Get the free Ct-12f

Get, Create, Make and Sign ct-12f

How to edit ct-12f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-12f

How to fill out ct-12f

Who needs ct-12f?

CT-12F Form: A Comprehensive Guide

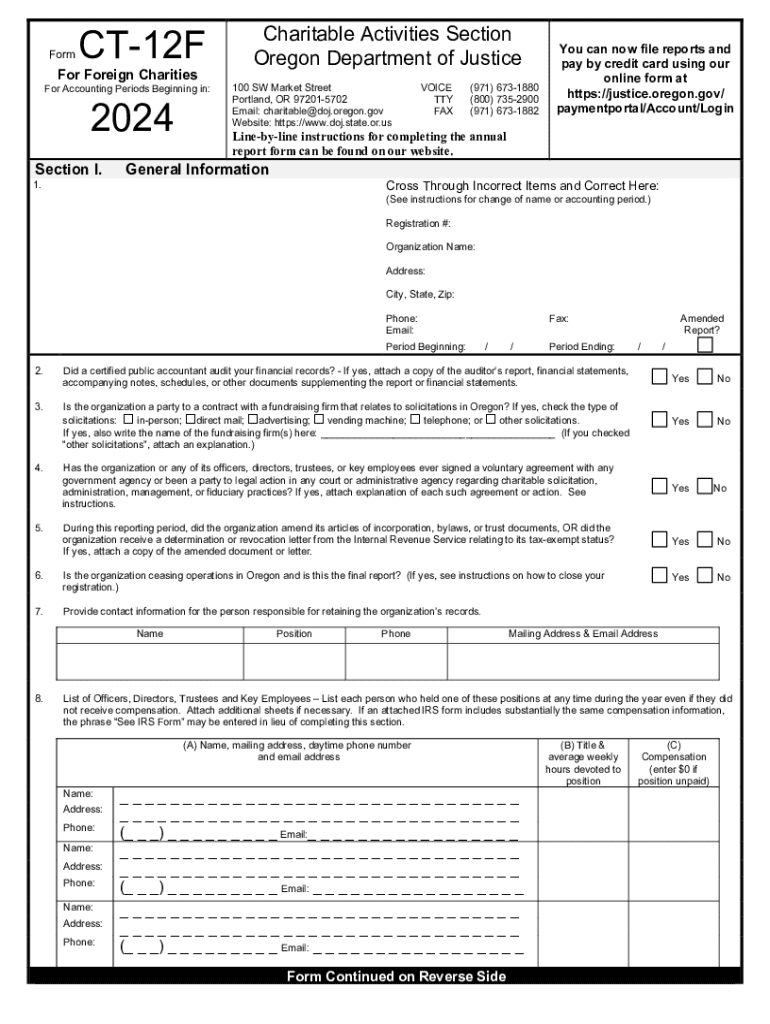

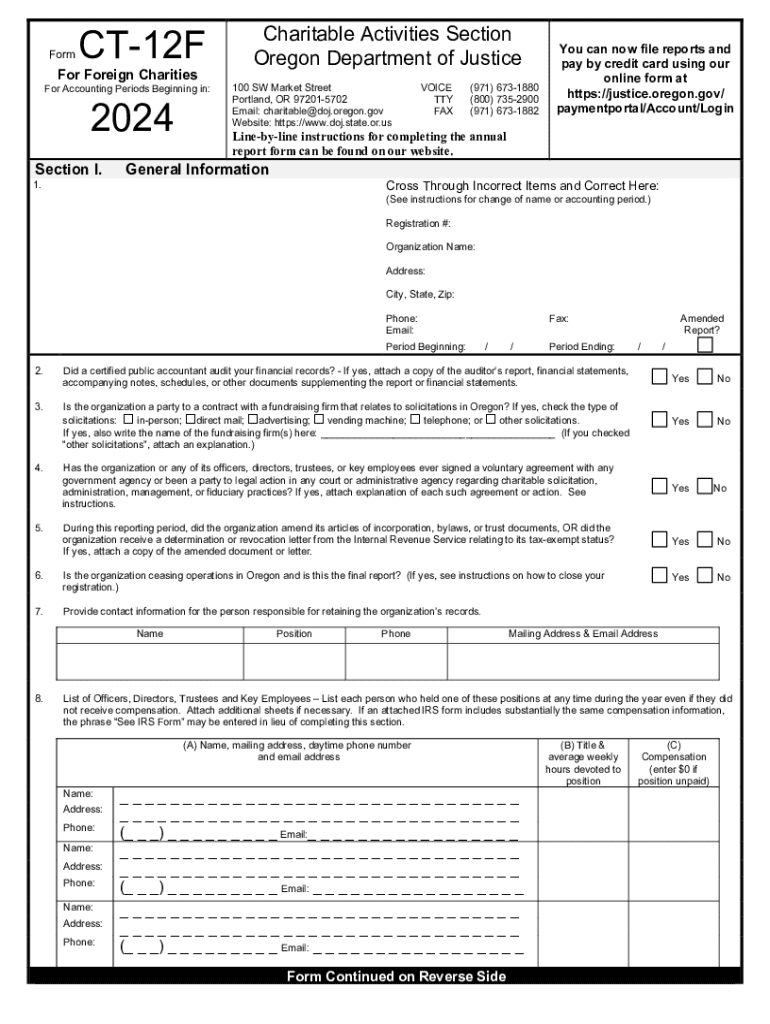

Overview of the CT-12F Form

The CT-12F Form is a critical document used primarily in the context of tax filings and financial reporting. This form serves as an essential tool that enables individuals and businesses to report specific financial information succinctly and accurately. The proper use of the CT-12F Form streamlines compliance with regulations and facilitates effective financial management.

