Get the free Ct-2

Get, Create, Make and Sign ct-2

Editing ct-2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-2

How to fill out ct-2

Who needs ct-2?

CT-2 Form - How-to Guide Long-Read

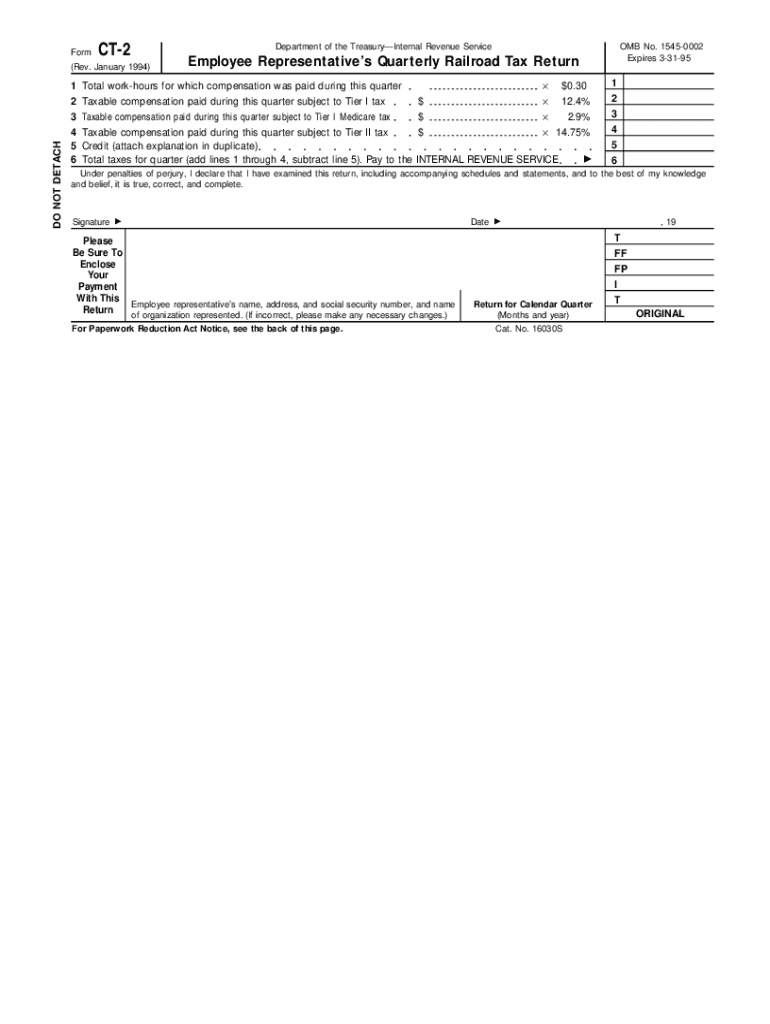

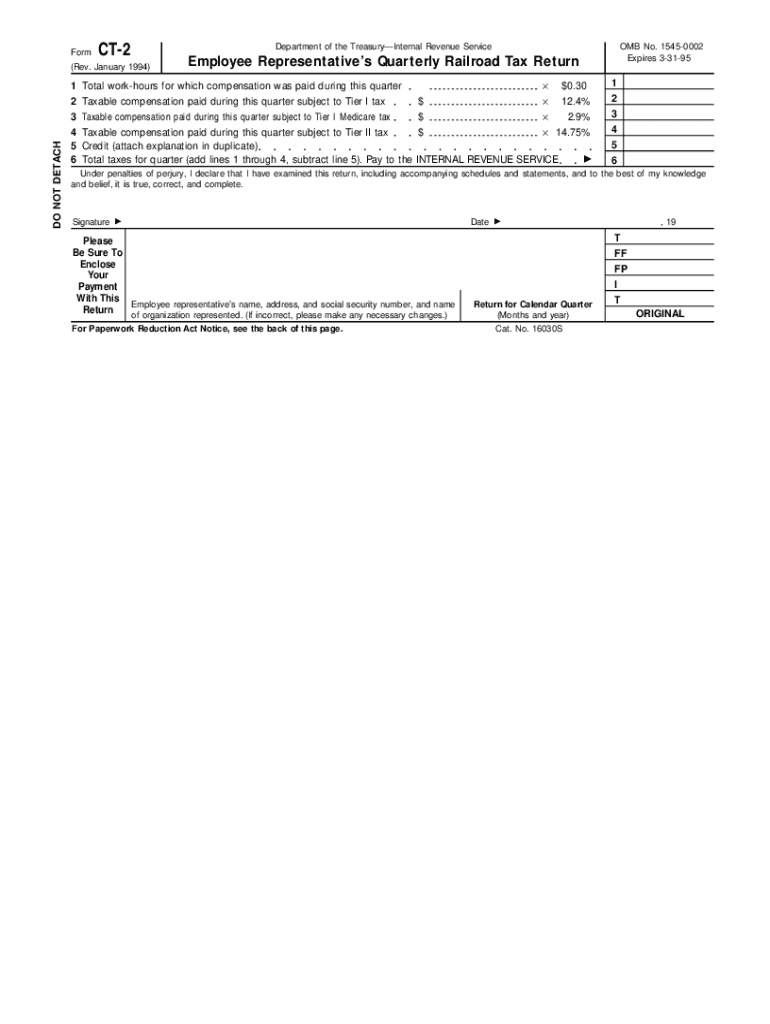

Overview of the ct-2 form

The ct-2 form is a key document utilized primarily in the context of tax information and reporting. It serves multiple purposes, including the gathering of personal details and tax-related information for both individuals and businesses. Understanding the ct-2 form is essential for accurate tax reporting, compliance with tax laws, and efficient document management.

The importance of the ct-2 form lies in its ability to streamline the tax compliance process. It provides a foundation for ensuring that accurate information is reported to tax authorities, which can significantly influence a taxpayer's obligations. Individuals who are typically required to fill out the ct-2 form include those filing their taxes, applying for various benefits, or updating their personal records related to taxation.

Understanding the components of the ct-2 form

The ct-2 form is divided into various sections, each crucial for completing the form accurately. The first section usually collects personal information, such as your full name, address, and contact details. This ensures that your identity is verified and all future correspondence is directed appropriately.

