Get the free Certificate of Insurance/financial Responsibility

Get, Create, Make and Sign certificate of insurancefinancial responsibility

How to edit certificate of insurancefinancial responsibility online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurancefinancial responsibility

How to fill out certificate of insurancefinancial responsibility

Who needs certificate of insurancefinancial responsibility?

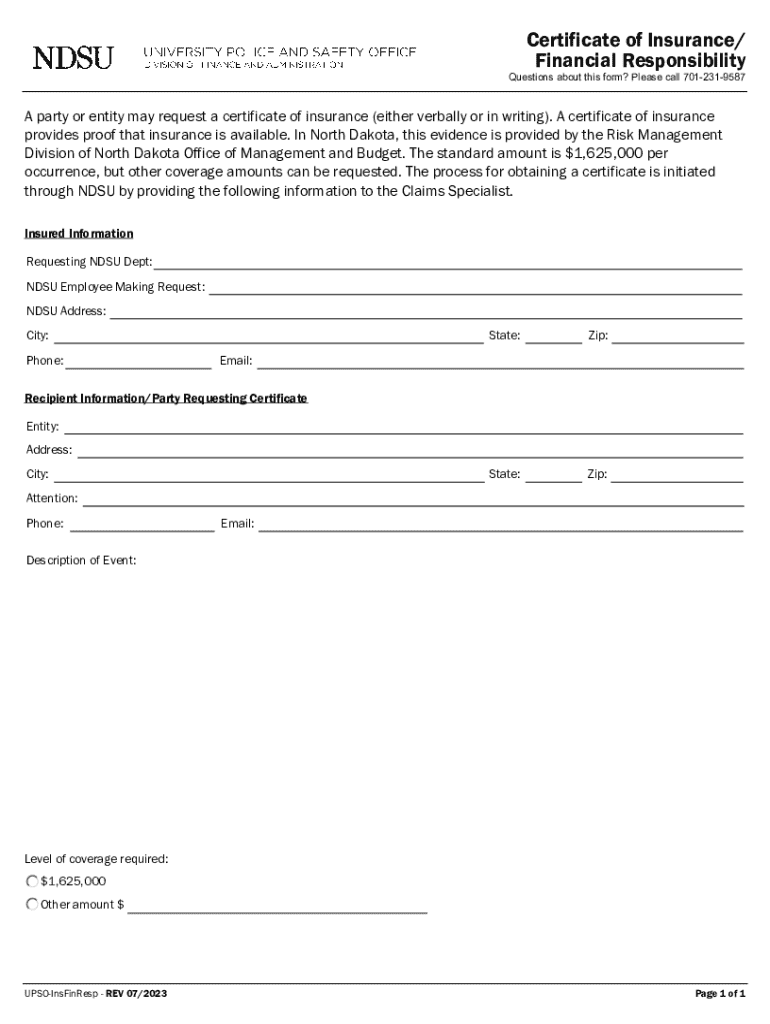

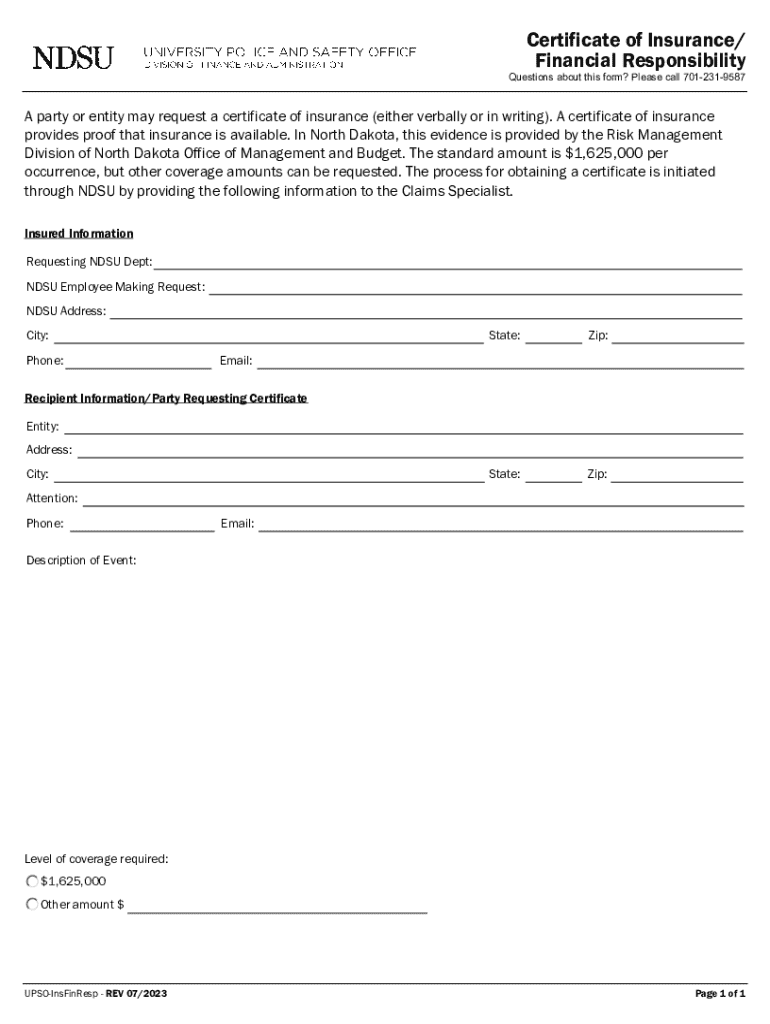

Navigating the Certificate of Insurance Financial Responsibility Form

Understanding the certificate of insurance

A certificate of insurance is a document that serves as proof that an individual or organization carries insurance coverage. It details the types of insurance, the amount of coverage, and the policyholder's information. The primary purpose of this certificate is to provide evidence of financial responsibility, ensuring that the individual or business has the necessary protection against potential liabilities.

