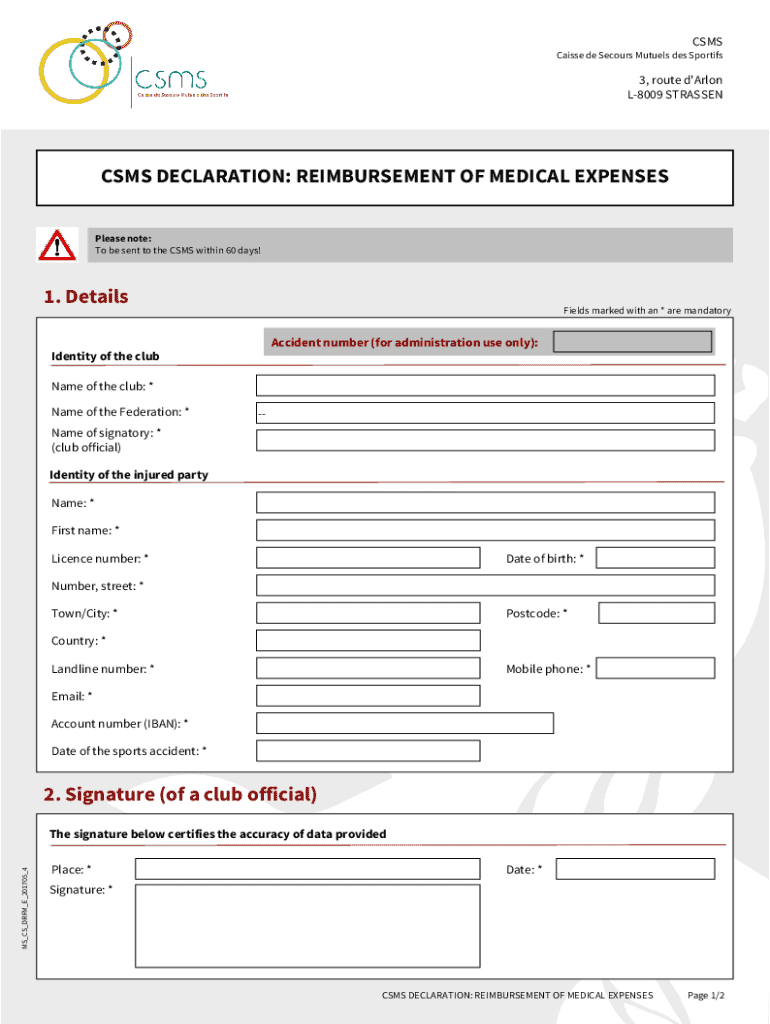

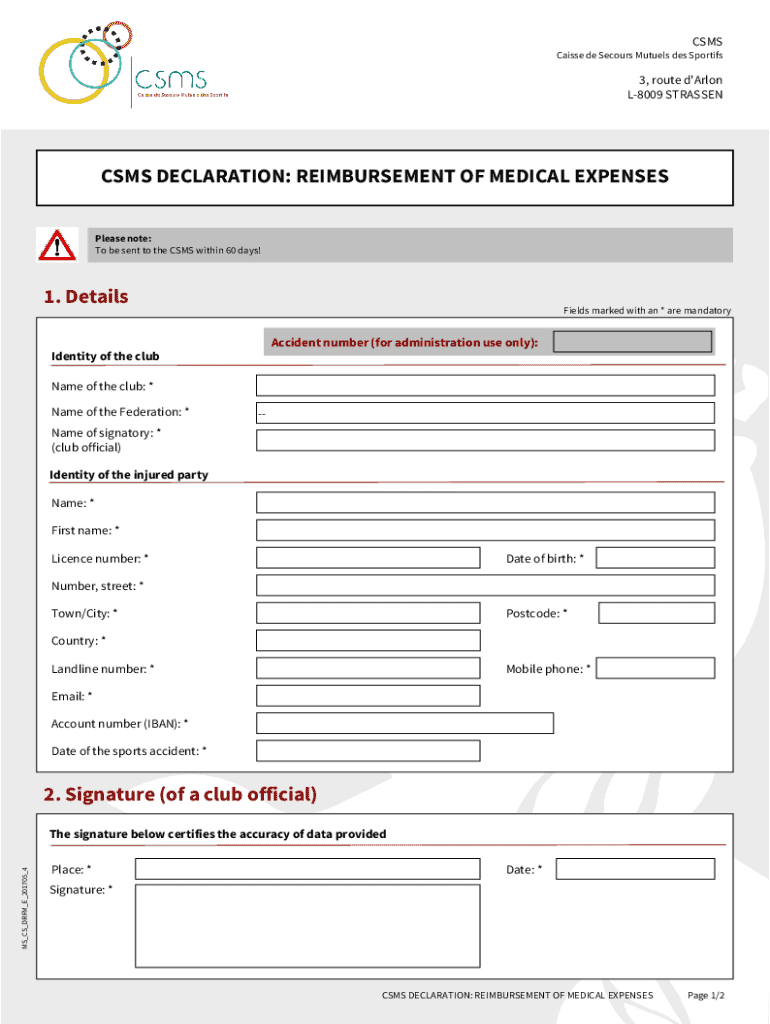

Get the free Csms Declaration: Reimbursement of Medical Expenses

Get, Create, Make and Sign csms declaration reimbursement of

How to edit csms declaration reimbursement of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csms declaration reimbursement of

How to fill out csms declaration reimbursement of

Who needs csms declaration reimbursement of?

