Get the free Ct-1120

Get, Create, Make and Sign ct-1120

Editing ct-1120 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1120

How to fill out ct-1120

Who needs ct-1120?

Comprehensive Guide to the CT-1120 Form: An In-Depth Resource

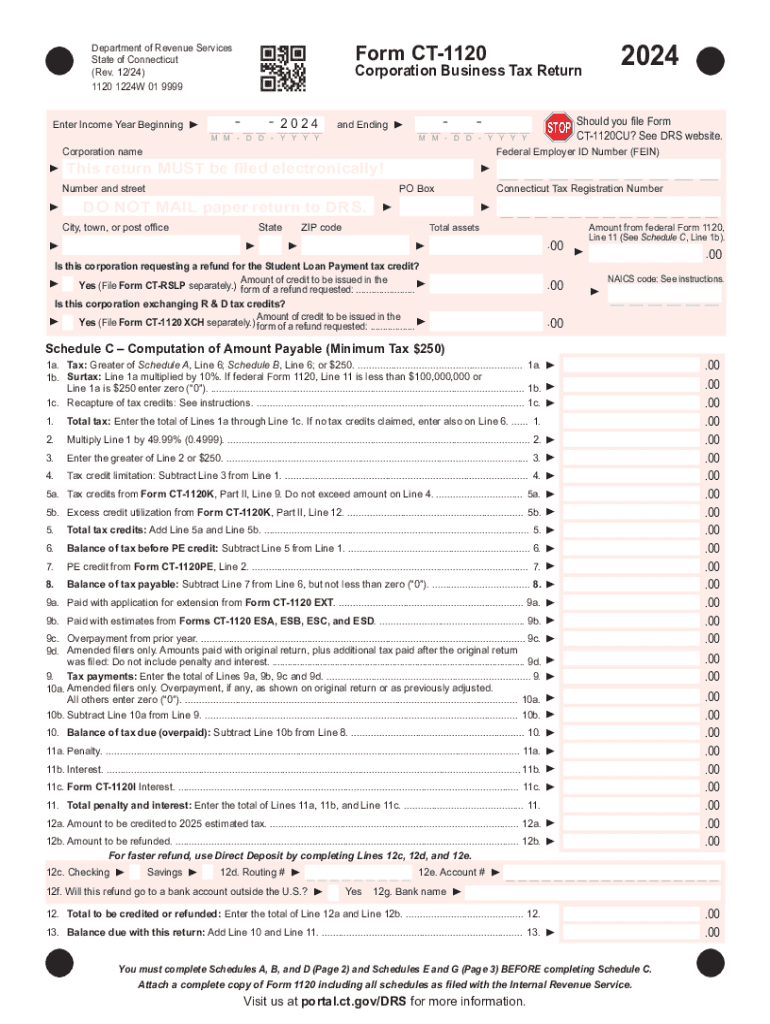

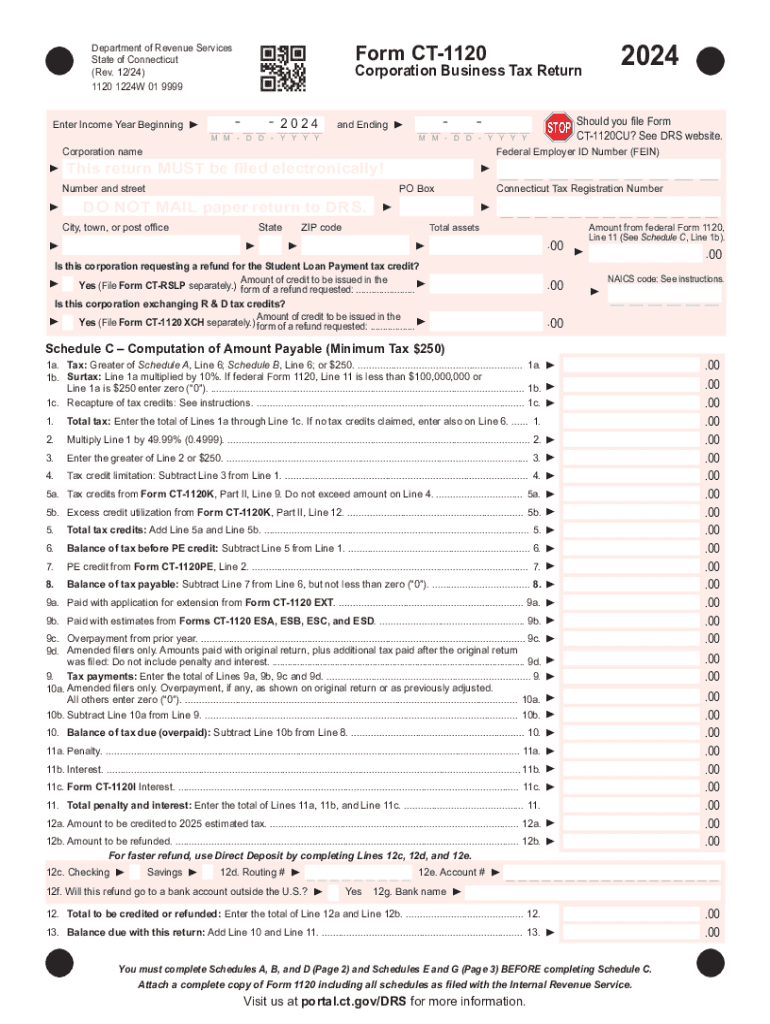

Overview of the CT-1120 form

The CT-1120 form is the Corporation Business Tax Return that businesses in Connecticut must file to report their income and calculate their tax liability. It serves as an essential document for corporations to comply with state taxation requirements, ensuring that revenue is properly accounted for and taxed accordingly.

Corporations, both domestic and foreign, doing business in Connecticut are required to file this form. This includes entities such as C-corporations, S-corporations, and limited liability companies treated as corporations for tax purposes. Understanding who needs to file is crucial, as failure to comply can result in penalties.

Key deadlines for submission are critical for compliance. Typically, the CT-1120 form must be filed on the 15th day of the fourth month following the close of the corporation’s taxable year. For many businesses, this aligns with the standard April 15 deadline if using a calendar year for reporting.

Understanding the CT-1120 filing structure

The CT-1120 form is structured to facilitate a clear reporting process, divided into several key sections that guide businesses through proper compliance. Each section of the form serves a specific purpose and requires careful attention to detail.

Key terminology related to the CT-1120 form typically includes terms like 'adjusted gross income', 'taxable income', and 'tax credits'. Understanding these terms is fundamental to accurately interpreting and completing the form.

Step-by-step instructions for filling out the CT-1120

Filling out the CT-1120 form can be a meticulous process that requires gathering a range of information and documentation. Before you begin, ensure that you have all necessary records on hand.

