Get the free Certificate of Exemption

Get, Create, Make and Sign certificate of exemption

How to edit certificate of exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption

How to fill out certificate of exemption

Who needs certificate of exemption?

Understanding the Certificate of Exemption Form: A Comprehensive Guide

Understanding the certificate of exemption form

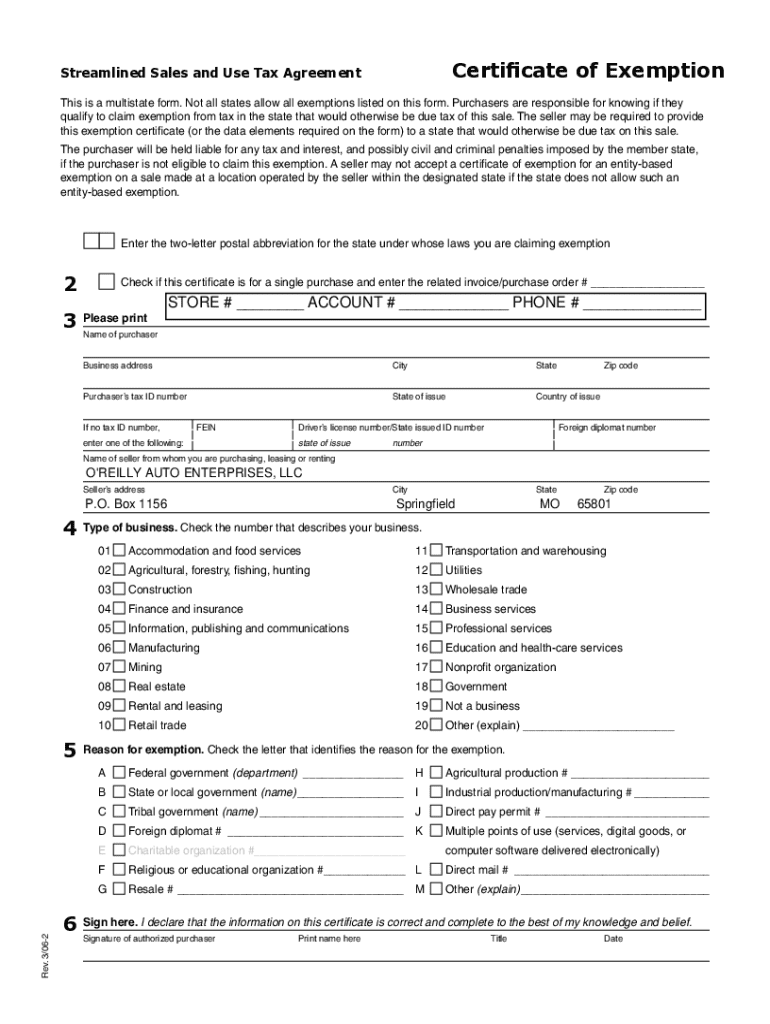

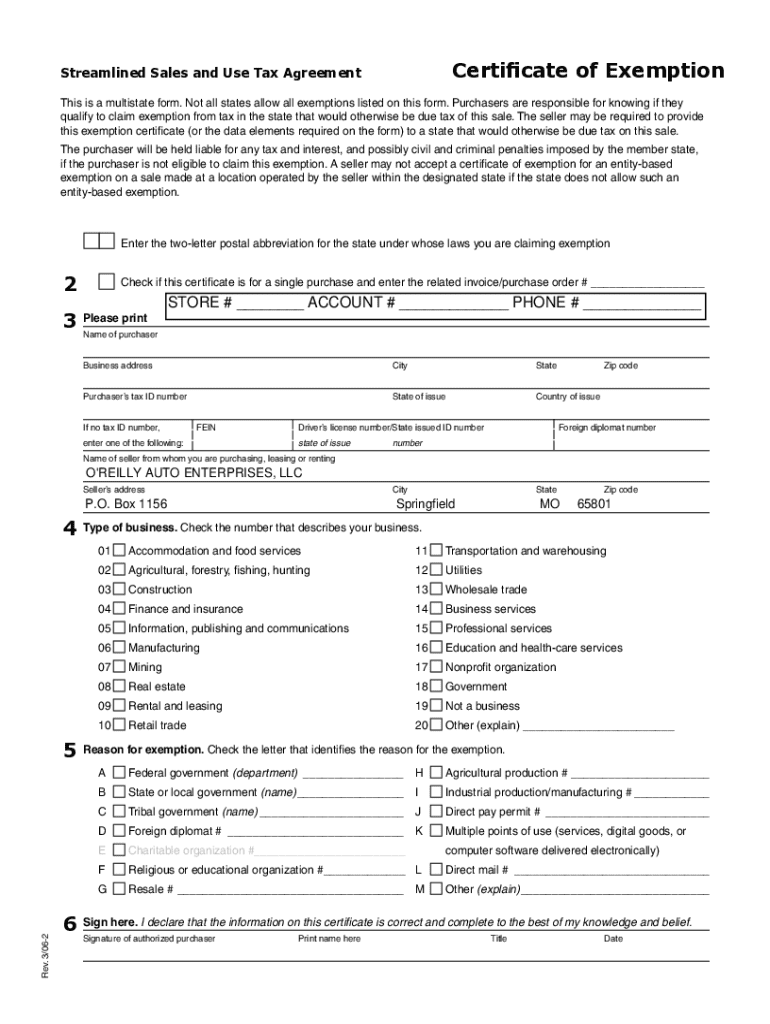

A certificate of exemption form serves as an essential document primarily utilized to indicate that certain purchases are exempt from sales and use taxes. This form is vital for both buyers and sellers as it identifies transactions that are eligible for tax exclusion, ensuring compliance with state regulations while preventing undue financial burden on eligible organizations.

Commonly, the certificate of exemption form is requested during business transactions involving non-profit organizations, government entities, or educational institutions. The primary purpose of this form is to delineate the specifics of the buyer's tax-exempt status and the nature of the purchases being made, enabling sellers to navigate the complexities of sales tax regulations effectively.

When is a certificate of exemption required?

A certificate of exemption is essential in various scenarios where the buyer qualifies for a tax exclusion. This includes instances where the buyer's purpose aligns with defined exemptions stipulated by state or local tax laws. For example, purchases made for charitable purposes or necessities during a state of emergency tax relief may be exempt. Knowing when to utilize this certificate is crucial for buyers to avoid unnecessary taxation.

Entities involved in these transactions encompass a range of organizations, notably non-profits, religious institutions, and government bodies. Understanding the specific regulations that delineate tax-exempt status can save significant amounts of money, especially for organizations heavily reliant on donations or public funding.

