Get the free Charitable Organization Annual Report Form - ago mo

Get, Create, Make and Sign charitable organization annual report

How to edit charitable organization annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable organization annual report

How to fill out charitable organization annual report

Who needs charitable organization annual report?

Understanding the Charitable Organization Annual Report Form

Understanding the Charitable Organization Annual Report Form

An annual report for charitable organizations serves as a crucial document detailing the organization's financial health, mission progress, and overall impact on the community over the past year. This comprehensive report not only reflects the charity's activities but also increases transparency and accountability to stakeholders, including donors, beneficiaries, and regulatory bodies.

The importance of annual reports cannot be overstated; they build trust and credibility within the community and among government entities. In addition, meeting legal requirements such as filing deadlines and regulations is essential for maintaining nonprofit status. Organizations must be aware of the specific regulations that pertain to their region or country, as these requirements can vary significantly.

Key components of an annual report

A well-structured charitable organization annual report typically includes several key components that convey the organization's work and effectiveness. The report should start with a compelling mission statement that captures the essence of the organization’s goals and ambitions.

Interactive tools for document creation

pdfFiller provides customizable resources that are ideal for creating an annual report. Users can upload existing documents and edit them using comprehensive tools tailored for nonprofits. In addition, features for eSigning and collaborating with team members on the report allow for seamless updates and changes, ensuring that all stakeholders are on the same page.

One of the major benefits of utilizing a cloud-based document solution like pdfFiller is its accessibility from anywhere. This is particularly valuable for organizations with remote teams or members in different locations. Moreover, its supportive features simplify the entire reporting process, making the task less daunting and more efficient.

