Get the free Charge Card Authorization

Get, Create, Make and Sign charge card authorization

How to edit charge card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charge card authorization

How to fill out charge card authorization

Who needs charge card authorization?

Charge Card Authorization Form: A Comprehensive Guide

Understanding the Charge Card Authorization Form

A charge card authorization form is a secure document used by businesses to obtain permission from a cardholder to process a payment using their credit card. It serves a vital role in transactions, ensuring that both parties are protected against unauthorized charges. This form is commonly utilized in sectors such as restaurants, online businesses, and any service industries where payment may be required in advance.

Common scenarios for using a charge card authorization form include hotel bookings, car rentals, and e-commerce transactions, where pre-authorization may be necessary to secure a reservation or confirm the payment method. Understanding when and how to use this form can greatly reduce risks associated with chargebacks, which occur when a customer disputes a transaction.

Why use a charge card authorization form?

Using a charge card authorization form prevents chargeback abuse by ensuring explicit consent is documented before processing the credit card payment. This is particularly crucial for businesses that experience high levels of chargebacks, as too many disputes can lead to increased fees, penalties, or even losing the ability to process card payments altogether.

Additionally, this form provides security benefits for both the business and the customer. For the business, it creates an official record of the transaction, outlining the terms under which the payment was authorized. For customers, signing this form reassures them that their card information is being handled with respect and that their consent is documented.

There are also legal implications attached to credit card transactions. Businesses may have a legal obligation to protect the information of cardholders and demonstrate that they have obtained proper authorization before processing payments. Not utilizing a charge card authorization form could expose businesses to liability if any financial disputes arise.

