Get the free Charitable Donation of Securities in-kind

Get, Create, Make and Sign charitable donation of securities

Editing charitable donation of securities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable donation of securities

How to fill out charitable donation of securities

Who needs charitable donation of securities?

Your comprehensive guide to the charitable donation of securities form

Understanding charitable donations of securities

Charitable donations of securities include contributions of investment assets, such as stocks, bonds, and mutual funds, to nonprofit organizations. By donating securities instead of cash, individuals can offer significant support to their chosen charities while benefiting from unique financial advantages.

Donating securities possesses substantial benefits, notably tax incentives. Contributors often avoid capital gains taxes on appreciated securities while receiving a charitable deduction based on the fair market value of the donated assets. This dual advantage amplifies the impact of their philanthropic efforts.

Moreover, donating securities allows for maximizing charitable contributions, fostering a culture of generosity that meets both personal and community needs. Support for charitable causes can create lasting benefits, helping organizations fulfill their missions more effectively.

The process of donating securities

Before proceeding with a donation of securities, donors must check their eligibility and understand pertinent criteria. Eligibility may include considerations related to the donor's tax status, the nature of the securities, and the specific requirements of the receiving charity.

Once eligibility is confirmed, donors should assess their investment portfolio to determine the worth and types of securities they can donate. Calculating the estimated market value is crucial, as it directly influences tax deductibility.

Finally, deciding on the charity is key. Research potential organizations to ensure their mission aligns with your values and that they can responsibly utilize the funds. Engaging with charities before donating may clarify any specific requirements or procedures they have in place.