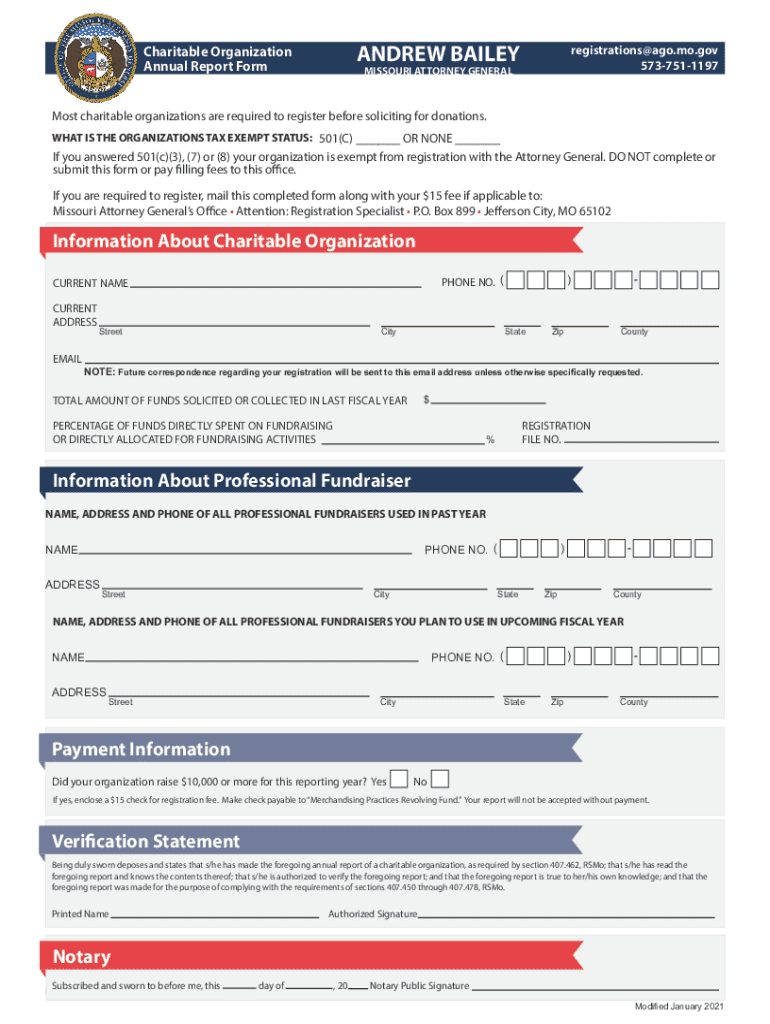

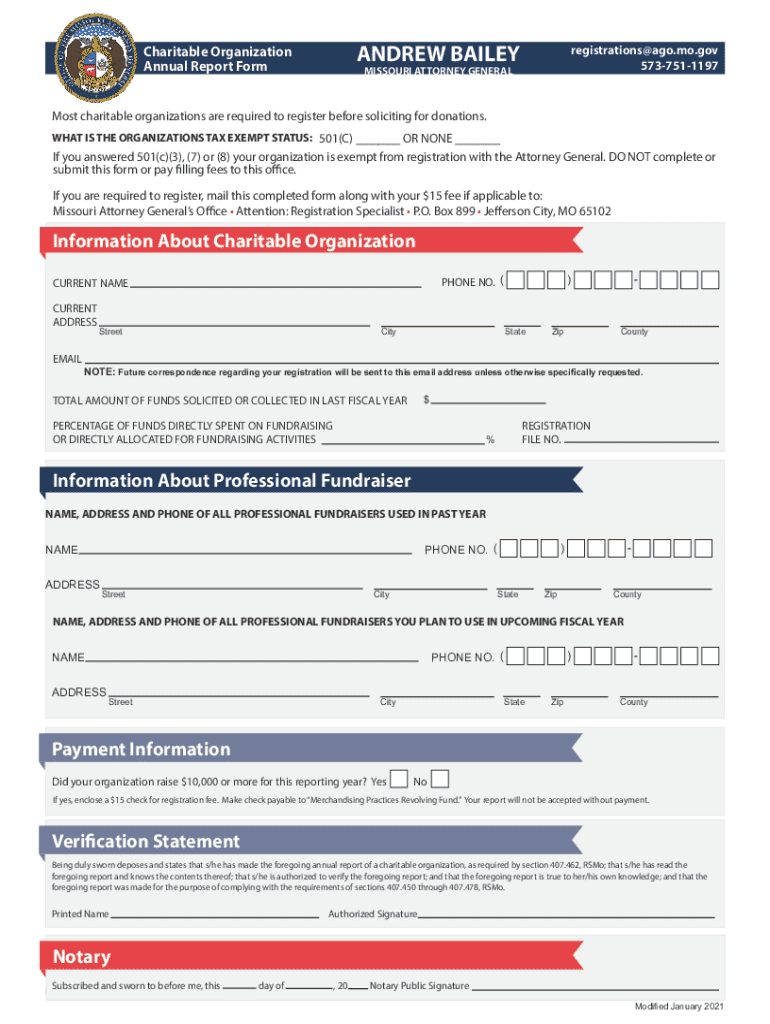

Filling out the charitable organization annual report form

Completing the charitable organization annual report form involves several crucial steps that ensure comprehensive and accurate reporting. Firstly, gathering all required information is vital to ensure that the report is accurate and complete. Missing data can lead to complications or delays in the reporting process.

Best practices for creating an engaging annual report

An engaging annual report requires not only the presentation of hard data but also a compelling narrative that draws in your audience. Utilizing visuals and a well-thought-out layout are indispensable for capturing and retaining the reader's interest. The use of graphics, charts, and tables can convey financial data in a more digestible format, making complex information clearer.

Furthermore, transparency and honesty in reporting are essential. Organizations should candidly discuss challenges encountered and lessons learned in the past year while still framing it within a positive narrative. This level of transparency fosters trust with stakeholders and reflects a mature, responsible organization. Finally, inspiring action through a clear call to support and involvement encourages contributions and fosters a lasting relationship with donors.

Common questions and FAQs

Navigating the requirements associated with annual reports can lead to several common questions among nonprofit organizations. For instance, many organizations wonder about the impacts of submitting late or the necessity of filing if they are small. Understanding these nuances is critical for compliance and maintaining good standing as a charitable organization.

Resources for assistance

Organizations seeking assistance in completing the charitable organization annual report form can find numerous resources specific to their location. Regulatory bodies often provide guidelines on filing requirements, as well as templates and examples of successful annual reports that can serve as inspiration.

Moreover, attending workshops and webinars focused on annual report creation can further enhance knowledge and efficiency, enabling your organization to produce a standout document. Having access to professionals who guide through the intricacies of the reporting process is invaluable, particularly for those new to nonprofit management.

Tailored features of pdfFiller for charitable organizations

pdfFiller provides specialized features that facilitate the annual report creation process, ensuring that every detail is meticulously attended to. One significant advantage is its seamless integration with existing software platforms, enhancing usability across different organizational tools. Collaborative features allow teams to work efficiently together, regardless of their location, fostering communication and idea sharing.

Additionally, pdfFiller's user guidance available through support and tutorials ensures that even the least tech-savvy users can navigate the platform competently. These tailored features not only streamline the reporting process but enable organizations to focus more on their mission and less on administrative burdens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send charitable organization annual report to be eSigned by others?

Where do I find charitable organization annual report?

How do I make changes in charitable organization annual report?

What is charitable organization annual report?

Who is required to file charitable organization annual report?

How to fill out charitable organization annual report?

What is the purpose of charitable organization annual report?

What information must be reported on charitable organization annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.