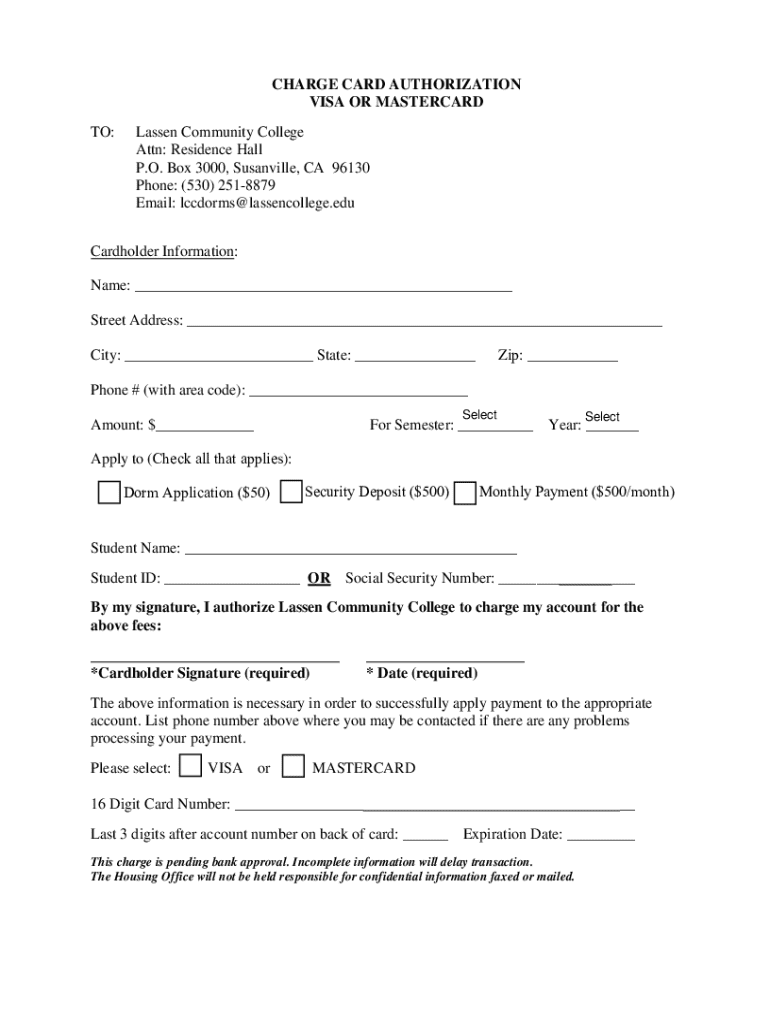

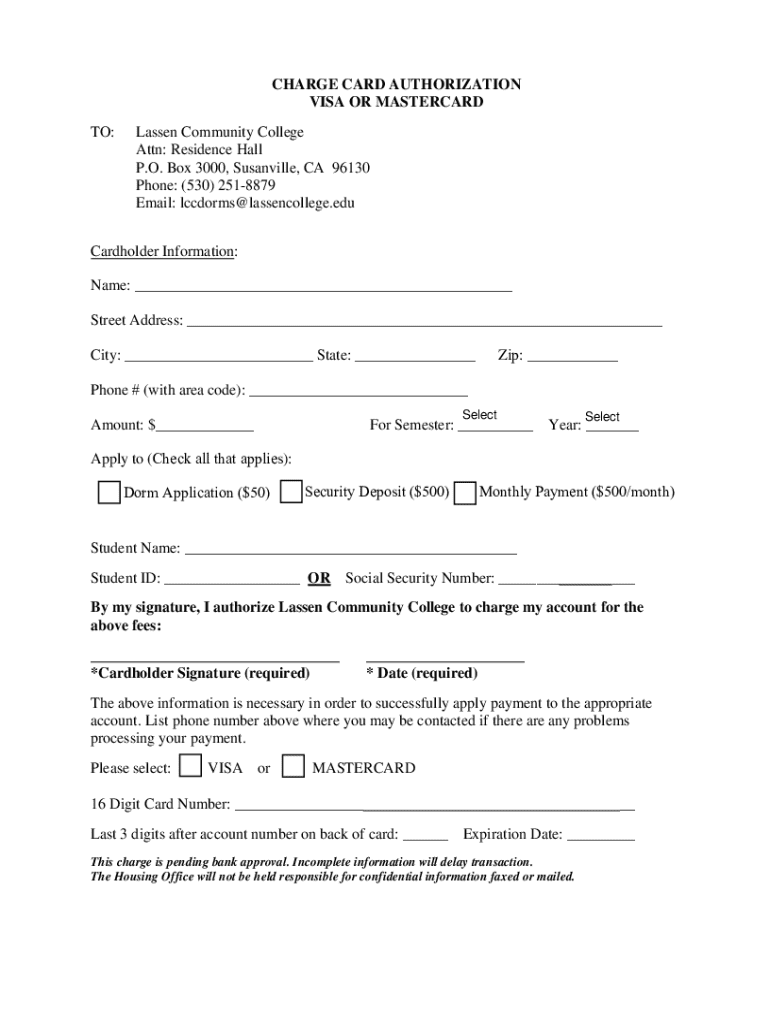

Key components of a charge card authorization form

A comprehensive charge card authorization form includes several essential elements. These components not only serve to collect necessary information but also enhance the form’s effectiveness in safeguarding both the merchant and the cardholder. Key fields often include customer information, payment information, and an agreement section.

Optional components can also enhance the security of the form. These may include CVV verification for additional security, customer signatures to validate the authorization, and contact information for any queries post-transaction.

How to complete a charge card authorization form

Completing a charge card authorization form requires meticulous attention to detail. Follow these steps for effective completion:

To maximize efficiency, consider some essential tips when completing the form. Maintain clear and open communication with the customer, and be sure to clarify any terms that they might find confusing. Common mistakes to avoid include incorrect card details and failing to secure a signature. Lastly, the importance of clarity and precision cannot be overstated; a well-filled form sets the foundation for a smooth transaction.

Managing charge card authorization forms

Once completed, securing signed documents for future reference is paramount. Recommendations for secure digital storage include utilizing cloud-based systems like pdfFiller, which offer encryption options to safeguard sensitive data. Compliance with regulations such as GDPR or PCI DSS regarding customers' data is crucial in preventing data breaches and ensuring customer trust.

As for retention, it's essential to know how long to keep authorization forms. A suggested retention period is typically three to five years, depending on local laws and regulations. Retaining these records can be valuable not just for audits but also for addressing any disputes that may arise later.

Interactive tools and templates

pdfFiller offers downloadable charge card authorization form templates in various editable formats. Users can easily access these forms, customize them to their needs, and ensure that they comply with legal requirements. Instructions for using pdfFiller to customize the form reach beyond mere editing; they empower users to harness its extensive features to streamline their documentation process.

In addition to editable templates, pdfFiller provides interactive filling features. Users can take advantage of tools for editing and eSigning, which simplify the process of obtaining signatures in real-time. Collaboration features also exist to facilitate team approval processes, ensuring that all necessary parties can easily review and sign the form.

Best practices for utilizing charge card authorization forms

Organizations must recognize when to use authorization forms in sales transactions to foster trust and satisfaction among customers. Situations, such as recurring billing or significant one-time purchases, are excellent candidates for implementing charge card authorization forms. Businesses can not only secure their interests but also reassure customers about the legitimacy of the transactions, ultimately enhancing client relations.

Addressing customer concerns proactively is key. Clearly communicate the safety features and purpose behind the charge card authorization form. This transparency helps to build trust, as customers feel more comfortable knowing their financial information is protected. If customers have questions regarding authorization and charges, being prepared with clear, concise answers can help resolve any doubts they may have, further solidifying their confidence in the transaction.

Frequently asked questions (FAQ)

Several queries often arise regarding charge card authorization forms. One common question is whether businesses are legally required to use such a form. While it's not always mandated, it is strongly recommended as it provides a layer of protection against potential disputes. Failing to utilize an authorization form can lead to serious consequences, especially if a chargeback occurs.

Another frequently asked question is how to verify a customer's authorization after the fact. Ideally, businesses should refer back to the signed authorization form that provides documented consent for the charge. If a form is filled incorrectly, businesses should have a clear process for correcting it promptly. Disputing unauthorized charges also has steps that should be followed closely to ensure resolution is reached.

Related documents and resources

In addition to charge card authorization forms, there are numerous other relevant financial authorization forms that businesses should be aware of. Understanding the differences and when to use each can be crucial for effective payment processing. Resources available online can guide users through best practices in payment processing and preventing payment fraud, further enhancing their business operations.

Further reading can also provide valuable insights into how businesses can refine their transaction processes while remaining compliant with regulations. Knowledge is power in the world of payment processing, and being equipped with the right information leads to better-informed decision-making.

Keep in touch

Staying up-to-date on documents and templates is essential for anyone in the business environment. Subscribing to newsletters offering valuable resources and guides can prove beneficial for continuous learning. Engaging with the pdfFiller community helps users connect with others facing similar challenges, further enriching their expertise in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my charge card authorization in Gmail?

How do I edit charge card authorization straight from my smartphone?

How do I fill out the charge card authorization form on my smartphone?

What is charge card authorization?

Who is required to file charge card authorization?

How to fill out charge card authorization?

What is the purpose of charge card authorization?

What information must be reported on charge card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.