Get the free Credit Card Regular Payment Request

Get, Create, Make and Sign credit card regular payment

Editing credit card regular payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card regular payment

How to fill out credit card regular payment

Who needs credit card regular payment?

A Comprehensive Guide to Credit Card Regular Payment Forms

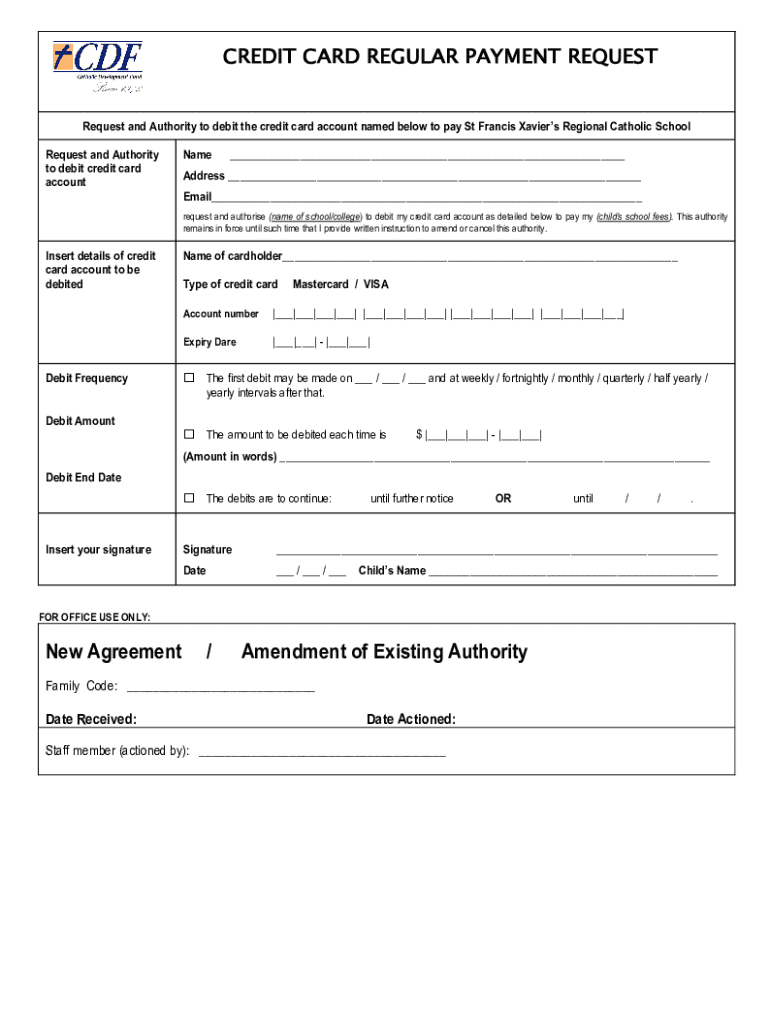

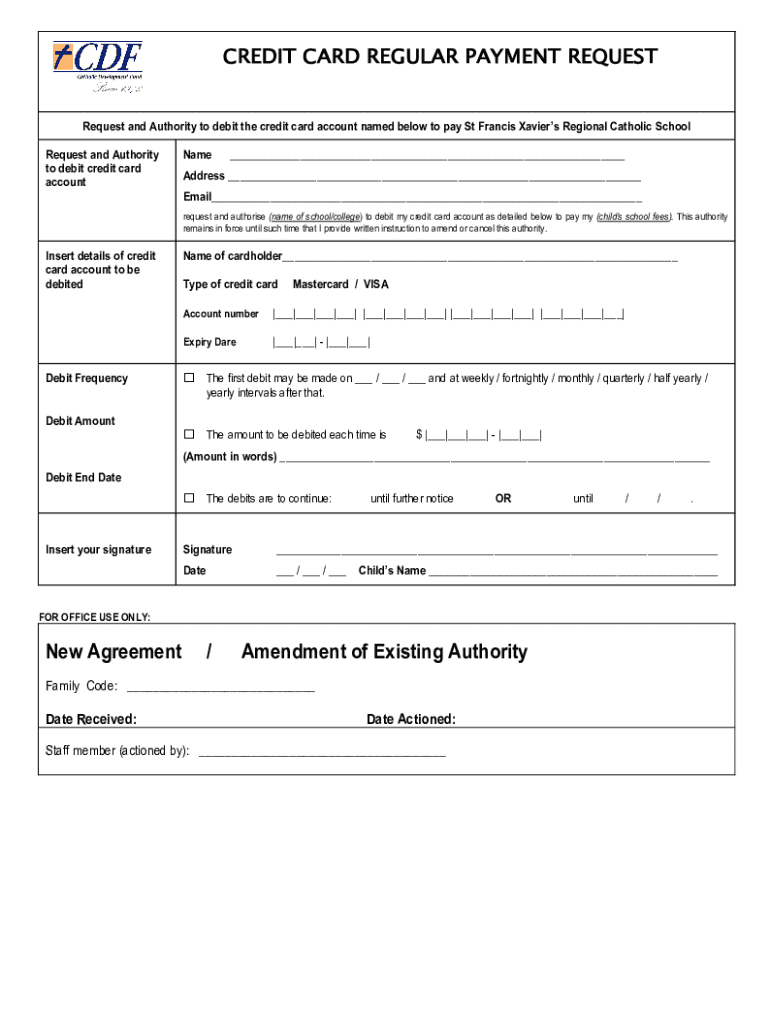

Understanding the credit card regular payment form

A credit card regular payment form is a document that enables businesses and service providers to automatically charge customers’ credit cards for recurring payments. This form is vital for creating smooth financial transactions, allowing both the businesses and customers to understand their payment obligations clearly. Regular payments are often associated with subscription services, memberships, or ongoing agreements, making this form a crucial tool in modern financial management.

