Get the free Construction Insurance Application Form

Get, Create, Make and Sign construction insurance application form

How to edit construction insurance application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out construction insurance application form

How to fill out construction insurance application form

Who needs construction insurance application form?

Comprehensive Guide to the Construction Insurance Application Form

Understanding construction insurance

Construction insurance plays a pivotal role in safeguarding construction projects from various risks. It is a specialized insurance product designed to protect businesses and contractors involved in construction activities.

The main purpose of construction insurance is to provide financial protection against potential liabilities arising from accidents, damages, or losses incurred during a project. Coverage options vary widely but typically include general liability, workers' compensation, builder's risk, and professional liability insurance.

For construction projects of any size, insurance is not just an option—it's often a necessity. Many jurisdictions require certain forms of construction insurance for compliance with local laws and regulations. Without proper coverage, businesses may be vulnerable to significant financial losses.

Types of construction insurance

There are several critical types of construction insurance, each serving a unique purpose and protecting against various risks.

General liability insurance is fundamental for all contractors. This insurance covers bodily injury, property damage, and personal injury claims that may arise during a construction project. Essentially, it protects against potential lawsuits from third parties.

Understanding these different types of construction insurance is crucial for selecting adequate coverage tailored to specific project needs.

Requirements for construction insurance

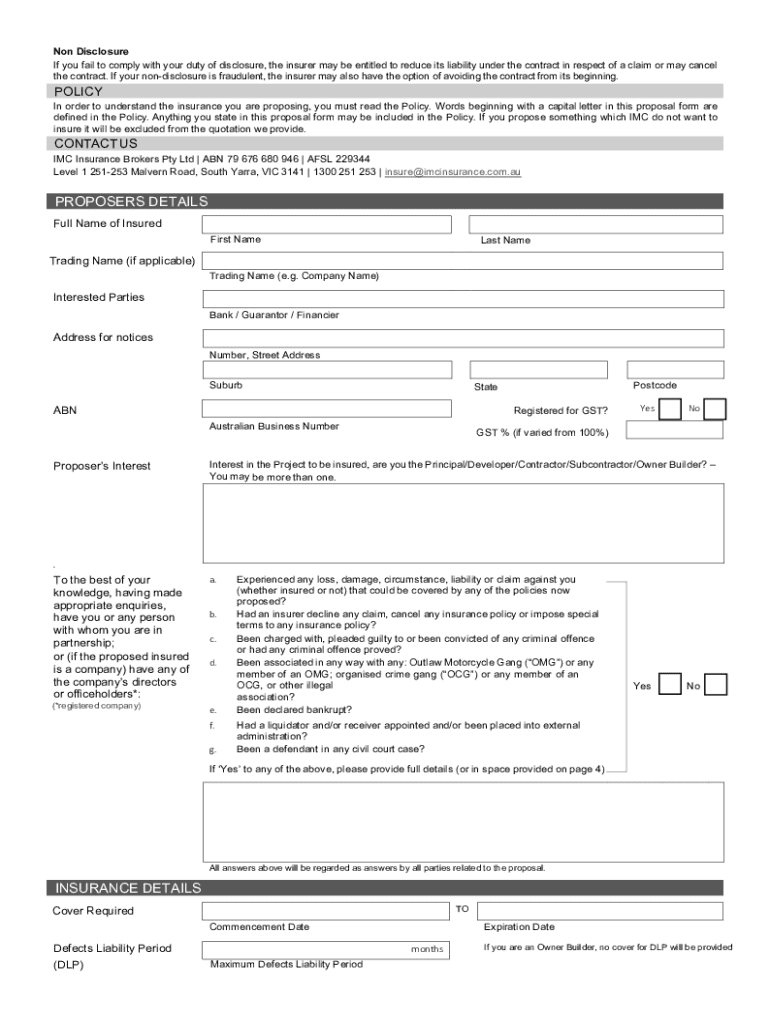

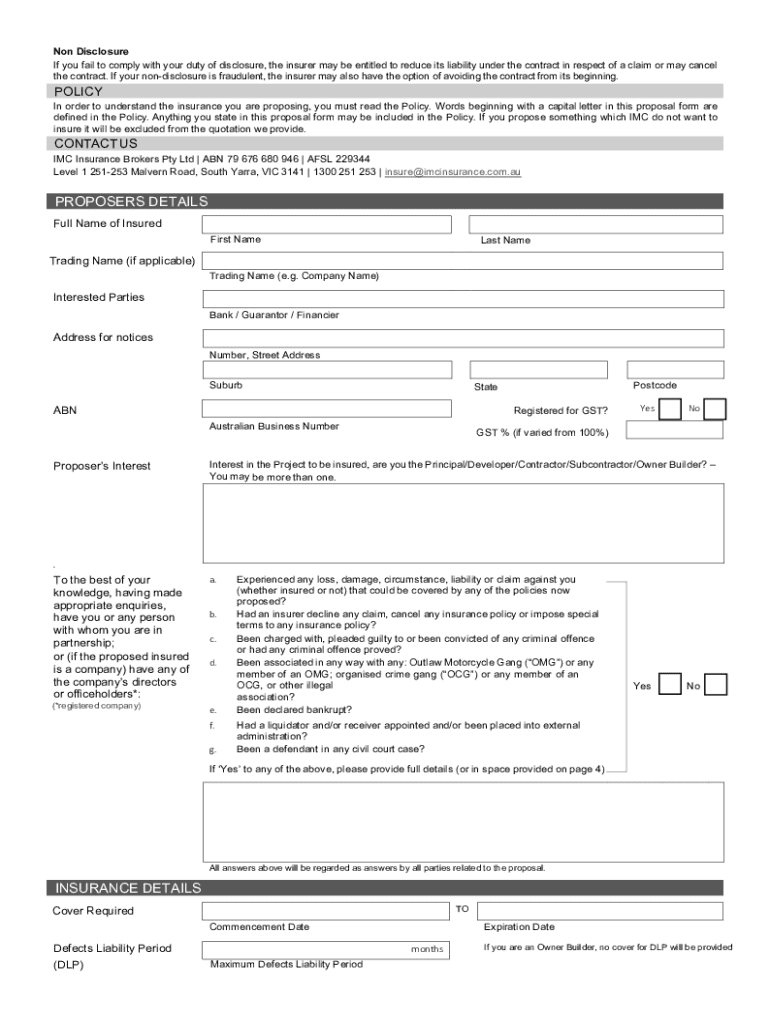

Applying for construction insurance requires several key documents that provide insights into your business operation and risks. While specific requirements may vary by insurance providers, the standard application form components generally include detailed information about the applicant's business, the scope of the construction project, and any previous claims history.

In addition to a completed application form, applicants often must provide financial information to assess their ability to manage claims. This information may include annual revenue figures, payroll records, and financial statements from the last few years.

Moreover, assessing risks related to the project location and type is crucial. Certain areas may have historical weather patterns or legal issues that elevate risk. Preparing ahead allows for more accurate coverage.

The construction insurance application process

Applying for construction insurance consists of several key steps that ensure a comprehensive understanding of your coverage needs.

