Get the free Corporate Entity Client Number Amalgamation

Get, Create, Make and Sign corporate entity client number

How to edit corporate entity client number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate entity client number

How to fill out corporate entity client number

Who needs corporate entity client number?

Understanding the Corporate Entity Client Number Form

Understanding the corporate entity client number

A Corporate Entity Client Number is a unique identification number assigned to corporations, partnerships, and nonprofits when they register for business operations. This number is pivotal in distinguishing your business from others, helping regulatory agencies track compliance and ensuring your organization meets industry standards.

Various industries utilize the corporate entity client number, including finance, healthcare, and retail, as it aids in transactions, compliance tracking, and facilitates interactions with government agencies.

Who needs a corporate entity client number?

Not every business needs a Corporate Entity Client Number, but certain types do. Corporations, partnerships, and nonprofits are commonly required to obtain this number as part of their legal formation or ongoing regulatory compliance.

Specific circumstances, such as applying for loans, bidding for government contracts, or maintaining a strong reputation, necessitate having a client number to validate a business's credibility and compliance.

Importance of the corporate entity client number

Obtaining a Corporate Entity Client Number is essential as it brings several benefits to your business operations. Firstly, it enhances your credibility and professionalism, which is vital in establishing trust among clients, partners, and regulatory bodies.

Additionally, having a client number streamlines your regulatory compliance processes. It simplifies interactions with various agencies, making it easier to adhere to state and federal laws. The efficiency gained translates into smoother business transactions, reducing delays and administrative burdens.

Overall, the corporate entity client number serves as a foundation for establishing a legitimate business presence, ensuring you navigate the complexities of regulatory requirements smoothly.

Prerequisites for obtaining your client number

Before filing for your Corporate Entity Client Number, it is crucial to understand the eligibility criteria. Each business type has specific requirements and associated documentation that must be prepared prior to filling out the application form.

Key eligibility requirements include having your business registered with the appropriate authorities and being compliant with regulatory standards. The necessary documentation generally includes business registration documents, identification information of owners or partners, and other specific forms depending on your industry.

When preparing to fill out the form, gather specific data such as your business's legal name, physical address, and federal tax identification number. Anticipate potential challenges, like ensuring accurate data entry or gathering required documents on time, and address them promptly to ease the application process.

