Get the free Checking Account Reconcilement

Get, Create, Make and Sign checking account reconcilement

Editing checking account reconcilement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checking account reconcilement

How to fill out checking account reconcilement

Who needs checking account reconcilement?

Your Comprehensive Guide to the Checking Account Reconcilement Form

Understanding the checking account reconcilement process

Checking account reconciliation is the process of ensuring that your financial records align with those of your bank. It involves verifying transactions, checking for discrepancies, and making adjustments as necessary. Reconciliation is essential for accurate financial management; it helps you track your spending and balances effectively, detect any unauthorized transactions, and support better financial decision-making.

The importance of reconciliation cannot be overstated. Regularly reconciling your accounts not only maintains financial accuracy but also safeguards your assets. It also identifies potential budgeting errors and helps prevent overdraft fees. Common issues that arise during reconciliations may include incorrectly recorded transactions, missing entries, or duplicated data. These problems can lead to confusion and financial discrepancies if not addressed promptly.

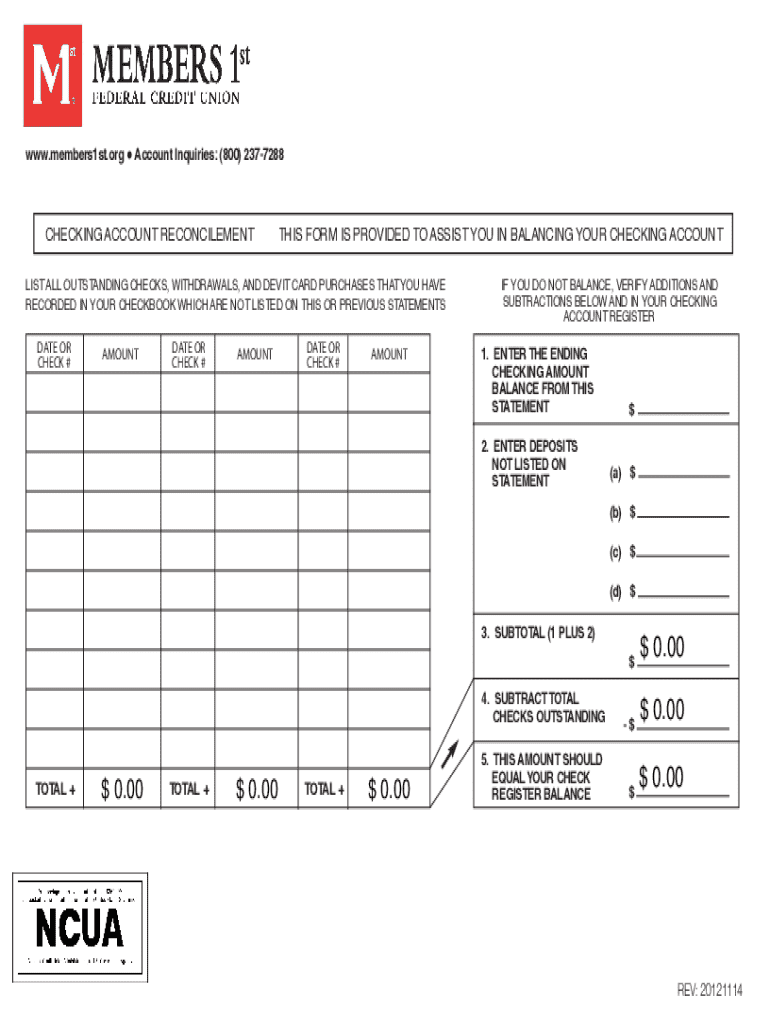

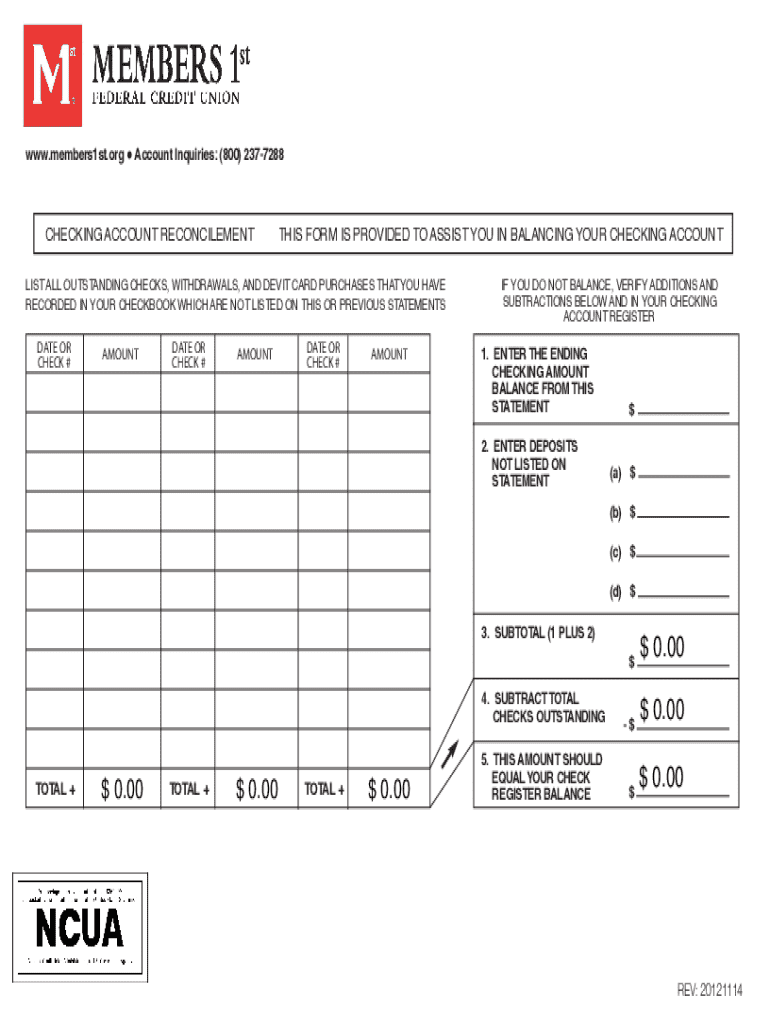

Overview of the checking account reconcilement form

The checking account reconcilement form is a structured document that facilitates this crucial process. It typically contains several key components designed to streamline reconciliation. First, basic account information is essential, including the account number and the date of the reconciliation. Next are transaction records, where you document all deposits, withdrawals, and fees incurred within the reconciliation period.

Transactions listed in this form typically include deposits, withdrawals, and applicable bank fees. The objective of this form is to create a clear comparison between your records and those of your bank, allowing discrepancies to be identified and resolved efficiently.

Step-by-step guide to completing the checking account reconcilement form

To effectively complete the checking account reconcilement form, start by gathering necessary documents. Collect your recent bank statements and any transaction receipts that provide details on your spending and income during the period. This foundational step sets the stage for accurate reconciliation.

Next, fill out the form methodically. Enter your basic information first, such as the account number and date of reconciliation. From there, begin documenting each transaction. Carefully check your bank statement against your records, inputting data where discrepancies may arise. When documenting transactions, ensure corrections are made for any bank fees or any other adjustments. After your entries are complete, cross-reference them with your bank statement; this is crucial in identifying discrepancies and reconciling balances efficiently.

Finally, after ensuring that all entries are accurate, finalize the reconciliation by signing and dating the form. Keep a copy of the completed form for your records, ensuring that it's easily accessible for future reconciliations.

Tips for effective reconciliation

Regular reconciliation offers immense benefits, but it needs to be done consistently and correctly. Best practices suggest conducting this procedure at least monthly or quarterly. Setting reminders on your calendar can help establish a routine, so check your accounts regularly and avoid the last-minute scramble when statements are due.

