Get the free Conventional Condo Questionnaire - Standard

Get, Create, Make and Sign conventional condo questionnaire

How to edit conventional condo questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conventional condo questionnaire

How to fill out conventional condo questionnaire

Who needs conventional condo questionnaire?

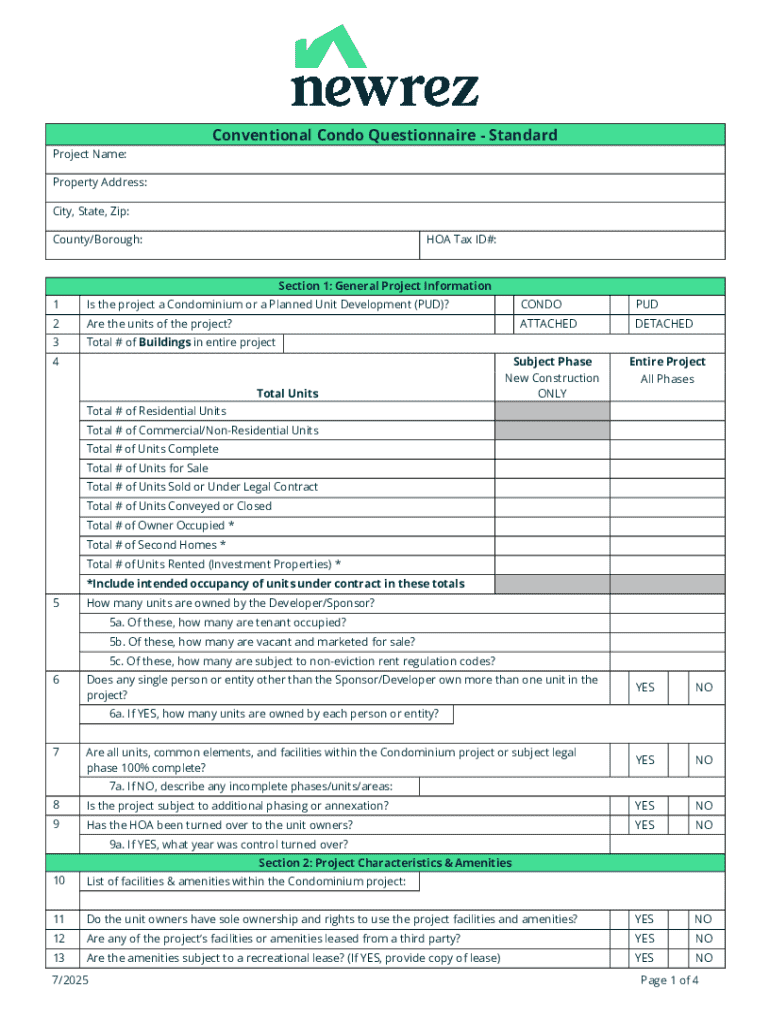

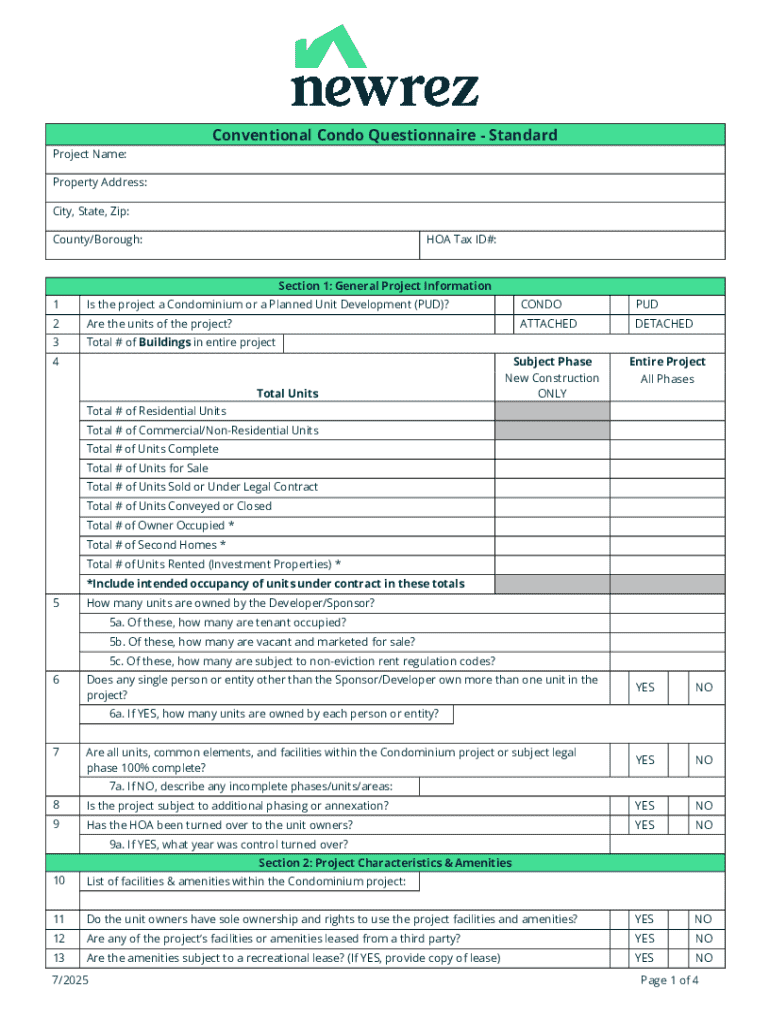

Understanding the Conventional Condo Questionnaire Form

Understanding the conventional condo questionnaire form

The conventional condo questionnaire form plays a crucial role in real estate transactions involving condominium properties. It serves as a vital tool for lenders, real estate agents, and buyers to gather essential information about the condominium association and its financial health. This standard form typically includes various questions pertaining to the condo community, which help assess the viability of the property for purchase, financing, and investment.

