Get the free Credit Card Transaction Authorization Form

Get, Create, Make and Sign credit card transaction authorization

How to edit credit card transaction authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card transaction authorization

How to fill out credit card transaction authorization

Who needs credit card transaction authorization?

Your Complete Guide to Credit Card Transaction Authorization Forms

Understanding credit card transaction authorization forms

A credit card transaction authorization form is a document that allows a seller to collect funds from a customer's credit card for a specific transaction. This form can be used in both online and offline transactions and is essential for facilitating secure payments. By obtaining customer approval, businesses not only confirm their intent to charge but also protect themselves from potential disputes and chargeback claims.

The purpose of a credit card transaction authorization form cannot be overstated. It serves as a legal record of consent between the seller and the customer. One of the key stakeholders in this process includes the sellers, often small businesses, or large corporations, seeking to complete a sale; the customers whose cards are being charged; and the payment processors that handle the transaction, ensuring that fund transfers occur securely and efficiently.

Why use a credit card authorization form?

Utilizing a credit card authorization form is crucial for various reasons. Firstly, it significantly aids in protecting vendors against chargeback abuse, where customers might deny a charge after receiving goods or services. Establishing clear terms and conditions through this form ensures that both parties are aware of the transaction details, reducing misunderstandings.

Moreover, there are legal and financial implications for both vendors and customers. A formal authorization form helps shield businesses from fraudulent activities and disputes, allowing them to operate more securely. Additionally, customers often feel more secure knowing that their payment details are processed legally, which strengthens overall trust between the parties involved.

Components of a credit card authorization form

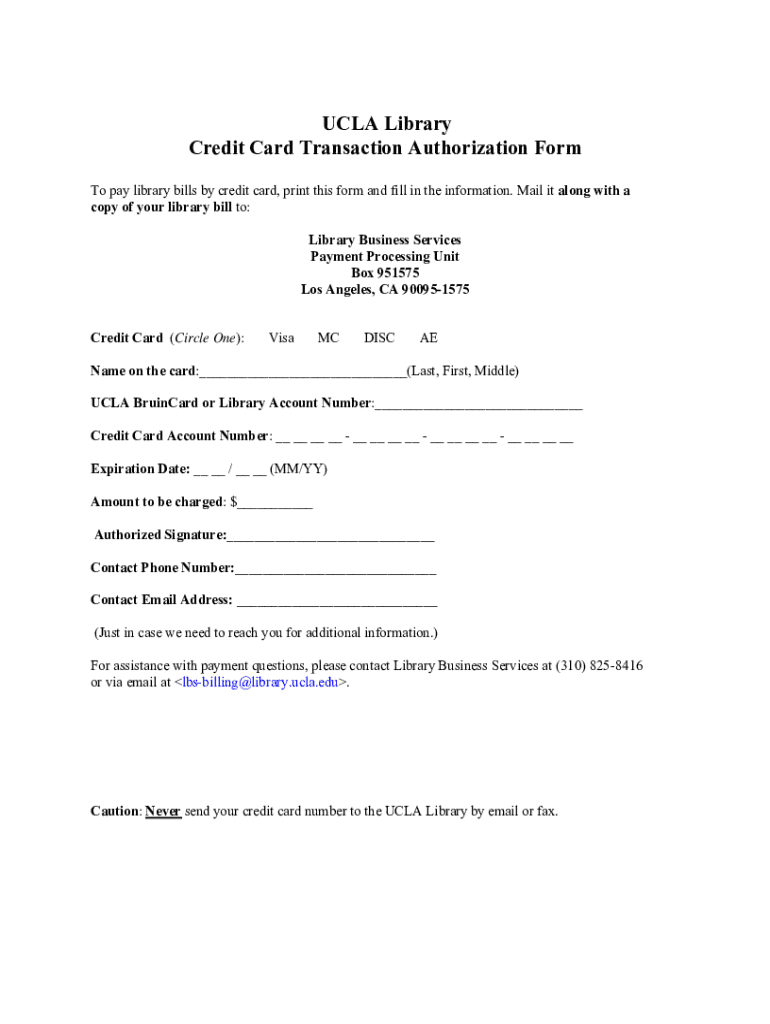

Creating a credit card transaction authorization form requires attention to detail to ensure all necessary information is included. Essential fields that should be included are:

Beyond these essentials, there are optional fields that can add further protection and clarity, such as the CVV number for additional verification, billing address to confirm identity, and a transaction description for transparency.

