Credit application for a form: A comprehensive guide

Understanding credit applications

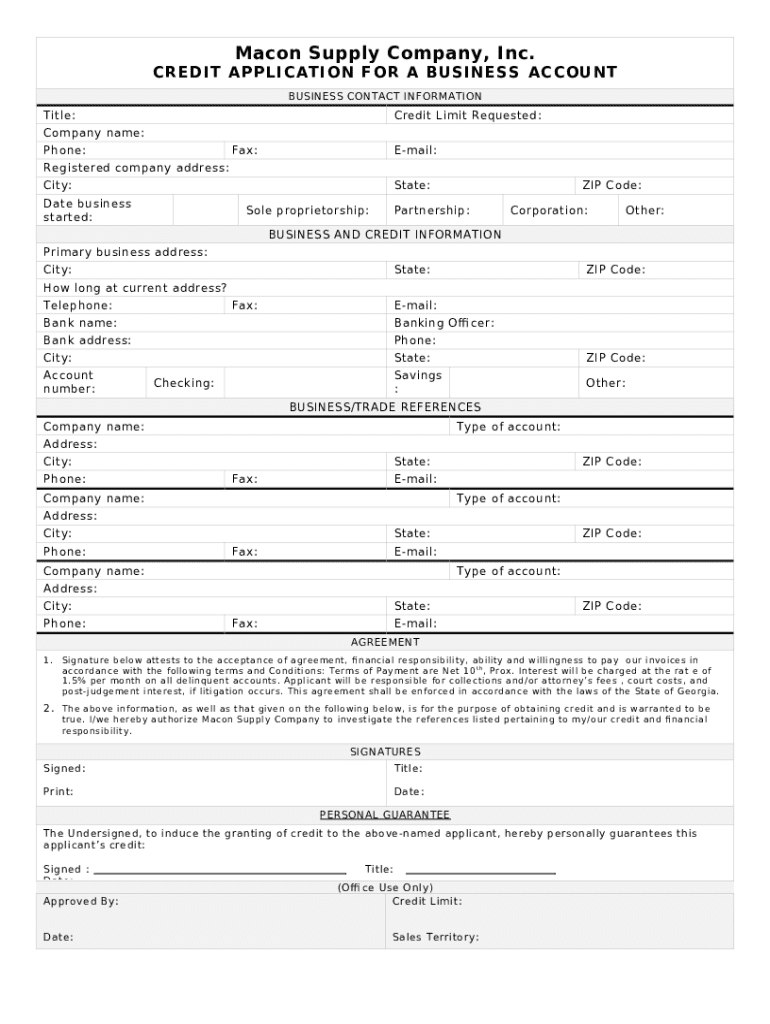

A credit application is a formal request made by an individual or business to obtain credit from a lender or financial institution. The core purpose of this document is to provide lenders with sufficient information to assess the creditworthiness of the applicant. This assessment influences lending decisions and helps financial institutions mitigate risk. For individuals, personal credit applications may include loan requests for purchases like vehicles or home mortgages, while for businesses, a credit application typically pertains to credit lines or business loans.

In the realm of credit applications, there are notable distinctions between personal and business applications. Personal credit applications focus on the individual’s financial history and ability to repay, while business credit applications examine the financial health of the business entity, including revenue, debts, and credit history of the business itself. Understanding these differences is crucial for applicants to tailor their documentation and responses effectively.

Credit applications are essential for evaluating the creditworthiness of an applicant.

Lenders use the information to make informed lending decisions.

Personal and business credit applications require different details for evaluation.

Key elements of a credit application form

A well-structured credit application form contains essential information to facilitate the evaluation process. For personal credit applications, key elements typically include personal details such as name, address, and contact information. Financial information is also critical, encompassing income, assets, and outstanding liabilities. Additionally, the applicant’s credit history is reviewed, including previous loans and current credit scores, often obtained from credit bureaus.

For business credit applications, more specific details are required. Applicants must provide the structure of the business (e.g., sole proprietorship, partnership, corporation), ownership details, and pertinent financial data. Trade references can also strengthen the application by showcasing a positive payment history with suppliers or service providers. Understanding these elements is vital for applicants aiming for a successful credit application.

Personal and business details: name, address, contact number.

Financial information: income, assets, liabilities.

Credit history: previous loans and credit scores.

For business applications: ownership structure and trade references.

Types of credit application forms

Credit applications vary based on the nature of the applicant. Personal credit application forms are streamlined for individual borrowers looking to secure loans for personal endeavors, such as home mortgages or personal loans. Conversely, business credit application forms are designed for businesses seeking credit lines or loans for expansion, inventory purchases, or other operational needs. These forms differ not only in content but also in the level of detail required, with business forms requiring more comprehensive data to assess overall business risk.

Additionally, specific industries may have unique requirements. For instance, retail businesses might be required to provide details about inventory management and expected sales while service industries may need to outline service contracts and client agreements. Recognizing these variations ensures that applicants present the most relevant information to potential lenders.

Personal credit application forms tailored for individual loan requests.

Business credit application forms with detailed financial and operational data.

Industry-specific requirements for various sectors like retail and services.

Step-by-step guide: How to fill out a credit application form

Completing a credit application form needs careful preparation. Start by gathering all necessary documents that may include bank statements, proof of income, and any prior loan documentation. Understanding the terms and conditions is equally important, as this helps clarify obligations and rights. Becoming familiar with the information required allows you to provide accurate answers, minimizing discrepancies during assessment.

