Get the free Credit Application - Documentation Checklist

Get, Create, Make and Sign credit application - documentation

Editing credit application - documentation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application - documentation

How to fill out credit application - documentation

Who needs credit application - documentation?

Credit Application - Documentation Form: A Comprehensive Guide

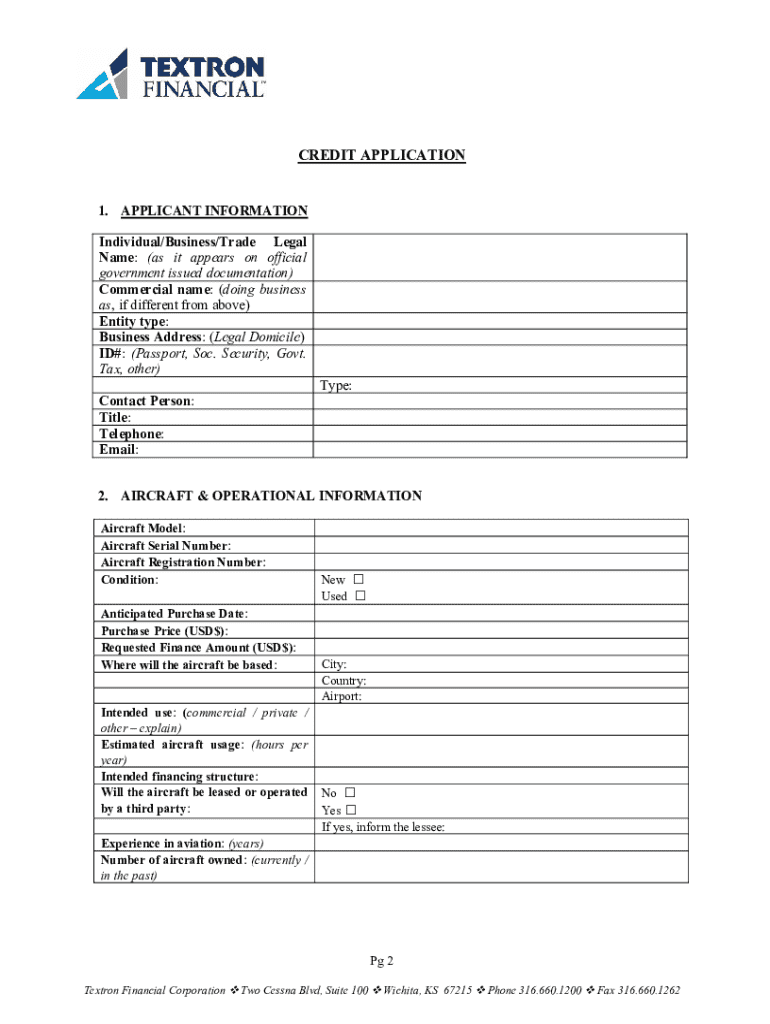

Understanding credit applications

A credit application serves as the initial step in obtaining a loan or credit from lenders. This formal request seeks to assess an individual's or business's eligibility for credit, thereby facilitating financial transactions. The purpose of the application is to provide the lender with essential information that helps determine the risk involved in issuing credit.

The importance of a credit application in financial decision-making cannot be overstated. It not only influences the approval process but also affects the interest rates and credit limits borrowers might receive. Without a thoroughly completed credit application, lenders may perceive potential borrowers as less reliable, leading to unfavorable terms or outright denial.

Types of credit applications

Credit applications can be broadly classified into two types: individual and business. An individual credit application is typically completed by private consumers seeking personal loans, credit cards, or mortgages. Conversely, a business credit application caters to companies looking for business loans or credit lines.

Additionally, credit applications can be categorized based on the collateral involved. Secured credit applications require the borrower to provide collateral, such as property or other assets, which the lender can claim if the borrower defaults. On the other hand, unsecured credit applications do not necessitate collateral. Understanding these distinctions aids applicants in selecting the appropriate application based on their financial status.

Essential documentation for credit applications

When preparing a credit application, several key documents are vital for a successful submission. Proof of identity is crucial, with government-issued IDs like passports or driver's licenses being standard. This documentation helps verify the applicant's identity, ensuring that the lender adheres to regulations and minimizes fraud risk.

Proof of income is another essential component. Lenders often require recent pay stubs, tax returns, or bank statements to confirm an applicant's financial stability. Presenting accurate income documentation not only strengthens the application but also builds trust with the lender.

Optional documents

While certain documents are mandatory, applicants may choose to include optional documents like personal references. These references can provide additional insight into the applicant's character and reliability. Furthermore, providing asset documentation, such as property deeds or investment statements, can bolster an application, particularly for secured loans.

The credit application - documentation form: A comprehensive walkthrough

Navigating the credit application documentation form can be daunting without proper guidance. Understanding its layout and sections will streamline the completion process. Typically, the form includes sections for personal information, financial details, and authorization. Familiarity with these sections allows applicants to efficiently fill out the form, separating mandatory fields from optional ones.

