Get the free Ct-1

Get, Create, Make and Sign ct-1

Editing ct-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1

How to fill out ct-1

Who needs ct-1?

Comprehensive Guide to the CT-1 Form: Access, Completion, and Management

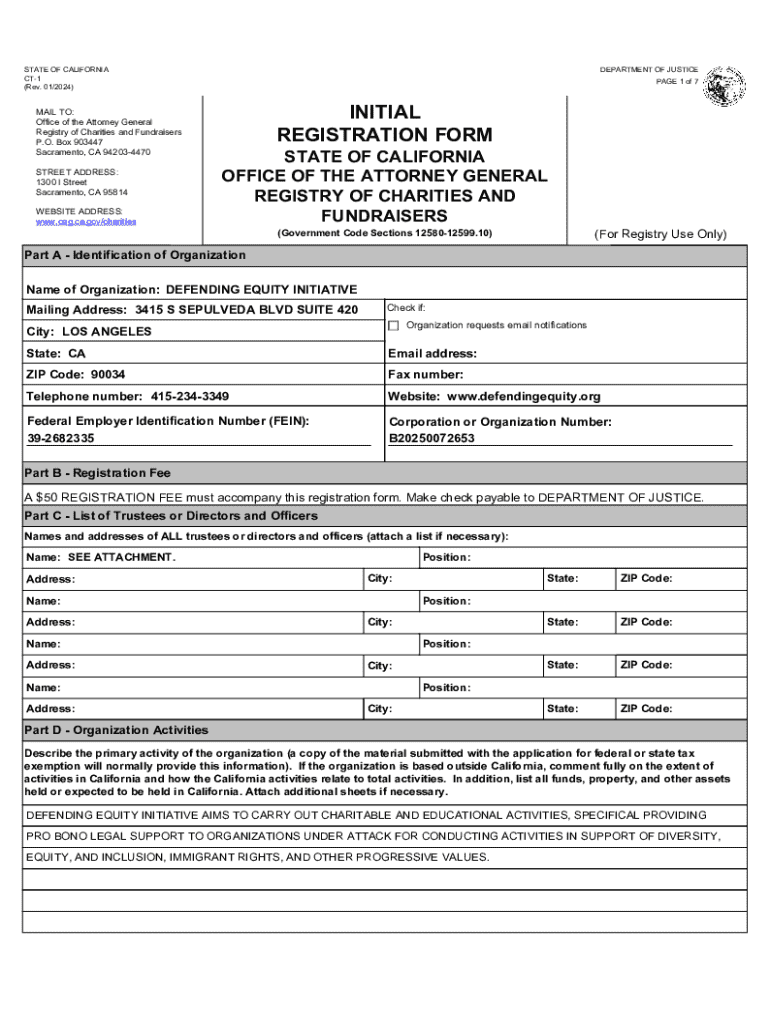

Overview of the CT-1 form

The CT-1 form is a crucial document used primarily in business environments and tax documentation. It serves the purpose of reporting certain financial activities and is an essential part of various tax filings. By accurately completing and submitting the CT-1 form, individuals and businesses can ensure compliance with tax regulations and contribute to an efficient financial reporting system.

Understanding the importance of the CT-1 form in relevant contexts cannot be overstated. It plays a critical role in federal and state tax returns, allowing for proper tracking of income and expenses. Businesses that utilize the CT-1 form can leverage it for better transparency in their financial practices, enhancing trust with stakeholders and regulatory bodies.

Accessing the CT-1 form

Accessing the CT-1 form is straightforward, particularly through dedicated platforms such as pdfFiller. Users can easily download the CT-1 form as a PDF from various official sources, including state tax websites or the IRS. The availability of this form online makes it easier for individuals and businesses to obtain the necessary documentation without the hassle of physical paperwork.

In addition to standard download options, pdfFiller allows users to access the CT-1 form on multiple devices. Whether you are using a mobile phone, tablet, or desktop, you can create and access the CT-1 form anytime, anywhere. This accessibility ensures that users can stay on top of their documentation needs without any time constraints.

Filling out the CT-1 form

Completing the CT-1 form requires careful attention to several key sections. Here's a step-by-step guide to ensure you fill out the form accurately. First, you need to provide your contact information in the designated section. This includes your name, address, and any relevant business identification numbers. It’s essential to ensure that all provided information is correct to avoid delays or issues during processing.

