Get the free Ct-1

Get, Create, Make and Sign ct-1

Editing ct-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1

How to fill out ct-1

Who needs ct-1?

Understanding the CT-1 Form: Your Comprehensive Guide

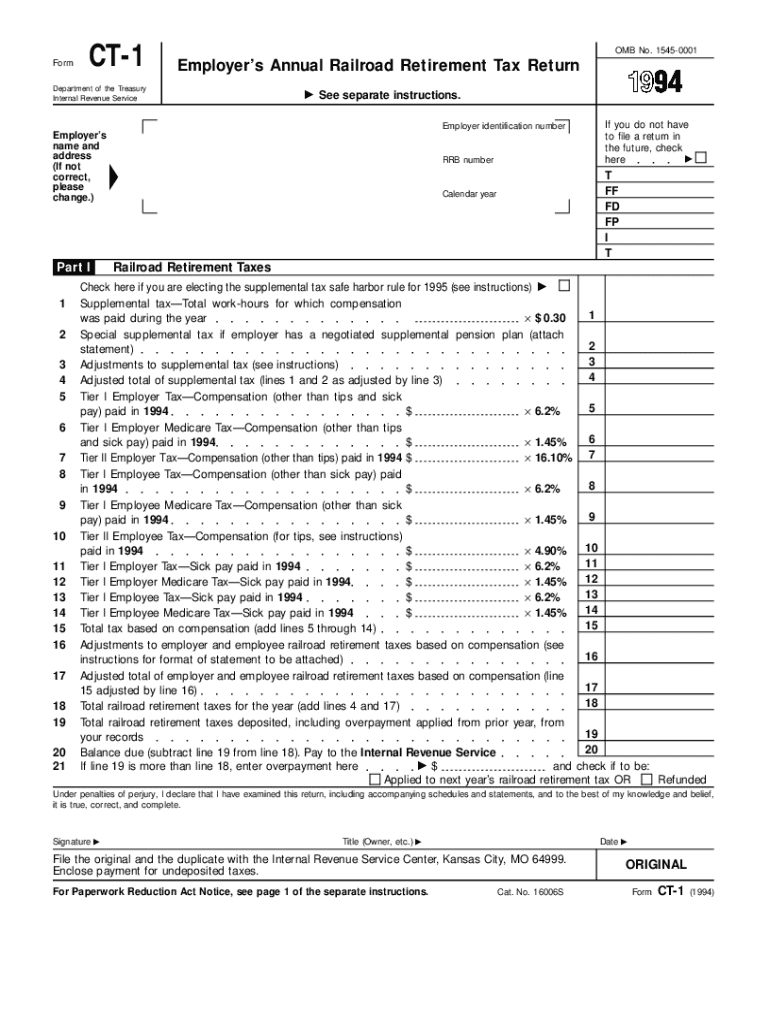

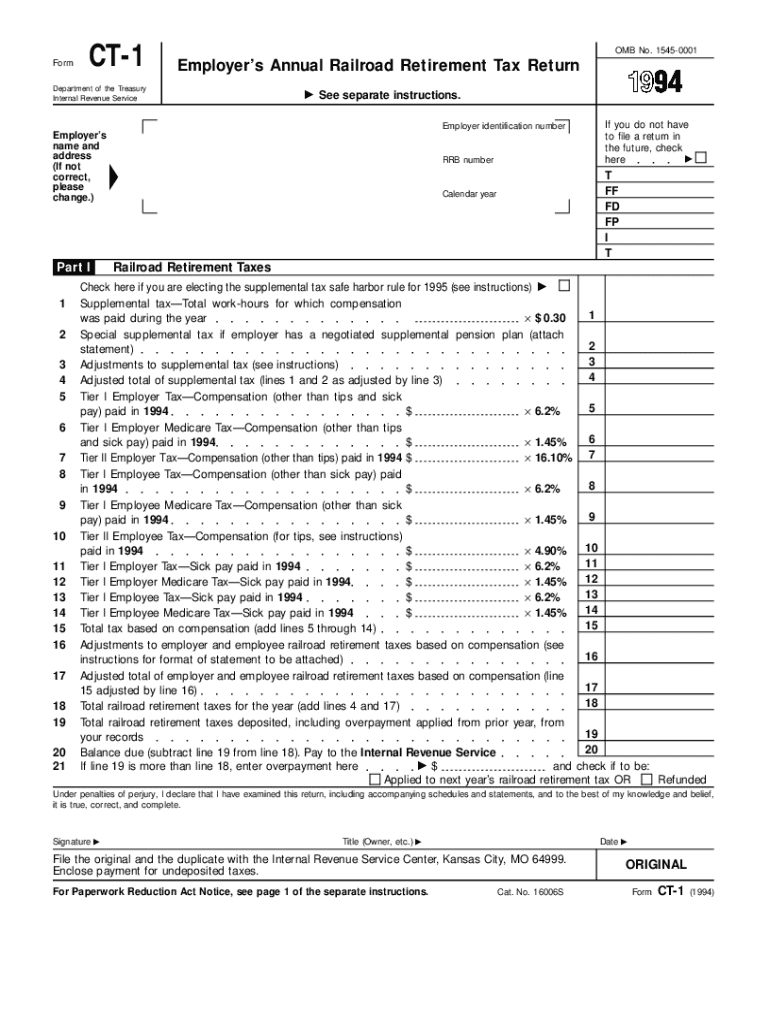

Understanding the CT-1 form

The CT-1 form is a crucial document used primarily in the realm of tax reporting and regulatory compliance. Specifically designed for certain businesses and organizations, it serves to report specific income and applicable deductions. Its accurate completion ensures compliance with Federal regulations, thereby safeguarding the filing entity from potential penalties.

Components of the CT-1 form

To properly navigate the CT-1 form, understanding its components is essential. The form includes an identification section that captures essential information about the entity filing, followed by various financial data fields. Each section demands precise clarity since inaccurate entries can lead to significant compliance issues.

Filling out the CT-1 form

Filling out the CT-1 form requires meticulous attention to detail. Begin by gathering all necessary information such as prior financial statements, your organization's tax ID, and any relevant receipts. Utilizing pdfFiller’s interactive tools can facilitate the data entry process, ensuring that all fields are accurately populated.

Editing the CT-1 form

Editing the CT-1 form is simple with pdfFiller's editing tools. Whether correcting mistakes or updating information, the platform provides seamless text editing features. Additionally, users can add annotations or comments to facilitate team collaboration and ensure all changes are clearly communicated.

eSigning the CT-1 form

eSigning the CT-1 form has become invaluable in the digital age. The process of obtaining eSignatures through pdfFiller is straightforward. Understanding the signatory roles and how to set signature fields is crucial to ensure that the document holds legal weight upon submission.

Submitting the CT-1 form