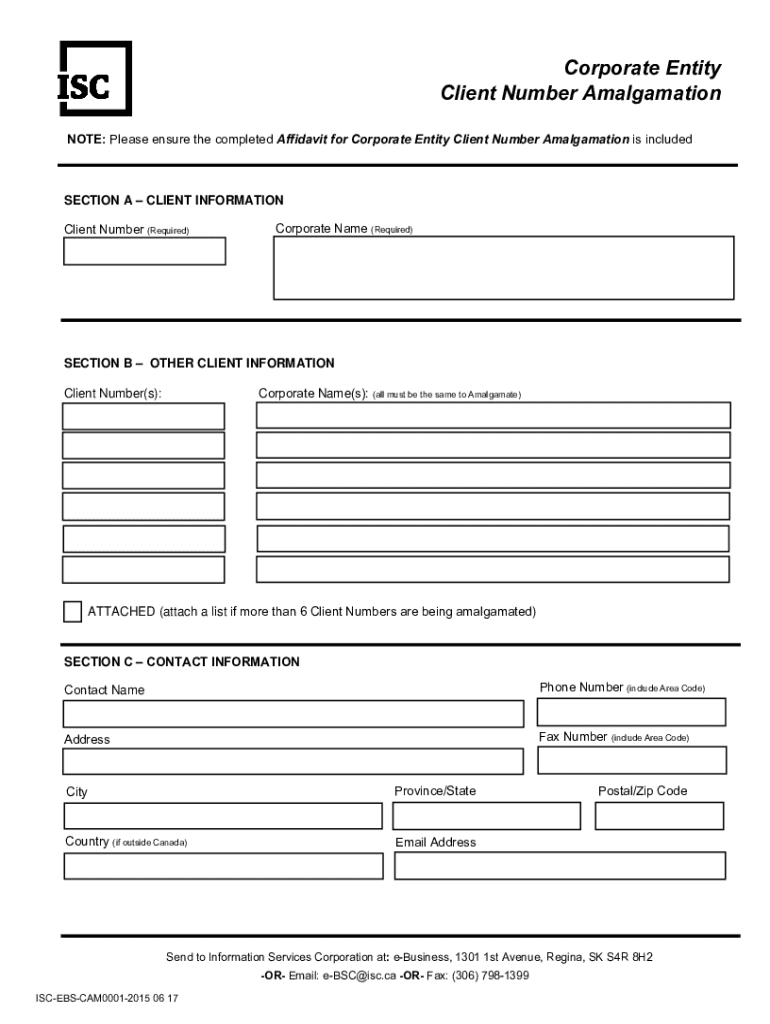

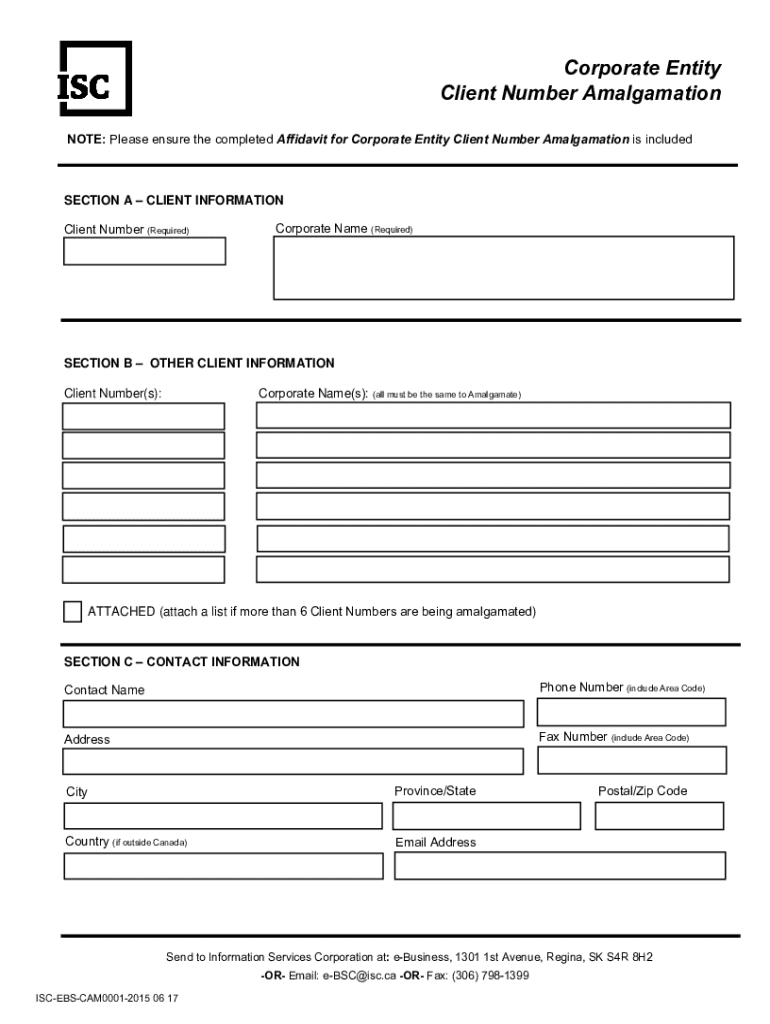

Step-by-step guide to filling out the corporate entity client number form

Step 1: Accessing the form

To obtain your Corporate Entity Client Number, the first step is to access the official form hosted on pdfFiller. Ensure that you are navigating to the correct website to avoid scams or fraudulent sites. Look for the designated section to download or fill out the form electronically.

Step 2: Completing the form

Carefully complete each section of the Corporate Entity Client Number form. Pay close attention to required fields, fill in your business's name exactly as registered, and provide accurate contact details. Utilize interactive tools offered by pdfFiller that can guide you through the completion process, such as tooltips or assistance prompts.

Step 3: Reviewing your completed form

Once you have filled out the client number form, review it thoroughly. Ensure all information entered is accurate, as mistakes can lead to processing delays. Having a checklist while reviewing can help ensure nothing is missed.

Step 4: Submission process

After confirming that all information is correct, you can proceed to submit the form electronically. Depending on the agency's requirements, you may receive a confirmation email or follow-up notification regarding the progress of your application.

Managing your corporate entity client number

Tracking the status of your application is crucial after submission. Most state agencies provide online portals where you can check the progress of your request. Make sure to hold onto any reference numbers provided during application submission.

If you encounter common issues such as errors in form submission or unexpected delays, contact the relevant authority promptly to address these problems. Keeping clear records of your submission can also help in resolving any discrepancies.

Updating or renewing your corporate entity client number

Organizations may need to update their Corporate Entity Client Number information due to changes such as a shift in business structure, location, or ownership. Understanding when and how to make these updates is critical in maintaining compliance.

Keeping your details current ensures you avoid legal complications and remain compliant with state regulations.

Utilizing your corporate entity client number

When running a business, knowing when to share your Corporate Entity Client Number is essential. This number is often needed when engaging with vendors, applying for loans, or submitting required documentation to regulatory agencies.

The Corporate Entity Client Number plays a critical role in tax filings, licensing, and permitting processes. Having this number at your fingertips helps streamline these functions, ensuring compliance and efficiency in operations.

Interactive tools and resources by pdfFiller

pdfFiller offers a suite of interactive features designed to simplify document management. Utilize tools for editing PDFs, applying electronic signatures, and collaborating with team members to ensure smooth and efficient document workflows.

With pdfFiller, you can create, fill, and manage your Corporate Entity Client Number form and other vital documents from a single cloud-based platform. This streamlining of processes enhances your productivity and reduces time spent on administrative tasks.

Frequently asked questions (FAQs)

Many individuals have inquiries about the Corporate Entity Client Number. One common question is whether sole proprietorships require this number; typically, they are not mandated unless they form a corporation or partnership.

Clarifying misconceptions is crucial—some assume having a client number is a one-time process. In reality, it may require amendments or renewals as your business evolves, based on changes in ownership or structure.

Related forms and transactions

In addition to the Corporate Entity Client Number Form, there are various other documents that businesses may need to complete during their operational lifecycle. Maintaining access to these forms is necessary for seamless management.

Access these forms via pdfFiller for a hassle-free experience and to ensure you are always prepared for any business filing needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit corporate entity client number online?

How do I fill out the corporate entity client number form on my smartphone?

How do I complete corporate entity client number on an iOS device?

What is corporate entity client number?

Who is required to file corporate entity client number?

How to fill out corporate entity client number?

What is the purpose of corporate entity client number?

What information must be reported on corporate entity client number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.