Get the free Certificate of Insurance Application

Get, Create, Make and Sign certificate of insurance application

How to edit certificate of insurance application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance application

How to fill out certificate of insurance application

Who needs certificate of insurance application?

Certificate of Insurance Application Form - How-to Guide

Understanding the certificate of insurance

A certificate of insurance (COI) is an official document issued by an insurance company that verifies the existence of an insurance policy and outlines the coverage details. This document serves a crucial purpose in business transactions, as it assures interested parties that relevant insurance coverage is in place.

In various industries, a COI is essential for compliance and risk management. It can protect businesses from liability claims that may arise from accidents, damages, or professional errors. Understanding how to apply for this document is critical for compliance and to maintain strong business relationships.

Types of insurance covered in the certificate

Prepping for your application

Before filling out a certificate of insurance application form, it's important to gather all necessary documentation. This preparation ensures a smoother application process and helps prevent inaccuracies.

Typical documents required include your business registration documents, previous certificates of insurance, details of the coverages you wish to apply for, and any existing claims. Organize your paperwork systematically to easily reference them when filling out your application.

Know your coverage needs

Understanding your insurance needs is vital. Assess your business operations, potential risks, and relevant industry standards to determine the appropriate types and amounts of coverage required.

Common coverage limits vary based on industry, but it's essential to consult with your insurance advisor to ensure comprehensive coverage, suited specifically to your operational risks.

