Get the free Certification of Non-tax Filing Status for 2020

Get, Create, Make and Sign certification of non-tax filing

How to edit certification of non-tax filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certification of non-tax filing

How to fill out certification of non-tax filing

Who needs certification of non-tax filing?

Certification of Non-Tax Filing Form: A Comprehensive Guide

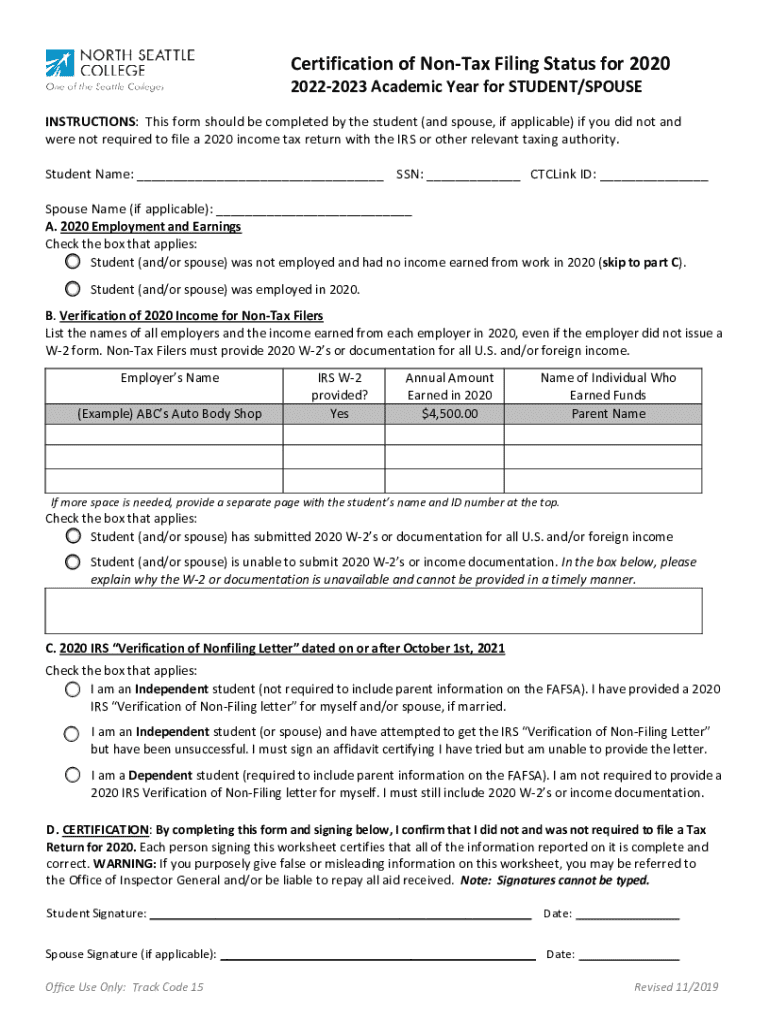

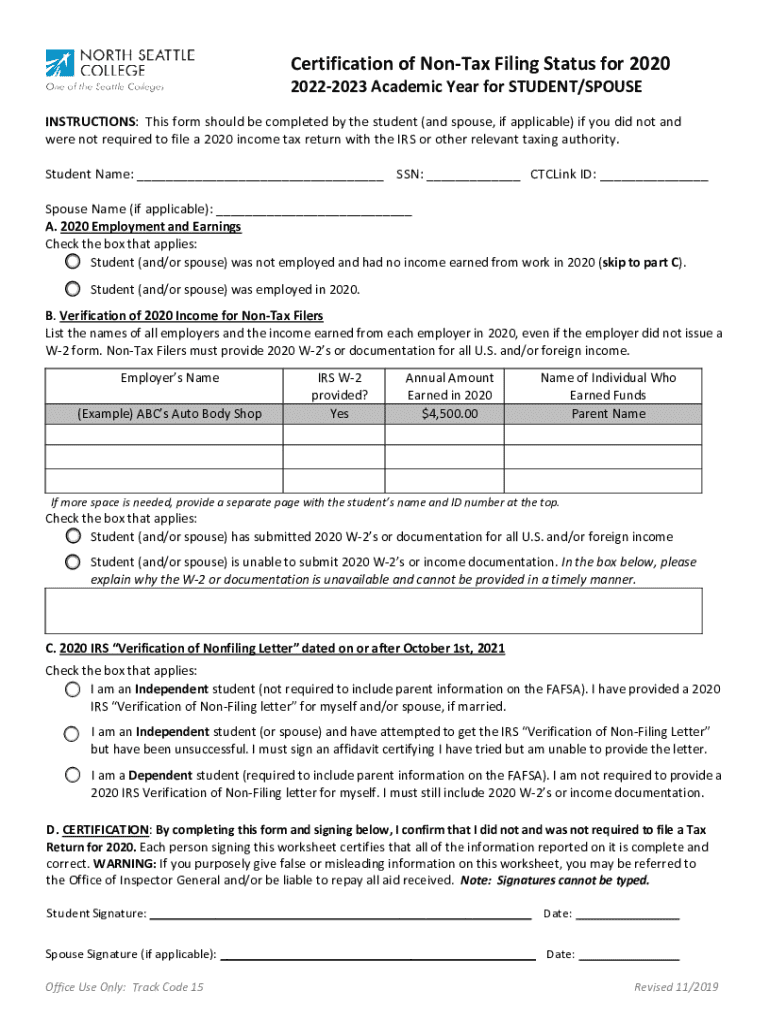

Understanding the certification of non-tax filing form

The certification of non-tax filing form is an essential document that certifies an individual did not file a federal income tax return in a specific tax year. This form is particularly important for students, parents, and veterans who need to provide proof of financial status when applying for financial aid, housing assistance, or government grants.

This document serves multiple purposes, such as demonstrating eligibility for federal financial aid programs like the Free Application for Federal Student Aid (FAFSA) or verifying income when applying for government housing assistance. A certification can also be required when a student or veteran needs support while attending educational institutions.

Who needs this certification? Individuals such as non-tax filers, veterans who are applying for aid, and students who did not earn income may frequently find themselves in need of this form. Each of these scenarios requires clear verification that no income tax return was filed, reinforcing the necessity of the certification of non-tax filing form.

Essential requirements for filing for certification

To obtain a certification of non-tax filing, you'll need to satisfy specific prerequisites laid out by the IRS. First and foremost, individuals must have a valid reason for their non-filing status, which often pertains to financial circumstances that resulted in no taxable income for the year in question.

Common documents required when applying include:

How to request an IRS verification of non-filing letter

Requesting an IRS verification of non-filing letter involves several steps. Follow this detailed guide to ensure you obtain the necessary documentation without a hitch.

Step 1: Determine eligibility for non-filing. Ensure that your income level falls below the IRS filing threshold, which varies by filing status and number of dependents.

Step 2: Obtain Form 4506-T from the IRS. This form will enable you to request the letter confirming your non-filing status.

Step 3: Fill out the form accurately, ensuring all required fields are completed and correct.

Step 4: Submit the request via mail or online, depending on your preference and available resources.

Step 5: Wait for processing. Typically, processing timelines can range from 5 to 10 business days.

To ensure a successful submission, double-check all information for accuracy and avoid common errors, such as incomplete forms or incorrect identification details.

Filling out the certification of non-tax filing form

