Get the free Ct Fair Plan Property Loss Notice

Get, Create, Make and Sign ct fair plan property

How to edit ct fair plan property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct fair plan property

How to fill out ct fair plan property

Who needs ct fair plan property?

CT Fair Plan Property Form - How-to Guide

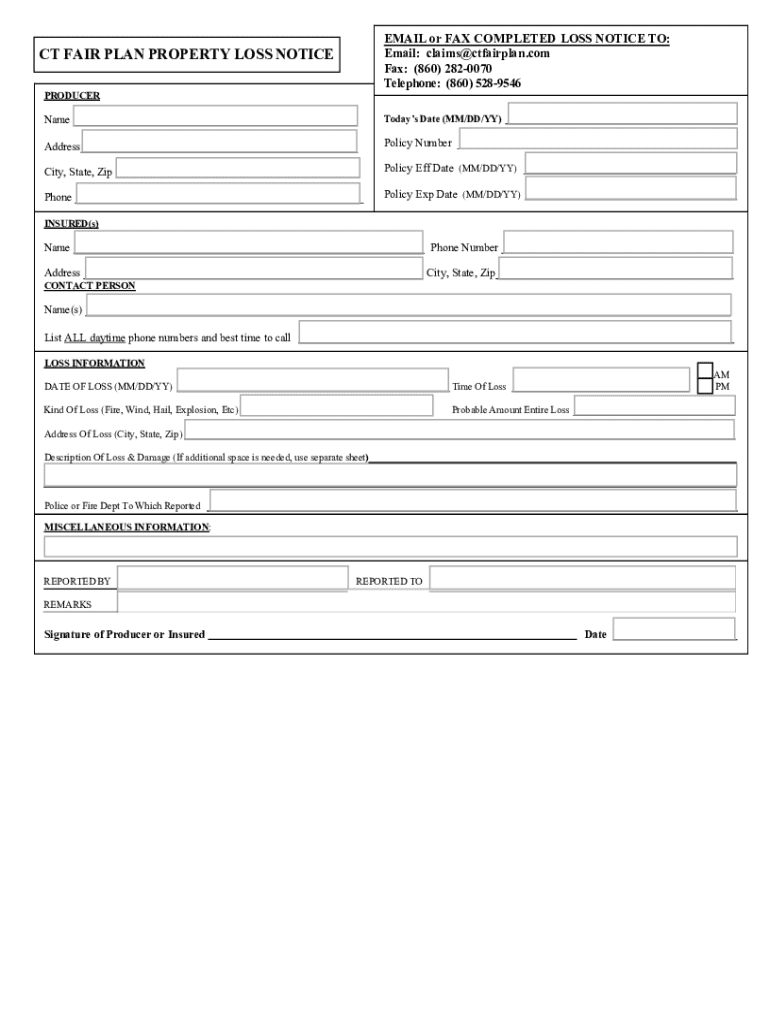

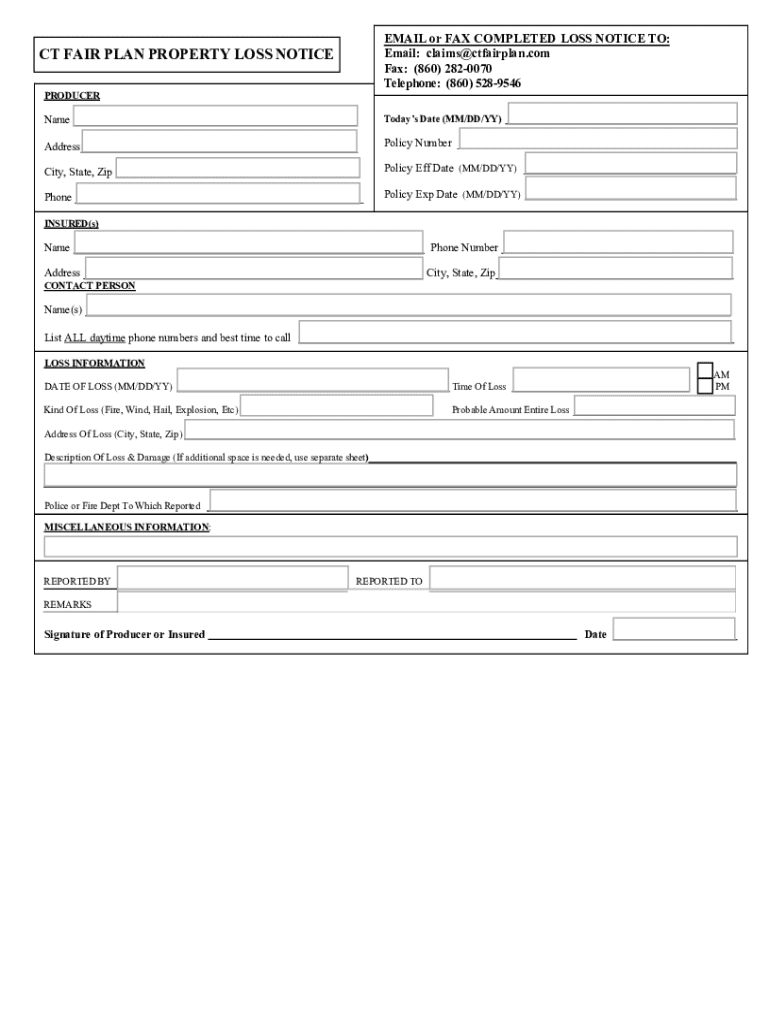

Understanding the CT Fair Plan Property Form

The CT Fair Plan is an insurance program designed to provide homeowners and businesses in Connecticut with access to essential property coverage when traditional market options are unavailable. Its foundation stems from the need to protect those at risk of fire, theft, and other perils. The CT Fair Plan Property Form is a critical tool within this program, serving as the application through which individuals can seek necessary coverage.