The importance of this form cannot be overstated. It provides lenders with insights into the condominium's financial stability, insurance coverages, and governance structures, thereby influencing their lending decisions. Not only does it help streamline the transaction process, but it also protects buyers by ensuring they are well-informed about the collective responsibilities and risks associated with condo ownership.

Key components of the conventional condo questionnaire form

Understanding the components of the conventional condo questionnaire form is essential for both buyers and sellers in the real estate market. The form is typically divided into several sections, each capturing vital information necessary for making informed decisions. These sections include general information about the condominium, details related to its financial standing, property management, insurance requirements, and the governance structure of the condo association.

Familiarizing yourself with the terminology used within the form is equally important. Key terms such as 'reserve fund', 'special assessments', and 'bylaws' will aid in understanding the implications of the provided information.

Preparing to complete the conventional condo questionnaire

Before filling out the conventional condo questionnaire form, it’s crucial to gather all necessary documentation. Accurate and complete information leads to a smoother transaction and avoids complications down the road. Financial statements, condo association bylaws, and relevant insurance policies should be readily available.

Both buyers and sellers must understand their roles in this process. Buyers need to ensure they complete the questionnaire truthfully, as inaccuracies can lead to penalties. Sellers, on the other hand, should provide complete records to assist their buyers in making informed choices.

Step-by-step guide to filling out the form

Filling out the conventional condo questionnaire form can be straightforward if you follow a structured approach. Each section of the form has specific questions that require clear, concise, and accurate responses. Begin by carefully reading the instructions provided with the questionnaire before proceeding.

It is essential to avoid common mistakes when filling out this form. Double-check for any typographical errors, as incorrect information can compromise the transaction. Always provide complete answers to avoid delays, and refer to your gathered documentation to ensure accuracy.

Using example scenarios can further clarify information requested. For instance, if the questionnaire asks about outstanding loans affecting the condo association, indicating both the loan details and the impact on the financials is crucial.

Editing and signing the conventional condo questionnaire form

Once the conventional condo questionnaire form has been filled out, the next step is to edit and review it thoroughly. Utilizing tools like pdfFiller simplifies this process, with features that allow users to access, edit, and format their documents digitally. Highlighting key editing features, pdfFiller enables users to manipulate text, adjust formatting, and check for errors conveniently.

Signing the document electronically is another notable feature of pdfFiller. The legality of electronically signed documents has been upheld in various jurisdictions, making this solution convenient for modern transactions. To sign the document effectively, simply follow the prompts provided by the platform, ensuring that your signature is clear and matches your legal name.

Collaboration and sharing: working with teams

Collaboration is essential when filling out a conventional condo questionnaire form, especially in a team setting. pdfFiller enables users to work together seamlessly, allowing multiple stakeholders to review, edit, and approve documents in real-time. Identify roles and permissions before sharing the document so that team members can focus on their specific responsibilities.

Secure collaboration promotes accountability and ensures that each aspect of the form is carefully vetted before finalizing the document. Maintaining a clear line of communication amongst team members will lead to a more accurate and efficient completion process.

Managing your document for future use

After completing and signing the conventional condo questionnaire form, effective document management should follow. Consider organizing your completed forms systematically for easy retrieval in the future. Using tools from pdfFiller, you can store your documents in the cloud, ensuring they are accessible from anywhere.

Having an organized approach to managing your documents ensures efficiency and encourages timely updates, minimizing the risk of missing vital information or deadlines.

Frequently asked questions (FAQs)

When dealing with the conventional condo questionnaire form, it’s natural to have questions about the process. If issues arise while filling out the form, don’t hesitate to reach out for assistance. Many resources, including real estate professionals, can provide clarity. Adding additional information to your form can often be done by attaching supplementary documents or providing detailed comments, so make sure to inquire about guidelines.

Conclusion: the benefits of using pdfFiller for your conventional condo questionnaire

Utilizing pdfFiller for your conventional condo questionnaire form streamlines the entire process of document creation, management, and collaboration. Features that enable editing, electronic signing, and secure sharing make it the ideal tool for anyone involved in real estate transactions. By leveraging pdfFiller’s capabilities, users can manage their documents efficiently, ensuring that the necessary information is accurate and up-to-date.

Empowering individuals and teams with access to interactive tools fosters seamless document management, providing a significant advantage in today's fast-paced real estate environment. Don't overlook the advantages of incorporating pdfFiller into your documentation processes – it’s more than just a platform; it’s a comprehensive solution for real estate documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get conventional condo questionnaire?

How do I edit conventional condo questionnaire online?

How do I complete conventional condo questionnaire on an Android device?

What is conventional condo questionnaire?

Who is required to file conventional condo questionnaire?

How to fill out conventional condo questionnaire?

What is the purpose of conventional condo questionnaire?

What information must be reported on conventional condo questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.