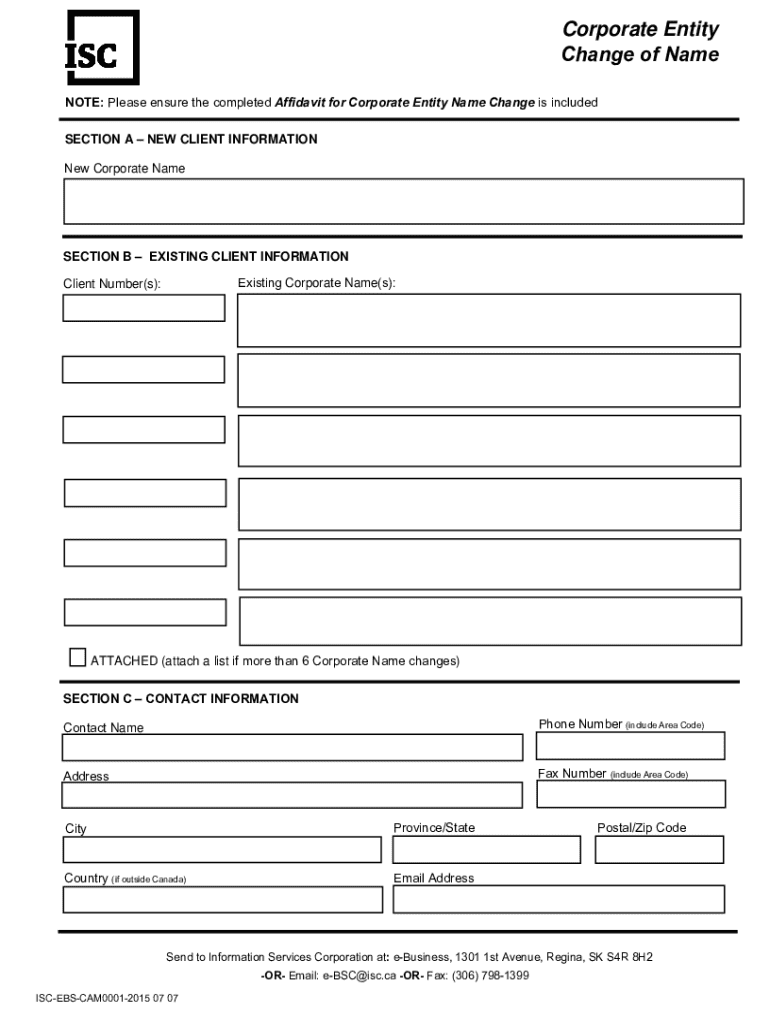

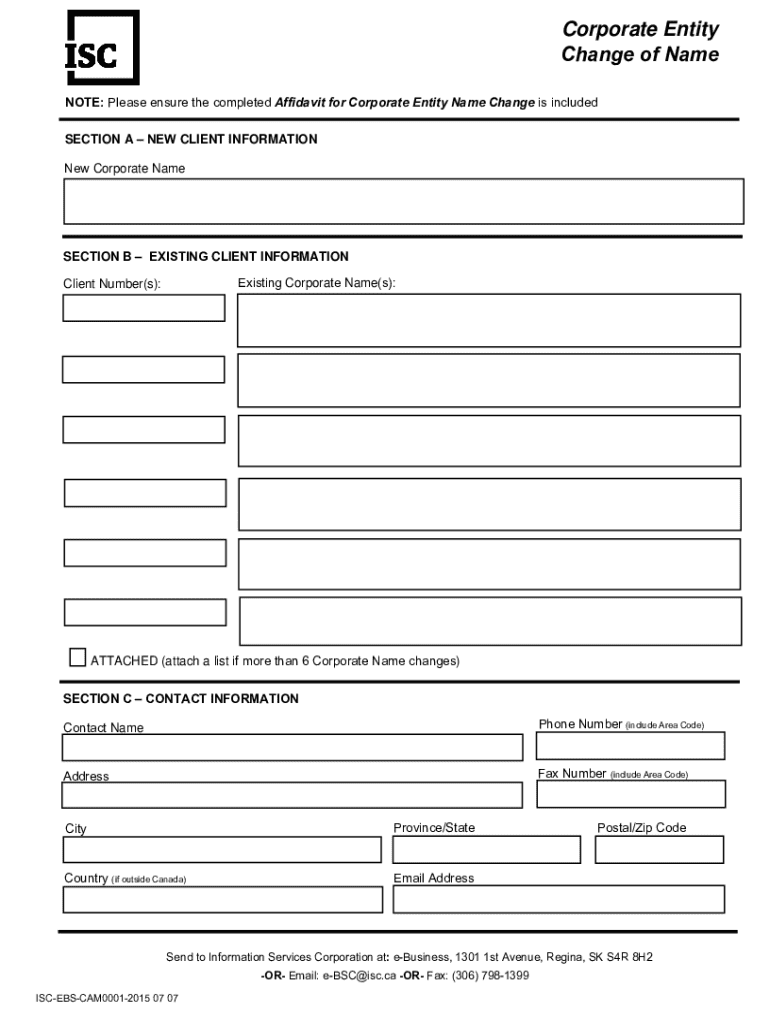

Get the free Corporate Entity Change of Name

Get, Create, Make and Sign corporate entity change of

How to edit corporate entity change of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate entity change of

How to fill out corporate entity change of

Who needs corporate entity change of?

