Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Understanding Campaign Finance Receipts and Forms

Understanding campaign finance receipts

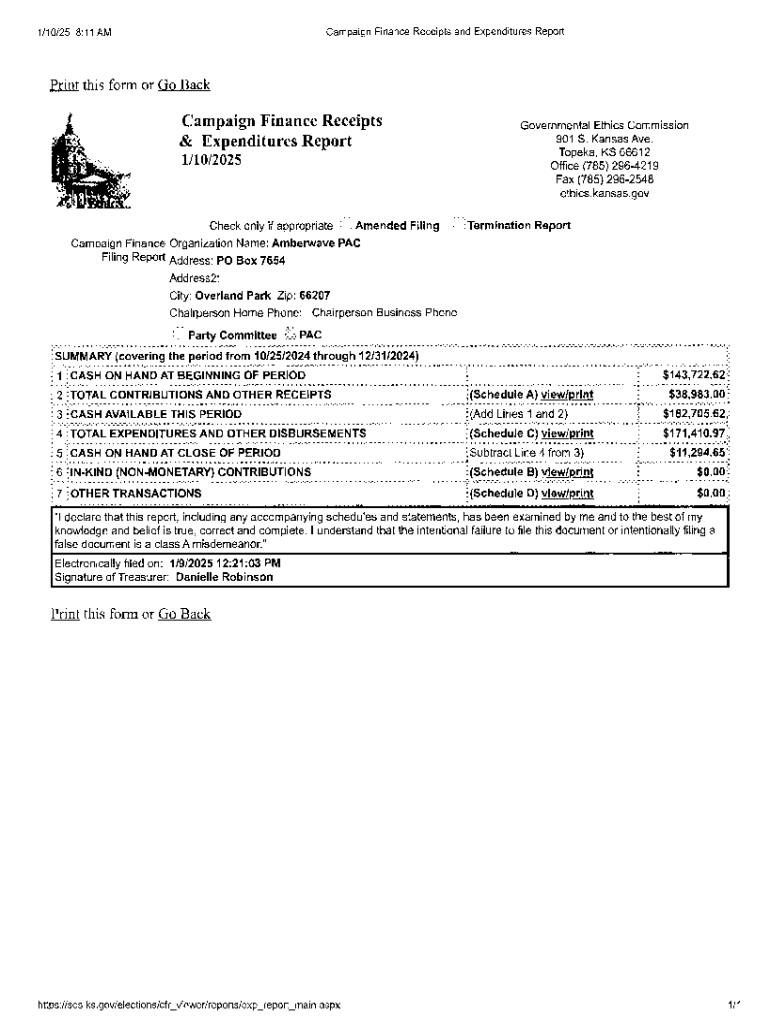

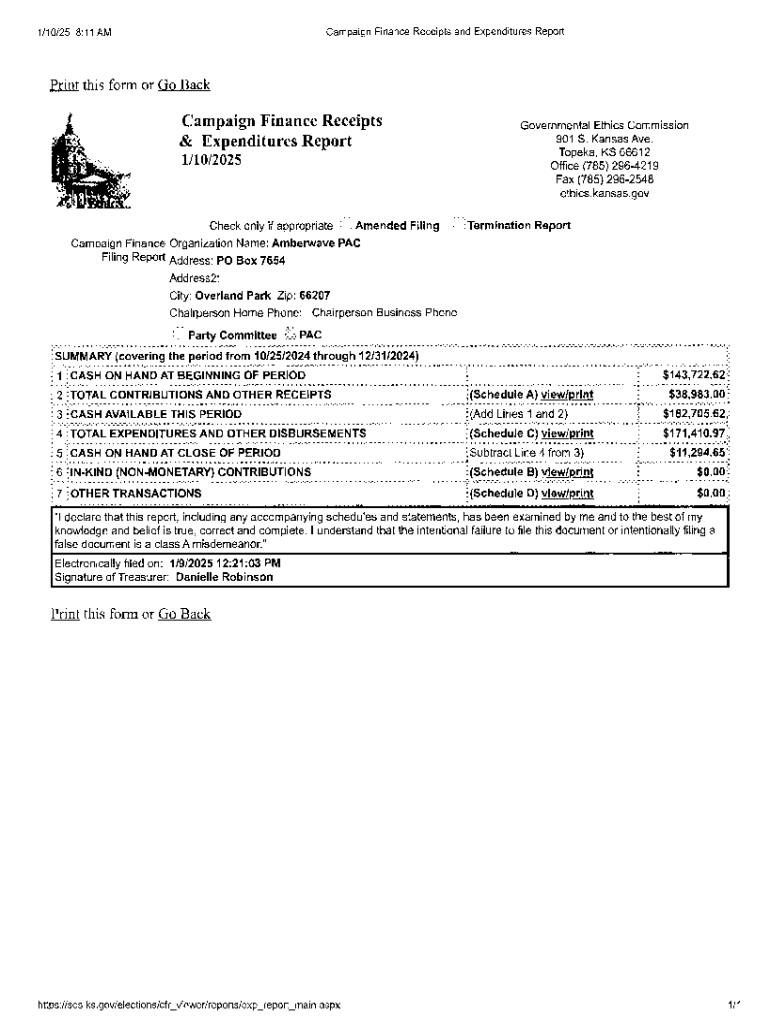

Campaign finance receipts represent the total contributions received by a political campaign, detailing financial backing from donors. They play a critical role in ensuring transparency in the political process by informing the public about the financial health of campaigns and the interests behind them.

Accurate reporting of these receipts is essential not only for compliance with legal requirements but also for building trust with constituents. Misreporting can lead to fines and damage a candidate’s reputation, while proper disclosures can enhance credibility and integrity in the electoral process.

