacks and disputes. Additionally, some industries, such as restaurants and membership-based companies, often utilize these forms for recurring payments.

Another common query involves the absence of space for the CVV. Generally, not collecting the CVV is a decision based on the level of security a business wishes to maintain. Lastly, understanding what constitutes a 'Card on File' agreement is crucial for both customers and businesses, ensuring clarity in recurring billing practices and customer consent.

User experiences and testimonials

Many businesses have experienced significant improvements in their payment processes after implementing pdfFiller’s credit card authorization forms. Testimonials reveal that companies appreciate the ease of customization and security features, which have streamlined transactions with customers, ultimately leading to increased satisfaction and trust.

Case studies highlight how pdfFiller has helped small businesses reduce chargebacks and enhance their billing efficiency. By utilizing easy-to-manage forms, these companies can focus more on providing services rather than handling paperwork or disputes, underscoring the platform's effectiveness in real-world applications.

Industry insights

The landscape of credit card processing and authorization is continually evolving, influenced by advancements in technology and changes in customer expectations. Current trends indicate a shift toward increasingly secure payment methods and the integration of blockchain technology for enhanced fraud prevention. Companies need to stay informed about these trends to adapt their payment processes effectively.

Experts suggest that the future of payment security will likely place greater emphasis on biometric verification, making transactions more secure while ensuring a smoother customer experience. Additionally, evolving global regulations surrounding credit card transactions necessitate that businesses remain vigilant in their compliance efforts and update their authorization practices accordingly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit card authorisation form?

Can I create an electronic signature for signing my credit card authorisation form in Gmail?

How do I edit credit card authorisation form on an iOS device?

What is credit card authorisation form?

Who is required to file credit card authorisation form?

How to fill out credit card authorisation form?

What is the purpose of credit card authorisation form?

What information must be reported on credit card authorisation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.