Get the free Credit Card Payment Authorization Form

Get, Create, Make and Sign credit card payment authorization

Editing credit card payment authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment authorization

How to fill out credit card payment authorization

Who needs credit card payment authorization?

Comprehensive Guide to Credit Card Payment Authorization Forms

Understanding credit card payment authorization forms

A credit card payment authorization form is a vital document that allows businesses to charge a customer's credit card for goods or services. This form serves as a legal confirmation from the cardholder granting permission to process payments using their credit card information. It is crucial in payment processing as it protects both the payer and the payee, ensuring that transactions are authorized, transparent, and legitimate.

In the realm of business, these forms are especially relevant in various scenarios, from retail transactions to service agreements. For instance, a square restaurant might require customers to fill out this form when placing large orders or signing service contracts, ensuring that payment can be processed seamlessly without future disputes.

When should you use a credit card payment authorization form?

Credit card payment authorization forms are essential for certain types of transactions, primarily those that require payment upfront or recurring payment schedules. For example, businesses need this form for recurring payments, such as subscription services or memberships, where customers are billed periodically.

One-time transactions also necessitate an authorization form, especially for high-value purchases. However, it is crucial to avoid using this form in situations where authorization is unnecessary, such as low-value transactions billed through secure payment gateways that already require customer authentication.

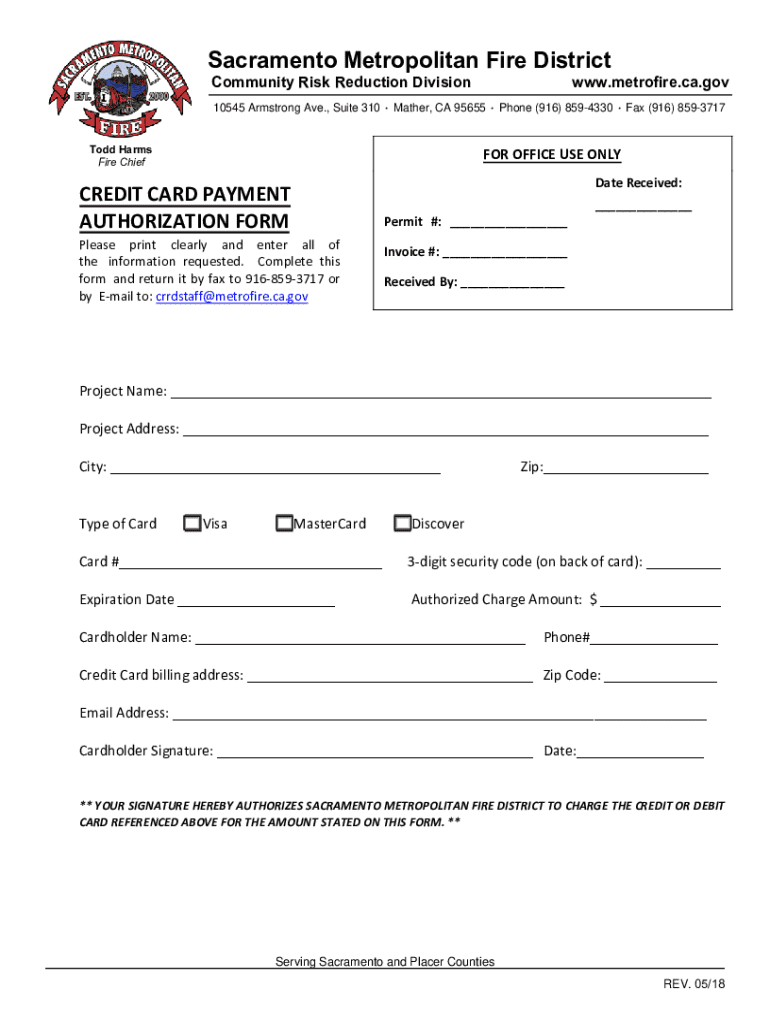

Key components of a credit card payment authorization form

Understanding the essential information to capture within a credit card payment authorization form is crucial for effective processing and compliance. Key components include the cardholder's name, which confirms identity; the card number and expiry date, which are critical for initiating the transaction; and the exact amount to be charged, ensuring clarity on the financial commitment.