Next, financial disclosures are a significant part of the CT-1 form. You'll be required to include details about your income, expenses, and any tax liabilities incurred during the reporting period. It's vital to avoid common mistakes such as computational errors or leaving sections blank. To enhance accuracy, consider reviewing your documents and verifying figures against your financial statements before submission.

Editing the CT-1 form

Editing the CT-1 form is made simple with pdfFiller’s user-friendly interface. Users can easily make alterations to the form, filling in new information or updating existing data. Directly within the pdfFiller platform, you can click on fields to modify the text, ensuring that your form reflects the most current and accurate information, essential prior to submission.

Additionally, pdfFiller's collaboration tools allow multiple users to work on the same form simultaneously. This feature is particularly beneficial for teams needing to review or approve changes before finalizing the CT-1 form. Common queries surrounding edits typically involve the types of modifications allowed. Users can edit text, add new sections, or remove unnecessary information easily.

Signing the CT-1 form

The importance of signing the CT-1 form cannot be overlooked. A valid signature certifies that the information provided is true and accurately represents the individual or entity submitting the form. It is also an affidavit, declaring that you understand the legal implications of the information provided, ensuring accountability in case of discrepancies.

Using pdfFiller, signing the CT-1 form electronically is a straightforward process. The platform allows users to create a digital signature that can be applied directly to the form. This digital method not only saves time but also reduces the need for physical documents, making it a more sustainable option compared to traditional signing.

Submitting the CT-1 form

Once the CT-1 form is completed and signed, the next step is submission. Understanding the submission guidelines is crucial to ensure your document reaches the right authorities without delay. The CT-1 form can often be submitted online through tax agency portals or via postal mail for physical copies. Accompanying documentation may be required, so it's advisable to attach necessary forms or receipts that support any claims made in your CT-1 submission.

Tracking your submission is just as essential as the submission itself. Using pdfFiller's advanced tracking features, users can easily verify whether their form has been received and processed. This capability provides peace of mind, ensuring that your submission is acknowledged and facilitating your financial planning.

Managing and storing your CT-1 form

Effective document management is paramount for maintaining organization and accessibility. Within pdfFiller, users can categorize and store the CT-1 form to enhance retrievability. By employing organizational tools, such as folders and labels, users can ensure that their forms are organized in a way that suits their needs and can be easily accessed when required.

Security is another major consideration in document management. pdfFiller employs cutting-edge security features, such as encryption and password protection, to ensure that your CT-1 form and other sensitive documents remain safe from unauthorized access. These features not only protect your data but also provide users with the confidence that their information is secure.

Troubleshooting common issues

While dealing with the CT-1 form, users may encounter various challenges. Common problems include incomplete sections, inaccurate calculations, or technical issues during submission. To address these issues, it is often helpful to refer back to your financial records and ensure that all entered data aligns with documented figures. pdfFiller provides helpful error diagnostics whenever problems arise during document processing.

In instances where users are unsure about the details in the CT-1 form or face complex issues, seeking professional help may be prudent. Tax professionals and legal advisors can provide valuable insights and mitigate risks associated with improper filings.

Interactive tools for enhanced user experience

pdfFiller offers an array of interactive tools designed to improve the user experience when filling out the CT-1 form. These tools include templates that eliminate guesswork and provide a structured approach to filling out necessary information. By utilizing these available resources, users can navigate the completion of the CT-1 form with greater ease and confidence.

User testimonials are a testament to the effectiveness of pdfFiller's platform. Many report an increase in efficiency and reduced stress associated with document handling, highlighting the seamless processes established by pdfFiller for managing the CT-1 form and other paperwork.

Best practices for using the CT-1 form

Employing best practices for utilizing the CT-1 form can lead to increased efficiency in document management. Customizing your approach to filling out and submitting the CT-1 form will align with your organizational needs, ensuring that all necessary data is collected without delay. As deadlines approach, maintaining rigorous tracking of submissions can prevent last-minute scrambles that often lead to errors.

Looking ahead, staying informed about trends in document management and eSignatures is essential for any modern business. Embracing technology for seamless workflows ensures that users are leveraging every possible advantage in their documentation processes, especially when utilizing platforms like pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ct-1?

Can I create an eSignature for the ct-1 in Gmail?

How do I complete ct-1 on an Android device?

What is ct-1?

Who is required to file ct-1?

How to fill out ct-1?

What is the purpose of ct-1?

What information must be reported on ct-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.