Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

A comprehensive guide to campaign finance receipts and form management

Understanding campaign finance

Campaign finance is a critical aspect of the electoral process, serving as the backbone for funding political campaigns. It encompasses all financial contributions to candidates, parties, and political committees aimed at influencing elections. The importance of campaign finance lies not only in facilitating candidates' ability to run for office but also in ensuring transparency and accountability within the political landscape.

Without robust campaign finance regulations, there would be an increased risk of corruption, diminished public trust, and inequitable representation in the political arena. Therefore, understanding the regulatory framework that governs campaign finance is essential for anyone involved in the electoral process.

Regulatory framework

Campaign finance in the United States is shaped by federal and state regulations, with the Federal Election Commission (FEC) overseeing compliance at the national level. Key legislation, including the Bipartisan Campaign Reform Act (BCRA) and the Federal Election Campaign Act (FECA), establishes rules regarding contribution limits, the disclosure of campaign finances, and the reporting requirements for candidates and committees. Understanding these laws is critical, especially for candidates and teams managing campaign finance receipts and forms.

The role of receipts in campaign finance

Receipts play a fundamental role in campaign finance by ensuring transparency and accountability. Each receipt serves as documentation for financial contributions, providing a clear record of incoming funds. This transparency helps build voter trust and ensures that candidates are held accountable for how they utilize their financial resources.

Moreover, campaign receipts are vital for tracking the campaign’s financial health. They allow candidates' teams to monitor contributions and expenditures, enabling them to make informed decisions as they navigate the complexities of running for office.

Types of campaign finance receipts

Campaign finance receipts typically fall into two categories: contributions and expenditures. Contributions may come from individuals, organizations, or political action committees (PACs). Expenditures, on the other hand, reflect the money spent in pursuit of campaign goals. Additionally, it’s important to understand in-kind contributions, which are non-monetary gifts such as services or goods that support a campaign.