The process of completing the CT-1120 can be broken down into several concise tasks:

Common mistakes to avoid when filing the CT-1120

Filing the CT-1120 form requires careful attention, and there are several common pitfalls that corporations should be conscious of to avoid complications.

Tools and resources for CT-1120 preparation

Preparing the CT-1120 form can be simplified with the right tools. pdfFiller offers robust interactive features designed to streamline the process of document management and form submission.

Frequently asked questions (FAQs) about the CT-1120 form

Having clarity on specific issues related to the CT-1120 can help alleviate common concerns among filers. Below are some frequently asked questions:

CT-1120 filing tips for small businesses

Small businesses can particularly benefit from proactive record-keeping and strategic planning when preparing to file the CT-1120. Implementing best practices can make this process easier and more efficient.

The broader context of Connecticut business taxes

Understanding the CT-1120 form requires contextual knowledge of the broader tax landscape that corporations face in Connecticut. This knowledge includes an overview of other corporation forms and their requirements.

Final checks before submission

Conducting a thorough review of the completed CT-1120 form before submission is paramount to ensure accuracy and prevent costly errors.

What to expect after filing your CT-1120

After filing your CT-1120 form, it's crucial to understand the next steps, including expected timelines and the review process by the state authorities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ct-1120 online?

Can I edit ct-1120 on an iOS device?

How do I complete ct-1120 on an iOS device?

What is ct-1120?

Who is required to file ct-1120?

How to fill out ct-1120?

What is the purpose of ct-1120?

What information must be reported on ct-1120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.