Understanding the importance of the CT-12F Form is vital for both taxpayers and tax professionals. Its accuracy can significantly impact one’s tax obligations or potential refunds. The form is particularly relevant for those who need to report income earned from various sources, ensuring that every dollar is accounted for and that accurate records are maintained. Consequently, it's imperative that those required to utilize this form do so with precision.

Key features of the CT-12F Form

The CT-12F Form consists of several fields and sections, each uniquely designed to capture specific data required for effective reporting. Fields may include taxpayer information, income sources, deductions, and credits. Understanding the structure of the form is crucial to avoiding common pitfalls that could lead to processing delays or errors in tax returns.

Common terms and acronyms found within the CT-12F Form, such as AGI (Adjusted Gross Income) or Deductions, must be comprehended fully to ensure accurate completion. Familiarity with these terms not only aids in filling out the form correctly but also arms users with the knowledge necessary to engage in discussions with tax professionals or auditors regarding their submissions.

Step-by-step instructions for filling out the CT-12F Form

Completing the CT-12F Form requires careful attention to detail. First, you must gather all necessary information and documents. This includes your previous tax returns, W-2 forms, 1099s detailing income, and any other relevant financial documentation. Having this information at your fingertips will facilitate a smoother process.

Completing each section of the CT-12F Form

When filling out each section, adhere strictly to the instructions provided. For example, ensure your taxpayer information is accurate and matches your identification documents. Errors here can lead to delays in processing your forms. Use clear language and double-check numerical data. Pay particular attention to income sections to ensure all earnings are accurately reported.

Once you've completed the form, reviewing all provided information is paramount. Check for any common errors such as numeric discrepancies or missed signature lines, as these can result in processing delays or penalties. A simple checklist of items to verify can be invaluable: ensure names are spelled correctly, Social Security numbers are accurate, and that every required signature is included.

Editing and managing your CT-12F Form

Accessing and editing your completed CT-12F Form can be seamlessly handled with pdfFiller. The platform allows users to make modifications to their forms effortlessly. Using tools provided by pdfFiller, you can easily correct mistakes or update information without hassle. This feature significantly enhances the user experience, especially in cases where multiple revisions are necessary.

The interactive tools available on pdfFiller for managing your CT-12F Form are tailored for efficiency. From sharing forms for collaboration to securely saving your progress in the cloud, the advantages of this cloud-based solution are clear. Users can take a collaborative approach, working together on the form and ensuring all necessary data is accurate.

eSignature options for the CT-12F Form

Understanding the eSigning process for your CT-12F Form can significantly expedite your submission. With pdfFiller, adding an electronic signature is simple. Just follow the system prompts to create your eSignature. This provides a fast and secure way to authorize your submissions, ensuring your documents comply with legal standards.

Adding an electronic signature enhances efficiency in completing essential paperwork. Once you’ve input your eSignature according to the instructions, you can proceed with submitting your form directly through pdfFiller. Understanding the legal implications of eSigning is also crucial; your eSignature holds the same validity as a handwritten signature, thus streamline your submission process.

Submission of the CT-12F Form

Submitting your CT-12F Form can be done through various channels, including online submission via pdfFiller, or physically mailing the form to the appropriate tax authority. Each method has its benefits, and selecting the right approach can aid in maintaining compliance efficiently.

It’s crucial to adhere to submission deadlines. Missing a deadline may result in late fees, which can accumulate quickly. By choosing to use pdfFiller, users benefit from streamlined submission processes that notify you of deadlines, reducing the chances of incurring unnecessary fees. Consider using the platform to manage reminders, ensuring that you’re always on top of important due dates.

Frequently asked questions (FAQs)

Many users have common queries about the CT-12F Form, ranging from filing requirements to troubleshooting issues when completing the document. One prevalent question is about what happens if there’s an error on the form post-submission. Understanding corrective measures and the protocols to follow can alleviate stress surrounding potential mistakes.

For those encountering trouble while completing the form, it's beneficial to have troubleshooting tips handy. Knowing where to find help, whether that's through pdfFiller’s support resources or professional tax advisors, can provide peace of mind during the filing process.

Benefits of using pdfFiller for the CT-12F Form

Using pdfFiller for your CT-12F Form offers distinct advantages, notably its cloud-based platform that enhances accessibility and flexibility. Users can access their forms from any device, allowing for complete document management on-the-go. The platform’s collaborative features enable teams to work together efficiently, ensuring that every aspect of the form is properly addressed.

Additionally, pdfFiller includes integrated functionalities such as eSigning and direct submission options, all in one place. This not only streamlines the workflow but also supports users with features tailored to their unique needs. Many customers have shared success stories about how pdfFiller has revolutionized their document management processes, making it a top choice for managing the CT-12F Form.

Interactive tools to enhance your CT-12F Form experience

pdfFiller offers a suite of interactive tools specifically designed to simplify the process of filling out the CT-12F Form. Features such as drag-and-drop functionality for document uploads, easy editing tools, and intuitive navigation streamline form completion. Harnessing these tools allows users to maximize efficiency and accuracy.

By utilizing the full suite of tools provided by pdfFiller, you can enhance your experience while working with the CT-12F Form. Tips like making use of template suggestions, utilizing the comment section for team feedback, and saving completed forms in an organized manner can transform the way you manage documents and streamline your workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ct-12f directly from Gmail?

How do I complete ct-12f online?

How can I fill out ct-12f on an iOS device?

What is ct-12f?

Who is required to file ct-12f?

How to fill out ct-12f?

What is the purpose of ct-12f?

What information must be reported on ct-12f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.