Various regulations govern campaign finance, including the Federal Election Commission (FEC) rules and state-specific statutes. These provisions dictate how much money can be raised, from whom, and how it must be reported, ensuring a level playing field during elections.

Types of campaign finance forms

Campaign finance forms can differ significantly between federal and state levels. At the federal level, the FEC sets specific forms like the Form 1 and Form 3, each tailored to different reporting needs. These forms require comprehensive details regarding contributions, expenditures, and loans, making them central to federal campaign operations.

In contrast, state forms vary widely, reflecting local election laws. For instance, some states might have stringent limits on contribution amounts and require distinct forms for cash contributions versus in-kind donations. Candidates must familiarize themselves with both federal and state requirements to avoid potential compliance issues.

Timing of form submissions

The timing of when forms need to be submitted is crucial. Generally, there are pre-election and post-election deadlines that candidates must adhere to. Pre-election forms usually require reporting about a month before an election, while post-election forms often focus on the remaining financial activity after the election has concluded.

Essential components of campaign finance forms

Completing campaign finance forms requires careful attention to detail. Essential information includes personal details of the candidate, donation amounts, and the identities of donors. Each component plays a role in ensuring the legitimacy and transparency of contributions.

Additionally, state regulations detail contribution limits, which vary by state and type of election. This includes scrutiny of large contributions and gifts, aiming to mitigate undue influence on candidates.

Categories of receipts

Receipts are classified into several categories. Contributions refer to direct financial gifts from individuals or entities, while loans represent borrowed funds that must be disclosed. Moreover, in-kind contributions, such as donated goods or services, should also be itemized. Understanding these distinctions is crucial for accurate reporting and compliance.

Step-by-step instructions for completing campaign finance receipts

Accessing the correct form is the first step in filing campaign finance receipts. Most forms can be downloaded in PDF format directly from FEC or state election office websites. To facilitate this, pdfFiller offers a range of customizable templates for seamless access anytime, anywhere.

Filling out the form

While filling out the form, pay attention to each section. Starting with personal information, ensure name, address, and relevant election details are accurate. Moving to donor information, record contribution amounts diligently, noting any limits that may apply.

Common pitfalls include not adhering to deadlines, failing to disclose all contributions, and neglecting the required donor information. Remaining organized and thorough can minimize these risks.

Editing and reviewing

Once the form is completed, reviewing it thoroughly is essential. Using pdfFiller, you can easily edit any information if discrepancies are found. Collaboration within financial teams is vital; multiple eyes on the document can help catch errors.

Electronic signatures

Utilizing pdfFiller enables users to electronically sign forms securely. While electronic signatures are legally recognized, candidates must ensure compliance with state laws regarding their use. Understanding the legal implications will ensure that electronic submissions are valid.

Submitting campaign finance forms

Submitting forms can be done through electronic filing or traditional mail. Online submission is often quicker and can be done via the FEC's electronic filing system, making it a preferred method for many campaigns.

For paper forms, candidates must adhere to specific instructions, which generally require mailing to designated election offices. Confirming submission is crucial; candidates should retain confirmation receipts or tracking numbers to ensure compliance.

Confirmation of submission

After submission, it's essential to confirm receipt of filed forms, particularly for important pre-election deadlines. If there are submission errors, promptly addressing them is critical to avoid penalties or issues with compliance.

Managing and storing campaign finance receipts

Organizing digital files containing campaign finance receipts is indispensable for transparency and future reference. Best practices include creating systematic folders, labeling documents clearly, and maintaining backup copies to protect against data loss.

Retention policies play a crucial role in legal compliance. Candidates should understand how long to retain these records, which can vary by federal and state laws. Failing to follow these regulations may lead to legal repercussions.

Interactive tools and resources on pdfFiller

pdfFiller revolutionizes document management through collaboration features that enable teams to work efficiently on campaign finance forms. The platform's ability to create, edit, and manage documents in one space makes it invaluable for campaign teams.

Templates and tools available

With customizable templates for various forms, pdfFiller allows candidates to focus on their campaign instead of paperwork. The use of fillable PDFs streamlines the process, ensuring that necessary information is captured accurately.

FAQs and support

Access to customer support for assistance with campaign finance forms is critical. Common questions regarding filings, amendments, and regulations can typically be resolved through pdfFiller’s extensive FAQs section. This readily available resource helps candidates stay informed and compliant with their campaign finance requirements.

Case studies on effective campaign finance management

Successful campaigns often showcase exemplary management of campaign finance, fostering trust and accountability. For instance, a gubernatorial campaign that carefully tracked expenditure and contributions led to robust community support and successful fundraising efforts.

Conversely, failed campaigns highlight the pitfalls of poor financial management. Misreporting or misunderstanding regulations can lead to legal troubles and loss of public faith. Observing these examples offers valuable lessons for current and future candidates in effectively managing their campaign finances.

Innovations in campaign finance reporting

Technological advancements are continually shaping campaign finance management. The future holds promise for more streamlined reporting methods and cloud solutions, allowing campaigns to manage data efficiently and in real-time. Trends indicate a movement toward fully digital systems, enhancing oversight and compliance across various jurisdictions.

Frequently asked questions (FAQs)

Common inquiries often revolve around the nuances of campaign finance receipts and forms, including how much can be raised and the implications of different types of contributions. Addressing misconceptions about the regulations surrounding campaign finance ensures candidates are well-informed and compliant.

Clarifying definitions and expectations can enhance understanding, guiding candidates through the maze of filing obligations, reporting dates, and legal requirements necessary for effective campaign finance management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find campaign finance receipts and?

How do I complete campaign finance receipts and online?

How do I fill out campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.