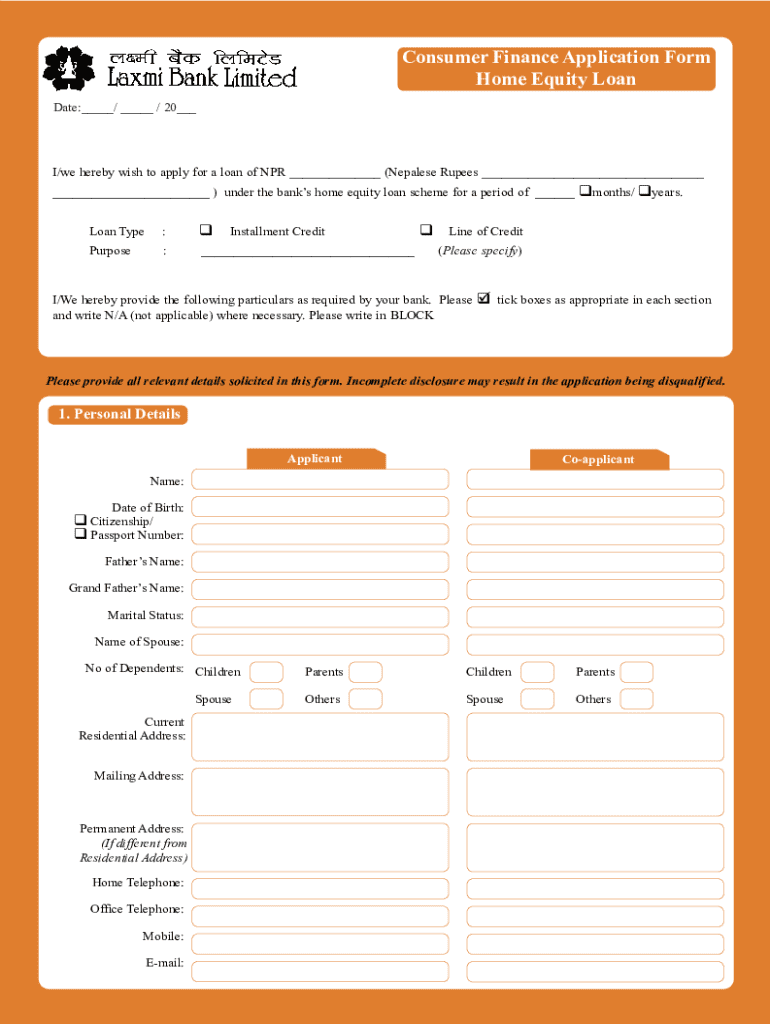

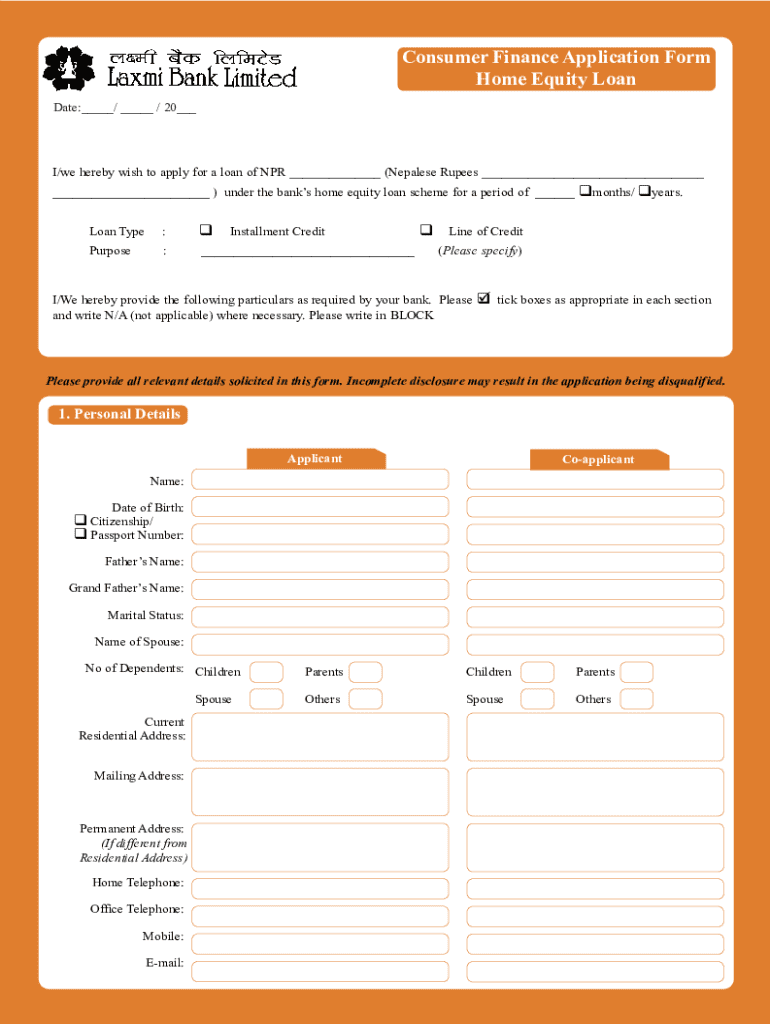

Get the free Consumer Finance Application Form

Get, Create, Make and Sign consumer finance application form

How to edit consumer finance application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer finance application form

How to fill out consumer finance application form

Who needs consumer finance application form?