Section two deals with tax information. Here, you provide specifics related to your tax situation, including any deductions, credits, or specific conditions that need to be noted. Finally, section three includes a declaration of accuracy, where the signer asserts that all provided information is correct and complete. Understanding these components helps in navigating the form efficiently.

How to access the ct-2 form

Accessing the ct-2 form is a straightforward process, especially through the pdfFiller platform. To find the ct-2 form, start by visiting the pdfFiller website. Once there, utilize the search bar by typing 'ct-2 form' or navigate through the categories dedicated to tax documents.

After locating the ct-2 form, you can click on the link to open it. From here, pdfFiller provides options to download or fill out the form digitally. The ability to access the form online not only saves time but also ensures that you always have the latest version readily available.

Filling out the ct-2 form: step-by-step

Before diving into filling out the ct-2 form, it's crucial to gather all necessary documents and information. This preparation includes acquiring your previous tax returns, identification, and any other relevant documents that provide tax information or personal data.

To ensure a smooth experience, follow this step-by-step approach to complete your ct-2 form:

Each step is designed to uphold accuracy and transparency in your tax reporting.

Editing the ct-2 form using pdfFiller

One of the standout features of pdfFiller is the ability to easily edit the ct-2 form. Whether you need to make corrections or add additional annotations, the platform offers a variety of editing tools. After completing your form, if you discover an error or wish to improve clarity, pdfFiller allows users to quickly revise any part of the form.