Understanding the intricacies of the CT Fair Plan Property Form is essential for any applicant. Proper completion of this form can mean the difference between securing adequate coverage and facing potential gaps or shortcomings in insurance protection. This guide aims to deliver an in-depth understanding of this form and the necessary steps to complete it accurately.

Navigating the CT Fair Plan Property Form

Each section of the CT Fair Plan Property Form plays a vital role in determining your insurance coverage. The first part is a property description, where you must provide crucial details about the location and characteristics of your property, such as the type of building, its address, and features that may influence your coverage status. This section is essential for underwriters assessing risk and determining applicable premiums.

Next comes the liability coverage options. Liability coverage protects you from claims that arise due to injuries or damages occurring on your property. It’s crucial to select limits that adequately reflect your risk exposure. Insufficient coverage can leave you vulnerable to significant financial losses in case of unforeseen events.

Filling out the CT Fair Plan Property Form

To fill out the CT Fair Plan Property Form correctly, start with pre-filling preparations by gathering necessary documents, including past insurance declarations, property details, and any previous claims history. Organizing these documents will help streamline the process, ensuring that you don’t forget any critical information.

Next, accurately enter your personal information. This includes your name, contact details, and any other relevant identification. Then, detail your property information accurately, including its physical condition, which can directly impact the premium. It’s essential to provide a clear description of property conditions to avoid misrepresentation, which might lead to challenges in securing the desired coverage.

Interactive tools for form completion

pdfFiller provides a user-friendly platform to complete the CT Fair Plan Property Form efficiently. One standout feature is the Smart Fill Tool. This tool allows users to fill in information seamlessly, reducing the likelihood of errors and ensuring that all necessary fields are addressed adequately before submission.

In addition, the platform offers interactive help features, including valuable inbuilt guides that offer tips during the completion process. These features provide users with immediate support, addressing questions and concerns as they arise, which is especially helpful for first-time applicants navigating their way through the CT Fair Plan Property Form.

Editing and reviewing your CT Fair Plan Property Form

Once you have filled out the CT Fair Plan Property Form, reviewing your submission is crucial. pdfFiller’s editing tools are incredibly effective for highlighting and annotating important sections that require special attention. This feature is especially useful for collaborative input if you're completing the form with a team.

When it comes to common mistakes, avoid using vague descriptions or incorrect numerical values for coverage limits, as these errors can complicate the approval process. A final review checklist can help ensure no details are overlooked before formal submission, boosting your chances of a smooth experience with the CT Fair Plan.

Submitting the CT Fair Plan Property Form

After thorough review, submitting your CT Fair Plan Property Form is the next key step. pdfFiller simplifies this process by allowing electronic submission directly through the platform. This feature minimizes the hassle of traditional submissions, ensuring your form reaches the insurers quickly.

Post-submission, it's vital to understand the confirmation and follow-up processes. After submission, you should expect a confirmation email detailing next steps. Keep an eye on your email for any further instructions or clarifications needed from the underwriters.

Managing your policy once the form is submitted

Once your CT Fair Plan Property Form has been submitted and approved, managing your policy becomes crucial. pdfFiller allows you to track your policy status online conveniently. This means you can check updates about your insurance coverage from anywhere, ensuring you are always informed of your policy’s standing.

Accessing policy documents via pdfFiller is also streamlined. Users can find all their relevant paperwork in one intuitive location. Understanding renewal options and procedures is important, as regular updates are necessary to ensure continued coverage. Be proactive about renewal to avoid lapses in your policy.

FAQs about the CT Fair Plan Property Form

As individuals and teams navigate the CT Fair Plan Property Form, several common questions arise. For instance, many applicants wonder about eligibility criteria specific to their situation or potential policy changes that might affect coverage. Addressing these inquiries frequently requires reaching out to customer support.

It’s advisable to have a list of commonly asked questions and their answers at your disposal. Many customers also inquire about the processes surrounding policy updates or navigating potential claims in the future. Understanding these areas can alleviate many concerns associated with property insurance.

Conclusion of the process

The importance of keeping your information up to date within the CT Fair Plan Property Form cannot be stressed enough. Regular updates to your personal and property information provide not only peace of mind but are crucial for ensuring that your home or business is adequately covered against unforeseen incidents.

Moreover, regularly reviewing your policy proactively contributes to your overall coverage wellness. This diligence can help you avoid gaps that may arise over time due to changes in circumstances such as renovations or changes in risk factors. Embracing a proactive approach will enable a more secure financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct fair plan property without leaving Google Drive?

How do I edit ct fair plan property in Chrome?

How do I edit ct fair plan property on an Android device?

What is ct fair plan property?

Who is required to file ct fair plan property?

How to fill out ct fair plan property?

What is the purpose of ct fair plan property?

What information must be reported on ct fair plan property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.