The Consumer Finance Application Form: A Comprehensive Guide

Understanding the consumer finance application form

A consumer finance application form is a crucial document used by financial institutions to assess an individual’s eligibility for credit products, such as loans and credit cards. This form collects essential information about the applicant’s personal and financial status, enabling lenders to make informed decisions. Given the competitive landscape of consumer finance, completing this form accurately and comprehensively is paramount in securing financing.

The importance of the consumer finance application form extends beyond mere approval. It lays the foundation for a relationship between the borrower and lender, establishing trust and transparency from the onset. It includes multiple components that reflect the applicant's financial health, including personal information, employment history, and references.

Key steps for filling out the form

Completing the consumer finance application form involves several important steps to ensure accuracy and completeness. Proper preparation is vital to facilitate a smooth application process and bolster your chances of approval.

Step 1: Gathering required documentation

Before starting the application, gather essential documents that provide evidence of your identity, income, and financial history. This preparation not only speeds up the process but also improves the quality of information provided to lenders.

Step 2: Completing the personal information section

In the personal information section, include precise details about yourself that lenders require to identify and assess your application. This typically includes your full name, date of birth, address, and social security number.

Be cautious to avoid common mistakes such as typos or incorrect information, as these discrepancies can slow down the approval process. Double-check your details to ensure everything is accurate.

Step 3: Filling in financial information

The financial information section is pivotal because it provides lenders with insights into your economic stability. Be honest and detailed while reporting your income and expenses, including monthly bills and any outstanding debts.

Step 4: Detailing employment history

Your employment history section needs to convey your job stability and reliability. List your current and past job titles, along with descriptions of responsibilities that pertain to your financial acumen.

If there are gaps in your employment, be prepared to explain these to ensure lenders understand your employment trajectory.

Step 5: Adding references

References can bolster your application with additional credibility. Select people who have a good understanding of your financial behavior and character.

Interactive tools for application management

To enhance your experience, pdfFiller offers interactive tools that simplify the management of your consumer finance application form. These features can greatly aid in the editing and submission process, ensuring a hassle-free completion.

Utilizing pdfFiller’s editing features

With pdfFiller’s editing tools, you can easily rearrange sections of your document, making it easy to customize the application to fit your needs.

eSigning the application

pdfFiller also allows you to eSign your application easily. This feature not only expedites the submission process but also ensures you meet the legal requirements associated with signing a document.

Collaborating with team members

If you’re working with a team, pdfFiller supports real-time document sharing options that promote collaboration. This helps ensure that everyone involved in the application process can add their input and review the document together.

Special considerations

When preparing your consumer finance application, it’s essential to consider data privacy and security. Protecting your personal information is paramount in today's digital age, where data breaches have become increasingly prevalent.

Understanding data privacy and security

Ensure that the platform you use, like pdfFiller, adheres to stringent security protocols to safeguard your data. pdfFiller employs various security measures to protect users' information, including data encryption and secure cloud storage.

Common challenges and how to overcome them

Creating a consumer finance application can present challenges, especially regarding verifying information accuracy. Inaccuracies can lead to delayed approvals or even rejections.

After submission: What to expect

After you submit your consumer finance application form, it enters the review process with lenders. This phase can vary in length depending on the lender’s workload and the complexity of your financial situation.

The review process by lenders

Lenders will scrutinize your application to ascertain your creditworthiness and assess any risks associated with lending to you. Typically, you should expect a timeline that ranges from a few days to several weeks.

Optimizing your application for faster approval

Optimizing your application can significantly impact the speed of approval. Proper organization of your documentation and clear presentation of your numbers can result in a smoother process.

Tips for organizing your information

Creating a checklist of required documents can streamline your application process. Ensure that all required paperwork is not only collected but presented clearly and accurately.

Leveraging technology to streamline document collection

Utilize productivity tools to automate your information gathering. Many apps can track expenses and incomes, making it easier to compile the information lenders require.

Maintaining your application over time

Your consumer finance application does not end with submission. Keeping it updated is key, especially when your financial circumstances change.

Keeping your application updated

Regular updates can be crucial for your financial standing with lenders. Inform them of substantial changes in income or financial responsibilities, as this information may affect your credit eligibility.

Final review steps before submitting another application

Before submitting another application, performing a final review is crucial. This involves checking all elements of your application against the requirements set by the lender.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit consumer finance application form from Google Drive?

How do I make edits in consumer finance application form without leaving Chrome?

How do I fill out the consumer finance application form form on my smartphone?

What is consumer finance application form?

Who is required to file consumer finance application form?

How to fill out consumer finance application form?

What is the purpose of consumer finance application form?

What information must be reported on consumer finance application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.