Users can add digital comments or notes directly on the form as well, which is beneficial for collaborative scenarios. If needed, you can also update any information dynamically, ensuring that your document reflects the most accurate details before submission.

eSigning the ct-2 form

Electronic signatures have become increasingly popular for their convenience and efficiency. pdfFiller enables users to eSign the ct-2 form seamlessly. After filling it out, simply click on the eSign option. You'll be guided through the necessary steps to create your electronic signature.

The benefits of eSigning this form are manifold; it eliminates the need for printing and scanning, ensuring that the document can be submitted quickly and securely. Additionally, eSigning can be verified, providing an extra layer of authenticity that traditional signatures may not offer.

Collaborating on the ct-2 form

With pdfFiller, team collaboration on the ct-2 form is made easy. The platform's features allow multiple users to view, edit, and comment on the form simultaneously. This is particularly useful in a team setting where members may need to contribute different sections or provide feedback.

To collaborate effectively, you can invite others to access the form by sending them a link. Furthermore, pdfFiller offers options to manage permissions, ensuring that only authorized users can make edits while others can merely view the document.

Managing your ct-2 form

Proper management of your ct-2 form is essential for future reference and organizational purposes. pdfFiller allows users to save and store their completed forms securely. You can also retrieve them easily whenever needed, which is a game-changer for busy individuals or teams.

To streamline document organization, establish a systematic naming convention and categorize your files accordingly. pdfFiller also provides features for tracking edits and changes made to the form, so you can maintain a clear history of revisions.

Common issues and solutions

While filling out the ct-2 form can be straightforward, users might encounter issues that need troubleshooting. Common errors often arise from inaccuracies in personal information, which can lead to complications during processing. For instance, misstated names or addresses can delay approval or lead to further inquiries from tax authorities.

Tax information discrepancies are another common issue. It's crucial to ensure that all numbers presented in section two align with any supporting documents. If you find yourself facing challenges, consider reaching out to customer support through pdfFiller or consulting a tax expert for assistance.

Important notes regarding the ct-2 form

Filling out the ct-2 form comes with specific deadlines for submission, which can vary based on your location or situation. Failing to meet these deadlines could carry penalties, including fines or additional tax liabilities. It's always advisable to stay updated on any changes in regulations surrounding the ct-2 form for the current year.

Furthermore, ensure that you are aware of any updates or modifications made to the ct-2 form annually. Staying informed helps prevent common mistakes and ensures that your submissions are processed without issues.

Exploring related document templates

In addition to the ct-2 form, pdfFiller offers a wealth of other essential tax forms and templates. These templates can gear up your document filing process and assist you in managing other applications, such as organ donor registration or voter registration, ensuring that all your important documents are in order.

Utilizing these templates in conjunction with the ct-2 form not only streamlines your workflow but also offers multiple avenues for compliance and record-keeping. Having everything in one place reduces stress and fosters greater efficiency.

Benefits of using pdfFiller for document management

Choosing pdfFiller as your go-to platform for your ct-2 form ensures a comprehensive approach to document management. With its wide range of features tailored for filling, editing, signing, and storing documents, pdfFiller stands out as an all-in-one solution.

The advantages of a cloud-based platform are significant for both individuals and teams. You can access your documents from anywhere, collaborate in real time, and keep everything organized in an intuitive manner. User testimonials demonstrate that pdfFiller has transformed the document management experience for many, resulting in savings of both time and resources.

Interactive tools for a seamless experience

pdfFiller offers an array of interactive tools meant to enhance your experience when managing the ct-2 form. From user-friendly interfaces that simplify form completion to customization features that allow for personal branding, these tools enrich the overall process.

Additionally, pdfFiller lets you personalize your forms for branding purposes, ensuring that your documentation reflects your individuality or organizational identity effectively. This attention to detail not only improves usability but also leaves a lasting impression on your recipients.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the ct-2 in Gmail?

How do I fill out ct-2 using my mobile device?

How do I complete ct-2 on an iOS device?

What is ct-2?

Who is required to file ct-2?

How to fill out ct-2?

What is the purpose of ct-2?

What information must be reported on ct-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.