The first step involves gathering the necessary information to fill out the application thoroughly. This includes your personal details and specific information about the construction project, such as location, timeline, and scope.

Filling out the application form precisely is crucial to avoid delays or errors that could hinder your coverage. After submission, maintaining communication with the insurance provider will help clarify any potential concerns.

Managing and tracking your application

After submitting your construction insurance application, it’s vital to manage and track its progress efficiently. Most insurance providers will offer tools to monitor the application status.

Using features on platforms like pdfFiller, applicants can track their applications, see estimated processing times, and obtain updates. It's also advisable to be prepared for any follow-up questions from the insurance provider to refine your application for approval.

Always emphasize transparency in communications—this fosters a constructive relationship with your provider.

Editing and signing your construction insurance application

Editing and signing the construction insurance application is a critical step in ensuring accuracy before submission. Using pdfFiller, you can seamlessly customize your application by adding any necessary details or making modifications.

This platform enables users to follow a straightforward editing process and incorporate electronic signatures without the hassle of printing and scanning documents. It's essential to ensure that the final document maintains integrity throughout the process.

Investing time in this phase will ensure that the application is not only error-free but also compliant with necessary legal requirements.

Frequently asked questions

When it comes to the construction insurance application form, many individuals have questions that are essential to address for clarity.

Addressing these questions early on can help streamline the application experience and ensure all parties are clear on the necessary steps.

Conclusion

Proper insurance coverage is vital for the success and safety of any construction project. Taking the time to thoroughly understand the construction insurance application form can significantly affect the outcome of your project.

Utilizing tools like pdfFiller can empower users not only to edit and sign their documents efficiently but also to manage their documents throughout the entire process with ease. By following the steps outlined above, you can ensure that your application is comprehensive and accurate, paving the way for a successful insurance experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get construction insurance application form?

How do I edit construction insurance application form straight from my smartphone?

How do I complete construction insurance application form on an iOS device?

What is construction insurance application form?

Who is required to file construction insurance application form?

How to fill out construction insurance application form?

What is the purpose of construction insurance application form?

What information must be reported on construction insurance application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.