Avoid common pitfalls like missing transactions and making assumptions without verification. When utilizing technology, platforms like pdfFiller can significantly enhance tracking and management. With its interactive tools for editing documents and cloud-based collaboration capabilities, pdfFiller streamlines the process of keeping your checking account up to date.

Troubleshooting common issues

Discrepancies between your records and bank's records can lead to significant confusion. Causes of discrepancies may include data entry errors, duplicated transactions, or unauthorized bank fees. Documenting the exact amount and date of each transaction helps resolve these conflicts.

Missed transactions can also pose a challenge. If you suspect you've overlooked an entry, checking transaction logs and comparing them with bank statements can help identify missing credits or debits. Resolving conflicts typically involves calculating adjustments and ensuring both records agree, which ultimately leads to accurate cash flow management.

Utilizing pdfFiller for your checking account reconcilement needs

pdfFiller offers an excellent solution for those looking to manage their checking account reconcilement seamlessly. The platform provides interactive tools, allowing users to easily edit and update documents as required. This means you can customize your checking account reconcilement form to fit your unique circumstances without hassle.

Additionally, pdfFiller's cloud-based collaboration features enable multiple users to work together on the same document, which fosters communication and quick decision-making. To access and use the checking account reconcilement form on pdfFiller, start by navigating the platform. Create an account or log in to your existing account, then locate the form you need. Once opened, you can customize your fields, adding or removing components as necessary.

The benefits of regular reconciliation

Regularly reconciling your checking account offers numerous benefits beyond mere accuracy. One primary advantage is the enhanced financial accountability it provides, ensuring that every transaction is accounted for. This leads to a clearer perspective on your cash flow, allowing individuals and teams to make informed financial decisions.

Additionally, understanding your cash flow through regular reconciliation can help identify areas where budgeting improvements can be made. A consistent and clear view of your financial landscape not only bolsters accountability but also supports strategic planning and resource allocation.

Frequently asked questions (FAQs)

One common question revolves around handling significant discrepancies. If you notice a major difference between your records and the bank’s statements, investigate thoroughly by reviewing each transaction and checking for errors. In case of any suspect transactions, contacting the bank for clarification is crucial.

Another frequently asked question relates to managing multiple accounts. If you operate more than one checking account, create individual reconcilement forms for each account. This streamlines the process and minimizes confusion. Last but not least, many wonder if reconciliation is possible without a bank statement. While not ideal, you can still reconcile by citing your transaction records but having the bank statement still remains the most accurate method.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send checking account reconcilement to be eSigned by others?

How do I edit checking account reconcilement on an iOS device?

How can I fill out checking account reconcilement on an iOS device?

What is checking account reconcilement?

Who is required to file checking account reconcilement?

How to fill out checking account reconcilement?

What is the purpose of checking account reconcilement?

What information must be reported on checking account reconcilement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.