The importance of credit card regular payments cannot be overstated. For businesses, it simplifies cash flow management, ensuring reliable revenue streams. For customers, it provides convenience and peace of mind, as it eliminates the need for manual payments.

Key features of a credit card regular payment form

Essential components of the credit card regular payment form are designed to capture all relevant information necessary for processing payments securely and efficiently. The typical features include:

Moreover, robust security measures are essential to protect sensitive information. Encryption technologies, secure storage systems, and compliance with Payment Card Industry (PCI) standards help minimize risks associated with handling credit card details.

Benefits of using a credit card regular payment form

Employing a credit card regular payment form brings significant advantages, both for businesses and customers. First, it streamlines the payment process. By automating regular transactions, businesses can ensure timely payment without exerting additional effort, making cash flow more predictable.

Second, it greatly reduces late payments. With an agreed-upon schedule, customers are less likely to miss payments, resulting in fewer late fees and improved service continuity. This positive reinforcement fosters customer loyalty, as they appreciate hassle-free transactions.

Lastly, this form is invaluable for managing subscription-based services. As millions of companies leverage recurring billing models, a streamlined, automated process helps maintain customer satisfaction and minimizes churn.

When and why to utilize a credit card regular payment form

There are specific scenarios where a credit card regular payment form is advantageous. It is typically used in subscription services, memberships for gyms or clubs, recurring donations to charities, and any service requiring consistent, automated billing. Using this form in these situations simplifies the payment process for both customers and merchants.

For service providers, adopting this form can vastly improve operational efficiency. By automating regular payments, businesses can reallocate resources originally spent on invoicing processes to other areas. Additionally, the regular receipt of payments can enhance financial forecasting and budgeting.

Step-by-step guide to filling out a credit card regular payment form

Completing a credit card regular payment form accurately is essential for ensuring payments are processed without issues. Follow these steps:

Taking time to complete this form correctly facilitates smoother transactions down the line, reducing potential disputes or errors.

Editing and customizing your credit card regular payment form

Customizing your credit card regular payment form can enhance the customer experience. Utilizing tools like pdfFiller allows you to modify existing forms easily. Options to add a brand logo, alter text fields, or create custom data fields are available, aligning the document with your business's identity.

Moreover, collaboration tools enable multiple team members to review and provide feedback on the form, ensuring that everything from the wording to layout meets business standards.

Signing the credit card regular payment form

Once completed, signing is a critical step in the process. With advancements in document management, options for electronic signing have become popular. eSignatures are not only convenient but are also legally valid in many jurisdictions, making them appropriate for use in official financial agreements.

Utilizing tools like pdfFiller for eSigning offers extra features such as security and audit trails, ensuring that you have a verifiable signing process.

Managing and storing your credit card regular payment forms

Safe and organized storage for credit card regular payment forms is vital to protecting sensitive customer information. Best practices suggest using encrypted cloud storage solutions, providing easy access while safeguarding against data breaches.

Retention guidelines should be established for these forms, typically keeping them for a certain number of years after termination of service. Ensure that shared access is limited to relevant staff, thus reducing the risk of unauthorized access to sensitive data.

Common FAQ about credit card regular payment forms

Addressing common questions can provide clarity on the handling of credit card regular payment forms. Here are some frequently asked questions:

Top tips for successful implementation of regular credit card payments

Implementing a successful system for regular credit card payments involves several best practices. Start by communicating clearly with customers about their payment schedules, amounts, and any potential changes.

Additionally, consider setting up reminder notifications before payment deductions to enhance transparency. Utilizing analytics tools to monitor transaction trends and payment behaviors can also aid in adjusting your strategies for future financial dealings.

Conclusion: Empowering your payment process with pdfFiller

Utilizing a credit card regular payment form can significantly empower the payment process. With its ability to streamline transactions, reduce late payments, and simplify subscription management, it’s an essential tool for businesses and service providers alike.

pdfFiller enhances your document management experience through seamless editing, eSigning, and collaboration features, making it the go-to platform for managing your credit card regular payment forms effectively.

Feedback section

We encourage you to share your experiences with credit card regular payment forms. Your feedback helps us improve and serve your needs better. If you have any additional questions or comments, feel free to reach out!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card regular payment to be eSigned by others?

How do I make changes in credit card regular payment?

How do I complete credit card regular payment on an iOS device?

What is credit card regular payment?

Who is required to file credit card regular payment?

How to fill out credit card regular payment?

What is the purpose of credit card regular payment?

What information must be reported on credit card regular payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.