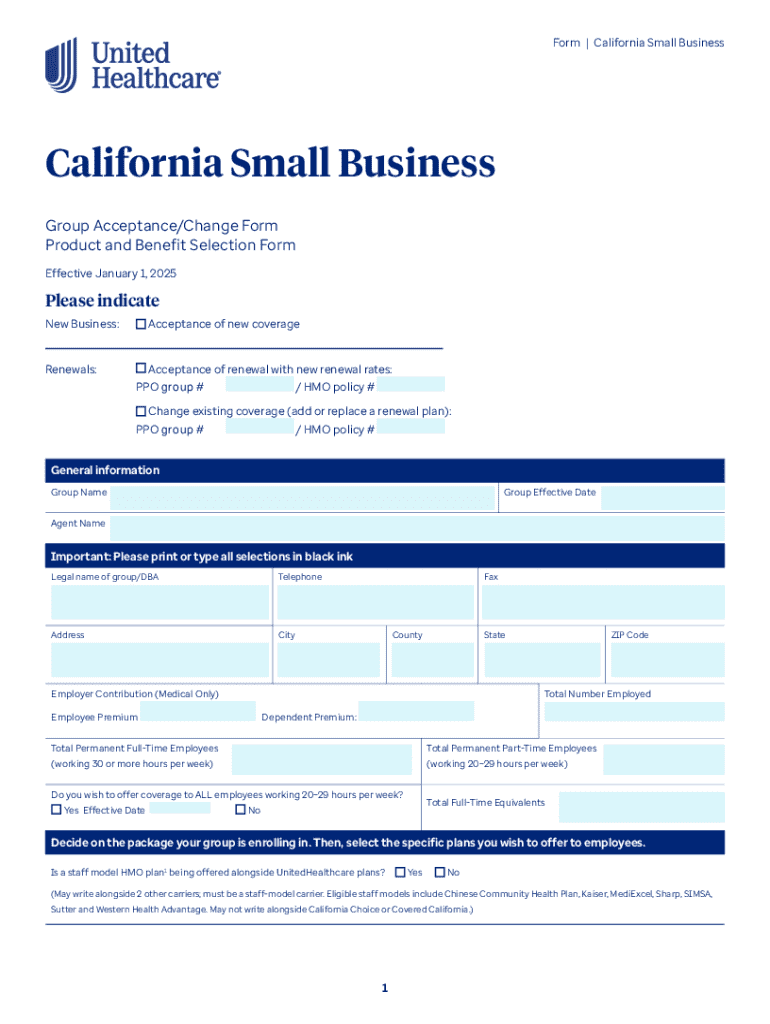

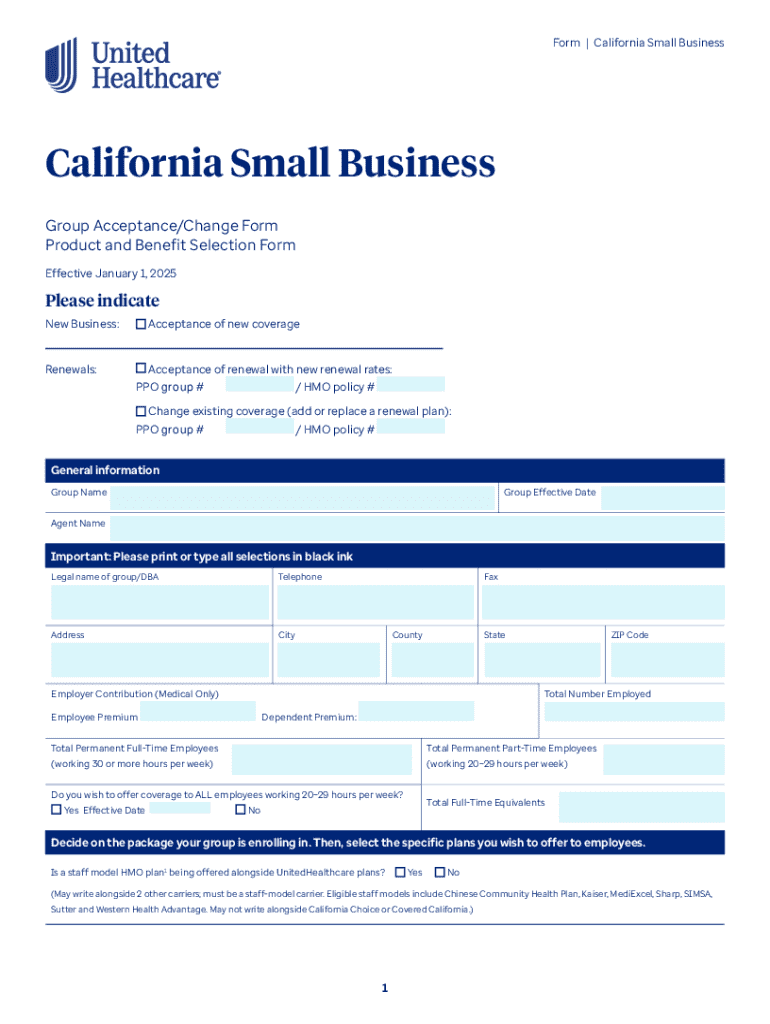

Get the free California Small Business

Get, Create, Make and Sign california small business

Editing california small business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california small business

How to fill out california small business

Who needs california small business?

A Comprehensive Guide to California Small Business Forms

Understanding California small business forms

California small business forms play a crucial role in ensuring that entrepreneurs meet legal and regulatory requirements necessary for operating a business in the state. These forms serve various purposes such as registering the business, obtaining permits, and maintaining compliance with state laws. Understanding the structure and types of forms available empowers business owners to navigate the process efficiently.

The primary types of small business forms available in California include business licenses, seller's permits, and statements of information, among others. Each form has specific requirements and implications based on the business structure, whether it’s a sole proprietorship, partnership, limited liability company (LLC), or corporation. Meeting legal requirements is fundamental to avoiding penalties or operational delays.

Key forms and their purpose

Business license application

A business license application is essential for any business operating in California. It grants a legal right to conduct business within a particular city or county. Depending on the type of business and location, various licenses may be required.

To obtain a business license application, entrepreneurs can visit their local city or county government office, where applications are usually available. Some municipalities also provide online applications through their official websites.

Seller’s permit

A seller's permit is required for businesses selling tangible goods. This permit allows the collection of sales tax from customers, making it crucial for compliance with the California Department of Tax and Fee Administration (CDTFA).

