Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign Finance Receipts and Form: A Comprehensive Guide

Understanding campaign finance receipts

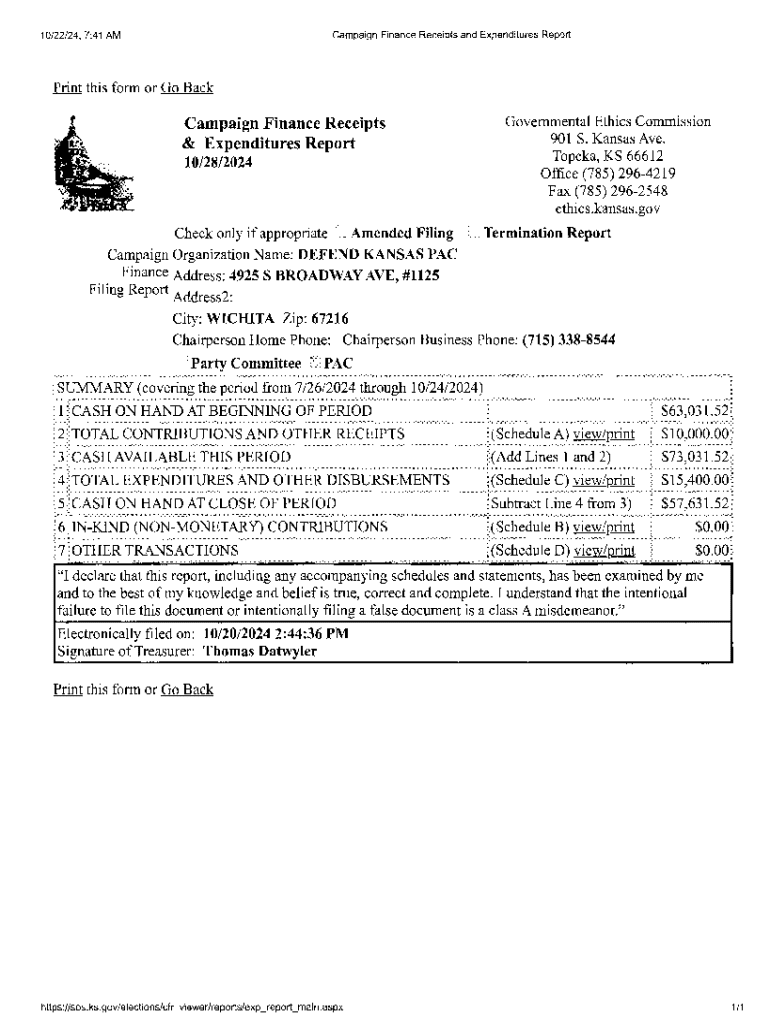

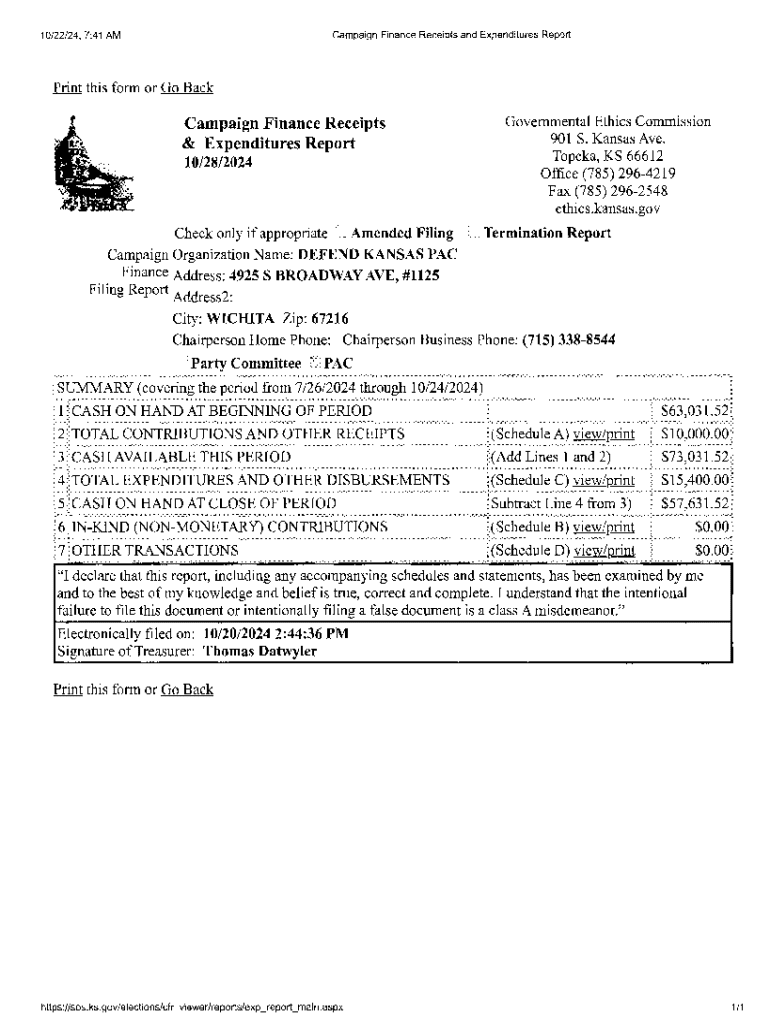

Campaign finance receipts represent the documented record of contributions collected during political campaigns. These receipts are crucial for maintaining transparency and accountability in financing electoral processes. They enable candidates and committees to report income received to regulatory bodies and the public, ultimately ensuring compliance with established laws.

