Get the free Credit Card Payment Authorization Form

Get, Create, Make and Sign credit card payment authorization

Editing credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Comprehensive Guide to Credit Card Payment Authorization Forms

Understanding credit card payment authorization forms

A credit card payment authorization form is a critical document that allows businesses to securely process payments using a customer's credit card. By filling out this form, customers provide consent for a specific transaction to be processed, giving businesses the authority to charge the card for an agreed amount. This form is essential in establishing trust between businesses and customers, safeguarding sensitive data, and ensuring compliance with payment processing regulations.

The primary purpose of the authorization form is to provide written consent. This is particularly crucial for companies that operate on a recurring payment model or need to validate a transaction without being physically present at the point of sale. The benefits of using authorization forms include protection against chargebacks, increased transparency in transactions, and enhanced operational efficiency.

Importance of credit card authorization forms

Using credit card authorization forms is vital for multiple reasons. One of the primary benefits is chargeback prevention. When a customer disputes a charge, having a signed authorization form can serve as evidence that the customer agreed to the transaction, significantly reducing the business's risk of losing the dispute. Without this document, businesses may face unfair chargebacks that can harm their financial stability.

Moreover, there are legal obligations tied to payment processing. Businesses are required to maintain proper records for transactions, and authorization forms serve that documentation purpose. They protect sensitive customer information as well by ensuring that businesses do not store card details unlawfully, which can lead to security breaches and compromised data.

