Get the free Crs Controlling Person Self-certification Form

Get, Create, Make and Sign crs controlling person self-certification

Editing crs controlling person self-certification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs controlling person self-certification

How to fill out crs controlling person self-certification

Who needs crs controlling person self-certification?

Understanding the CRS Controlling Person Self-Certification Form

Understanding CRS and its importance

The Common Reporting Standard (CRS) is an international standard for the automatic exchange of financial account information between tax authorities. Established by the Organisation for Economic Co-operation and Development (OECD), the CRS is designed to combat tax evasion and enhance transparency in global finance. This means financial institutions worldwide are required to collect certain information from account holders and report it to their respective tax authorities.

A pivotal tool in this framework is the self-certification form. These forms enable financial institutions to obtain necessary information from their clients, aiding in the identification of tax residency and ensuring compliance with global tax regulations. For controlling persons—individuals with significant control over an entity—this self-certification plays a crucial role in clarifying tax obligations and upholding the integrity of compliance processes.

What is a CRS controlling person self-certification form?

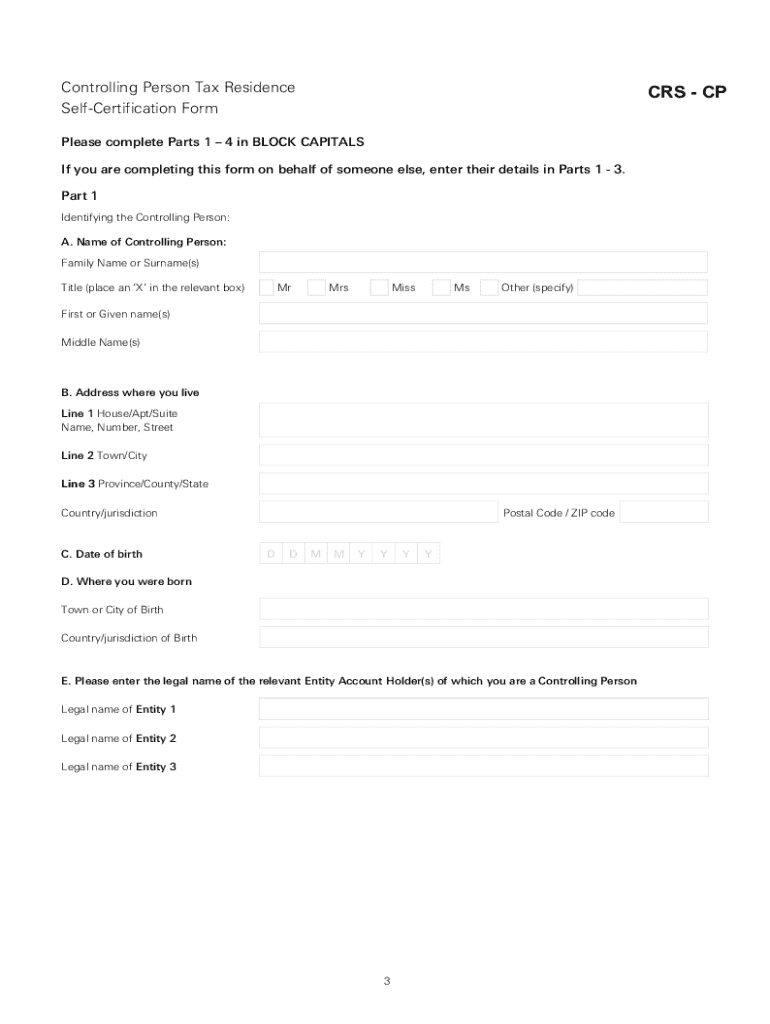

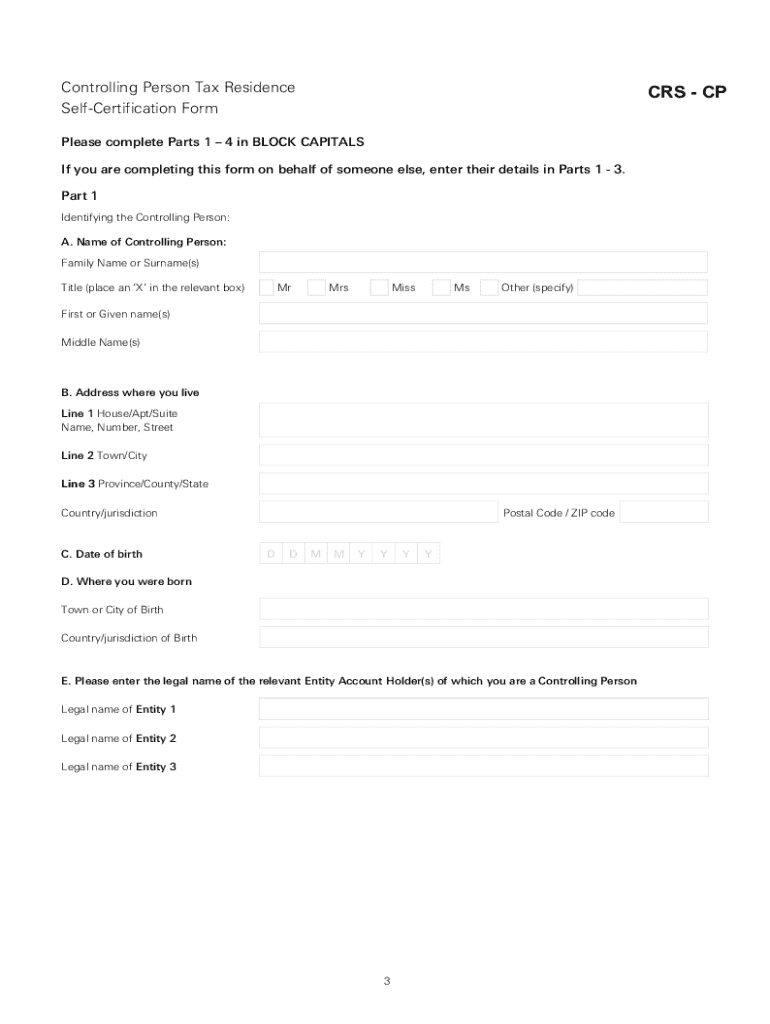

A CRS Controlling Person Self-Certification Form is specifically designed for individuals who qualify as controlling persons within various entities, such as corporations or partnerships. The definition of a controlling person typically refers to anyone who can exercise control over a legal person directly or indirectly. This could mean possessing voting rights, holding a significant percentage of shares, or being the largest stakeholder.

The primary purpose of this self-certification form is to collect the controlling person's detailed personal information, aiding financial institutions in fulfilling their CRS obligations. This form differs from standard individual self-certification forms, particularly for entities. While individual forms focus mainly on personal tax residency, the controlling person form examines the entity’s ownership and management structure, ensuring more nuanced financial reporting.

Who needs to complete the CRS controlling person self-certification form?

The completion of the CRS Controlling Person Self-Certification Form is essential for individuals classified as controlling persons of entities that are financially active in countries adopting the CRS. These controlling persons usually include shareholders, partners, and others who hold substantial control over the business activities of an entity.

Certain scenarios require the submission of this form, including when opening a new financial account or when there is a significant change in the entity’s ownership. However, some exceptions exist. For example, controlling persons of entities in jurisdictions that do not implement CRS may be exempt from completing the form.

Step-by-step guide on how to fill out the CRS self-certification form