Understanding the regulations governing campaign contributions is vital for candidates. Various rules delineate the types of donations, contribute limits, and necessary disclosure requirements. Ignoring these regulations can lead to penalties that may hinder a candidate’s campaign or result in legal ramifications.

Types of campaign finance receipts

Key components of campaign finance receipts

Each campaign finance receipt must include essential information to satisfy regulatory requirements. Key details include the donor's name and contact information, the amount contributed, and the date the contribution was received. This information aids in tracking donor participation and serves as evidence of compliance with regulations.

Additionally, categorizing contributions correctly is essential. Varying between primary and general election contributions and considering party affiliation can impact reporting obligations. These classifications ensure that campaigns adhere to specific rules attached to different election cycles.

Regulatory compliance

Compliance with federal and state regulations is paramount in managing campaign finance receipts. The Federal Election Commission (FEC) has established guidelines that regulate how much individuals and corporations can contribute to campaigns. State-specific laws, such as those in New York, may have unique provisions that campaigns must adhere to, particularly concerning contribution limits and reporting requirements.

Campaigns must avoid common pitfalls that can jeopardize compliance. Key areas for attention include ensuring timely financial reporting deadlines are met and accurately disclosing all contributions. Failing to do so can result in significant penalties and undermine public trust.

Filling out the campaign finance receipt form

Completing the campaign finance receipt form correctly is central to a campaign's transparency. There are three main sections in the form that need careful attention. In Section 1, the donor's information must be collected and input accurately. This includes gathering details like the full name, mailing address, and contact information.

In Section 2, the contribution details need to be specified. This entails choosing the right category for the donation and correctly entering the amount. Misclassifying contributions can be detrimental, so ensuring clarity in this section is critical. Finally, Section 3 involves certification and signature, which solidifies the acknowledgment of the contribution details. Maintaining compliance with signature requirements is essential to validate the form.

Tools for managing campaign finance receipts

Leveraging tools such as pdfFiller can enhance efficiency in managing campaign finance receipts. With comprehensive features like cloud-based document editing, users can easily access and modify forms from anywhere. The platform supports eSigning, ensuring compliance with signature requirements while facilitating a secure process for both donors and campaigns.

Furthermore, pdfFiller's collaborative tools empower campaign teams to work together seamlessly. Integration with campaign finance management systems allows for effective tracking and aligned compliance efforts, reducing the complexities that can arise in donation management.

Tracking and reporting campaign finance receipts

Maintaining accurate records of campaign finance receipts is vital for ensuring transparency and accountability in fundraising. Proper documentation builds trust with voters and stakeholders, demonstrating the campaign’s commitment to ethical fundraising practices. By regularly reviewing and organizing these receipts, campaigns can better prepare for filing obligations and potential audits.

Additionally, using tools like pdfFiller to generate detailed reports from receipts can facilitate strategic planning. Reporting functions allow campaigns to analyze contributions over time, assess engagement levels, and adjust fundraising strategies to meet or exceed campaign goals. Accurate data analysis based on these reports can guide decisions on expenditure, matching funds, and addressing potential changes in a special election calendar.

FAQs on campaign finance receipts

Addressing common questions about campaign finance receipts can clarify processes for both candidates and contributors. A frequent concern is how often receipts need to be submitted. Typically, campaigns must adhere to specific reporting schedules mandated by the FEC and state regulations, which varies according to the type of election.

What happens if a receipt is missing or contains an error? Candidates must document such occurrences and take necessary amendments to ensure compliance. Moreover, understanding how to handle refunds or adjustments is essential for campaigns to maintain accurate records and avoid discrepancies that may arise during audits.

Additional considerations for campaign finance management

Best practices for campaign teams include actively engaging with supporters and keeping detailed engagement records. Understanding the diversity of contributions can improve fundraising strategies and help campaigns maximize their potential. Developing a compliant fundraising strategy involves not only adherence to regulations but also fostering positive relationships with potential donors to enhance contribution levels.

Additionally, campaigns should monitor their fundraising against the guidelines to ensure compliance with provisions set forth by the appropriate regulatory bodies. Keeping abreast of amendments and changes to regulations can prevent unintentional violations. Establishing a transparent culture around campaign finance can boost credibility and encourage voter trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts and directly from Gmail?

How do I edit campaign finance receipts and online?

How do I edit campaign finance receipts and on an iOS device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.