Types of certificate of exemption forms

There are various types of certificate of exemption forms, each governed by different state regulations. It's critical to discern the specific form required for your transactions, as many states have their unique versions. For instance, a California Tax Exemption Certificate differs significantly from a New York State Resale Certificate. Understanding state-specific requirements allows for compliance and seamless transactions.

In general, state certificates may fall under national guidelines, but they often require unique information such as state identification numbers or other localized requirements. Familiarizing oneself with these differences can prevent complications when dealing with tax exemption.

Step-by-step guide to completing the certificate of exemption form

Filling out the certificate of exemption form involves several well-defined steps, ensuring each section is completed thoroughly. The form typically includes sections dedicated to buyer information, seller details, and the reason for exemption. Ensuring accuracy and completeness in these sections is vital to prevent rejections and delays.

Start by gathering required information, such as tax identification numbers and official purchase details. Next, fill in the buyer information accurately, ensuring to specify the exempt status clearly. The seller's details should also be entered, followed by a precise description of the exemption's rationale. Lastly, don’t forget to sign the form to validate the information provided.

Common mistakes to avoid

While filling out the certificate of exemption form, several common mistakes can lead to complications. One prevalent issue is leaving sections incomplete. Each field must be thoroughly filled to avoid issues during audits or processing. Additionally, providing incorrect information—such as inaccuracies in tax ID numbers—can also lead to rejections, making it imperative to double-check everything before submission.

