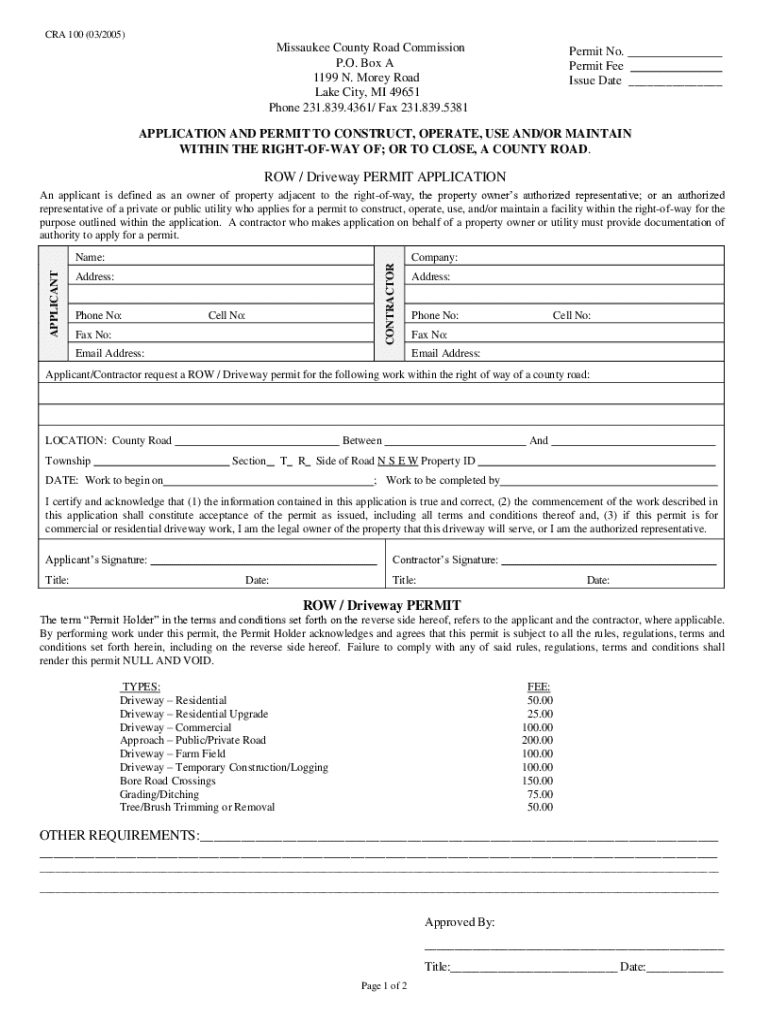

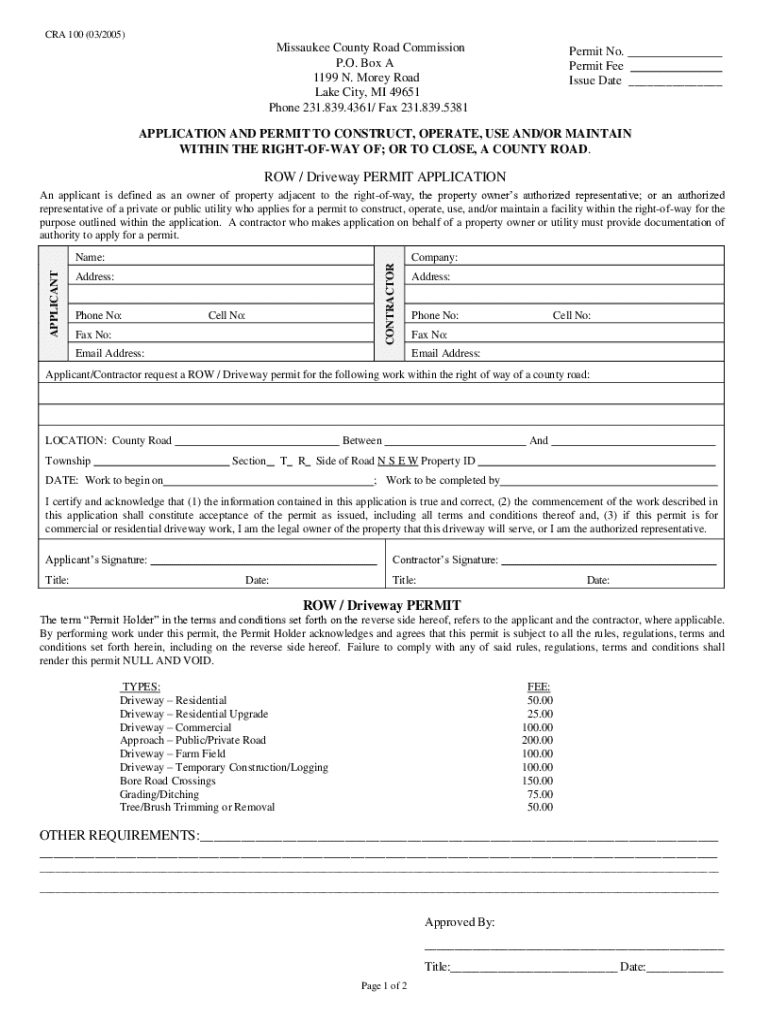

Get the free Cra 100 (03/2005)

Get, Create, Make and Sign cra 100 032005

How to edit cra 100 032005 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cra 100 032005

How to fill out cra 100 032005

Who needs cra 100 032005?