When to use a credit card authorization form

Knowing when to utilize a credit card authorization form can save businesses from future complications. Typical scenarios requiring such a form include high-ticket transactions, where large amounts are charged, and recurring payments or subscriptions where customers are billed periodically. Pre-orders and reservations in the restaurant or service industries may also necessitate authorization to ensure commitment.

Conversely, simpler or lower-value transactions may not require an authorization form. It's essential for businesses to assess their specific needs and the nature of each transaction to determine the necessity of using a credit card authorization form.

How to create your credit card authorization form

Creating a credit card transaction authorization form can be made simple by following a step-by-step guide. Start by selecting a template from pdfFiller, which offers a variety of customizable forms tailored for different business needs. After choosing a template, customize the fields to ensure all required information is included.

It’s vital to ensure compliance with PCI DSS regulations to protect sensitive card information. Effective language is key; use straightforward, concise wording that is easy for customers to understand while still being legally binding.

Filling out the credit card authorization form

For cardholders, safely completing the credit card authorization form is essential. Always ensure that the form is filled out in a secure environment to mitigate the risk of sensitive information being captured by unauthorized individuals. Double-checking that all details are accurate before submission is a must, as small mistakes can lead to delays or transaction failures.

Common mistakes include entering incorrect card information, missing signatures, or failing to specify the authorization amount clearly. To facilitate smoother transactions, take the time to verify every detail meticulously.

Digital solutions: eSigning and managing forms on pdfFiller

With the rise of digital solutions, managing credit card authorization forms has never been easier. pdfFiller offers tools for online form management, enabling users to conveniently eSign forms without the need for physical copies. This digital process speeds up transactions and provides a user-friendly experience.

Collaborating with teams on form creation and management is also streamlined on pdfFiller. It's important to adhere to best practices by securely storing signed forms, ensuring that sensitive data remains protected. Consider using password protection and encrypted storage to maintain confidentiality.

FAQs about credit card authorization forms

Frequently asked questions provide clarity surrounding credit card transaction authorization forms. One common query is whether it is legally obligatory to use these forms; while laws may vary by jurisdiction, they are strongly recommended for secure transactions. Another concern is regarding errors on the form; in the event of a mistake, it's best to amend and resubmit the form rather than allowing the error to propagate.

Storing signed forms properly is critical for businesses; the general guideline suggests retaining this documentation for at least one year. Understanding concepts like 'Card on File' can also help businesses streamline recurring payments while ensuring compliance and security.

Download our credit card authorization form templates

To simplify your transaction processes, access customizable credit card authorization form templates on pdfFiller. These templates are designed for various business needs, and downloading them is as easy as a few clicks. Once downloaded, you can customize them further to fit your specific requirements.

Utilizing professionally designed templates not only saves time but also ensures that all essential legal components are included, allowing businesses to operate confidently.

Related resources and articles

To enhance your understanding of credit card processing, consider exploring additional resources that explain the difference between online and offline credit card processing. Protecting customer data during transactions is also crucial, and reading up on the importance of payment gateways can further augment your knowledge, ensuring that your business remains secure.

Stay updated

Subscribe to our newsletter on pdfFiller for the latest updates about document management tools. Get valuable insights and tips on how to manage financial documents more seamlessly, helping you stay informed and ahead in your business.

Engaging with the pdfFiller community

Engage with the pdfFiller community by sharing your experiences and tips. Opportunities for feedback and feature requests are plentiful, giving users a chance to voice their thoughts. Community support channels also provide a space for questions and assistance, making your experience as seamless as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card transaction authorization for eSignature?

How do I edit credit card transaction authorization in Chrome?

Can I create an electronic signature for the credit card transaction authorization in Chrome?

What is credit card transaction authorization?

Who is required to file credit card transaction authorization?

How to fill out credit card transaction authorization?

What is the purpose of credit card transaction authorization?

What information must be reported on credit card transaction authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.