Filling out the form section-by-section

The personal information section is where applicants provide basic details such as their full name, address, date of birth, and Social Security number. Best practices suggest double-checking this information for accuracy, as discrepancies can delay processing or lead to denial.

Next, the financial information section requires a comprehensive view of the applicant's financial health. Here, applicants should list their assets, such as savings, property, and investments, alongside their liabilities, which include debts and regular financial obligations. Demonstrating a positive net worth by ensuring that assets outweigh liabilities enhances the application's strength.

Finally, the authorization section is integral to the application process. This section typically includes consent for the lender to access the applicant's credit history. Understanding consent and the implications of signing this section is crucial, as it can significantly impact the application outcome.

Editing and managing your credit application with pdfFiller

pdfFiller offers a user-friendly platform for editing your credit application form, making the process both efficient and straightforward. To begin, simply upload your completed documentation form onto pdfFiller's platform. The editing tools allow you to make adjustments, corrections, or updates with ease.

Once your form is complete, pdfFiller enables you to eSign directly within the application, ensuring your document remains secure and legally binding. This feature is particularly beneficial for individuals who require quick access to signed copies, especially when dealing with time-sensitive financial matters.

Collaborating with others

Collaboration is often essential when preparing a credit application, especially for businesses. pdfFiller supports this by allowing multiple users to access and edit the document simultaneously. This feature ensures that all necessary parties have input and can make real-time updates, streamlining the application process.

Saving and sharing your form

After editing and signing your credit application, pdfFiller provides cloud-based storage options for easy document access and management. Users can save their forms securely in the cloud, ensuring that they can retrieve their documents from anywhere and at any time. When ready to submit the application, sharing it with lenders or financial institutions is straightforward via email or direct links.

Common mistakes to avoid in your credit application

Completing a credit application is not without its challenges, and several common mistakes can hinder success. The top errors often include providing incomplete information, misrepresenting income or assets, and neglecting to sign or date the application. Each of these oversights can lead to application delays or even outright denial of credit.

To ensure a polished application, implementing a review checklist can be beneficial. Before submission, applicants should verify that all information is accurate, complete, and clearly presented. Utilizing pdfFiller's feedback tools can further enhance the application by providing tips and ensuring that the document meets lender requirements.

Tips for reviewing your application

Frequently asked questions about credit applications

After submitting a credit application, applicants often wonder what comes next. Generally, the credit approval process involves a review of the submitted documentation and the applicant's credit history. Timeframes can vary by lender; however, many institutions provide feedback within a few days to a few weeks.

In the unfortunate event of a credit denial, applicants should know the steps to take next. Lenders are required to provide an explanation for the rejection, allowing individuals to review the reasons and improve their applications in the future. Resources such as credit counseling services can assist users in understanding credit reports and addressing any issues that may have led to the denial.

Industry insights and trends in credit applications

In recent years, the credit approval process has evolved significantly, particularly with the integration of technology. Digital tools have streamlined the evaluation process, enabling lenders to assess applications more efficiently. Current trends indicate a growing reliance on data analytics and machine learning to better predict borrower risk, which impacts how credit applications are evaluated.

Future trends in credit applications point towards an increasing shift to digital documentation and enhanced security measures to protect sensitive information. As more lenders adopt innovative technologies, applicants may encounter more automated processes that yield quicker decisions. Keeping abreast of these changes can help individuals prepare for a future that prioritizes efficiency and security in credit management.

Using pdfFiller for efficient document management

Embracing a cloud-based document solution like pdfFiller offers numerous benefits, most notably the ability to access your documents from anywhere, at any time. This flexibility is invaluable for individuals and teams who need to manage documentation efficiently, especially in a fast-paced financial environment concerning credit applications.

Moreover, organizing and tracking financial documents is simplified using pdfFiller's intuitive interface. Users can categorize forms, set reminders for renewals or expirations, and maintain an orderly digital file system. This level of organization saves time and reduces stress significantly.

Staying compliant and secure

pdfFiller places a strong emphasis on data security, ensuring that user information is protected throughout the credit application process. Understanding privacy policies and terms of use allows users to engage confidently with the platform, knowing their sensitive information is in safe hands. Adopting a compliant approach to document management aids in meeting legal requirements and maintaining integrity in financial affairs.

Connect with us

For those seeking support with their credit applications, pdfFiller provides dedicated contact options for assistance. Whether navigating the documentation form or understanding the editing features, our team is here to help ensure a smooth experience for every user.

Feedback is always welcomed as pdfFiller strives for continuous improvement in its document management services. Users are encouraged to share their experiences and suggestions, contributing to the evolution of our platform to better meet their needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit application - documentation?

Can I sign the credit application - documentation electronically in Chrome?

How can I edit credit application - documentation on a smartphone?

What is credit application - documentation?

Who is required to file credit application - documentation?

How to fill out credit application - documentation?

What is the purpose of credit application - documentation?

What information must be reported on credit application - documentation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.