When filling out the form, break it down into sections. Typically, sections may include personal identification, financial information, and credit history inquiries. Each must be filled in meticulously to avoid common mistakes such as omitting information or incorrectly reporting figures. After completing the form, review it thoroughly to verify all information is accurate. Finally, submit your application through the appropriate method, either online or via paper.

Gather necessary documents: bank statements, proof of income.

Understand terms and conditions of the credit offer.

Fill out the form section by section to avoid errors.

Review your application for accuracy before submission.

Challenges with traditional credit application forms

Traditional credit application forms, often paper-based, come with inherent limitations. One significant drawback is the likelihood of manual entry errors that can lead to processing delays. If a form is incorrectly filled, it can result in a rejection or require a prolonged verification process. Furthermore, collecting and entering data manually increases the risk of inaccuracies, which may profoundly impact lending decisions. These factors contribute to a frustrating experience for both applicants and lenders.

Compliance is another concern. Credit applications must adhere to legal requirements, such as the Equal Credit Opportunity Act (ECOA), which demands that all eligible applicants receive fair consideration regardless of race, sex, or marital status. Ensuring that paper applications comply with regulatory standards can be cumbersome and may invoke scrutiny from regulatory bodies if not managed properly.

Manual entry leads to errors and delays in application processing.

Higher risk of data inaccuracies impacting lending decisions.

Complexity in ensuring compliance with legal requirements.

Transitioning to digital credit applications

Shifting to digital credit application forms offers a plethora of benefits. Digital platforms streamline the process, allowing for easier access and quicker submission. Applicants can fill out their forms from anywhere, using various devices, which enhances convenience and user experience. Immediate updates and notifications are often a built-in feature of digital solutions, allowing both parties to track the status of an application in real time.

Automated features linked to digital credit applications significantly enhance efficiency. Platforms like pdfFiller offer functionality that helps manage document workflows seamlessly, ensuring that all stakeholders can collaborate effectively. Integration with existing business systems is also a key benefit, allowing lenders to process applications more rapidly while retaining transparency and efficiency.

Easier access and submission process enhances applicant experience.

Immediate updates and notifications regarding application status.

Automation features improve efficiency in processing applications.

Best practices for effective credit applications

For applicants, clear and concise information is crucial when submitting a credit application. Providing comprehensive details not only aids the lender in assessing risk but also instills confidence in the borrower’s capability to repay. Including supporting documents as attachments can enhance credibility and present a strong application. Being organized and thorough allows applicants to improve their chances of approval significantly.

On the lender's side, creating user-friendly application forms is vital to facilitate smooth interactions. Platforms should prioritize transparency in the application process, clearly outlining what is required and any necessary legal considerations. An efficient and straightforward application process reflects positively on the lender's brand and encourages more applicants to engage.

Submit clear and concise information to improve approval rates.

Provide necessary supporting documents to enhance credibility.

Create user-friendly forms that clarify what is required from applicants.

Case studies: Successful credit application processes

Understanding real-world applications of credit processes can provide valuable insights. Individual success stories often highlight how clear documentation and preparation led to successful loan approval, enabling the borrower to achieve their financial goals. For example, an applicant who meticulously prepared their documents and followed up on their application ended up securing a mortgage at favorable terms, demonstrating the importance of diligence in the application.

On the business side, companies that transitioned to streamlined credit applications benefited significantly. One such business implemented an automated credit application process, resulting in faster approval times and reduced workload for staff. By integrating their application process with a digital solution, the company not only enhanced operational efficiency but also improved customer satisfaction through quicker responses.

Successful individual stories show the importance of preparation.

Businesses streamlined processes led to faster approvals.

Insights from case studies can guide future applicants.

FAQs on credit applications

Frequently asked questions encompass a range of aspects regarding credit applications. Applicants often want to know about the specific information required, how a credit score impacts their application, and what documents they should prepare. Clarity on these points ensures confidence in submitting accurate applications while understanding the credit evaluation process better.

Lenders, too, have inquiries about the processing of applications, including common pitfalls to avoid and guidelines for ensuring decisions adhere to regulatory requirements. This dual perspective enhances both applicants’ and lenders’ knowledge and fosters a smoother application experience overall.

Common questions from applicants about required information.

Clarifications for lenders on best practices for processing applications.

Insights that bridge understanding between lenders and borrowers.

The future of credit applications

The financial services industry is increasingly leveraging technology in credit assessments. Advancements in software and application tools are shifting the landscape of lending, which makes processes like credit application more efficient and user-friendly. Emerging trends suggest that customer experience will become a central focus, driven by streamlined digital solutions that cut out unnecessary red tape.

Forecasts indicate that future credit applications will further prioritize automation, ensuring borrowers have an intuitive and straightforward experience while applying for credit. This evolution will inevitably shape industry standards, pushing both applicants and lenders towards more efficient interactions that respect consumer needs and enhance financial health across the board.

Increasing use of technology enhances credit assessments.

Customer experience will become central in credit application processes.

Automation will shape the future of credit applications.

Conclusion

Comprehensive credit applications play a vital role in establishing financial health for both lenders and borrowers. By providing lenders with the necessary insights into an applicant's financial situation and history, credit applications promote more informed lending decisions. Utilizing platforms like pdfFiller can further streamline this process by enabling users to manage their documents efficiently, from filling out forms to tracking application status.

As credit application processes evolve, it's crucial for individuals and businesses to remain informed and prepared. By leveraging the tools offered by pdfFiller, applicants can navigate their credit applications with confidence, ensuring a smoother journey towards financial stability and success.

Credit applications are essential for informed lending decisions.

Using digital platforms like pdfFiller enhances document management efficiency.

Staying informed is key in navigating credit applications.