The process for obtaining a seller’s permit involves completing an application, which can be done online through the CDTFA website or in person at designated field offices. If your business involves selling goods, this permit is a necessity.

Statement of information

The statement of information is a critical filing for corporations and LLCs in California. It ensures that the state and the public have up-to-date information regarding the business's primary contact and management structure.

Filing timelines depend on the type of business entity, with initial statements typically due within 90 days of formation. Subsequent statements must be filed biennially. Business owners must verify their specific requirements via the California Secretary of State’s website.

Federal employer identification number (EIN) form

For tax purposes and employee payroll, a Federal Employer Identification Number (EIN) is often necessary. This unique identifier is crucial for filing taxes and complying with federal regulations concerning employment.

Applying for an EIN is straightforward. Entrepreneurs can complete the application online on the IRS website, and once submitted, the EIN is typically issued immediately. This form is integral for establishing a business entity and ensuring proper tax compliance.

Filing process: Step-by-step guide to submitting forms

File online - fastest service

Filing forms online is often the fastest service available to small business owners in California. Not only does it expedite the process with immediate acknowledgment of receipt, but it also allows for convenient tracking of submissions.

To file online, businesses can visit the specific government websites associated with the desired forms. For example, applying for a seller’s permit or filing a statement of information can be done through the California Secretary of State and the CDTFA websites, respectively.