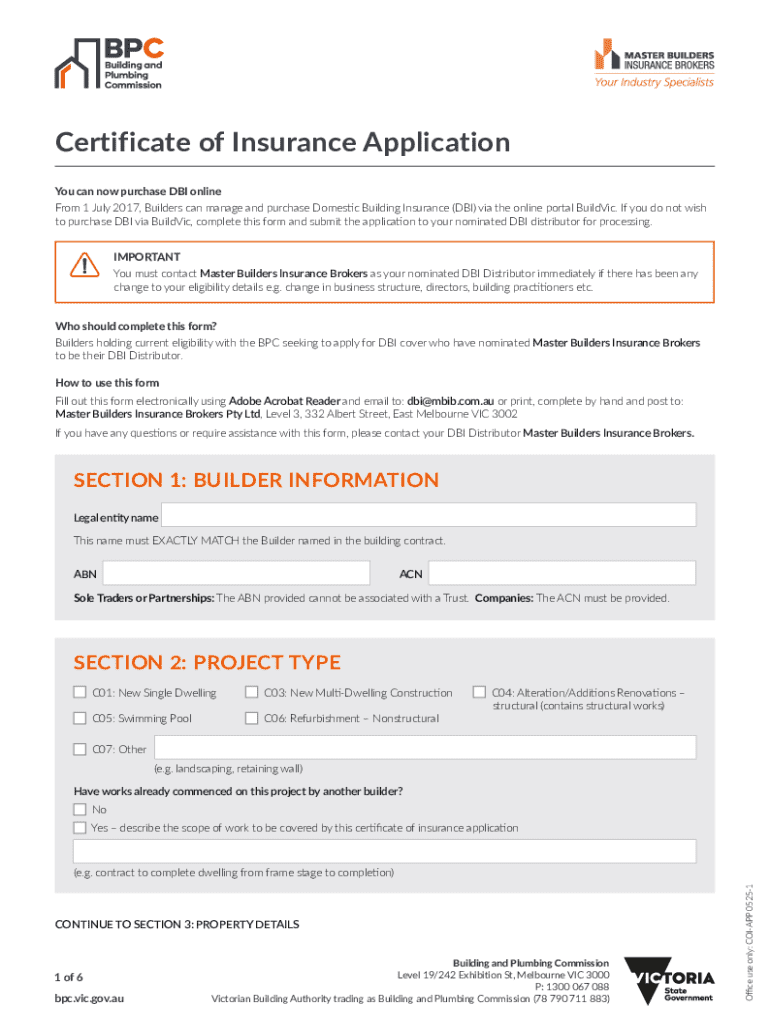

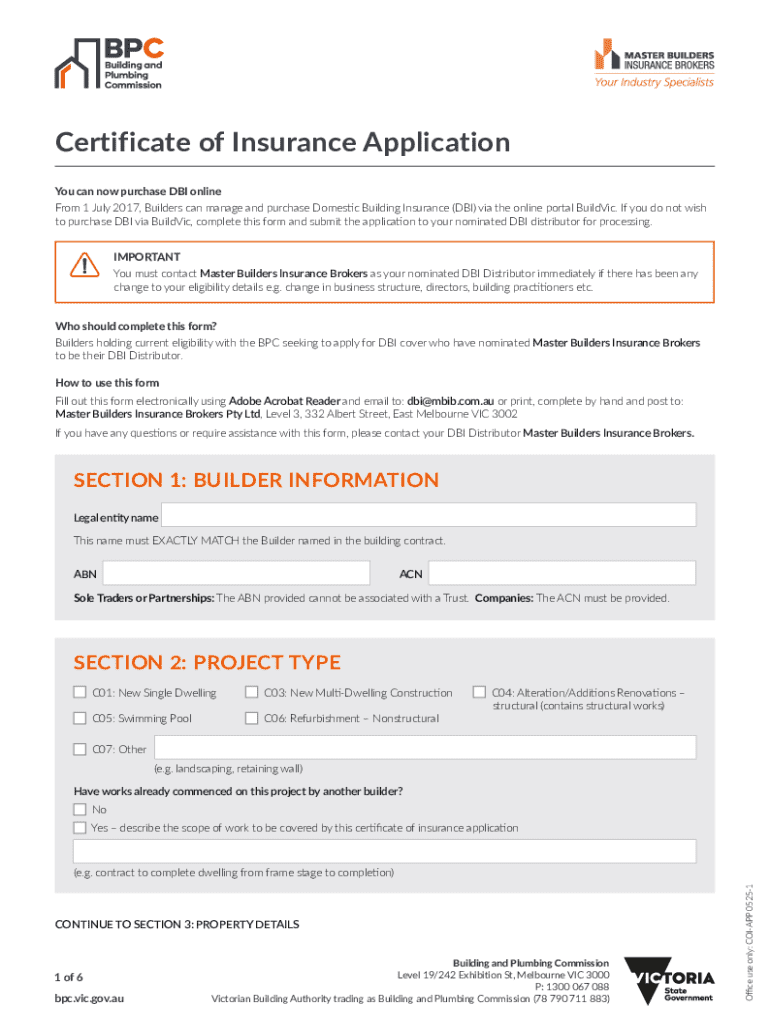

Step-by-step application process

To apply for a certificate of insurance, first, determine where to obtain the application form. Many insurance companies provide application forms via their websites, while platforms like pdfFiller offer additional convenience for managing these documents.

Navigating pdfFiller is straightforward: simply visit the homepage, search for the certificate of insurance application form, and you can start filling it out directly online.

Filling out the certificate of insurance application form

When it comes to filling out the application form, accuracy is key. Start by entering your business information, including name, address, and type of business. Provide a detailed description of the activities your business engages in.

Next, specify the types of coverage you wish to include and the limits you need. This section might also ask for supplementary documentation to support your request, such as prior insurance certificates or claims history.

Common mistakes to avoid

Many applicants overlook the importance of accuracy; common mistakes include inputting incorrect policy numbers, misrepresenting business operations, or failing to provide necessary documentation. These errors can lead to application delays or denial.

Reviewing the entire application and cross-checking all entered information is crucial before submission. Always ensure that you've included attachments as required.

Editing and reviewing your application

Once your application has been filled out, utilizing tools like pdfFiller is beneficial for editing and reviewing your document. The platform allows you to modify any section easily and make necessary corrections without hassle.

Key features include the ability to annotate, highlight, and comment, which makes the revision process collaborative if you're working with a team. This functionality helps ensure that everyone involved can contribute to finalizing the document.

Collaborating with team members

Collaboration is easier when using pdfFiller. The platform enables sharing documents with team members for feedback. You can set different permission levels to control access, ensuring that sensitive information remains secure while allowing for constructive input.

Signing the application

After making sure your application is correct, the next step is signing it. eSigning is increasingly important, and with pdfFiller, it's a seamless part of your workflow. Electronic signatures provide a secure and legally binding way to sign your documents.

To eSign your application, follow the prompts on pdfFiller. You can also customize your signing experience by adding signature fields anywhere on the document, making it user-friendly for various signers.

Using advanced features for signing

PdfFiller’s advanced features also allow you to create multiple signature fields if needed, which is particularly useful for applications requiring non-standard signatories or additional approvals.

Managing your document post-submission

After you submit your certificate of insurance application form, managing the resulting documents is a crucial consideration. It’s recommended to store your COI securely, and pdfFiller offers cloud storage solutions for easy access and management.

Best practices include organizing your COIs in clearly labelled folders for quick retrieval and regularly updating your stored documents to comply with any changes in your insurance status or business operations.

Follow-up procedures after submission

Post-application, expect a follow-up from your insurance provider regarding the status of your certificate. Some applications may require additional documentation or clarification.

It’s essential to respond promptly to any inquiries to facilitate a smooth approval process. Keeping track of communications and documents submitted can help avoid any delays.

Additional tips for success

Maintaining compliance with insurance requirements is an ongoing duty. Regularly review and update your insurance as business operations change, and stay informed about any new industry regulations that may necessitate adjustments.

Resources, such as industry associations or insurance advisors, can provide valuable guidance to help you keep your certificate of insurance up to date.

Leveraging pdfFiller for future applications

PdfFiller can serve as an all-in-one solution for not only your certificate of insurance application but for various forms and documents you may need in the future. The platform’s user-friendly features streamline document management, and its signature collection tools ensure that you can efficiently handle multiple transactions.

Utilizing pdfFiller allows you to focus on what matters most—growing your business while ensuring you're compliant and covered.

Interactive FAQs

When applying for a certificate of insurance, many questions arise. Here are some of the most frequently asked questions to guide you through the process:

Contact information for additional support

If you require further assistance while navigating the certificate of insurance application form, customer support is readily available. PdfFiller offers multiple ways to reach out, including live chat, email, and a dedicated support phone line.

For a quicker resolution, ensure you have all relevant documents and details on hand when contacting customer support. This preparation will help the support team assist you more efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of insurance application directly from Gmail?

How can I edit certificate of insurance application from Google Drive?

How do I fill out certificate of insurance application using my mobile device?

What is certificate of insurance application?

Who is required to file certificate of insurance application?

How to fill out certificate of insurance application?

What is the purpose of certificate of insurance application?

What information must be reported on certificate of insurance application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.