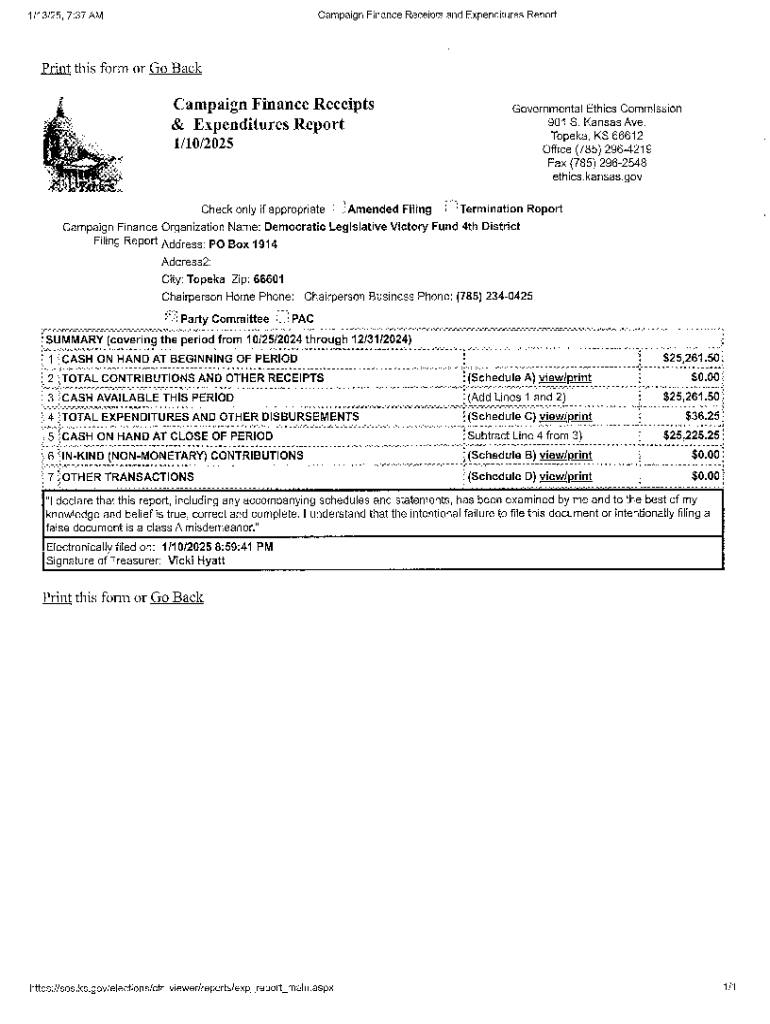

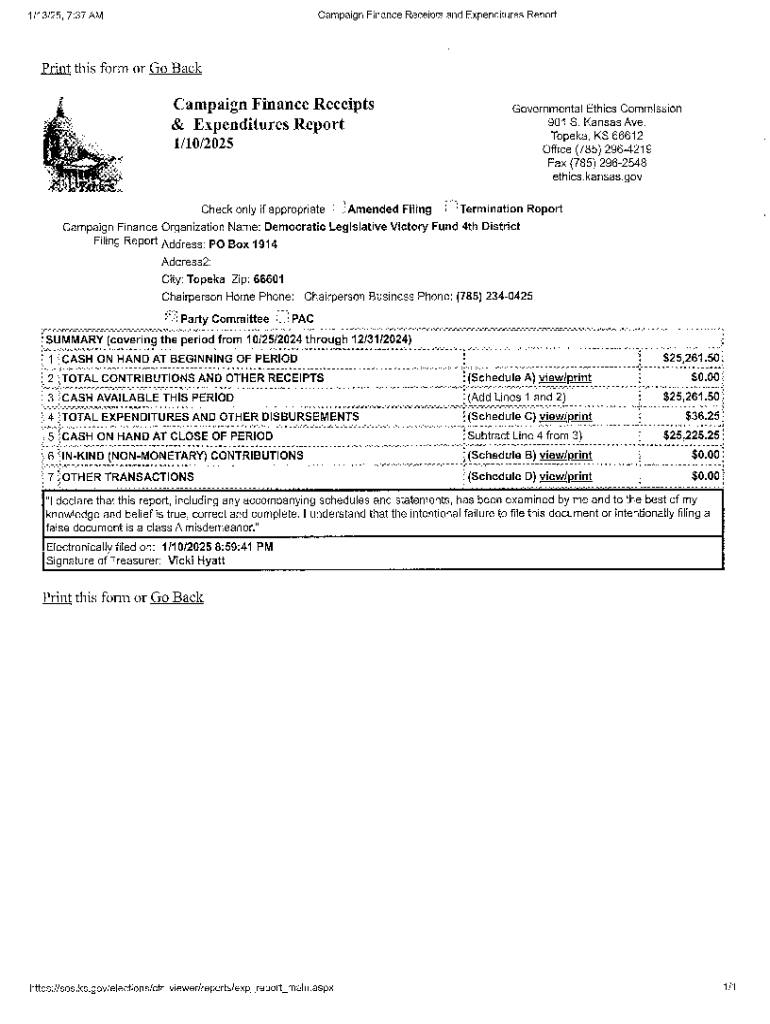

Campaign finance receipts form overview

The Campaign Finance Receipts Form is a crucial document that candidates, political parties, and committees are required to file. This form consolidates all financial contributions and expenditures related to a campaign, creating a comprehensive disclosure report. Its primary purpose is to maintain transparency in campaign fundraising and spending, fostering public trust in the electoral process.

Candidates and political entities must understand who needs to file this form to maintain compliance with federal and state election laws. Failure to do so can lead to penalties, including fines or disqualification from the election.

Key components of the form

The Campaign Finance Receipts Form requires several key components for thorough documentation. These include:

Step-by-step guide to filling out the campaign finance receipts form

Successfully completing the Campaign Finance Receipts Form begins with preparation. Gathering the necessary documentation ahead of time will streamline the process. This includes establishing a clear record of each contribution received, along with any relevant details that may be required.

Understanding the reporting deadlines is also vital, as each state and federal requirement will differ, affecting when your document must be submitted.

