Get the free Fitch AA(See Ratings herein) - alnb uscourts

Show details

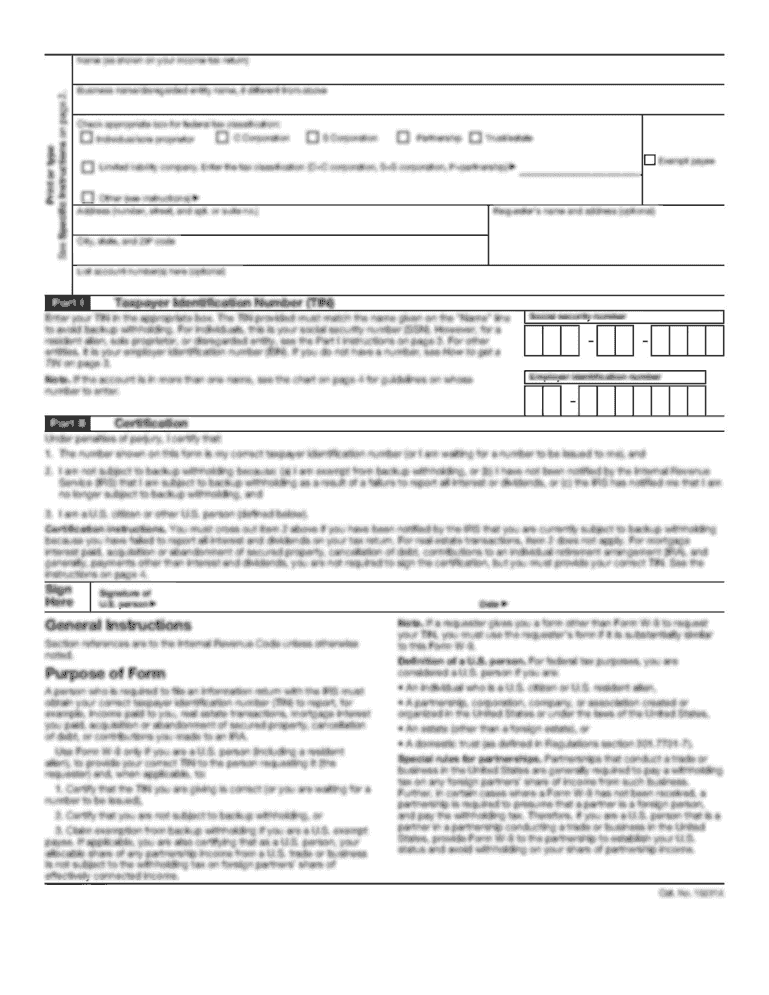

Attachment A OFFICIAL STATEMENT NEW ISSUE: Coventry Only Ratings: Moody's: Aa3 Standard & Poor: AA Fitch: AA(See Ratings herein) In the opinion of Bond Counsel, under existing law and as of the date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

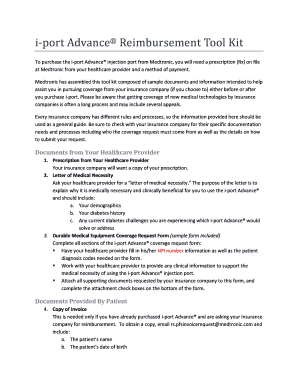

Edit your fitch aasee ratings herein form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fitch aasee ratings herein form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fitch aasee ratings herein online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fitch aasee ratings herein. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out fitch aasee ratings herein

How to fill out fitch aasee ratings herein:

01

Start by gathering all the necessary financial information for the entity being rated. This includes details about their assets, liabilities, revenue, expenses, and cash flows.

02

Review the fitch aasee rating methodology and guidelines to understand how the ratings are determined and what criteria are considered.

03

Assess the financial performance and stability of the entity based on the gathered information. Look for factors such as debt levels, profitability, liquidity, and creditworthiness.

04

Analyze the industry and market conditions in which the entity operates. Consider any potential risks and challenges that could affect its financial position.

05

Use the rating scale provided by fitch aasee to assign an appropriate rating for the entity. This scale usually ranges from AAA (highest rating) to D (default).

06

Provide a comprehensive explanation and justification for the assigned rating, highlighting the key strengths and weaknesses of the entity.

07

Submit the filled-out fitch aasee rating form or report to the relevant authority or organization for review and approval.

Who needs fitch aasee ratings herein:

01

Investors: Investors use fitch aasee ratings to assess the creditworthiness and financial stability of an entity before making investment decisions. These ratings help them evaluate the level of risk associated with investing in a particular entity.

02

Financial Institutions: Banks and other financial institutions refer to fitch aasee ratings when deciding whether to offer loans or credit to an entity. The ratings provide insights into an entity's ability to repay its debts and meet its financial obligations.