File by mail or in person

While online filing is efficient, there are instances when mail or in-person submission is preferable. For example, businesses might choose this option for forms requiring original signatures or those complicated enough to necessitate direct assistance.

When mailing forms, ensure to send to the correct state office using certified mail for tracking purposes. For in-person submissions, visiting the respective office can provide immediate feedback and assistance from staff.

Managing your forms efficiently

Using pdfFiller for document management

Managing California small business forms can be simplified through tools like pdfFiller. This cloud-based platform offers various features for editing, filling, and storing PDF forms efficiently. Users can create a streamlined process for their business documentation.

With pdfFiller, business owners can save time by editing existing templates and instantly filling out required forms. Collaboration tools facilitate input from partners or advisors, ensuring documents are always up-to-date.

eSignature integration

In California, eSignatures hold the same legal validity as traditional signatures, paving the way for digital document approval. With pdfFiller, users can seamlessly add eSignatures, simplifying the signing process for forms that require approval.

To add eSignatures using pdfFiller, users can upload their document, select the eSignature option, and easily drag and drop the signature field where needed. This integration enhances document management efficiency, particularly in a remote working environment.

Troubleshooting common issues with small business forms

Common errors and how to avoid them

Form submission often comes with pitfalls. Common errors include incomplete fields, wrong entity type selected, and incorrect contact details. These mistakes can result in delays or rejections by regulatory bodies.

To avoid such errors, double-check all form fields before submission. It's beneficial to have a peer review your filings to catch mistakes that may have been overlooked. Familiarizing yourself with the specific requirements of each form also aids in ensuring accuracy during completion.

Resolving submission issues

If your form is rejected or an issue arises, prompt action is essential. Begin by reviewing any feedback provided by the state office. They may offer specific instructions on how to amend the submission or correct mistakes.

For additional assistance, contact the relevant office using their provided contact information. Circling back to resolve these issues swiftly not only maintains your business’s compliance but also keeps your operations running smoothly.

Keeping your business compliant

Maintaining compliance with small business forms is vital for avoiding penalties and ensuring the smooth operation of your business in California. This includes keeping accurate and up-to-date records, which is crucial as businesses grow or change.

Regular updates and document management practices can significantly ease the compliance process. Utilize reminders and scheduling tools to track important filing deadlines, such as when statements of information are due or when updates to business licenses must be completed.

Regular updates and document management

Implementing a systematic approach to document management can prevent compliance issues. Periodically review your forms and information to ensure they reflect current business status and structure.

Consider using project management tools or calendar reminders to keep track of necessary updates. This proactive approach can save valuable time and mitigate stress as deadlines approach.

Related links and resources

State resources for small businesses

California offers a plethora of resources for small business owners. Official state websites, such as the California Secretary of State and the California Department of Tax and Fee Administration, provide comprehensive information on requirements, forms, and updates.

Local business support programs also play a crucial role in assisting entrepreneurs. Organizations such as the Small Business Development Center (SBDC) provide mentorship and guidance, helping small businesses to navigate complex regulatory landscapes.

Legal assistance and guidance

Navigating the legal aspects of small business forms can be daunting. Seeking legal assistance when necessary can provide valuable insights and ensure compliance with all regulations. Many law firms specialize in business law and can guide you through the process.

Consider options for legal advice, such as consulting local business networks or utilizing online platforms for legal guidance tailored to small businesses. These resources can alleviate anxiety and provide clarity as you manage your business forms.

Feedback and improvements

Submitting feedback for better services helps enhance user experience and improve available resources for small business owners. Engaging with platforms like pdfFiller allows for collaborative dialogue regarding document management solutions.

Encouragement for feedback can create a more user-oriented experience. Share suggestions or best practices for managing documentation effectively, and participate in forums or discussions to contribute to community knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute california small business online?

Can I sign the california small business electronically in Chrome?

How do I edit california small business on an iOS device?

What is california small business?

Who is required to file california small business?

How to fill out california small business?

What is the purpose of california small business?

What information must be reported on california small business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.