CSMS Declaration Reimbursement of Form: Your Comprehensive Guide

Understanding CSMS Declaration

The CSMS (Centralized Service Management System) Declaration is a crucial document when it comes to the reimbursement of expenses. It serves as a formal declaration from individuals or businesses seeking reimbursement for costs incurred during various operations. The significance of the CSMS Declaration lies in its ability to streamline the reimbursement process, ensuring that claims are filed correctly and efficiently.

For individuals and teams, understanding the CSMS Declaration is essential as it not only facilitates the tracking of expenses but also supports proper budget management. The reimbursement process related to the CSMS Declaration usually involves submitting a detailed expense report along with supporting documentation, which this article will delve into.

Eligibility criteria for reimbursement

To qualify for CSMS Declaration reimbursement, individuals typically need to meet specific criteria. These include having legitimate and valid expenses directly related to business processes or operations. Both individuals and organizations can apply, but they must ensure to follow the stipulations outlined by the entity managing the reimbursement process.

Key requirements often include having receipts or invoices, clear documentation of the purpose of the expenses, and, in some cases, prior approval from management. Common scenarios where reimbursement can apply range from travel expenses incurred during work assignments to costs associated with necessary supplies for business operations.

Overview of the reimbursement process

The reimbursement process for CSMS Declaration can be broken down into several straightforward steps. Following these steps carefully will help ensure that claims are processed smoothly and efficiently.

Ensuring each of these steps is followed will expedite the process and minimize the chances of any delays in receiving reimbursement.

Detailed instructions for filling out the CSMS Declaration form

Filling out the CSMS Declaration form accurately is crucial to obtaining reimbursement. Here's a detailed walkthrough of how to approach filling out each section.

By paying attention to these steps and providing accurate information, individuals can significantly reduce the chances of delays in processing their reimbursement claims.

Editing and managing your CSMS Declaration documents

Managing documents related to the CSMS Declaration is essential, especially when it comes to securely editing PDFs. Using tools like pdfFiller can greatly enhance efficiency. Best practices include keeping sensitive documents secure while ensuring they are easy to access when needed.

pdfFiller offers robust features for editing CSMS Declaration forms, allowing users to update, edit, and manage their documents seamlessly. Collaborative features make it easier to share documents with teams or auditors, ensuring all stakeholders stay informed throughout the reimbursement process.

eSigning the CSMS Declaration form

The importance of eSigning in the reimbursement process cannot be overstated. eSignatures provide a fast and legally binding way of confirming that all parties agree to the content of the document. Using pdfFiller, eSigning the CSMS Declaration form is straightforward.

When eSigning, it's crucial to be aware of the legal considerations; for instance, the signature must be unique to you and stored securely to prevent unauthorized access. Implementing eSignature technology not only speeds up the reimbursement process but also enhances security and traceability.

Troubleshooting common issues

During the reimbursement process, various challenges can arise. Common issues include missing documentation, incorrect information on forms, and discrepancies in submitted receipts. Addressing these challenges promptly can save time and hassle.

If you encounter difficulties, it’s important to know where to turn for assistance. Having access to a support team can expedite resolutions. pdfFiller offers user support to guide you through any problems related to CSMS Declaration reimbursement.

Success stories: Real-life experiences with CSMS Declaration reimbursement

Testimonials from individuals and teams who have successfully navigated the CSMS Declaration reimbursement process can provide valuable insights. Many users report that clear documentation and utilizing efficient tools played a critical role in their success.

Lessons learned often include the importance of attention to detail and proactive communication with management and finance teams. Tips shared among experienced claimants highlight the value of organizing receipts and documents as soon as expenses are incurred, rather than waiting until the submission deadline.

Additional considerations for future CSMS Declaration submissions

It's vital to keep abreast of any changes in reimbursement policies that may affect future CSMS Declaration submissions. Staying informed can greatly improve the efficiency of claiming reimbursements.

Developing strategies for managing documents effectively is essential for streamlining this process. Utilizing platforms like pdfFiller can help you store, edit, and manage documents securely in one place, facilitating easier and faster submissions in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my csms declaration reimbursement of in Gmail?

Where do I find csms declaration reimbursement of?

Can I create an eSignature for the csms declaration reimbursement of in Gmail?

What is csms declaration reimbursement of?

Who is required to file csms declaration reimbursement of?

How to fill out csms declaration reimbursement of?

What is the purpose of csms declaration reimbursement of?

What information must be reported on csms declaration reimbursement of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.