Get the free Certificate of Expected Annual Income

Get, Create, Make and Sign certificate of expected annual

How to edit certificate of expected annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of expected annual

How to fill out certificate of expected annual

Who needs certificate of expected annual?

Your Comprehensive Guide to the Certificate of Expected Annual Form

Understanding the certificate of expected annual form

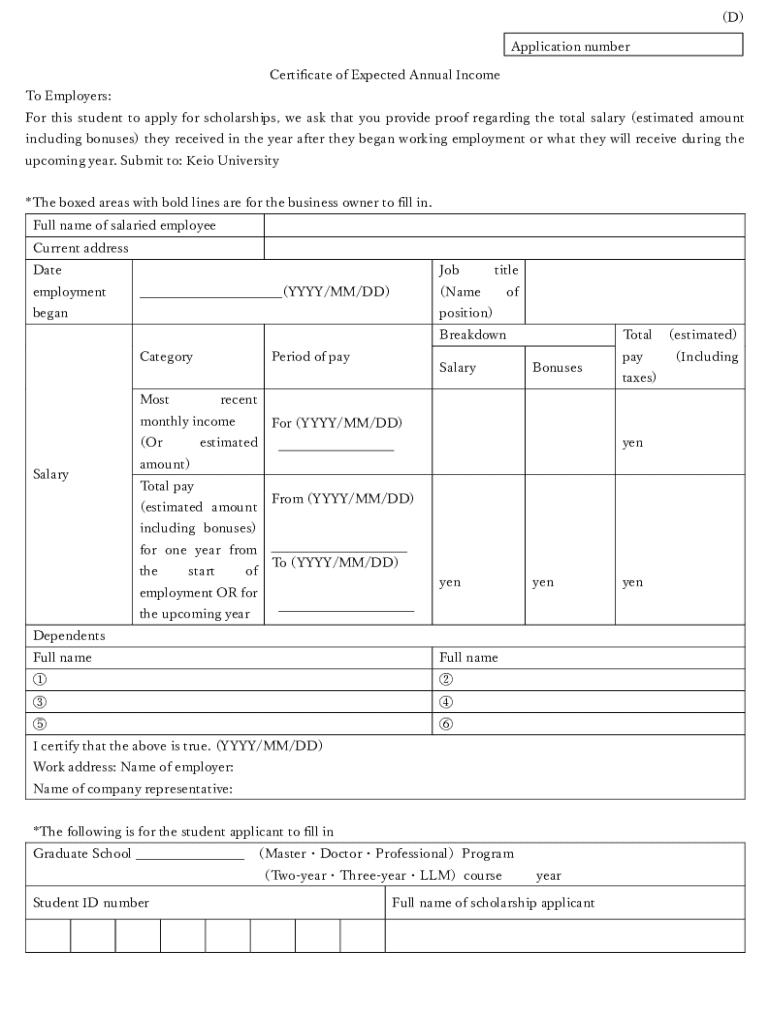

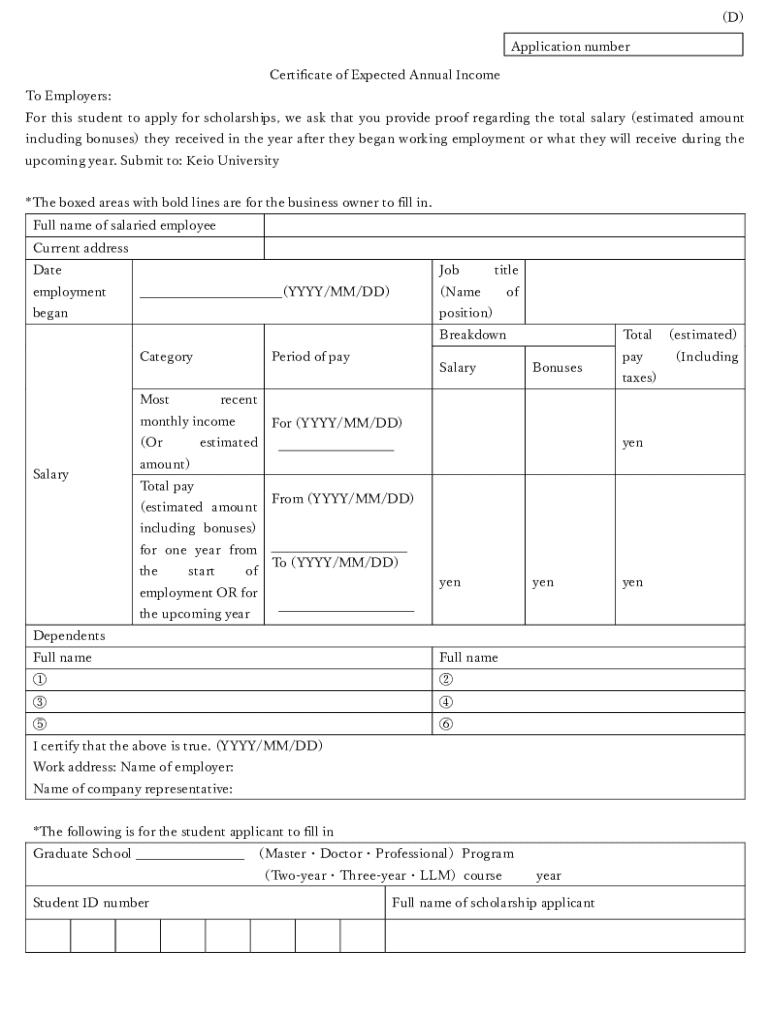

The Certificate of Expected Annual Form is a pivotal document often required for personal and organizational financial management. It consolidates anticipated income details for the current financial year, allowing both individuals and businesses to plan effectively. This form plays a crucial role in tax compliance, budgeting, and financial forecasting. By providing a clear picture of expected earnings, users can make informed decisions regarding expenditures, investments, and savings.