A comprehensive guide to the CRA05 form

Understanding the CRA05 form

The CRA05 form, commonly referred to as the CRA05 form, is a crucial document for individuals and businesses alike in Canada, used primarily for the claim of eligible medical expenses. This form facilitates taxpayers in documenting and reporting their expenditures on medical costs, which can significantly impact tax returns. Its completion not only allows individuals to maximize their potential deductions but also ensures compliance with Canada's tax regulations.

Accurate completion of the CRA05 form is paramount. Errors or omissions could lead to delays in processing claims or, worse, a denial of deductions. The form is often utilized each tax season, making familiarity with its structure critical for effective tax planning and preparation.

Who needs the CRA05 form?

The CRA05 form serves a diverse array of individuals and entities within Canada. Understanding the target audience is essential to utilize the form effectively. Individuals who have incurred qualifying medical expenses throughout the tax year, as well as small businesses and organizations with employee healthcare expenses, can benefit from the provisions this form offers.

Individuals primarily include those who have out-of-pocket medical expenses for themselves or dependents. Small businesses might use the form when handling expenses related to employee health benefits. Moreover, organizations, especially those in the healthcare sector, may need to document various medical expenses for compliance and reporting purposes.

Step-by-step instructions for completing the CRA05 form

Completing the CRA05 form may seem daunting, but following structured instructions can ease the process. The form is divided into distinct sections, each requiring specific information to support your claims.

Section 1: Patient information

Begin by entering accurate patient information. This includes full names, addresses, and the relationship to the taxpayer. Ensuring the correct spelling and up-to-date details is critical. For instance, any discrepancies in names or dates can result in delays in the processing of your claims.

Section 2: Medical expenses

This section requires a breakdown of eligible and ineligible medical expenses. Familiarize yourself with what qualifies as eligible expenses, such as certain medications, treatments, and procedures. Gather documentation like receipts and invoices as proof of these expenses.

Section 3: Tax details

Accurately calculating deductions is vital in this section. Familiarize yourself with the tax laws regarding medical expenses as they can vary annually. One common mistake to avoid is neglecting to account for all eligible amounts; ensure that each expense is accurately listed and reconciled with documentation.

Incorporating interactive tools

In today's digital landscape, tools like pdfFiller enhance the form-filling experience. With features designed for user convenience, filling out the CRA05 form becomes both efficient and straightforward.

Utilizing pdfFiller's interactive form fields allows users to fill in data directly, saving time and minimizing errors. The platform's cloud-based accessibility ensures that users can work on their forms from anywhere, making collaboration easier among teams.

Editing and customizing the CRA05 form

Editing your completed CRA05 form is straightforward with pdfFiller. You can adjust details and add comments where necessary to clarify entries or provide additional context. This is especially useful for teams working collaboratively on tax claims.

Users can also adjust the format for better clarity. For example, bolding key points or using color coding can help in quickly identifying essential sections. Saving and exporting the completed form after finalization ensures that all edits are preserved.

Managing your submitted CRA05 form

Once the CRA05 form is submitted, managing your submission is crucial. Keeping track of the submission status is essential for timely follow-up. Many users may wonder how long processing will take; typically, it can vary based on tax volume and processing schedules.

Revisions post-submission may be necessary if errors are discovered later. Knowing the correct protocol in such cases can prevent further complications. If issues arise, immediate documentation of the problem and timely communications with tax authorities can facilitate better resolution.

Frequently asked questions (FAQs)

Understanding common uncertainties can empower users over the CRA05 submission process. For those worried about not receiving a confirmation after sending the form, it is advisable to check the electronic portfolio provided by Canada's revenue agency.

In cases where errors are spotted after submission, it is essential to know the process of amending the CRA05 form. Communication with the CRA should be immediate to facilitate any necessary corrections.

Comparative insights: CRA05 form vs. other CRA forms

Different CRA forms serve unique purposes, and understanding the distinctions between the CRA05 and other related forms is fundamental. For instance, while the CRA05 focuses specifically on medical expenses, forms like CRA 101 or CRA 100 report income or business-related deductions.

In selecting which forms to utilize, it is critical to align them with the specific tax situation. Ensuring accuracy in selecting forms prevents complications and optimizes potential deductions.

Additional tools and resources available through pdfFiller

The pdfFiller platform provides additional tools that complement the CRA05 form process. Users can access a variety of related templates and forms that assist with comprehensive document management beyond just the CRA05 itself.

Incorporating tutorials and video guides can further enhance the understanding of the CRA05 form, easing the learning curve for those less familiar with tax documentation requirements. Support features within pdfFiller are also invaluable when navigating complex situations.

Best practices for filing the CRA05 form

Filing the CRA05 form successfully necessitates organizing all relevant documentation beforehand. Start by ensuring that all receipts and bills are gathered, noting the specific details required in the form's sections. Adopt a checklist approach to avoid overlooking essential information.

Additionally, awareness of deadlines is crucial. Tax deadlines can vary based on personal circumstances, such as self-employment. Keeping a calendar reminder can ensure you submit your CRA05 form on time, thus preventing any penalties or missed deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cra 100 032005 directly from Gmail?

How can I send cra 100 032005 to be eSigned by others?

How do I edit cra 100 032005 online?

What is cra 100 032005?

Who is required to file cra 100 032005?

How to fill out cra 100 032005?

What is the purpose of cra 100 032005?

What information must be reported on cra 100 032005?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.