Get the free Credit Application Form

Get, Create, Make and Sign credit application form

Editing credit application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application form

How to fill out credit application form

Who needs credit application form?

Credit Application Form: A Comprehensive How-To Guide

Understanding credit application forms

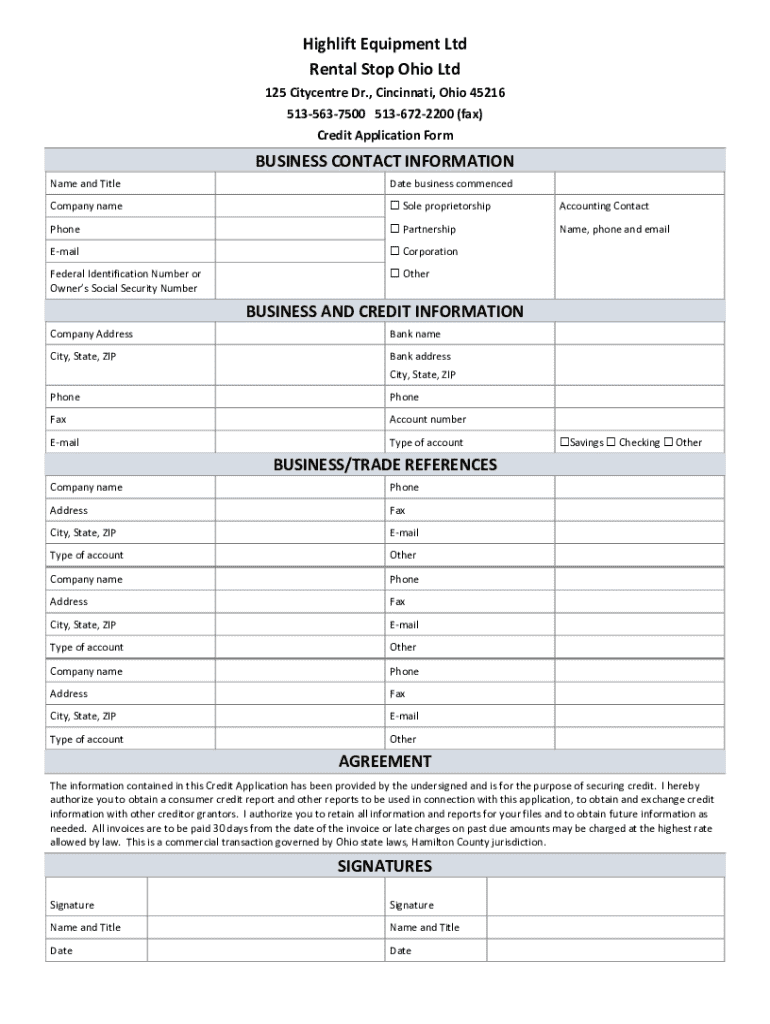

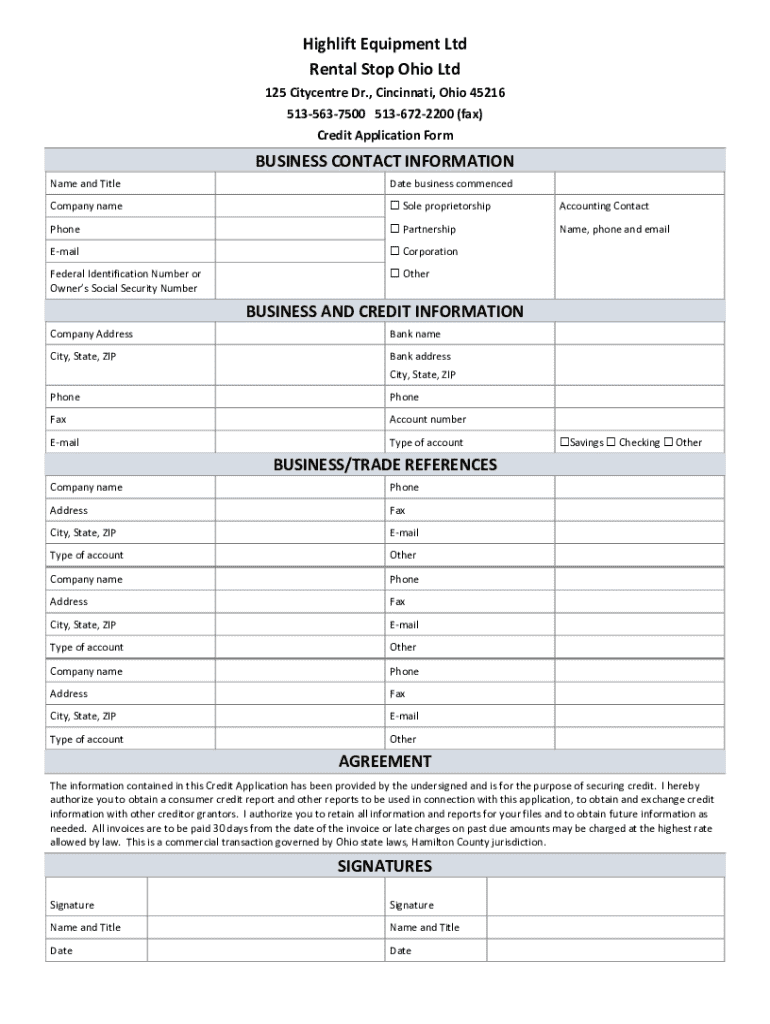

A credit application form is a crucial document that lenders use to collect detailed personal and financial information about an individual or organization applying for credit. This document plays a vital role in determining the applicant's eligibility for loans, credit cards, and other types of financing.

The importance of a credit application in financial transactions cannot be overstated. It helps creditors assess risk by evaluating an applicant's creditworthiness, which includes their credit history, income level, and employment status. Without a comprehensive credit application form, lenders would struggle to make informed decisions regarding loan approvals.

Elements of a comprehensive credit application form

A well-rounded credit application form consists of various sections that provide detailed insights into the applicant's financial health. Personal information is usually the first step, where applicants must supply their name, address, date of birth, and Social Security Number or Tax ID.

Financial information is another central aspect. Applicants must disclose income sources, amounts, and employment history to allow lenders to gauge their repayment ability. A credit history inquiry section typically follows, wherein applicants detail previous loans and current credit accounts, thereby granting lenders a comprehensive view of their borrowing habits.

Moreover, consent and signatures are required to confirm understanding of the associated terms and conditions. Optional sections might allow for co-applicant information and the inclusion of supporting documentation, which can strengthen the application.

Creating a credit application form using pdfFiller

pdfFiller offers an efficient way to create a credit application form tailored to specific needs. The first step involves accessing the template library within the platform, which houses numerous customizable forms suitable for various purposes.

Once you've accessed the template library, utilizing existing credit application templates simplifies the process. You can further edit these templates by adding or removing fields as necessary to ensure they align with your requirements. Customization options allow you to adjust the design and layout, enhancing the overall user experience.

Filling out a credit application form

For individuals, accurately completing each section of a credit application is crucial for a successful outcome. When filling out personal information, double-check for typos and ensure that details match official documents. Best practices for providing financial information include being transparent about your earnings and current debt obligations.

On the other hand, businesses applying for credit must consider specific aspects unique to corporate applications. This includes accurately detailing revenue sources, business structure, and existing financial obligations. Providing necessary documentation—such as tax returns, financial statements, and legal documents—can also enhance the credibility of the application.