Inaccurate or incomplete submissions could cause delays in obtaining tax relief or result in unwarranted tax assessments against the purchase. It's crucial to approach the form systematically to mitigate these risks effectively.

Editing and customizing the certificate of exemption form

Customizing the certificate of exemption form to suit specific state regulations is essential for ensuring compliance. Using tools like pdfFiller, users can easily upload and edit their forms directly within the platform. This flexibility allows for modifications to be made in real-time, ensuring the document meets all necessary criteria, including incorporating additional documentation if required.

Additionally, pdfFiller enables users to add signatures and modify content effectively. Familiarizing oneself with such editing tools can greatly streamline the completion process and enhance overall document management.

Digital signature and eSigning the certificate of exemption form

In today's digital environments, the legality of digital signatures varies by state. A digital signature on your certificate of exemption form can greatly expedite the process while maintaining compliance. It is crucial to understand whether your state accepts eSigning to ensure the validation of the document.

When eSigning using pdfFiller, ensure you follow a structured step-by-step process. First, upload your completed document, then navigate to the signature section and choose your preferred method of signing, whether it be typing, drawing, or uploading an image. Once signed, double-check to ensure acceptance before finalizing the submission.

Submitting the certificate of exemption form

After completing the certificate of exemption form, submission procedures may differ based on each state’s regulations. Users should be aware of the appropriate methods for sending the completed document, whether electronically or through traditional mail. Knowing where to send it is essential for timely approvals and processing.

Furthermore, maintaining records of submissions is vital. Tools like pdfFiller can assist users in tracking their submissions efficiently, which is essential for audit trails or inquiries that may arise later.

Managing your certificate of exemption form

Post-submission, organizing your certificate of exemption form is crucial for ongoing compliance and easy access when needed. Utilizing platforms like pdfFiller provides users with powerful document management tools, enabling them to efficiently categorize and retrieve their forms whenever necessary.

Additionally, understanding when and how to renew or revise your certificate of exemption is vital. Submissions may need to be updated periodically based on changes in policies or operational structures, making vigilance in document management a necessity.

Frequently asked questions about the certificate of exemption form

One of the most common inquiries pertains to what action to take if a certificate of exemption form is rejected. In such cases, it is advisable to review the submitted information for any discrepancies before reaching out to the relevant authority for clarification. Keeping communication open can ensure a smoother resolution.

Another frequent question revolves around the validity of the certificate of exemption. Depending on the state, these forms can have a specific shelf life. It’s good practice to stay informed about your state’s regulations regarding the form’s validity, ensuring you remain compliant.

Case studies: Real-life scenarios using the certificate of exemption form

Examining real-life scenarios reveals how various individuals and organizations effectively utilize the certificate of exemption form. For instance, a local non-profit organization successfully obtained tax relief on the purchase of equipment essential for poverty alleviation initiatives, demonstrating the form's impact on enabling charitable efforts.

Conversely, some businesses learn valuable lessons from mistakes made during these transactions. For example, incorrect completion of the form resulted in a failure to secure tax exemption, leading to an audit that emphasized the importance of diligence in completing these forms accurately.

Conclusion: Your path forward with the certificate of exemption form

Navigating the intricacies of the certificate of exemption form can be daunting, but with the right tools and knowledge, the process can be streamlined. With pdfFiller, users are empowered to edit, sign, and manage their forms seamlessly from anywhere. By leveraging the features offered by pdfFiller, individuals and teams can ensure they stay compliant with state regulations while minimizing the time spent on document management.

Encouraging proactive engagement with forms allows users to maximize their benefits while maintaining vigilance in compliance. The path forward becomes clearer with the right tools at your disposal, setting a foundation for successful future transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get certificate of exemption?

How do I edit certificate of exemption online?

How do I complete certificate of exemption on an iOS device?

What is certificate of exemption?

Who is required to file certificate of exemption?

How to fill out certificate of exemption?

What is the purpose of certificate of exemption?

What information must be reported on certificate of exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.