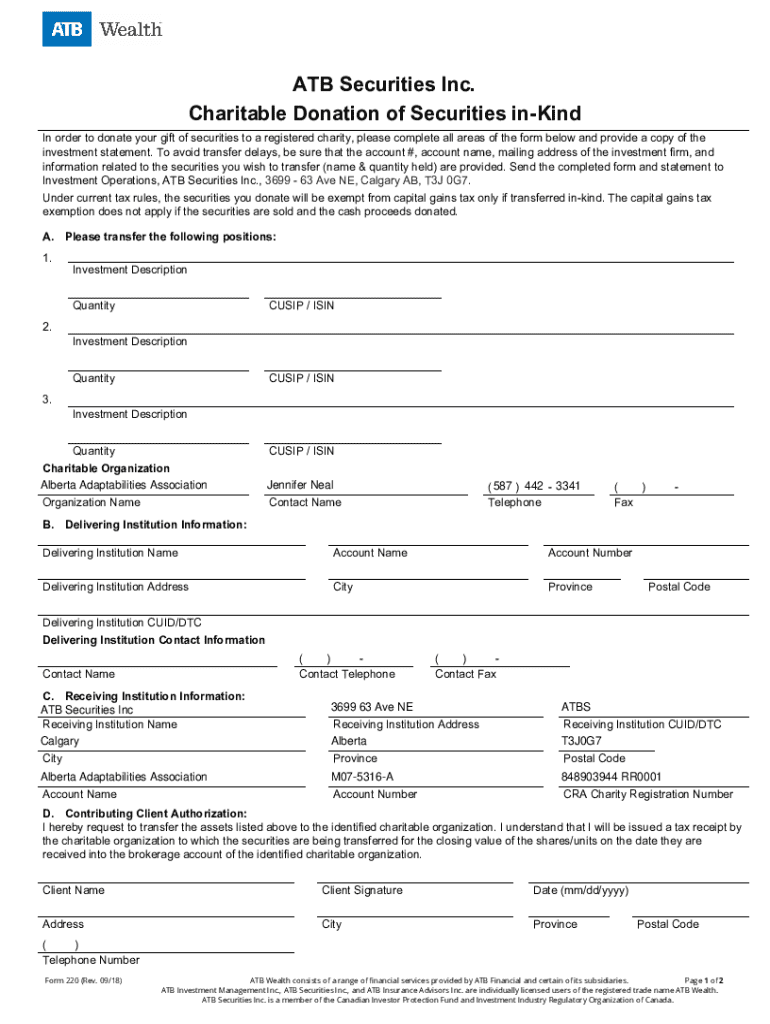

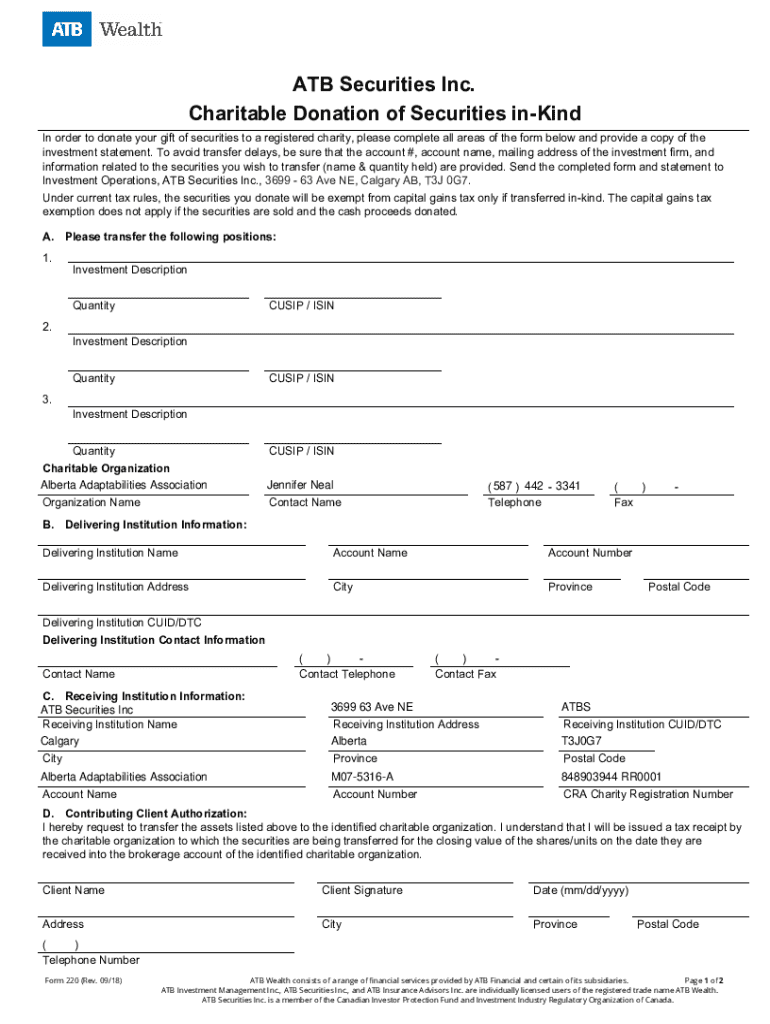

Completing the charitable donation of securities form

The charitable donation of securities form serves as the official documentation needed for processing the donation. It's crucial for donors to fill it out accurately to ensure proper recording and compliance with IRS regulations.

Start with the personal information section, filling in your name, address, and contact details. Next, document the details of the securities, including a clear description, the number of shares or units being donated, and their estimated market value based on recent trading data.

When providing charity information, include the name of the charity and their registration number to ensure proper identification. Lastly, all necessary signatures must be included for the form to be valid.

Strategies for engaging with charitable organizations

Effective communication with the charity enhances the donation experience. Informing the charity early about your intent to donate can facilitate a smooth process, allowing them to prepare for the incoming securities and understand your specific contribution.

Post-donation, it is prudent to follow up with the charity. Requesting acknowledgment letters not only serves as a record for personal tax purposes, but also helps the charity acknowledge and plan for the future support you will be providing.

Ensuring proper tax documentation is crucial to maintain compliance with tax laws. Ensure that you receive a donation receipt from the charity, which will be essential when filing tax returns.

Managing the donation process with pdfFiller

pdfFiller provides users with powerful features for managing forms such as the charitable donation of securities form. With the ability to access form templates from anywhere, users can start their donation process with ease.

To use pdfFiller, simply upload the charitable donation of securities form, edit it as required, and then send it for eSignature. Users benefit from cloud storage, ensuring that their completed forms are safe and easily accessible for future reference.

This streamlined process helps minimize errors, allowing you to focus more on the impact of your charitable donation rather than the paperwork involved.

Making the most of your charitable donation

After completing the charitable donation of securities form, it's essential to assess the impact of your contribution. Understanding how your donation will support the charity's mission can deepen your commitment and enhance your philanthropic journey.

Donors can also plan for future giving strategies. Setting up a giving account or developing a structured donation plan will allow you to manage your charitable efforts more effectively.

Engaging with charities over time and observing the results of your contributions can create a meaningful ongoing relationship with these organizations, ultimately benefiting both the donor and the recipient.

Conclusion

In summary, donating securities can be a rewarding process that delivers significant benefits to both the donor and the charity. By understanding the steps involved, filling out the charitable donation of securities form correctly, and utilizing tools like pdfFiller, individuals can maximize their philanthropic impact.

Taking action by donating securities not only enriches the lives of those in need but also fulfills personal financial goals. Embrace the opportunity to give back while optimizing your investments today.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in charitable donation of securities?

Can I create an eSignature for the charitable donation of securities in Gmail?

How do I fill out charitable donation of securities using my mobile device?

What is charitable donation of securities?

Who is required to file charitable donation of securities?

How to fill out charitable donation of securities?

What is the purpose of charitable donation of securities?

What information must be reported on charitable donation of securities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.