Reviewing and managing your credit application

After completing your credit application, reviewing for common mistakes is essential. Ensuring accuracy in all submitted information can prevent delays and complications during the approval process. Transparency is key; any attempt to embellish or hide information can lead to rejection.

Utilizing pdfFiller tools for collaboration can prove beneficial in managing your credit application effectively. Share the form with stakeholders for their input, and gather feedback for revisions. This collaborative approach ensures your application stands the best chance of approval.

Signing and submitting your credit application form

Using pdfFiller's signing tools, eSigning your application is seamless and ensures that you remain compliant with legal requirements. Electronic signatures are widely accepted, and pdfFiller makes the process straightforward and secure.

When it comes to submission methods, you have several options. You can choose to submit your application via email, upload it through an online portal, or even fax it if required. Understanding the preferred submission method of the lender can expedite the process.

After submission: What to expect

Once you've submitted your credit application, it's essential to understand the review process ahead. Lenders typically assess applications based on credit scores, income, debt-to-income ratios, and other factors that influence the approval outcome.

The timeline for approval can vary significantly based on the lender and loan type. If your application is denied, reviewing feedback provided by the lender can offer insights for future applications. Conversely, if approved, take note of any next steps, such as signing loan agreements or additional documentation required.

Frequently asked questions about credit application forms

One common concern is what to do if your application is rejected. It’s advisable to request specific reasons for denial, which can help you address any deficiencies before reapplying. Additionally, working on improving your credit score can greatly enhance your chances for future applications.

Security of your information is also paramount when using platforms like pdfFiller. With state-of-the-art encryption and secure access controls, your data remains protected throughout your document management process.

Conclusion

A well-prepared credit application form can significantly influence the outcome of your request for credit, whether personal or business-related. By utilizing pdfFiller, you can confidently edit, sign, and submit your credit application from anywhere, making the process efficient and user-friendly. Prioritizing the accuracy and completeness of your application is vital for achieving a favorable response.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit application form without leaving Google Drive?

How can I send credit application form to be eSigned by others?

Can I create an eSignature for the credit application form in Gmail?

What is credit application form?

Who is required to file credit application form?

How to fill out credit application form?

What is the purpose of credit application form?

What information must be reported on credit application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.