Completing the certification of non-tax filing form requires attention to detail. Start by providing your personal information clearly, including your full name, Social Security number, and address. It's crucial to indicate your non-filing status accurately.

Additionally, some forms may require you to include statements or certifications about your non-filing status. Be precise in your declarations to avoid delays.

Common mistakes that individuals make when filling out this form include:

For reference, examples of completed forms can often be found through various online resources, providing a visual guide to assist in proper completion.

Interactive tools available on pdfFiller

pdfFiller offers a range of document editing tools that simplify the process of preparing and submitting the certification of non-tax filing form. By utilizing pdfFiller's cloud-based platform, users can take advantage of various features to streamline document management.

To fill out the certification of non-tax filing form using pdfFiller, follow these steps:

With pdfFiller's user-friendly interface, managing your documentation becomes efficient and hassle-free.

FAQs related to applying for aid with certification of non-tax filing form

Many individuals have questions when it comes to the certification of non-tax filing. Here are some frequently asked questions to clarify common concerns.

Contacting the IRS for further assistance

If you're facing challenges while applying for the certification of non-tax filing or have additional questions, reaching out to the IRS can provide clarity. It's critical to know when to seek help and how to do so effectively.

Resources for contacting the IRS include their official website and customer service phone numbers. Make sure to have your identification and any relevant documents ready when you contact them.

A few tips for speaking with IRS representatives include being polite, having all necessary documentation on hand, and being prepared to ask specific questions related to your situation.

Additional considerations

After submitting your application for the certification of non-tax filing, maintaining accurate records is crucial. Keep a copy of your submission and any correspondence with the IRS or other entities regarding your application.

Upon receiving your certification, it’s essential to understand the next steps. If using it for financial aid, promptly forward the document to the educational institution or relevant authority to prevent delays.

Lastly, always prioritize keeping your financial information secure. Store any sensitive information about your income and tax status in a safe place to prevent unauthorized access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certification of non-tax filing directly from Gmail?

How can I edit certification of non-tax filing from Google Drive?

How do I edit certification of non-tax filing on an iOS device?

What is certification of non-tax filing?

Who is required to file certification of non-tax filing?

How to fill out certification of non-tax filing?

What is the purpose of certification of non-tax filing?

What information must be reported on certification of non-tax filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.