To correctly complete the CRS Controlling Person Self-Certification Form, follow these systematic steps:

Tips for maintaining compliance with CRS regulations

Compliance with CRS regulations is crucial for individuals and entities involved in international finance. Here are several best practices to maintain compliance:

Common issues and frequently asked questions

Navigating the CRS Controlling Person Self-Certification Form can present challenges. Here are some common questions and their answers:

Utilizing pdfFiller to simplify the self-certification process

pdfFiller offers an efficient solution for managing your CRS Controlling Person Self-Certification Form. With features that allow easy document editing, signature collection, and collaboration, users can navigate the self-certification process more easily.

Accessing the CRS Controlling Person Self-Certification Form on pdfFiller is straightforward. Users can search for the specific form template, then utilize pdfFiller’s editing tools to fill out the required information seamlessly. This online platform enhances document management with cloud storage capabilities, allowing users to access their forms from anywhere.

The platform provides excellent collaborative tools, catering to teams that need to work collectively on financial documentation. PdfFiller makes managing forms easy and compliant with current regulations.

Interactive tools to enhance your self-certification experience

pdfFiller is not just about filling out forms; it also offers a suite of interactive tools that enhance the self-certification experience. Features such as templates for repetitive documents, reminders for deadlines, and integrated workflows help streamline the process.

Experiencing these tools can be beneficial as they reduce manual handling and improve accuracy in submissions. User testimonials often highlight how pdfFiller has simplified their document processes, creating a more organized approach to compliance and management.

Understanding the global impact of CRS reporting

The evolution of the Common Reporting Standard has drastically transformed international tax compliance. Initially adopted by a handful of countries, the CRS has been embraced globally, reflecting an increased commitment to transparency and accountability in financial practices.

Different jurisdictions have varying reporting requirements, and staying updated on these regulations is paramount for both individuals and institutions. The future of CRS may see adjustments in response to emerging global financial trends and economic needs, making it essential for controlling persons to stay informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify crs controlling person self-certification without leaving Google Drive?

How do I execute crs controlling person self-certification online?

Can I create an eSignature for the crs controlling person self-certification in Gmail?

What is crs controlling person self-certification?

Who is required to file crs controlling person self-certification?

How to fill out crs controlling person self-certification?

What is the purpose of crs controlling person self-certification?

What information must be reported on crs controlling person self-certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.