Understanding its significance is essential as it assists in meeting not only tax obligations but also in securing loans or financial assistance where accurate financial projections are required. Furthermore, maintaining clear and accurate financial records can help in audit situations, enhancing credibility with financial institutions. Therefore, the certificate of expected annual form serves as more than just a tax document; it embodies a strategic tool in financial planning.

Required information for the certificate

To accurately complete the certificate of expected annual form, certain personal and financial information is mandatory. This ensures that the form reflects a realistic projection of earnings and is compliant with regulatory requirements. The information needed typically falls into two key categories: personal information and financial data.

Personal information should include:

Additionally, accurate financial data is crucial, which generally includes:

Step-by-step instructions for completing the form

Completing the certificate of expected annual form can be straightforward if you follow a structured approach. The process can be broken down into three main sections, enabling clarity and precision.

Section 1: Gathering your documents

Before filling out the form, it is beneficial to gather all necessary documents. Common documents required include pay stubs, previous tax returns, and any other financial statements. To streamline this process:

Section 2: Completing the form

Next comes the actual filling out of the form. Start by inputting personal information accurately and comprehensively. This includes your name, contact details, and tax identification number. Following that, enter your financial data meticulously, ensuring all numbers reflect your true expectations.

Section 3: Reviewing your entries

After completing the form, the importance of a meticulous review cannot be overstated. Errors in financial forms can lead to tax complications or misinformation. Common mistakes include:

Editing and customizing the certificate

Once you have completed the certificate, you might want to customize it for clarity or branding purposes. pdfFiller offers intuitive editing tools to enhance the document. Begin by accessing the document through the online platform.

Consider these options to improve your form:

Additionally, experimenting with different layouts can result in a more visually appealing document, further improving comprehension.

Signing and managing your certificate

Digital signatures are becoming increasingly important for document verification. eSignatures affirm the authenticity of your certificate, ensuring both the issuer and recipients trust its contents. pdfFiller provides a seamless step-by-step guide to electronically sign your certificate.

Once signed, effective management of your form is crucial. pdfFiller offers numerous options for saving and sharing your certificate securely. Users can collaborate with team members, share via email, or download documents seamlessly within a protected environment.

Common use cases for the certificate of expected annual form

The certificate of expected annual form serves a variety of purposes across different contexts. For individuals, it is a vital tool for planning personal budgets and preparing for the tax season. By outlining expected income, individuals can make informed decisions regarding spending, saving, and investments.

Teams within organizations utilize this form for organizational yearly financial forecasting. It allows departments to align budgets with projected financial performance, ensuring that resources are allocated efficiently and effectively. Moreover, businesses often use the certificate to comply with financial reporting requirements, providing clarity to stakeholders about anticipated income and growth potential.

Frequently asked questions (FAQ)

Navigating the certificate of expected annual form can raise various questions. Below are some frequently asked queries and their answers.

Best practices for utilizing the certificate

To maximize the benefits of using the certificate of expected annual form, adhering to best practices is essential. Regular updates to the certificate can ensure that it remains relevant as circumstances change. Set reminders annually to revisit and revise projections, reflecting shifts in income or expenses.

Additionally, engaging with financial advisors or utilizing budgeting software alongside the form can enhance your financial planning strategy, providing deeper insights into your financial health.

Accessing support for your certificate needs

If you encounter challenges while working with the certificate of expected annual form, pdfFiller's support can assist you. You can contact their support team via chat or email for quick assistance. They also provide a comprehensive FAQ section to address common issues and concerns.

For community-driven support, consider joining user forums where fellow users share experiences, tips, and additional resources related to document management and effective usage of pdfFiller's features.

Additional tools and features of pdfFiller

pdfFiller offers a suite of additional functionalities that enhance document management capabilities. Integration with other financial software allows users to streamline their workflows, ensuring data consistency across platforms. Moreover, analytics features are available for tracking how your certificate is used, adding a layer of accountability to your financial reporting.

The platform stands out with innovations in document management facilitated by cloud-based solutions. This enables easy access from any location, ensuring that you can update and manage your forms whenever required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute certificate of expected annual online?

Can I edit certificate of expected annual on an iOS device?

How do I complete certificate of expected annual on an iOS device?

What is certificate of expected annual?

Who is required to file certificate of expected annual?

How to fill out certificate of expected annual?

What is the purpose of certificate of expected annual?

What information must be reported on certificate of expected annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.