While certain details are mandatory, such as those listed above, optional information may enhance security and build trust. For example, including the CVV (Card Verification Value) can protect against unauthorized charges. However, businesses must handle CVVs with care due to compliance requirements and potential security risks.

Benefits of using credit card payment authorization forms

Utilizing credit card payment authorization forms can significantly benefit businesses by minimizing risks associated with chargebacks. Chargeback abuse can occur when customers dispute transactions without proper justification. By having a signed authorization form, businesses can provide proof of consent, thus reducing the chance of chargeback losses.

Furthermore, these forms help secure payment information and establish clear payment authority. This not only protects the financial interests of the business but also builds trust among customers, knowing that their payment details are adequately handled and authorized.

How to fill out a credit card payment authorization form

Filling out a credit card payment authorization form requires accuracy and attention to detail. Start by clearly entering the cardholder’s name as it appears on the credit card to prevent any processing issues. Next, input the card number and expiration date correctly, ensuring all digits are accurately captured.

Once these sections are complete, specify the amount to be charged. It's advisable to double-check these figures before finalizing the form for clear communication and to avoid misunderstandings. Be sure to read through the terms and conditions – if applicable – and ensure both parties’ signatures are included.

Common mistakes to avoid

As you complete the form, being mindful of common errors can prevent processing delays. Avoid incorrect card numbers or expiry dates, as these can lead to transaction refusals. Also, ensure the amount charged matches what was discussed with the customer. Lastly, neglecting to include signatures can invalidate the authorization, leading to unnecessary disputes.

To ensure clarity and completeness, consider providing clear guidelines on filling out the form or giving customers verbal or written prompts about required information.

Editing and customizing your credit card payment authorization form

pdfFiller makes it easy to modify your credit card payment authorization form template for your business needs. By using the platform, companies can edit the form to include their logo, specific payment policies, or even add security disclaimers that suit their operational policies.

Moreover, adding interactive elements, such as checkboxes or fields for digital signatures, enhances user experience and streamlines the completion process. Customizing the form ensures that it aligns with your branding and operational requirements while making it user-friendly.

Best practices for storing and managing signed authorization forms

Storing and managing signed credit card payment authorization forms necessitates adherence to legal practices and retention policies that safeguard customer information. Businesses have a duty to ensure that these documents are securely stored to prevent unauthorized access and comply with pertinent regulations.

Various secure digital storage solutions are available that allow businesses to organize and protect these sensitive documents. Additionally, companies should ensure their practices align with Payment Card Industry Standards to create a safe environment for customer data handling.

Frequently asked questions

Customers often have queries regarding credit card payment authorization forms. One common question is whether these forms help prevent chargeback abuse. Indeed, a signed form provides legal backing in disputes, reducing potential chargeback incidents.

Another frequently asked question is the necessity of using these forms legally. While there is no absolute legal obligation, they greatly enhance trust and protect both parties involved.

Download templates and resources

For those looking to utilize a credit card payment authorization form, pdfFiller offers several free templates ready for customization. These templates can be tailored to meet specific needs, whether for a restaurant or any other business type.

Additionally, pdfFiller provides guidance on how to easily modify templates, enhancing usability by allowing you to add your branding and terms directly on the form. Exploring related forms such as ACH authorization forms may also be beneficial for your business.

Related articles and further reading

To gain a deeper understanding of payment processing, consider exploring related articles. For instance, 'How to Accept Apple Pay at Your Small Business' discusses integrating modern payment solutions, while 'A Comprehensive Look at Card-not-Present Transactions' provides insights into online transaction safety.

These resources can help business owners navigate the complexities of payment systems, ensuring they are well-equipped to manage transactions securely.

Keep updated

Staying informed about updates and best practices in payment processing is crucial for business success. Subscribing to the pdfFiller newsletter offers access to the latest tips and templates, helping you streamline your document management as you navigate the world of payment authorizations.

With continuous updates and innovative features, pdfFiller empowers users to manage and create documents effortlessly from any device, ensuring compliance and efficiency in payment processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card payment authorization from Google Drive?

How can I send credit card payment authorization to be eSigned by others?

How do I complete credit card payment authorization on an iOS device?

What is credit card payment authorization?

Who is required to file credit card payment authorization?

How to fill out credit card payment authorization?

What is the purpose of credit card payment authorization?

What information must be reported on credit card payment authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.