Corporate entity change of form: A comprehensive guide for business owners

Understanding corporate entity change of form

A corporate entity change of form refers to the process whereby a business transforms its legal structure from one entity type to another. This can range from changing a sole proprietorship to a Limited Liability Company (LLC), or even converting an LLC into a corporation. The importance of this transformation cannot be overstated as it often aligns with the evolving objectives and needs of the business.

Adopting a new entity form can lead to essential benefits such as enhancing legal compliance, unlocking tax advantages, providing greater operational flexibility, and improving brand positioning. Each of these factors plays a significant role in a company's growth and development. When considering a change of form, business owners must evaluate their current situation and the potential benefits that a new structure may provide.

Types of corporate entity changes

Corporate entity changes typically occur through various conversion types, each with its own pros and cons. For instance, transitioning from a sole proprietorship to an LLC provides limited liability protection but may involve navigating through new regulatory requirements. Conversely, moving from an LLC to a corporation can enhance the ability to raise capital through the sale of stock, yet it carries more complex operational regulations.

Some common scenarios that prompt such changes include the expansion of business purposes, changes in ownership structure, or a shift in the overall strategy of the business. Understanding these types and the implications of each is vital for business owners contemplating a change.

The process of changing your corporate entity form

Changing the form of your corporate entity requires thorough initial considerations that can impact the entire business. Firstly, assessing your business needs is crucial. Evaluating factors like growth expectations, potential liabilities, and taxation will guide your decision in selecting a new form. Additionally, understanding state regulations is vital since each state may have different requirements for entity changes.

Here is a structured step-by-step guide to facilitate the transformation of your corporate entity form:

Managing and updating entity information post-change

After successfully changing your corporate entity form, it’s crucial to confirm compliance with all local, state, and federal regulations. This may include notifying creditors and banks about the change in structure. Additionally, updating business licenses and permits is essential to reflect the new entity details.

Managing fictitious names, or DBA (doing business as) registrations, can also be essential after a change of entity form. When a business adopts a new name or changes its structure, it must ensure that its fictitious name registrations correlate with the new entity form. This involves filing the appropriate forms to avoid legal complications.

Frequently asked questions (FAQs)

Business owners often possess misconceptions surrounding the financial and legal implications of changing their corporate entity form. Common questions regarding affordability and the impact on existing contracts arise during this transition. It's important to realize that while the process may involve initial costs, the long-term benefits often significantly outweigh these expenses.

In addressing the change's impact on existing contracts, it’s vital to understand that continuity is often maintained. Nevertheless, consulting with legal professionals can provide clarity and help navigate specific nuances in the agreements. Moreover, international entities contemplating a change may encounter additional legal implications that require specialized handling.

Tools and resources for corporate entity changes

Utilizing interactive tools can be significantly beneficial for business owners assessing their entity needs. Flowcharts and decision trees can help clarify the best path for your corporation based on unique circumstances. Additionally, having access to PDF templates designed specifically for entity changes can streamline filling out forms, minimizing the potential for error.

Moreover, knowing the appropriate forms required for various entity changes—such as conversion documents and state-specific forms—can save your team from regulatory headaches. For those requiring personalized assistance, hiring legal expertise can provide invaluable insight through this often complicated process.

The role of pdfFiller in the entity change process

pdfFiller plays a pivotal role in simplifying the document creation process associated with corporate entity changes. With features allowing users to easily edit PDFs, eSign, and collaborate on documents, the platform streamlines what can often be a cumbersome process. By consolidating tools in one location, you can ensure all team members can weigh in effectively while maintaining accuracy.

Furthermore, the 'access-from-anywhere' solutions provided by pdfFiller enable secure document management on the cloud. This accessibility aligns perfectly with the needs of teams undergoing transformation during entity conversion, eliminating geographical constraints and fostering seamless collaboration.

Navigating complex entity changes

When contemplating a corporate entity change, understanding the legal and financial implications is crucial, especially for business owners seeking to protect their interests. Consulting with legal professionals can provide detailed insights into potential risks and obligations that come with the transition. Each entity change may invoke different laws and regulations, which are pivotal in planning a successful transition.

Certain special cases, such as mergers and acquisitions, may require esteemed attention to additional legal procedures. Often, modifications due to court orders or other intricate matters may impose unique demands that necessitate precise and well-defined actions.

Staying informed on regulatory changes

Remaining updated on regulatory changes that impact corporate entities is essential for ongoing compliance. Establishing a routine to follow relevant websites and organizations can keep business owners ahead of any forthcoming alterations in business law. Knowledge serves as a protective measure against potential liabilities or business missteps.

Subscribing to newsletters and blogs dedicated to corporate law can also prove advantageous. Many resources not only notify subscribers of upcoming changes but also provide insights into how these amendments affect various business structures.

Exploring alternative entity solutions

While changing the corporate entity form is a proactive step, business owners should also explore alternative solutions such as mergers, dissolutions, or reorganizations. Each approach has its unique advantages and potential drawbacks that should be evaluated carefully.

Mergers can lead to strengthened market presence, while dissolutions may offer a strategic exit without extending liability. On the other hand, reorganizations may best serve firms aiming to retain crucial aspects of their identity while optimizing resources. Understanding these options allows for tailored decisions that best fit each business's specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate entity change of to be eSigned by others?

How do I make edits in corporate entity change of without leaving Chrome?

How do I complete corporate entity change of on an iOS device?

What is corporate entity change of?

Who is required to file corporate entity change of?

How to fill out corporate entity change of?

What is the purpose of corporate entity change of?

What information must be reported on corporate entity change of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.