Financial responsibility is crucial, especially in sectors where significant risks are present. For instance, contractors, landlords, or businesses engaging in potentially hazardous activities must present proof of insurance coverage to clients, regulatory bodies, or other stakeholders. This not only protects the interests of all parties involved but also assures them of your commitment to responsible business practices.

Whether for personal or commercial purposes, a certificate of insurance is essential. Personal insurance might involve home or auto policies, while businesses could require more comprehensive coverage based on the industry standards. Understanding the implications of this certificate can significantly impact both personal security and business credibility.

Overview of financial responsibility forms

Financial responsibility forms are documents that individuals or businesses must complete to demonstrate they have the proper insurance coverage in place. These forms are typically required by a variety of entities, including regulators, clients, and partners. By providing proof of insurance through these forms, individuals and businesses can show they can cover potential liabilities that may arise during their operations.

There are different types of financial responsibility forms, which can vary by state or industry. Common examples include the SR-22 form for drivers showing proof of auto insurance, workers' compensation insurance certificates for businesses, and liability insurance certificates in the construction sector. These forms relate directly to insurance policies; they outline the essential coverage details so that stakeholders can assess the level of risk involved.

Understanding these forms and their requirements is vital for anyone looking to maintain compliance in their industry. An accurate financial responsibility form can safeguard against legal repercussions while enhancing trust and transparency among business relationships.

Step-by-step guide to completing a certificate of insurance financial responsibility form

Filling out a certificate of insurance financial responsibility form can seem daunting at first. However, by following a structured approach, you can ensure that you provide accurate information without any hassles. Here’s a step-by-step guide to help you through the process.

Preparing to fill out the form

Before you start filling out the form, gather the necessary information. This includes your personal or business details, insurance provider's information, and the specific coverage details required. It's important to be as thorough as possible, as incomplete data could lead to delays or the need for resubmission.

You will also need to understand the required documentation. Typically, this includes proof of policy coverage, premium payment records, and any endorsements that might apply. By having this documentation handy, you will streamline the filling process.

Filling out the form

When you start filling out the form, pay attention to the different sections. Key portions include:

To ensure accurate information entry, double-check all inputs and avoid assumptions. It is always best to verify if you're uncertain about certain entries.

Submitting your form

Once completed, you'll need to submit your form. Depending on the recipient, you might submit it online or transfer a physical copy. Ensure you understand the submission preferences of the certificate holder, as they might require certain formats.

Additional requirements may include providing proof of any supplementary documents. These requirements become particularly important in legal or regulatory contexts. Always confirm these details before submission.

Common mistakes to avoid

Navigating the completion and submission of a certificate of insurance financial responsibility form can come with pitfalls. Being aware of common mistakes can help mitigate challenges that could arise later.

By being aware of these mistakes, you can significantly increase the likelihood of a smooth process. It’s worth taking the time to double-check your work.

When to update your certificate of insurance

An essential aspect of maintaining your certificate of insurance is knowing when to update it. Life changes, business shifts, or changes in coverage often necessitate a revision of your financial responsibility form.

Common triggers for updates include changes to your policy limits, the addition or removal of coverage types, and your business information, such as relocations or rebranding. Each of these events may impact the validity of your certificate.

Updating an existing form typically involves filling out a new certificate and providing any new proof of coverage documents. Keeping your information current not only meets compliance requirements but enhances your credibility in your field.

Interactive tools for managing your certificate of insurance

In today’s digital world, having robust tools to manage your documents makes all the difference. Online platforms like pdfFiller provide a seamless experience for those looking to create, edit, eSign, and manage their certificate of insurance financial responsibility forms.

Features offered by pdfFiller include:

Using a cloud-based solution ensures that your documents are secure while providing the flexibility to access your forms anytime, anywhere. This level of efficiency can save significant time and reduce frustration in managing important documents.

FAQs about the certificate of insurance financial responsibility form

Case studies: Real-world application of financial responsibility forms

Examining how various industries utilize the certificate of insurance financial responsibility form can illustrate its significance. For example, in the construction industry, contractors are often required to provide proof of liability insurance before commencing work on a client’s property. This requirement not only protects the client but also showcases the contractor's professionalism and reliability.

Some businesses have found success stories from implementing robust document management systems like pdfFiller. Teams that adopted pdfFiller reported quicker turnaround times for filling out and submitting necessary forms, thereby improving workflow and client relations. Moreover, proper document management can also lead to enhanced compliance with regulatory requirements, which can prevent costly penalties.

Best practices for using pdfFiller for document creation

To maximize the benefits of pdfFiller for your certificate of insurance financial responsibility form, consider incorporating the following best practices:

These practices foster not only an efficient document management system but also a more collaborative environment, where your team can effectively work toward a common goal.

Contact and support information

If you encounter any issues while using pdfFiller or have specific questions related to completing your certificate of insurance financial responsibility form, reaching out to customer support can provide the guidance needed. Ensure you utilize support resources effectively and seek professional advice when necessary.

Professional guidance in insurance matters cannot be overstated. Consider consulting with an insurance expert to clarify policies and requirements related to your certificate of insurance. Additionally, utilizing resources for further assistance can alleviate confusion and contribute to informed decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of insurancefinancial responsibility directly from Gmail?

How do I fill out certificate of insurancefinancial responsibility using my mobile device?

Can I edit certificate of insurancefinancial responsibility on an iOS device?

What is certificate of insurance financial responsibility?

Who is required to file certificate of insurance financial responsibility?

How to fill out certificate of insurance financial responsibility?

What is the purpose of certificate of insurance financial responsibility?

What information must be reported on certificate of insurance financial responsibility?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.