03

Regulators: Regulatory bodies and government agencies utilize fitch aasee ratings to monitor the financial health and stability of entities within their jurisdiction. These ratings assist in identifying potential systemic risks and implementing appropriate regulatory measures.

04

Bond Issuers: Entities issuing bonds use fitch aasee ratings to attract investors and determine the interest rates they offer. Higher ratings indicate lower credit risk, which allows issuers to obtain financing at more favorable terms.

05

Insurance Companies: Insurance companies consider fitch aasee ratings when determining the appropriate premiums and coverage for entities seeking insurance policies. The ratings help assess the likelihood of an entity experiencing financial difficulties or defaulting on its obligations.

Please note that this is a general guideline, and the specific requirements and usage of fitch aasee ratings may vary depending on the country and industry. It is advisable to refer to fitch aasee's official resources for detailed instructions and guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

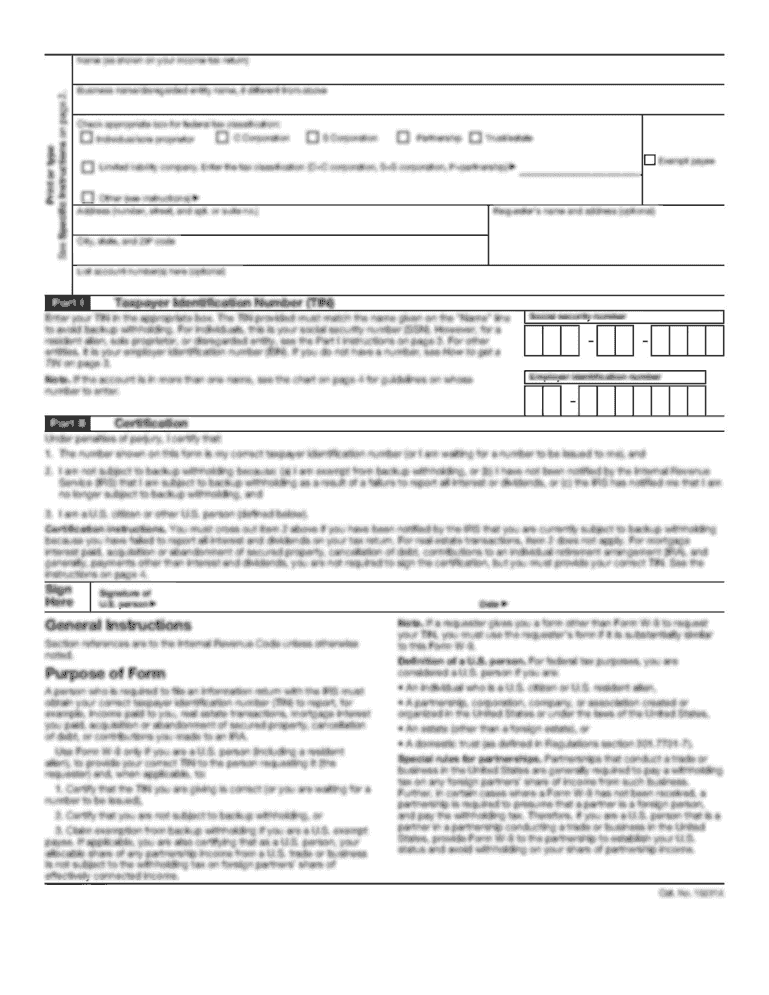

What is fitch aasee ratings herein?

Fitch Aasee ratings refer to credit ratings assigned by the Fitch Ratings agency to assess the creditworthiness of an entity.

Who is required to file fitch aasee ratings herein?

Entities looking to provide investors and creditors with an independent assessment of their credit risk are required to file Fitch Aasee ratings.

How to fill out fitch aasee ratings herein?

Fitch Aasee ratings can be filled out by providing detailed financial information and other relevant data to the Fitch Ratings agency for assessment.

What is the purpose of fitch aasee ratings herein?

The purpose of Fitch Aasee ratings is to provide investors and creditors with an indication of the creditworthiness of an entity, helping them make informed decisions.

What information must be reported on fitch aasee ratings herein?

Information such as financial statements, debt levels, and cash flow projections must be reported on Fitch Aasee ratings.

When is the deadline to file fitch aasee ratings herein in 2023?

The deadline to file Fitch Aasee ratings in 2023 may vary, it is recommended to check with the Fitch Ratings agency for specific deadlines.

What is the penalty for the late filing of fitch aasee ratings herein?

The penalty for late filing of Fitch Aasee ratings may include financial penalties or a negative impact on credit ratings.

How do I complete fitch aasee ratings herein online?

Easy online fitch aasee ratings herein completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit fitch aasee ratings herein on an iOS device?

Use the pdfFiller mobile app to create, edit, and share fitch aasee ratings herein from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out fitch aasee ratings herein on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your fitch aasee ratings herein. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your fitch aasee ratings herein online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.