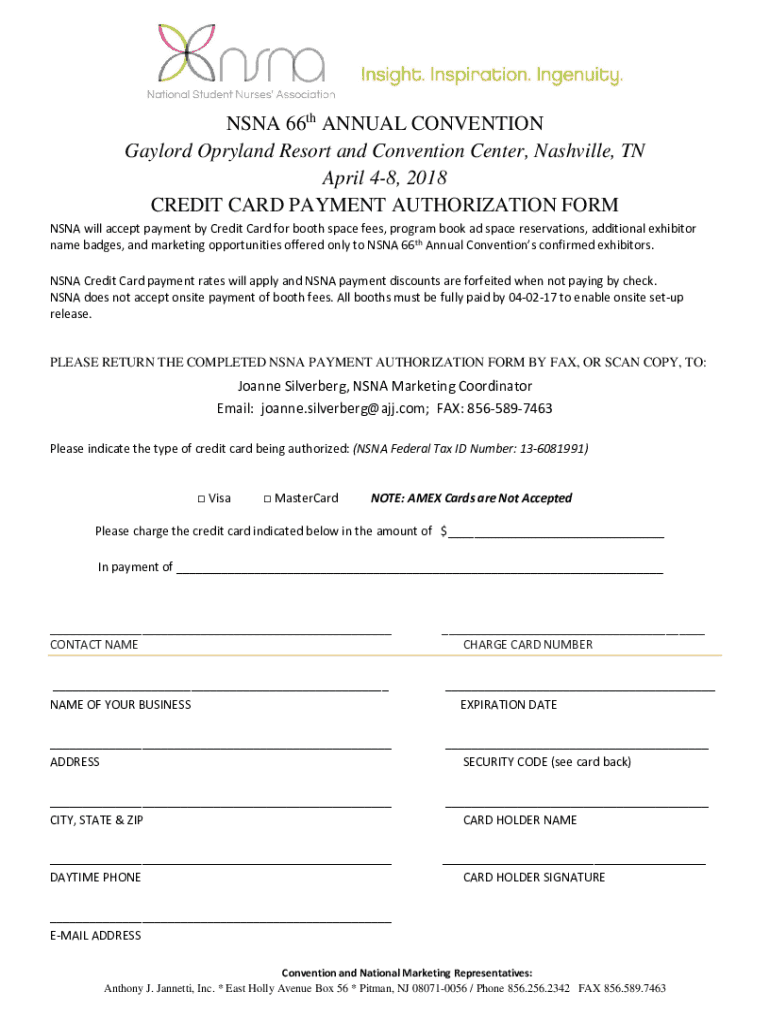

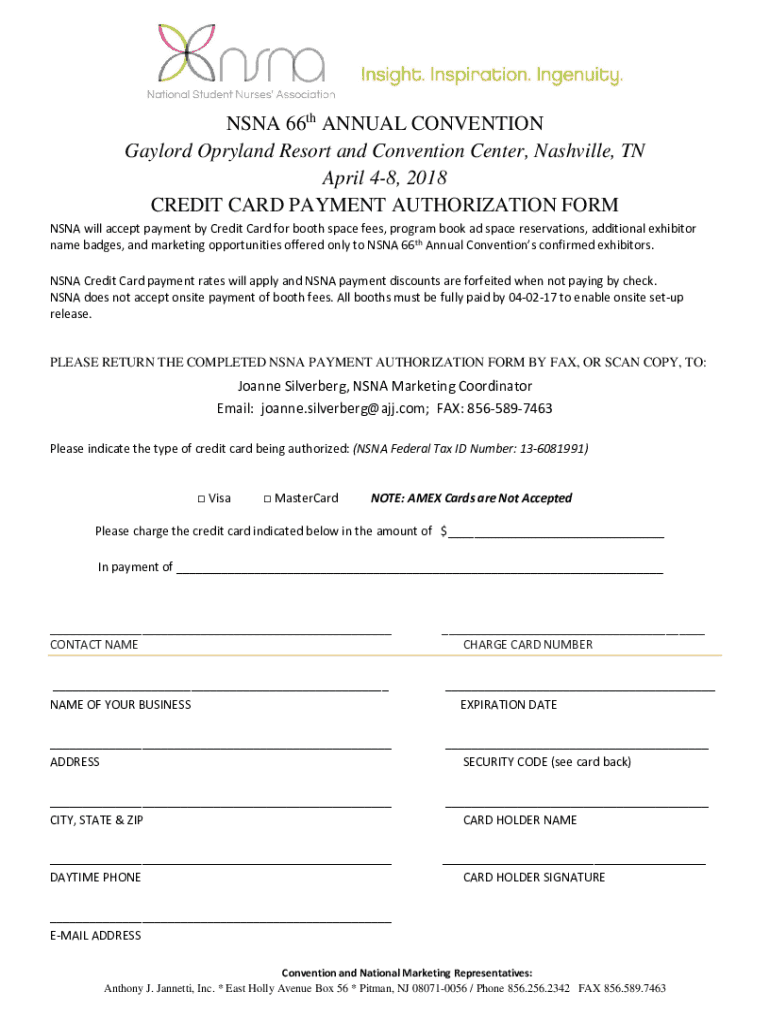

Components of a credit card payment authorization form

A credit card payment authorization form must contain several essential elements to fulfill its purpose effectively. Firstly, it should include cardholder information, such as the cardholder's name, billing address, and card number. The amount to be charged and the currency of the transaction must also be specified to avoid any confusion later on.

Signatures are crucial, too; a signature from the cardholder confirms their consent. Optional elements that can enhance security include a CVV (Card Verification Value) requirement, which serves as an extra verification measure, along with expiration dates and billing addresses to ensure accuracy.

How to fill out a credit card payment authorization form

Filling out a credit card payment authorization form is straightforward if you follow a structured process. Start by gathering essential information, including the cardholder's name, card number, expiration date, and CVV. Next, fill in the cardholder details exactly as they appear on the card, ensuring there are no typos.

Specify the payment amount clearly, making sure it is correct and includes the appropriate currency. The final steps involve the cardholder signing and dating the form, indicating their consent to the transaction. Common mistakes to avoid include incorrect card information or omitting signatures, both of which can lead to payment delays.

Managing and storing authorization forms

Proper management of signed authorization forms is crucial to maintaining customer trust and comply with legal requirements. Businesses should implement best practices for storage, whether in physical or digital formats. Physical documents should be securely locked away, while digital forms should be stored on encrypted servers to prevent unauthorized access.

Retention duration is another important consideration; legal guidelines often dictate how long transaction records must be kept. Beyond just storing the documents, businesses should adopt security measures such as password-protecting files and implementing data protection policies to shield sensitive customer data.

Interactive tools for credit card payment authorization

pdfFiller offers a suite of interactive tools that streamline the management of credit card payment authorization forms. With features for editing and updating forms online, businesses can ensure that all documentation is current and accurate. The eSigning capabilities allow users to obtain quick approvals without the hassle of printing and scanning.

Cloud-based collaboration enables teams to share and review authorization forms effectively. This capability allows multiple staff members to access, edit, and approve documents in real-time, increasing efficiency and reducing the risk of errors in payment processing.

FAQs about credit card payment authorization forms

Am I legally obligated to use credit card authorization forms? While there may not be a universal law mandating their use, financial institutions often require businesses to have proper documentation for card payments to protect against fraud. The lack of authorization can lead to burdens in chargebacks.

Why doesn’t my authorization form have a space for CVV? Some forms may exclude this for simplicity, but including a CVV field enhances security and validation during transactions. What should I do if a customer disputes a charge after signing the form? If such a situation arises, provide the signed authorization as evidence to dispute the chargeback.

How should I handle expired credit card authorizations? It is best practice to always request a new authorization if the previous one has expired before processing any new transactions.

Additional considerations

Understanding the role of a 'card on file' can streamline your payment processes. This practice allows businesses to store customer card details securely for future transactions, simplifying repeat purchases and maximizing customer convenience. However, it comes with additional responsibilities to protect that data.

International transactions often necessitate adaptations to authorization forms, such as accounting for currency differences and complying with various regulatory standards. The rise of contactless payments also influences how authorization processes are handled. Given that payments can be made without physical cards, businesses must consider how electronic authorization is documented and verified.

Resources and templates for credit card payment authorization forms

To help you get started with credit card payment authorization forms, pdfFiller offers downloadable templates that you can easily customize to fit your brand's needs. Check out our tools for seamless modification options, making it simple to design a form that meets your specific requirements.

In addition, related documents for comprehensive payment processing can be found on our platform, ensuring that your business remains compliant and efficient in managing customer transactions.

Explore more with pdfFiller

Maximizing your experience with our document solutions can elevate your payment processing capabilities. With pdfFiller, businesses can harness the power of a fully integrated platform designed for editing PDFs, eSigning documents, collaborating in teams, and managing forms all in one place.

Stay updated on the latest best practices and tips by subscribing to our content. Additionally, as we continue to see success stories from users, we highlight those experiences that can inform and inspire new ways to utilize our tools, further enhancing your document management success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card payment authorization to be eSigned by others?

Can I edit credit card payment authorization on an Android device?

How do I fill out credit card payment authorization on an Android device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.