The submission of the CT-1 form can occur via electronic filing or traditional postal methods. Each method comes with distinct deadlines that must be adhered to in order to avoid potential complications. Utilizing pdfFiller’s tracking features allows you to monitor submission status and address any delays or issues promptly.

Managing your CT-1 form post-submission

Post-submission management of your CT-1 form is vital for long-term compliance. Best practices involve archiving completed forms securely and ensuring easy retrieval for any follow-up requests from regulatory agencies. Being proactive in document management can prevent unnecessary headaches during audits or validations.

Common mistakes to avoid with the CT-1 form

Navigating the CT-1 form can be fraught with pitfalls. Common errors include misreporting income or failing to claim eligible deductions. Understanding these mistakes proactively can enhance your filing accuracy and ensure adherence to regulations, thus avoiding IRS audits or penalties.

Real-life examples and case studies

Case studies can provide insights into how various organizations have leveraged the CT-1 form effectively. For instance, a non-profit organization streamlined their filing process using pdfFiller, resulting in timely submissions and favorable outcomes during audits. These success stories highlight practical measures that can enhance the overall efficiency of completing the form.

FAQs related to the CT-1 form

Addressing frequently asked questions (FAQs) about the CT-1 form can clarify the filing process and alleviate common concerns. For example, many individuals question the necessity of certain attachments or the implications of late submissions. Clear answers to these questions foster understanding and promote compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-1 to be eSigned by others?

How do I execute ct-1 online?

How do I edit ct-1 straight from my smartphone?

What is ct-1?

Who is required to file ct-1?

How to fill out ct-1?

What is the purpose of ct-1?

What information must be reported on ct-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.