Detailed instructions for each section

Each section of the form must be completed meticulously to avoid errors and ensure compliance. Here’s a breakdown of what is needed:

Common mistakes to avoid

Mistakes in the Campaign Finance Receipts Form can lead to compliance issues with greater repercussions. Common errors include failing to report all contributions, leaving fields incomplete, or misclassifying the type of contribution. Ensuring thoroughness will help avoid amendments and the need for additional reports.

Editing and managing your campaign finance receipts

Once the Campaign Finance Receipts Form is completed, it's crucial to effectively manage and edit these documents as necessary. pdfFiller offers an intuitive platform for making adjustments to forms, allowing easy editing of existing information directly in a cloud-based format.

To get started, simply upload your form and utilize features that enable annotating and correcting any erroneous entries. Saving and storing your documented forms securely in the cloud ensures they are retrievable at any time, which is especially important during filing periods.

Collaborating with team members

Collaboration is a significant aspect of managing campaign finance receipts. pdfFiller allows you to share documents with team members for review and input. Using real-time collaboration tools enhances teamwork efficiency, making it easy for multiple users to engage in the editing process simultaneously.

eSigning your campaign finance receipts form

The use of electronic signatures (eSignatures) has gained traction as a legally accepted means of signing documents, including the Campaign Finance Receipts Form. This not only expedites the approval process but also ensures compliance with legal regulations surrounding documentation.

pdfFiller streamlines the eSigning process, allowing users to create and apply an eSignature effortlessly. By securing signed documents, candidates can maintain a clear chain of accountability and protect sensitive financial information.

Submitting your campaign finance receipts form

Submission of the Campaign Finance Receipts Form can vary between online and mail-in processes depending on state-specific rules. Most candidates prefer the online submission route for convenience, allowing for quicker processing and receipt acknowledgment.

Mail-in submission, while still an option, requires adherence to specific guidelines and deadlines to ensure timely acceptance. Candidates should meticulously check all pieces of information to avoid filing obligations that can generate penalties for late submissions.

Deadlines for submission

Awareness of submission deadlines is critical for compliance. Each state establishes its schedule, and candidates must familiarize themselves with these timelines to avoid complications. Missing a deadline can significantly impact a candidate's campaign viability.

Monitoring and tracking your campaign finance contributions

Monitoring contributions is essential for the overall health of a campaign. Utilizing tools available in pdfFiller can assist in tracking and reporting contributions efficiently. They provide individualized dashboards that make contribution tracking straightforward and intuitive.

Additionally, establishing best practices for record-keeping, such as maintaining digital backups and categorizing financial records, can further enhance management efficiency. This proactive approach helps ensure candidates are always prepared for audits and reporting periods.

Navigating state-specific variations in campaign finance forms

Campaign finance regulations can vary significantly from state to state. Candidates must familiarize themselves with specific form requirements to avoid discrepancies and ensure compliance across different jurisdictional lines. Many states offer resources and guidance on locating appropriate forms.

Resources include state election offices, nonprofit organizations, and online toolkits that outline specific requirements and best practices for different state regulations.

Key differences across states

Recognizing the key differences across states can save time and resources. Understanding how each state's election laws influence the required filing processes is crucial as it dictates everything from contribution limits to the form of reporting required.

Case studies: Successful campaigns and their finance management

Examining successful campaigns provides valuable insight into effective financial reporting practices. For instance, observing campaigns that have utilized transparency as their main strategy reveals the direct correlation between clear financial communication and voter support.

However, analyzing failed campaigns offers critical learning opportunities, showcasing how lack of transparency and poor financial management can lead to distrust and, ultimately, electoral failure. Candidates can use these lessons to structure their financial practices toward success.

Additional tools and features of pdfFiller for campaign finance management

Leveraging innovative document management features in pdfFiller greatly enhances the effectiveness of campaign finance form management. The platform provides users with the ability to fill forms, edit documents, and collaborate efficiently in one central location.

Ongoing updates ensure that tools are continually improved to meet evolving needs within campaign finance. Users can expect enhanced features that facilitate easier navigation and increased compliance with updated regulations, which is crucial for maintaining accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify campaign finance receipts and without leaving Google Drive?

How do I execute campaign finance receipts and online?

How do I edit campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.